Summary:

- Alphabet had a strong third quarter, beating on both the top and bottom lines.

- Google Cloud’s growth shows that the company’s investments in AI are paying off.

- The growth slowdown in Search and YouTube is a cause for concern.

3DSculptor

Investment Thesis

The last time I wrote about Alphabet (GOOG) (NASDAQ:GOOGL), in July 2024, I analyzed the company’s Q2 earnings report and dissected some of the major developments announced by the company, especially with respect to the AI race. I had a strong buy rating on the stock.

Since the article was published, the company’s stock has gained 3.21%, slightly underperforming the S&P 500, which gained 5.7% during the same period.

In this article, I analyze the company’s Q3 earnings report and explore how the company has been navigating a challenging competitive landscape for its Search business as well as its progress in the AI race.

A Snapshot of Second Quarter Results

It was yet another impressive quarter from Alphabet in my opinion. Q3 revenues of $88.27 billion were up 15.1% y/y and beat analyst estimates by $2.05 billion. Diluted EPS of $2.12 was up 36.8% y/y and comfortably beat analyst estimates by $0.27. Despite another round of significant capex spending, the company’s operating margins came in at 32%, which translates to a y/y expansion of 450 bps. Free cash flows for the quarter came in at $17.6 billion, which took the trailing 12-month free cash flows to $55.8 billion. The company ended the quarter with $93 billion in cash and marketable securities, a decline from the $101 billion in the second quarter. The company maintained its quarterly dividend payment of $0.20, which it had announced in Q2.

New CFO Anat Ashkenazi, who replaced long-standing CFO Ruth Porat, offered some commentary on what to expect from the company in Q4. She reiterated the company’s stance from Q2, which is to capitalize on the AI revolution, would require “continued meaningful investment.” Moreover, the company would continue to face headwinds from increases in depreciation as well as from higher expenses linked with “higher level of investment in technical infrastructure.” At the same time, the new CFO also stressed upon the company’s continued attempts to drive efficiencies of its technical infrastructure as well as leveraging AI to streamline operations across the company. There was also mention of optimizing “headcount growth.” Finally, the company also mentioned that advertising revenue will face twin headwinds: from the base effect resulting from strong advertising revenue in the second half of 2023, as well from the pull forward of the Made by Google launches into Q3 from Q4 this year.

Google Cloud Goes from Being an Also-Ran to a Potential Challenger to AWS & Azure

The last time I wrote about Alphabet, I mentioned how the second quarter belonged to Google Cloud, as a result of the progress made by the segment. Google Cloud’s Q3 performance, in my opinion, blew even the Q2 performance out of the water, thereby firmly placing it as a potential challenger to Amazon Web Services and Microsoft Azure.

While the second quarter marked the first time that the Cloud segment crossed the $10 billion mark, Q3 cemented the Cloud business as a $10 billion+ business, as the segment brought in $11.4 billion in revenues. The y/y revenue growth was also on the up, as it went from 28% in the second quarter to 35% in the third quarter. The segment’s operating margins also significantly expanded, from 11% in the second quarter to 17% in Q3. While this is still far behind both AWS and Azure, it is definitely heading in the right direction, and given the leeway that’s available for the company to scale up the business as well as the pace at which it is spending to grow the segment, I expect it to catch up with the top-2 sooner than later.

The performance of the Cloud segment also vindicated the company’s decision to keep spending on AI infrastructure to gain a stronghold in the AI arms race. The AI investments in the Cloud business are enabling the company to win larger deals and during the third quarter, it led to a “30% deeper product adoption with existing customers.” The company is also seeing strong demand for its AI-powered cybersecurity solutions, with customer adoption of the company’s Mandiant-powered threat detection increasing 4x during the last six quarters.

There is still a long way to go before GCP can start to put pressure on both AWS and Azure. But Q3 showed how the Cloud segment is heading in the right direction. It also showed that with the help of all the AI-related investments made by the company, Google Cloud has not only evolved to a significant challenger to the Top-2 from being an Also-Ran, but this has also helped the company offset, to an extent, the slowdown seen in its bread-and-butter Search Business as well as in YouTube. The timing of this growth could not have been more perfect in my opinion.

