Summary:

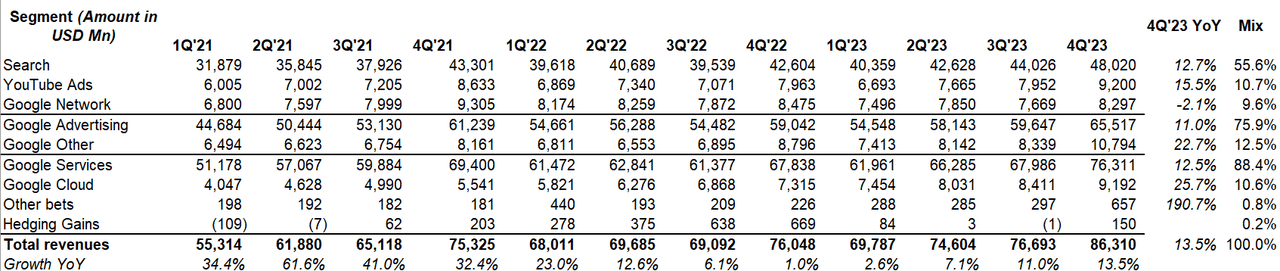

- While almost every single revenue segment grew by double digits, Google Network was down ~2% YoY and ~10% from 4Q’21.

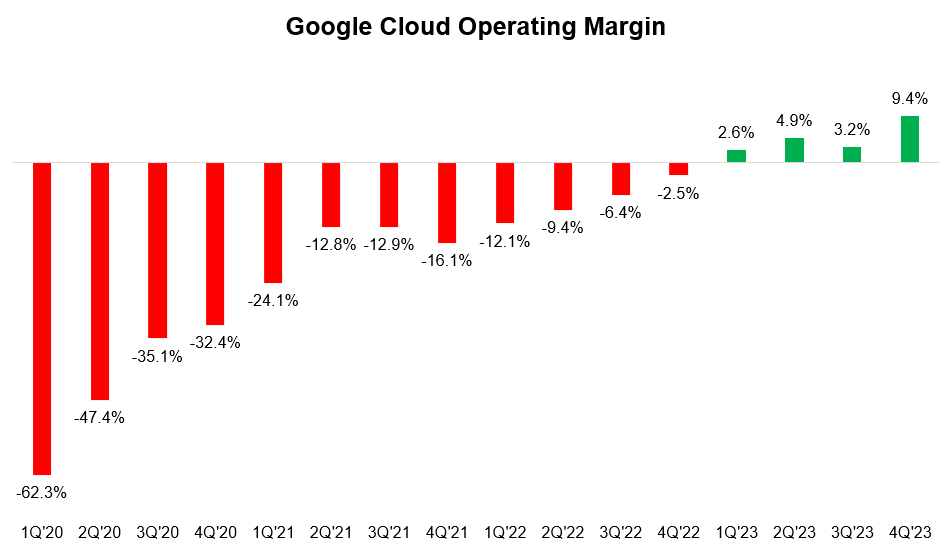

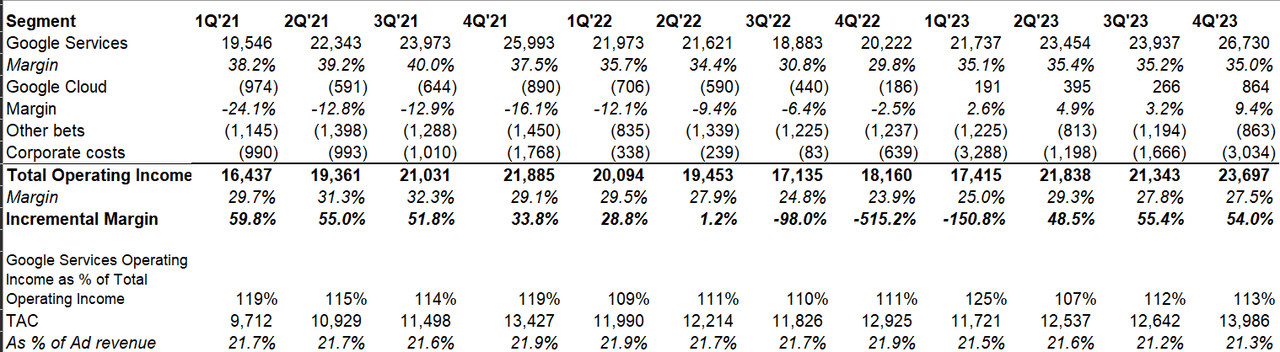

- Google Services business maintained its mid-30s operating margin profile. The real surprise was Google Cloud which accelerated margin from just 3.2% in 3Q’23 to 9.4% in 4Q’23.

