Summary:

- I am bullish on Alphabet Inc. due to its market dominance, strong cloud computing and digital advertising growth, and effective AI integration.

- GOOG’s Q3 2024 performance showed 15% YoY revenue growth, 34% net income growth, and impressive results in Google services, YouTube, and Google Cloud.

- Despite competition from open AI, Alphabet’s diversified business model, including Google Cloud and Waymo, ensures continued growth and resilience.

- GOOG’s historical stock performance during election years and current bullish technical indicators justify a buy rating with a price target of $377.28 by 2029.

bunhill

Investment Thesis

I am bullish on Alphabet Inc.(NASDAQ:GOOG) given its attributes that, I believe, will enable it to weather the growing competition from open AI. Further, I believe its strong growth in its cloud computing and digital advertising segments bode well for its long-term growth.

In June 2024, I wrote a bullish article on GOOG whereby I estimated a price target of $377.28 by 2029. My bullish stance was backed by the company’s market dominance and favorable market trends. While my price target remains intact, in this follow-up coverage I will reflect on the MRQ performance and put it in context over the last 7 quarters. In addition, I will do a DuPont and Economic value added (EVA) to get an in-depth insight into what, I believe, is a consistent strong financial performance. In addition, I will reflect on the company’s stock performance during election years which will form a basis as to why I believe this stock is a buy despite 2024 being an election year.

Above all, I will weigh in on the growing concern for investors as far as competition for GOOG’s major revenue source, search engine, from open AI is concerned. Weighing in these pertinent issues, I find GOOG a decent investment opportunity in 2024 and beyond warranting a buy rating as I will discuss in the succeeding sections.

Financial Analysis: Q3 2024 Put Into Perspective

Alphabet reported its Q3 2024 on October 29, 2024. Looking at the highlights, the company demonstrated what I can term as a strong quarterly performance. To begin with, its revenue came at $88.27 billion translating to a 15% YoY growth. This double-digit growth was driven by an impressive performance from its segments such as Google services, YouTube, and Google Cloud whose figures I will provide shortly. Moving to profitability, the company reported very impressive results. Its operating income grew by 34% to $28.5 billion while its net income grew to $26.3 billion marking a 34% growth. The company’s effective cost management and efficient operations through AI integration contributed to improved profitability. Below is a quote from the CEO on AI and its impact on operating costs.

Sundar Pichai,” Using a combination of our TPUs and GPUs, LG AI research reduced inference processing time for its multimodal model by more than 50% and operating costs by 72%. Second, our enterprise AI platform, Vertex, is used to build and customize the best foundation models from Google and the industry.”

The above overall strong performance arose from the company’s solid performance in its segments. To begin with, the Google service segment reported revenue of $76.5 billion, up 13% YoY. On the other hand, Google Cloud reported revenue of $11.4 billion, a growth of 35% YoY. Further YouTube ad revenue came in at $8.9 billion, up 12% YoY. In summary, GOOG had an overly strong Q3 2024 characterized by top and bottom line growth.

While this growth can be attributed to several factors some of which I have mentioned above, one of the major reasons for this exemplary growth is the company’s vast user base. As of Q3 2024, GOOG had about 2 billion monthly users which marks about 25% of the total global population which stands at about 8 billion. More interestingly, the global adult population (Aged 18 and above) stands at about 5.8 billion meaning that more than 34% of the global adult population forms part of Google’s monthly user base. In my view, this is an unshakable MOAT that I believe through the company’s AI integration can only get better and therefore a compelling reason for its long-term growth.

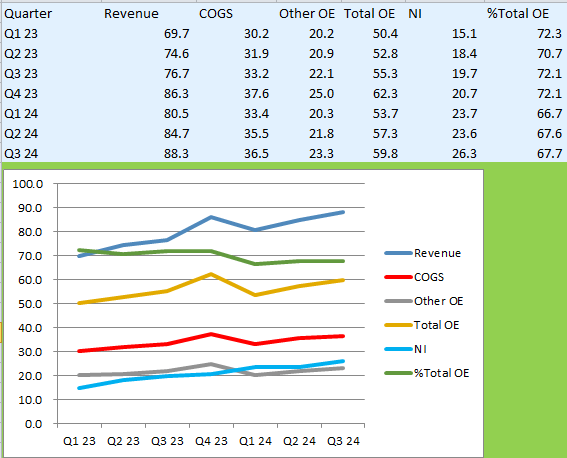

Given this Q3 2024 highlights, let’s put it into perspective by reflecting on the last 7 quarters. In my analysis, I considered revenue, expenses, and net income to assess the trends. Below is the raw data and my graphical representation of the same.