Search Business Standing Tall for Now but Growth Slowdown a Concern

As I mentioned in the previous section, the company’s Search Business and YouTube are witnessing a growth slowdown, which is a concern, as the likes of OpenAI and Perplexity AI grow deeper pockets to challenge Google. In the third quarter, while both Google Search and YouTube ads each registered impressive y/y revenue growth of 12.2%, the growth, compared to the second quarter, has slowed down. For instance, in the second quarter, Google Search revenues grew at 13.8% y/y whereas revenues from YouTube ads grew at 13% y/y. This was the second straight quarter that both these segments were registering slower revenue growth. The slowing growth of both these segments also led the company’s overall revenue growth to slow down, from 11.1% in Q2 to 10.4% in Q3.

While the growth slowdown is not a worrying concern yet, it is not an area that should be ignored by investors, in my opinion. According to eMarketer, Google’s search ads business is expected to fall below 50% market share next year, as a result of increasingly competition from Amazon. And when one factors in Bing, as well as the likes of Perplexity AI, then the threat becomes even more significant.

The company also faced a slowdown in spending in the US from two of its largest advertisers, e-commerce giants Temu and Shein, which also affected its growth. All of this lends further support to the company’s decision to spend heavily on AI. During the quarter, the company rolled out AI Overviews to over a billion people, and the company is witnessing strong consumer engagement with ads that the company has placed above and below Overviews, which is promising.

Management, during the earnings call, did announce that they have plans to monetize AI Overviews in the long run, but this “long run” may have to come sooner than management’s own calculations based on the current landscape.

Waymo may be a Small Business but Still Flexes Its Muscle in Q3

Finally, I have to mention Alphabet’s autonomous vehicle division Waymo, which is part of its Other Bets segment. The division has made tremendous progress, as evidenced by the fact that it now drives more than a million fully autonomous miles and undertakes over 150,000 paid rides every week. The division has also partnered with Uber in Austin and Atlanta, which should offer it a significant tailwind in the long run. During the earnings call, management also mentioned that the company was planning to expand to new markets albeit without a fixed timeline.

Last week, Waymo closed a $5.6 billion funding round with the intention of expanding its coverage across the US, led by Alphabet, along with external investors such as Fidelity and Tiger Global. As the autonomous ride-hailing race heats up, now that Tesla has also announced its Cybercab, first-mover advantage is crucial. Based on the commentary that we received in the third quarter, along with the additional funding, Waymo appears to be well-positioned to succeed in the AV race. The segment’s revenue might be a drop in the bucket for Alphabet today, but in the long term, based on current evidence, it most certainly has the potential to be one of the main growth catalysts for the company in the future.

Valuation

|

Forward P/E Multiple Approach |

|

|

Price Target |

$248.00 |

|

Projected Forward P/E Multiple |

22.4x |

|

Projected FY24 EPS |

$8.24 |

|

Projected Earnings Growth |

42% |

|

Projected FY25 EPS |

$11.11 |

Source: LSEG Data (formerly Refinitiv) and Author’s Calculations

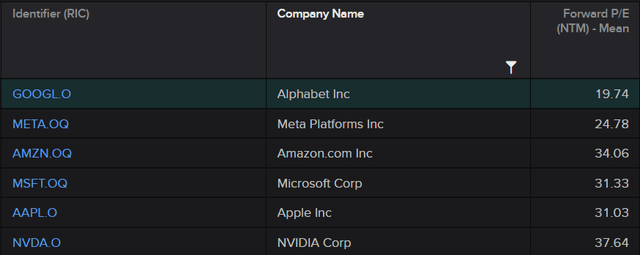

The company, according to LSEG Data, currently trades at a forward P/E of 19.7x, which continues to make it the cheapest amongst the Sensational Six (Alphabet, Meta, Amazon, Microsoft, Apple, and Nvidia). It also continues to trade cheaply relative to its own historical multiples of 22.1x (5-year historical median forward P/E) and 22.4x (10-year historical median forward P/E). The median P/E multiple of the Sensational Six stands at 31.1x, slightly higher than my previous estimate of 31x. Like I did in my previous article on Alphabet, I am dropping Nvidia from the peer list given that it belongs to a different category, which takes the median P/E multiple to 31x, much higher than the previous figure of 30.2x.

