Summary:

- Even a halt to the accused practices would not harm Google. The savings from TAC would offset losses in Search market share.

- Alphabet is becoming increasingly diversified, with the Cloud’s growing importance and profitability, while Google Services remain strong.

- High AI CAPEX will impact free cash flow, but I see Alphabet in a comfortable position where, in the worst case, it becomes a future income play.

- YouTube is a true gem within the company, competing in the top tier of both music and video streaming.

- Valuation is more than fair for Google’s growth and seems to account for the regulatory Sword of Damocles.

400tmax

Reaffirming My Long Position in GOOGL

Alphabet is the second-largest position in my portfolio with a significantly above-average weight of 9%, and it has held this position for several years now. Consider this a disclaimer indicating personal bias, although I always strive to analyze as objectively as possible. In this article, I am going to explain why I consider it appropriate to keep my positioning unchanged for many more years to come, despite the high regulatory pressures and uncertainty amid the antitrust ruling against Google.

Even more so, I will perhaps slightly expand the existing position at current levels, and Alphabet remains highly ranked on my watchlist in the event of further market turbulence, a.k.a. downturns. Also, in a previous coverage, we selected Alphabet as our top pick within a German investment community at the beginning of the year, which has paid off significantly with +18% or +31% annualized to date.

My article will be structured as follows:

- A brief assessment of the potentially paradigm-shifting monopolistic case that may or may not impact Alphabet’s most important Search-Ad business

- A review of the recent Q2-24 figures in the context of long-term fundamentals

- A focus on free cash flow, increased CAPEX amid AI, and shareholder participation

- An overview of the strong market positions in cloud and streaming as a welcome and growing diversification from the search business

- A fundamental valuation considering the regulatory risks looming over the company

Jumping On A Reasonable Monopoly Thesis

Recently, Millennial Dividends outlined three potential outcomes of Google’s antitrust ruling in a great article. The main issue is Google’s dominant practice of paying Apple and other manufacturers large sums to set Google Search as the default option. Google categorizes these payments as Traffic Acquisition Costs (TAC). The scenarios discussed in the article, which I highly recommend, range from:

- The unlikely breakup of Google,

- A financial penalty that seems more probable but would likely be manageable for Google given its size, although it would probably not be sufficient on its own,

- And the most likely outcome of prohibiting payments to secure its search engine as the default on devices, opening the market to more competition.

Millennial Dividends argues that even a significant loss in market share could be manageable because GOOGL would save on TAC in return. I fully agree with this and would like to add my own considerations:

Google’s global market share currently stands at 91%. 17% of the world’s operating systems are iOS. Let’s first assume a simplified distribution of Google’s 91% market share across all operating systems. Next, assume that after this practice is banned, suddenly 50% of iOS users choose another search engine over Google as their default option – which I consider very conservative. This would result in a market share loss of around 7%.

91% x 17% = 15.5% (currently) vs.

50% x 17% = 8.5% (new scenario)

→ 15.5% – 8.5% = 7% loss

The overwhelming majority of operating systems is Google’s own Android, with a 41% market share. I find it unlikely that there would be intervention here, as it would be an especially harsh move. However, if we assume this in the extreme case, with the same assumptions as above, we arrive at an additional 16.5% market share loss.

91% x 41% = 37% (currently) vs.

50% x 41% = 20.5% (new scenario)

→ 37% – 20.5% = 16.5% loss

Attentive readers might have noticed that Windows was missing between Android and iOS as a top operating system – correct. Windows ranks second with a 29% market share. However, competitor Windows already has Bing and not Google set as the default. This makes Google’s 91% market share even more impressive. If the default setting were actually more influential than the quality of the search engine, Bing should already have 29% of the search engine market share just due to Windows’ 29% market share. But that is not the case, because Google appears to be simply the preferred, better choice, and not (just) because of supposedly monopolistic practices. Therefore, I consider the above-mentioned 50% voluntary choice in favor of Google to be very conservative.

Google’s Search Ad revenue in Q2-24 was around $49 billion. A market share loss of 7% due to the restriction on Apple agreements would correspond to a quarterly revenue loss of $3.8 billion, applied retrospectively to this exemplary quarter. A further ban on Android devices would amount to an additional 16.5% loss, resulting in a total market share loss of nearly 24%, equating to approximately $13 billion in last quarters Search revenue. This would be a Search revenue decline of 26%, which initially sounds harsh. However, Google would save the now-banned Traffic Acquisition Costs, which amounted to exactly those $13 billion in Q2-24. So, even in such a conservative scenario, it would be a zero-sum game for Google on the bottom line.