Author

From this analysis, several things came out; first off, GOOG revenue appears to be in a strong upward momentum. Although the Q1 2024 revenue appears to have broken the continuous trend for QoQ growth, it should be noted that it marked a 15% growth YoY perhaps marking it Q1 as the low season for this company. Generally, the revenue growth for this company is very impressive reflecting the strong demand for its products. Secondly, looking at the cost of goods sold [COGS] IT appears to be relatively flat something that speaks about the company’s effective cost management. This proves true considering that its COGS have remained relatively flat when its revenue curve has been rising. For its other operating expenses [OE] it appears that over the most recent quarters, the OE is slightly increasing. While this could appear to be a major concern to some investors, to me it isn’t. This is because the OE is majorly growing due to the growing R&D expenses which have expanded from $11.26 in Q3 2023 to $12.45 in Q3 2024. I believe this is healthy because it is through R&D that this company will sustain its innovation and growth.

This led me to the broader analysis of cost whereby I computed costs as a percentage of revenue. This is where the test of effective cost management was well presented. As asserted earlier in this section, GOOG’s improved profitability has benefited from the company’s effective cost control. As shown in my analysis, this company has kept its total operating expenses at about 67% over the last two quarters significantly low from the 72% witnessed in Q3 and Q4 of 2024.

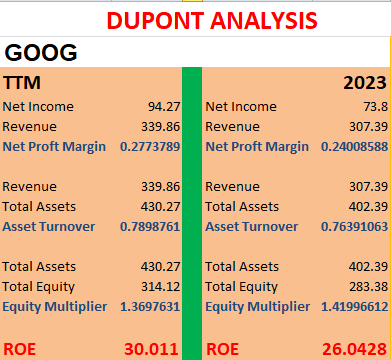

To support Alphabet’s strong financial performance is a DuPont analysis where the company’s ROE has improved from 26% in 2023 to 30% TTM as shown below.

Author

From this analysis, the company’s return on equity has improved. The main takeaway here is that the company is increasing shareholders’ returns while maintaining a low leverage. This has been demonstrated by the company’s equity multiplier of 1.37 in the TTM down from 1.42 in 2023. Further, its increasing efficiency has been affirmed by its increased asset turnover ratio of 0.79 in the TTM up from 0.76 in 2023. Lastly, the increased net margin in the TTM compared to 2023 confirms its growing profitability and effective cost management.

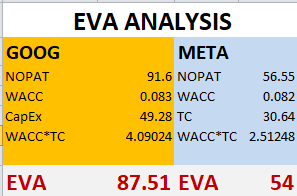

Lastly, I worked on its Economic value added [EVA], an analysis aimed at measuring GOOG’s residual wealth generated over and above the cost of capital. In other words, EVA measures a company’s true economic profit which confirms if indeed a company is generating value for its shareholders. It is calculated using the formula below;

EVA = NOPAT – (Invested Capital*WACC)

Where:

NOPAT is net operating profit after taxes.

WACC is the weighted average cost of capital.

In this evaluation, I compared GOOG’s EVA in the TTM to that of its competitor. The comparative study was aimed at determining which of the two has created the highest value for its shareholders. In my analysis, I adopted WACC from value investing. Given this background, below is the output of my analysis.

Author

From these results, both companies have a positive EVA meaning that they have created value for their shareholders. However, GOOG has the highest EVA at $87.51 billion. This implies that it has created $87.51 billion in value above the cost of capital invested. This is an indication of its financial health and efficiency as it shows that it is not only covering its capital costs but also generating substantial value for its shareholders compared to its peers.

In conclusion, GOOG has a very impressive financial performance which has led to substantial returns to its shareholders warranting a buy rating for investors aiming at a company with consistent and strong financial performance with higher returns.

Why I Believe GOOG Will Maintain Its Strong Growth Despite Competition From Open AI

While Alphabet has demonstrated impressive growth in the past quarters, there have been concerns from some investors that GOOG’s growth could take a major hit due to competition from open AI models such as ChatGPT. In this section, I will discuss why I believe Alphabet will maintain its growth despite this concern.