The last time I wrote about Alphabet, I made a case about Alphabet deserving to trade at the median P/E multiple of its peer universe (31x in this case). However, the dynamics have changed significantly in the last three months. Despite making significant headway into the AI race, Google’s Search business is under considerable threat for the first time in years due to the twin shocks of regulatory challenges as well as an increasing competitive landscape thanks to the emergence of the likes of OpenAI and Perplexity AI. As such, I don’t believe that it would trade at multiples of 30x and above anytime soon. However, it certainly deserves a higher multiple than what it’s trading at today. Taking things together, I have assumed a forward P/E of 22.4x for my calculations, marginally lower than my previous estimate of 22.5x.

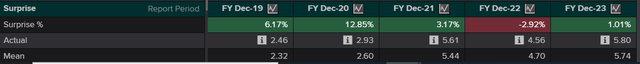

LSEG Data (Formerly Refinitiv)

The consensus EPS estimate for FY24, according to LSEG data, stands at $7.92, higher than the previous consensus of $7.65. In my last article, I mentioned how, on average, the company has beaten its full-year EPS consensus estimates by 4.05%, with FY22 being the only outlier. I have maintained my assumption that the company would beat analyst estimates by 4.05%, which brings my FY24 estimate to $8.24. This would require Q4 EPS to come in at $2.30, which is not an unreasonable estimate given that Q4 has traditionally been its strongest quarter in the last five years (FY22 is the only outlier). An FY24 EPS estimate of $8.24 would imply a y/y EPS growth of 42.1%, higher than my previous growth estimate of 38%. Given that both the competitive landscape and regulatory challenges would be less favourable in the coming years, I don’t expect the company to maintain the same growth rate in FY25. As a conservative measure, I have assumed a y/y EPS growth in FY25 to be 34.8% (the average of FY23 EPS growth and my projected EPS growth rate in FY24), which is lower than my previous estimate of 38%. At this growth rate, FY25 EPS is projected to come in at $11.11, a marginal increase from my previous estimate of $11.02.

LSEG Data (Formerly Refinitiv)

A forward P/E of 22.4x and a projected FY25 EPS of $11.11 results in a price target of $248, which is the same as my previous target, but which suggests an upside of about 46% from current levels. Given the significant upside from current levels and given that the company has so far navigated the major headwinds well, I am maintaining my rating on the stock as strong buy.

Risk Factors

My risk factors for the company remain largely unchanged from my last article. There have been major developments, with respect to the company’s regulatory issues, since my last article. More specifically, a US federal judge, in August, ruled that the company maintained an illegal monopoly on search. Separately, the company is also facing a landmark case against its ad tech business, which goes into the “closing arguments” phase in November. A defeat there could create a significant dent to the company’s future profitability and as such, is a major risk factor to my bull case.

The other risk factor remains the competitive landscape, which has taken a turn for the worse from Google’s perspective. Companies like OpenAI and Perplexity AI are fiercely competing with Google, and are also moving into the ads business, through features such as ‘sponsored’ question system, which, if successful, could shake up the $300 billion digital ads industry and threaten Google’s ads business. This is yet another significant risk factor to my bull case.

Concluding Thoughts

Alphabet had yet another impressive quarter, with the company beating on both the top and bottom lines. Google Cloud took a significant step forward in being a formidable challenger to both AWS and Azure, delivering strong revenues and even stronger margins. The timing of growth of the Cloud Segment comes at the right time, given that the company’s Search business and YouTube show signs of slowing growth.

Both segments saw revenue growth decline for the second straight quarter, and while, for now, the situation is not worrying, given the increasingly competitive landscape, the future does look less rosy. Finally, the company’s autonomous division, Waymo, continued to show tremendous progress and is well-positioned to be a strong growth driver for the company even as the AV race heats up.

From a valuation standpoint, there is a significant upside from current levels. And with the company’s AI investments starting to pay off steadily, as evidenced by the growth seen in Google Cloud, in my opinion, investors should use this opportunity to buy into the name. Based on the Q3 report, don’t write off the Search giant yet.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in GOOGL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.