Great Fundamentals Across The Board

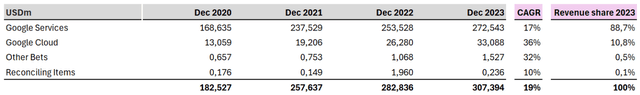

At this scale, Alphabet impresses with still significant double-digit top-line growth, for example, averaging 19% annually over the last four fiscal years. This growth is primarily driven by Google Cloud, which has impressively expanded by 36% per year, growing its revenue share from 7% to 11% in 2023 and thus contributing positively to the diversification of the company. This helps counter the often-criticized dominance of Google Services within the company, which still accounted for 89% of revenue by the end of 2023. However, even this heavyweight division has grown by 17% annually over the same period – despite the rise of ChatGPT. The reports of Search’s demise appear to have been greatly exaggerated.

Author | Data: dividendstocks.cash

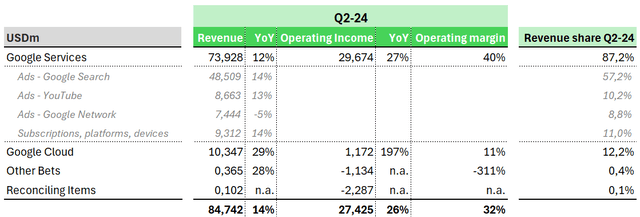

Let’s take a closer look at the last quarter. The diversification continued, with Google Cloud further increasing its revenue share to 12%, up 29% YoY, slightly reducing Google Services’ revenue share once again. This shift – again – wasn’t due to weakness in Google Services – in fact, the segment still grew by 12% YoY, driven by Search, YouTube, and Subscriptions. Search accounted for 57% of total revenues, while subscriptions made up 11%, including YouTube Premium subscriptions, meaning that YouTube contributes more to the overall company than the 10% of ad revenues shown.

The operating margins for the revenue-heavy Google Services stood at 40%, and Google Cloud, with its continued strong growth, is also becoming increasingly profitable, recently achieving an 11% operating margin. This combination of significant margin expansion alongside high top-line growth is ideal.

Meanwhile, the Other Bets division continues to burn cash – but that is negligible. On the contrary, it is actually desirable. For Alphabet, this is a playground for innovation. On one hand, Alphabet can simply afford to lose money here. On the other hand, this costly drive for research could very well produce the next major, profitable growth driver for the “Alpha-Bet”.

Author | Data: Alphabet Q2-24

Cash Machine As Future Income Play

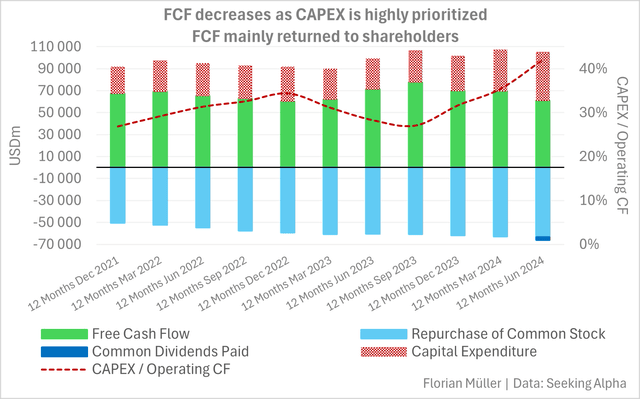

See below an overview of Alphabet’s cash flow statement using data from Seeking Alpha on a quarterly TTM basis. I argue that, even if it is hardly visible yet, due to the law of large numbers, Alphabet will eventually mature to significantly lower growth rates. But that is not a problem at all. Mature companies typically return more cash to shareholders. With the shift in the narrative from Alphabet being a growth story to becoming a future steady-state blue chip, the narrative could evolve more towards Alphabet as an income investment. In that case, I expect generous dividends from Alphabet, as is common for companies when excess cash can no longer be effectively reinvested for growth within the company.