First off, this company has a diversified business model which can help it cope in case one business segment is affected. While the open AI model poses a threat to GOOG’s main revenue generator the search engine business, this company has other revenue streams which have shown significant growth recently. For instance, its Google Cloud business segment is one of its major diversified revenue streams which saw a 35% revenue growth YoY in the MRQ. Further, another notable revenue stream that can supplement its search engine revenue stream is its ads business which saw a revenue growth of about 12% in the MRQ. Above all, Alphabet has diversified into autonomous driving through its heavy investment in its autonomous vehicle [AV] Waymo including its newfound funding of $5.6 billion aimed at expanding Waymo’s robotaxi services.

The Waymo business has registered remarkable strides forward with the management opening the service to all users a big statement which confirmed that the AV is safe enough for anyone to ride. Since then, Waymo’s performance has increased substantially previously it had grown its weekly rides from 50,000 to 100,000. In the MRQ, the management confirmed that Waymo is driving more than 1 million fully autonomous miles weekly and it serves more than 150,000 paid rides per week. The AV is currently growing its ride volume by approximately 50,000/ week implying that by the end of the year, it will have grown to about 200,000 rides/week.

With these diversified streams, GOOG’s growth outlook is very promising. To begin with, the global cloud computing market is projected to grow by a CAGR of 21.2% by 2030. This massive market growth grants its promising Google Cloud business an opportunity to keep fostering the strong growth figures it has reported in the past quarters. I believe the company’s AI integration in its Google cloud business along with its comprehensive service offering comprising of computing power, networking, and storage give it a competitive edge and hence positions it to leverage the projected market growth.

On the other hand, the US AV market is projected to grow from $22.52 billion in 2023 to $78.63 in 2030. Given Waymo’s growing service delivery amid this projected market growth, GOOG shall have another significant growth catalyst here that will supplement its search engine revenue stream amid the growing concern of increasing competition.

The other reason I think that GOOG will maintain its growth is its integration of AI in its products. In my view, I believe this move from GOOG faced the competition head on and it was the best move to address the concern. In the MRQ, it was revealed that Alphabet has all its seven products using the Gemini model, which is its AI. The Gemini which includes models like Gemini 1.5 pro enables Google to provide intelligent and nuanced responses to fed questions matching what other open AI models offer. Most interestingly, Gemini has better features than ChatGPT making it a better option. For instance, it is multimodal with the ability to handle multiple data types such as text, image, audio, and video compared to ChatGPT which is text-only focused. Secondly, Gemini’s deep integration with Google’s services/products offers a seamless user experience a benefit that ChatGPT and o1 don’t offer because they are more antagonistic platforms. Lastly, Gemini permits extensive customization within the Google ecosystem, on the contrary, ChatGPT and o1 focus is in broader accessibility and community support.

Above all, while some investors view the competitor’s open AI as a threat to the GOOG search engine business, my view is different. I believe the open AI model are complementary tool to GOOG’s search engine and therefore I believe Alphabet will keep its search engine market dominance intact. I believe the two are complementary tools when I look at the market figures of each. To support this assertion, I refer you to GOOG’s search engine market share dominance and its user visits against that of ChatGPT. Since the launch of ChatGPT in 2022, GOOG has maintained its market share at about 90% which implies that its market dominance is far from shaken.

In addition, in September 2024, the GOOG search engine generated total visits of about 83.2 billion a figure close to 83.3 billion visits in September 2023. This implies that despite the growing open AI models threatening Alphabet’s search business, the company has maintained its traffic. As of October 2024, ChatGPT has a total user of more than 180 million after about 2 years of its existence. In my view, if this were to be a major threat to GOOG, I think the numbers should be higher to mean something relative to GOOG’s billions in monthly and annual user visits. Above all, it is estimated that about 65% of ChatGPT’s social media traffic comes via YouTube and this lends credence to my assertion that open AI complements GOOG’s search engine. Above all, open AI mostly offers a brief report on a subject matter which mostly culminates in in-depth research from the Google search further marking the two as complimentary products rather than competing products.

Lastly, one of the greatest reasons why Google search is not likely to face significant competition from the open AI model is the academic prohibition of AI-generated work preferring human work. With significant Google usage by students, this block opens AI from exploiting a significant market portion for GOOG.

