Summary:

- Alphabet Inc. is undervalued within the Magnificent Seven stocks, with AI and cloud growth tailwinds not fully priced in.

- Fears of AI chatbots replacing Google Search are overblown; Google’s ecosystem and Gemini AI advancements strengthen its competitive position.

- Google Cloud’s robust growth and improving margins significantly contribute to Alphabet’s overall revenue and profitability.

- Chrome Divestiture fears may be overblown considering the incoming Business-friendly administration.

- Quantum Computing innovations and undervaluation relative to peers support a Buy rating for Alphabet, with a price target of $240 in 6–9 months.

da-kuk/E+ via Getty Images

Brief/Overview

Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) is an American multinational technological company headquartered in California. While it is the parent company of Google, the search engine, it is more popularly known as Google, a name synonymous with online search. It also operates other popular products such as Gmail, YouTube, Google Cloud, and Gemini AI.

Google is the most undervalued stock in the famous Magnificent Seven (Mag 7) stocks that have characterized the bull market since 2023. My bullish thesis is based on the opinion that pessimism around the company, such as generative AI tools eating into search engine volumes and the potential Chrome divestiture, has been over-priced into the stock. At the same time, tailwinds from quantum computing, developments with Gemini AI 2.0, and the stellar performance of Google Cloud are yet to be fully priced into the price.

Thesis/Triggers

GenAI / Search pessimism irrational

Since their launch, artificial intelligence tools like ChatGPT have captivated the world with their capabilities, rapid learning speed, and rapid release of new versions and models. Amidst all the hype, Gartner released a report in February 2024 forecasting that AI chatbots and other virtual agents would lead to a 25% drop in search volumes of traditional search engines. Alan Antin, VP Analyst at Gartner, believes Generative AI solutions will substitute search engines as sources for user queries, which would force companies to reorganize their marketing strategies. These fears would be somewhat priced into the stock in the form of lower valuation multiples or, more likely, lower revenue estimates based on the consensus estimates, which seem to suggest revenue growth slowing down to between 9% and 11%.

However, these fears are largely overblown, in my opinion. There are many problems with Generative AI that many seem to be ignoring intentionally or may be oblivious to. In the near 18 months since the integration of ChatGPT into Bing in May 2023, Google has lost only 3% market share.

There are multiple reasons why AI-powered tools will find it incredibly hard to replace Google. The first is the Google ecosystem, from maps to the Google suite to Drive and Cloud and other things, which all help drive traffic through and to the search engine. While many users are moving to search engines such as DuckDuckGo, which promote privacy, Google has also adapted by moving its source of data collection to Google Chrome and by creating different user profiles that help drive customization. This is exactly the moat possessed by the company—to be able to collect personalized information and offer high-quality ad targeting to their advertisers. It is questionable how much data AI search engines will be able to collect legitimately and offer personalized advertisements to their users. Additionally, the vast base of customers and advertisers builds a strong network effect, which creates a lot of inertia among users on both ends, making it difficult to time when one would switch to other platforms (in this case, AI search engines or chatbots).

These new-age AI search tools also face challenges. AI search platforms frequently encounter the dual challenge of gathering adequate and valuable data to enhance their algorithms, while simultaneously managing the delicate balance of user privacy expectations. For instance, Reddit called out OpenAI for data scraping, and Musk threatened to sue Microsoft for using Twitter data to train their AI models. AI search engines also have large financial requirements to fund their current state of lack of profitability, as well as to fund infrastructure such as data centers and acquiring (and later developing) their own artificial intelligence chips. Traditional search engines, including Google, have developed sophisticated monetization models centered around advertising. Even ChatGPT developer OpenAI is struggling to remain profitable, as it expects losses of $5 billion on a revenue of $3.7 billion in 2024. These losses do not include stock-based compensation and other large expenses not fully documented.

Apart from this, Alphabet itself is working on integrating its Gemini AI into the Google search engine. CEO Sundar Pichai took to X (previously Twitter) to announce the launch of Gemini 2.0, which he claims is twice as fast as the previous Gemini 1.5 Pro whilst also outperforming it on key benchmarks (see image below).

Sundar Pichai on X (prev. Twitter)

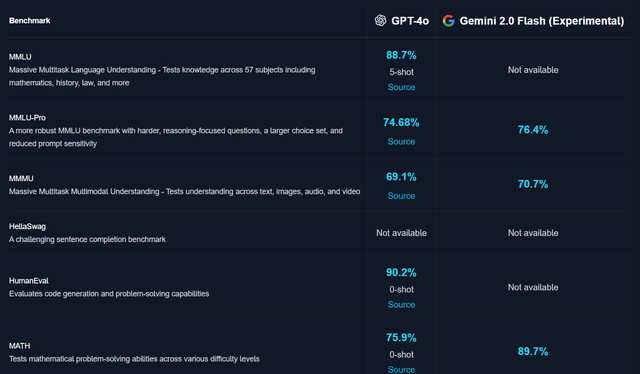

While Google has managed to improve upon the Gemini 1.5 Pro, OpenAI’s new GPT-4o is worse than its predecessor, scoring lower on the Artificial Analysis Quality Index as well as on the GPQA Diamond question set. The below image demonstrates a comparison of the Gemini 2.0 Flash (Experimental) vs. OpenAI GPT-4o on various key metrics.

Gemini 2.0 Vs GPT4o (DocsBot.AI)

All the talk of Microsoft or OpenAI being the undisputed leader in generative AI can now rest as the Gemini 2.0 Flash (Experimental) being proven to be better than the OpenAI GPT-4o.