Author | Data: Seeking Alpha

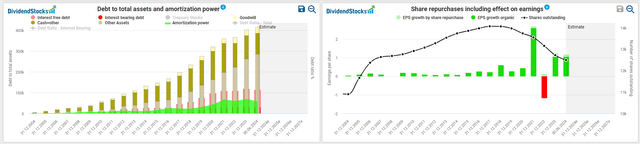

On average over the periods shown above, Alphabet already indirectly returned 60% of its operating cash flows, or 88% of its free cash flows, to its shareholders – mainly through share buybacks. However, the shift towards an additional dividend has already begun recently. On average, Alphabet has reinvested 32% of its operating cash flow in the form of CAPEX. This share has recently increased significantly to over 42% due to AI investments. The risk of investing too little in AI is greater than the risk of investing too much. I agree with this, even though it impacts free cash flows. If successful, Alphabet will secure its leading tech position with AI. If AI expectations are overstated, Alphabet can quickly reduce the CAPEX share, leaving more FCF for shareholders. I therefore see Alphabet in a comfortable position in this regard.

I calculated the free cash flow like Alphabet states to do itself, as operating cash flow minus CAPEX, based on Seeking Alpha data. The free cash flow conversion from net income during the period under review averages around 96%, which could allow the synonymous use of net income/EPS and FCF in the later valuation.

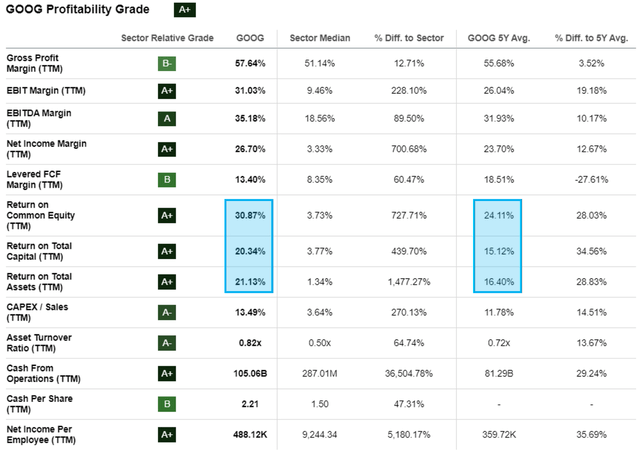

What investors also fear is that the intensive asset buildup for AI might erode profitability on the invested capital if additional AI returns fall short of expectations. Only time will tell, but for now, everything is in a very healthy range, as indicated by Seeking Alpha’s A+ profitability score. Profitability on capital is even well above its five-year averages.

Seeking Alpha

And then, of course, Alphabet’s balance sheet is also full of cash, which exceeds its interest-bearing debt by three times. Goodwill is modest, and the debt repayment capacity is tremendous. To me, this is what a rock-solid balance sheet looks like.

dividendstocks.cash

Multi-Market Diversification Power

Before concluding this analysis with final thoughts on valuation, I want to provide a few high-level insights about the market positioning that Alphabet occupies in so many important areas that are not just Google Search. And remember, Google Search has a 91% market share. And bear in mind that their in-house Android operating system is the most widely used in the world, with a 41% market share. Below, I’ll let the charts speak for themselves, as I have encountered and crafted them in previous analyses. Because in so many industries where you analyze major players, you come across Alphabet services as direct and significant market competitors:

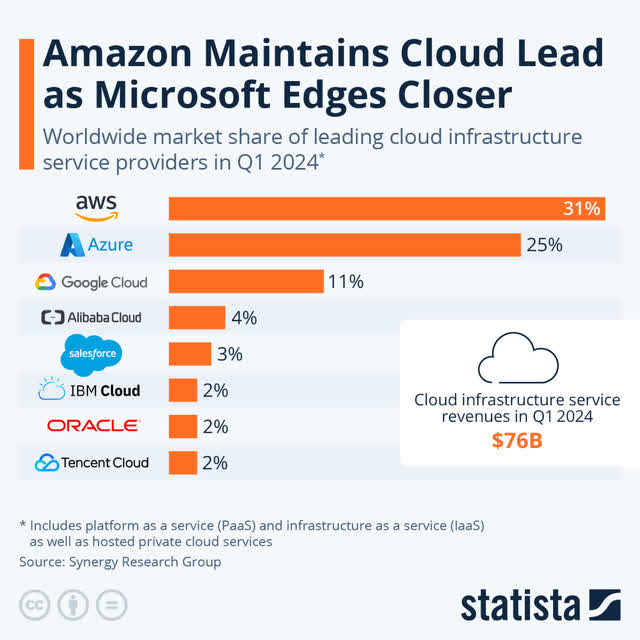

- Google Cloud ranks third in the cloud infrastructure market. I came across Google as a significant player when I was actually analyzing the market leader Amazon with AWS for a German investment community.