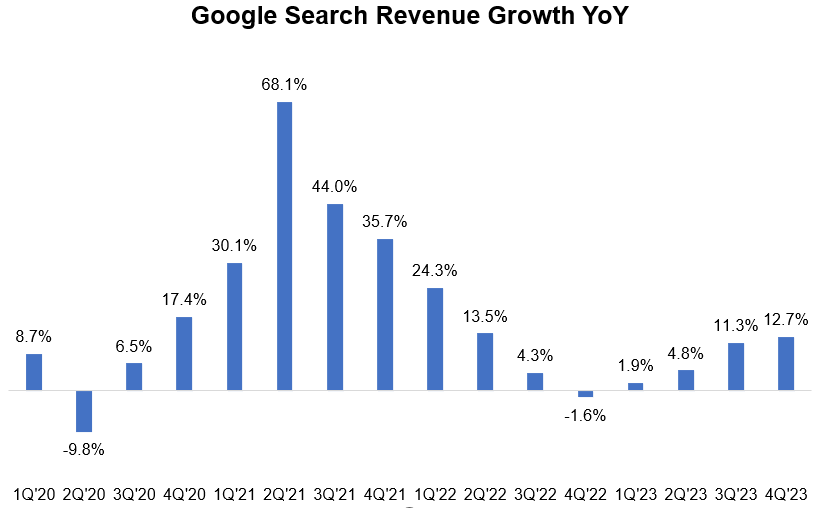

- Search revenue growth YoY continued to accelerate. While GenAI bear case remains top of mind concern for Search among Google observers, the business seems to be cruising along so far.

Justin Sullivan/Getty Images News

While I have sold my shares in Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) last month, I remain a very curious observer.

Here’s my highlights from today’s earnings.