In light of the above background, I believe that GOOG is likely to maintain its market growth amid the competition concern from the open AI model. In my view, the above factors explain why GOOG has been registering strong growth figures even with the existence of the competitor products thus underscoring the resilience of its diverse and innovative business model.

Why You Should Not Be Scared Of GOOG In The Election Year

While to some investors, the US presidential elections have been a consideration in decision-making, I find GOOG to have consistently grown its stock in the past election years. For instance, in 2016, the stock rose by about 18% from a price of about $33 in January to a price of about $39 in Dec that year. This was still replicated in the 2020 election year when the stock gained approximately 38% from a price of about $64 in January to about $88 in Dec 2020. This year, the stock has already soared 22.51% YTD continuing its history of stock growth during presidential elections in the US.

From the above history, GOOG has demonstrated its stock resilience to the political temperatures and therefore a reason enough as to why potential investors should invest in this promising stock despite the political atmosphere revolving around the presidential elections.

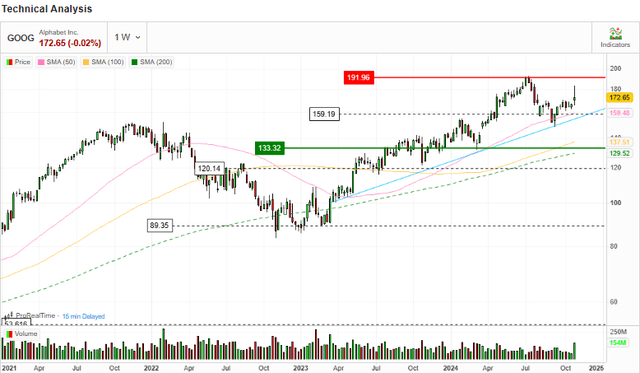

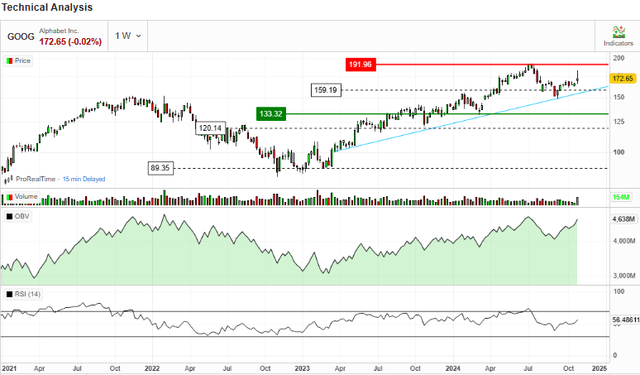

Technical Take

From a technical standpoint, GOOG has entered what appears to be a new bullish rally. Initially, the stock was in a rising bullish pattern which ended in July 2024 and the stock exhibited a pullback. However, the pullback has ended and a new bullish configuration set in. The end of the pullback was marked by the formation of an inverted head and shoulder pattern as shown below.

To support the bullish out, the price has moved above the 50-day, 100-day, and 200-day moving averages meaning that the stock is bullish in the short, medium, and long-term time horizons. In addition, the 50-day MA crossed above the 100-day MA in November forming the golden cross which is a confirmatory signal for sustainable long-term bullish momentum.

In addition, GOOG OBV is currently rising an indication of increasing buying pressure which is a recipe for bullish momentum. The rising OBV essentially means that the volume of shares traded on up days is higher compared to those on down days therefore the buyers are dominant. In addition, its RSI is at 56 and moving upwards, this implies that it has crossed the neutral outlook and is leaning toward the bullish territory. The fact that it is rising suggests that buying pressure is increasing and the upward momentum has gained traction.

In summary, from a technical point of view, this stock is bullish, and thus a buy decision is justified especially considering its strong financial performance discussed in the previous section.

Risks

While I acknowledge that GOOG has responded well to the AI threat, I strongly believe that the company must keep innovating to catch up with current trends given that the AI market is very dynamic. This calls for rigorous research and innovation failure to which the company could seize its market share to competitors.

Conclusion

While there is no material change in my previous regression model variables, I maintain my price target of $377.28 by 2029. The company’s strong financial performance in the MRQ which has continued over the last 7 quarters confirms the strength of my bullish outlook. Given its diverse and resilient business model as demonstrated in this article, the company’s market dominance is set to be the strongest growth catalyst backed by its other revenue streams whose growth has been impressive and the market projections offer a bright outlook for them. In light of this background and the bullish technical analysis, I believe GOOG is a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.