Statista

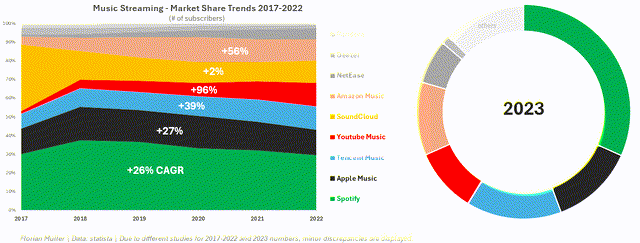

- YouTube Music was the fastest-growing music streaming service over five years until 2022, outpacing market leaders like Spotify, Apple Music, and Tencent Music. I discovered this in my Spotify analysis.

Author | Data: Statista

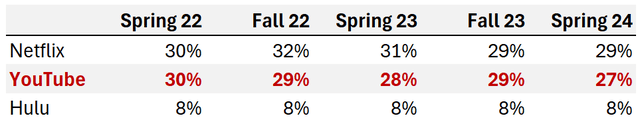

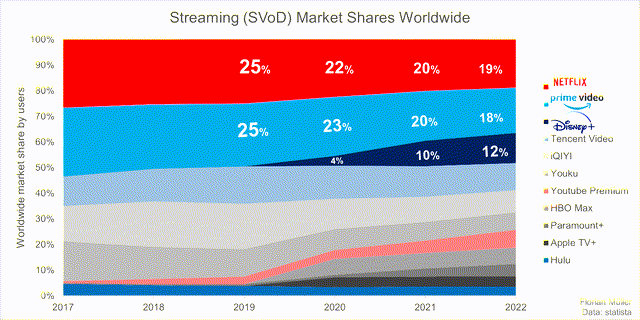

- Or in another context: YouTube in its Premium version is even a relevant player in video streaming. While the market is dominated by Netflix, Prime Video, and Disney+, according to Piper Sandler’s semiannual survey of U.S. teenagers, YouTube accounts for about a quarter of daily video consumption, almost on par with Netflix. The fact that YouTube Premium, now with well over 100 million paying subscribers, also holds a considerable position in this market was something I came across in my Disney analyses.

Daily Video Consumption Among Teens (Author | Data: Piper Sandler)

Author | Data: Statista

Valuation Renders GOOGL A Buy

In conclusion, I estimate that for Alphabet, given its elevated beta factor, an appropriately higher WACC of around 10% should be applied. Due to its high market capitalization, which overshadows its interest-bearing debt, this figure effectively represents the cost of equity. To account for the regulatory risks associated with the antitrust lawsuit and the many other challenges that a monopoly like Google faces from regulators worldwide, I would add an alpha risk discount of 2%, bringing the discount rate for Alphabet’s future earnings to 12%. It seems to me that the market is pricing it accordingly.

A TTM P/E ratio of around 23.5 (depending on whether GAAP or non-GAAP figures are used) translates to an earnings yield of 4.3% today. Assuming a 12% cost of capital (including the additional risk discount), this implies a 7.7% annual growth rate from today into perpetuity.

This might be easier to grasp when looking at EPS forecasts. Analyst estimates until 2029 show a peak coefficient of variation of 27%. Therefore, I rely only on estimates through 2026, where the coefficient of variation is at most 14%. The 2026 forward P/E of 16.6 implies a 6% forward earnings yield. From there, a 6% perpetual growth rate after 2026 remains. Net cash is an extra.

Alternatively, if we hadn’t added the 2% alpha risk discount and were satisfied with a 10% WACC, the market would be expecting a lower perpetual growth rate of 5.7% from today, or 4% after 2026, but with greater certainty.

Either way, this suggests that Alphabet is very attractively valued, and the valuation accounts for regulatory risks, given that the residual eternal growth rates appear achievable for Alphabet. This not only confirms Alphabet’s position as #2 in my portfolio with an overweight allocation, but it also makes me consider expanding the position. Alphabet remains a long-term buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.