Revenue

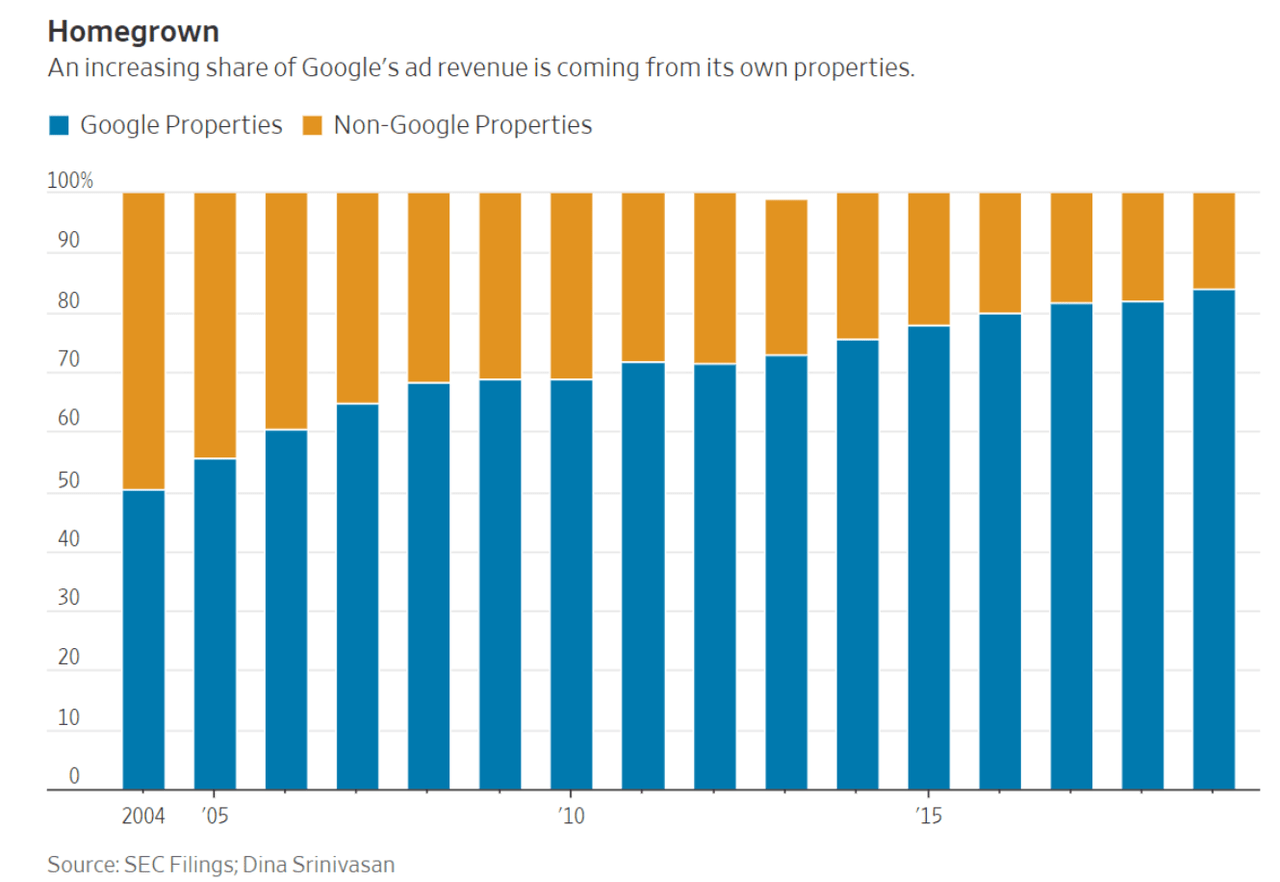

While almost every single revenue segment grew by double digits, Google Network was down ~2% YoY and ~10% from 4Q’21. The Network business may not be terribly important given it’s a relatively lower margin segment compared to Search, but it may be indicative of the general direction of where the open web is heading.

Company Filings, MBI Deep Dives, Daloopa

As I have mentioned before, Google’s reliance on non-Google properties has declined consistently since its IPO 20 years ago; this trend has likely accelerated and likely will continue to do so in the age of GenAI.

Is that bad news for Google? On the one hand, you can argue that open web’s role has been diminished for years without making much of a dent on Google’s health. On the other hand, Dan Taylor, VP of Global Ads for Google, was quoted saying this on a WSJ piece published in 2022:

“Without websites to be searchable and discoverable content, people would have less need for search engines like ours. In that way our interests are really aligned with supporting publishers through ads.”

It remains an open question in my mind to what extent Google can be insulated if open web becomes increasingly crippled. It would be clearly a terrible news if Google didn’t own YouTube; perhaps Google’s YouTube acquisition will prove to be an even better masterstroke than it already is regarded in 5 years’ time!

EBIT

Google Services business maintained its mid-30s operating margin profile. The real surprise was Google Cloud which accelerated margin from just 3.2% in 3Q’23 to 9.4% in 4Q’23. In just 16 quarters, Google Cloud’s margin improved from negative 62% to +9.4%!!

Company Filings, MBI Deep Dives, Daloopa

Google’s incremental margin also remained quite healthy at 54% in 4Q’23. While corporate costs appear inflated. Please note it includes restructuring costs of $1.2 Bn in 4Q’23 and $3.9 Bn in 2023.

Company Filings, MBI Deep Dives, Daloopa

Search

Search revenue growth YoY continued to accelerate. While GenAI bear case remains top of mind concern for Search among Google observers, the business seems to be cruising along so far.

Company Filings, MBI Deep Dives, Daloopa

Some interesting comments on Search from the call:

We are already experimenting with Gemini in Search, where it’s making our Search Generative Experience, or SGE, faster for users. We have seen a 40% reduction in latency in English in the U.S.

We had particular strength in retail in APAC, a trend that began in the second quarter of 2023 and continued through the end of the year.

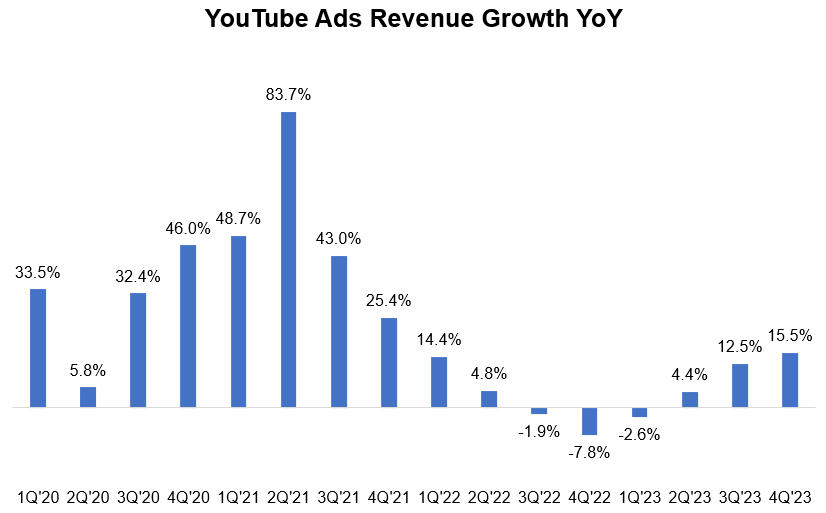

YouTube

Like Search, YouTube ads growth also accelerated this quarter. YouTube shorts is now viewed 70 Bn times daily (note, it’s the same data they shared last quarter).

Company Filings, MBI Deep Dives, Daloopa

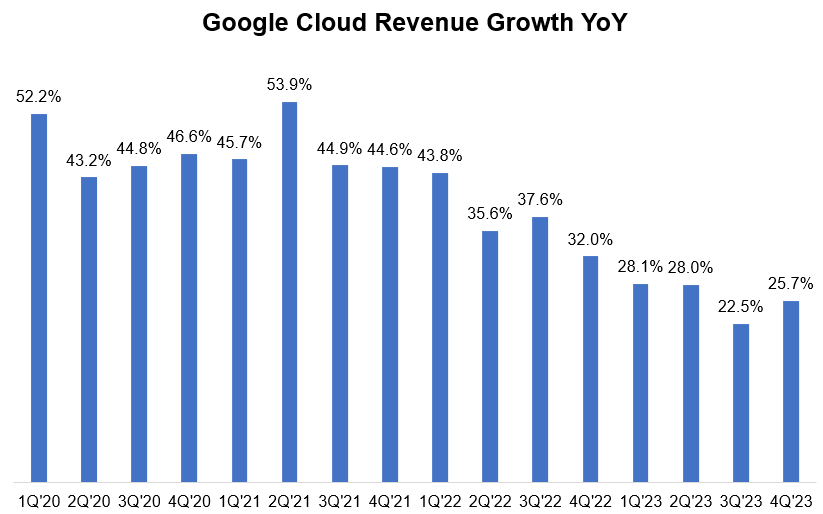

Google Cloud

After disappointing investors last quarter, Google Cloud beat expectations (which was ~22%) this quarter.

Company Filings, MBI Deep Dives, Daloopa

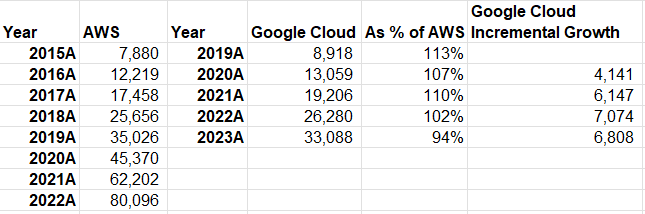

As I noted before, Google Cloud’s revenue historically lagged AWS revenue by four years. Looking at how AWS performed in 2020-22 period, I think it is fair to assume Google Cloud will almost certainly not be able to maintain this historical trend in 2024-26 period.

2023 was also the first time Google Cloud’s incremental revenue $ growth was lower than it was the year before.

Company Filings, MBI Deep Dives

Some interesting comments on Google Cloud from the call:

Vertex AI has seen strong adoption with the API request increasing nearly 6x from H1 to H2 last year.… the cost optimizations in many parts are something we have mostly worked through

Google Other

Google Other is now categorized as “Google subscriptions, platforms, and devices”. Subscription revenue (YouTube Premium and Music, YouTube TV and Google One) is now $15 Bn revenue business, which has been ~5x since 2019.

While this is quite impressive, please note the primary driver for subscription business is YouTube Premium and Music, both of which are likely lower gross margin business.

Some interesting comments from the call:

Google One is growing very well, and we are just about to cross 100 million subscribers.Play had solid growth again in the fourth quarter driven primarily by an increase in the number of buyers. In devices, we continue to make sizable investments with increased emphasis on our Pixel family, particularly with AI-powered innovation while driving further efficiencies across the portfolio.

Capital Allocation

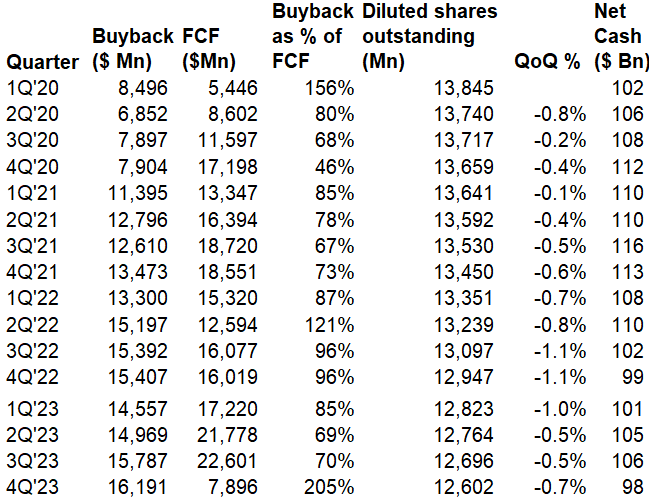

Google posted $7.9 Bn FCF last quarter and bought back $16 Bn shares. Please note Google made a $10.5 Bn tax payment in October last year which affected their FCF for the quarter.

Overall, they generated $69 Bn FCF in 2023 and repurchased $62 Bn shares. They still have $98 Bn net cash on balance sheet.

Company Filings, MBI Deep Dives, Daloopa

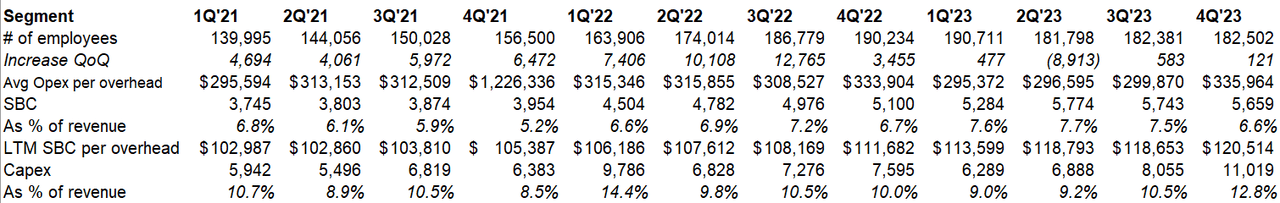

Capex and Opex

Google’s headcount was largely flat QoQ, but capex as % of revenue increased to 12.8% in 4Q’23 which was higher since 1Q’22. This increased capex was “driven overwhelmingly by investment in technical infrastructure with the largest component for servers followed by data centers”.

Google also indicated that 2024 capex will be “notably larger” than it was in 2023 which was ~$32 Bn. Management didn’t quite hint or clarify what is meant by “notably larger”, but I would guess around $40-44 Bn:

The step-up in CapEx in Q4 reflects our outlook for the extraordinary applications of AI to deliver for users, advertisers, developers, cloud enterprise customers and governments globally and the long-term growth opportunities that offers. In 2024, we expect investment in CapEx will be notably larger than in 2023.

Company Filings, MBI Deep Dives, Daloopa

Outlook

Google doesn’t provide guidance, but management did seem to hint at tougher comps ahead:

As we enter 2024 with advertising revenues of more than $100 billion higher than 2019, we remain focused on sustaining healthy growth on this larger base.

While topline may face a tougher second half ahead of Google (and other big tech), Google can perhaps navigate that and grow earnings through a better operating discipline:

As we have repeatedly stressed, we remain committed to our framework to durably reengineer our cost base as we invest to support our growth priorities. Key contributors to moderating our expense growth include: first, product and process prioritization to ensure we have the right resources behind our most important opportunities and to reallocate resources where we can; second, organizational efficiency and structure. We’re focused on removing layers to simplify execution and drive velocity.

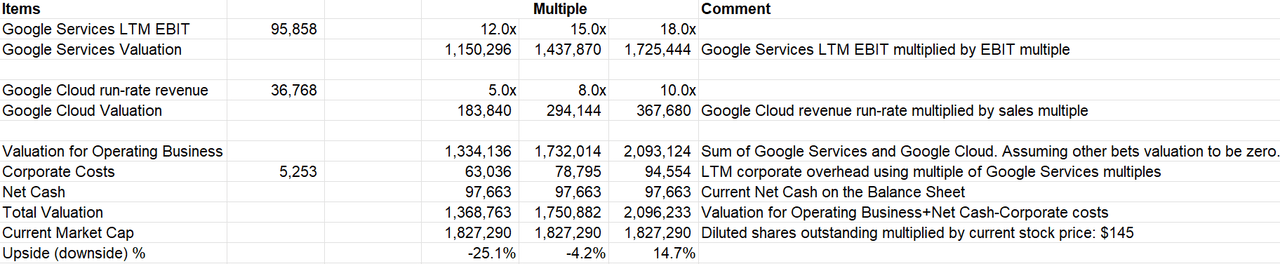

Valuation

I share the following valuation framework every quarter. The market seems to be valuing the Google Service business at ~15x EBIT and the Cloud business at ~8-10x revenue multiple.

While Cloud or other segments can provide some downside protection for shareholders, Alphabet remains essentially a bet on Search and its ability to protect, sustain, and grow Search. That reality is unlikely to change anytime soon.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.