Even if AI search engines are to replace traditional search engines, currently available information on generative AI models as presented above would suggest that Google has leapfrogged OpenAI into first position in that race.

Google Cloud performance: Growth and Margins

Every large technology has inevitably forayed into the cloud business, and while search remains the cash cow business for Alphabet, Google Cloud is starting to emerge as a real rising star for the company.

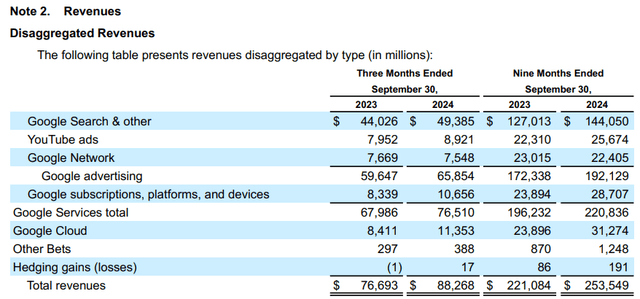

Based on data available in the 10-Q filing for Q3 2024, Google Cloud generated $11.353 billion in revenue (12.86% of total), which represents a 35% increase from $8.411 billion (10.96% of total) in Q3 2023. Apart from growing revenues at a very strong pace, the cloud has also shown steadily improving margins. The below graph shows quarter-wise revenues and operating income (and margins) for Google Cloud. Operating margins in the Google Cloud business have improved from 256 basis points (2.56%) in Q1 2023 to 940 basis points (9.40%) at the start of 2024, and up 775 basis points (7.75%) to 1715 basis points (17.15%).

The cloud business contributed nearly a quarter of the total revenue growth, highlighting Google Cloud’s significant role in Alphabet’s overall growth. Operating income at Alphabet grew $7.178 billion YoY, of which Google Cloud contributed nearly 24% as it grew Q3 operating income from $266 million to $1.947 billion.

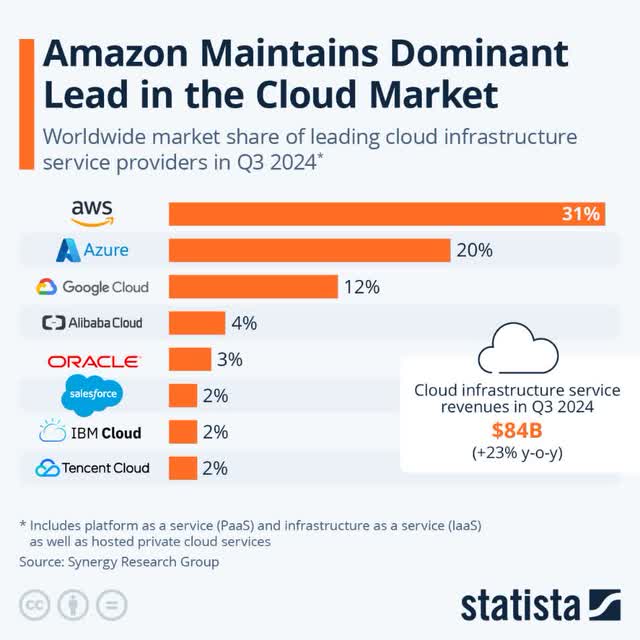

Global spending on cloud infrastructure services increased 23% YoY to $84 billion in Q3 2024 for reasons such as increased enterprise spending on artificial intelligence-oriented services. It is no surprise to me that Google, a company very well integrated into the corporate working system through its suite of products, has outperformed in this segment as Google Cloud grew revenues faster than the broader market and picked up a percentage point or two in market share.

Cloud Computing market share (Synergy Research Group via Statista)

I would expect Google Cloud to grow revenues at a healthy rate, at least in line with the broader industry average and likely even faster as it benefits from its network of products in the workspace, as well as what seems to be the most capable GenAI model (as highlighted earlier). Additionally, cloud computing is a market with high operating leverage, and once breakeven has been reached, there are little headwinds to operating margins, and they could go up to as high as 40% as demonstrated by AWS (38%) and Microsoft Azure (46%). Google Cloud is currently only at 16% operating margins, and I would expect that figure to rise much higher in the coming quarters.

Quantum Computing

Google surprised the tech world on December 9th by revealing its new quantum computing chip, Willow. Let us first try and understand what computing is. IBM defines quantum computing as “Quantum computing is an emergent field of cutting-edge computer science harnessing the unique qualities of quantum mechanics to solve problems beyond the ability of even the most powerful classical computers.”

While traditional computers function based on the well-known system of binary bits (zeros and ones) to store and process data, quantum computers can encode much more data using quantum bits, or qubits in short.

A qubit behaves like an ordinary binary bit storing either a zero or a one, but it can also be a weighted combination of zero and one at the same time. When combined, qubits in superposition can scale exponentially. Two qubits can compute four pieces of information, three can compute eight, and so on and so forth.

Returning to Alphabet, their Quantum AI Lab unveiled the Willow chip, a technology they believe will enable humanity to make significant progress in quantum computing. It claims to process computations, requiring even the best supercomputer today 10^25 years within 5 minutes. Additionally, the company claims it has mitigated one major risk factor in quantum computing with Willow, which is that of increased risk of errors as one increases the number of qubits.

Boston Consulting Group expects quantum computing to grow to a market size as high as $170 billion by 2040, much like McKinsey, which expects the market size for quantum computing to be as high as $131 billion by 2035. Compared to the level of Alphabet’s revenues currently or even in 2035, these figures may appear very small. However, this moment seems to me to be the equivalent of the creation of the World Wide Web (1989) moment for the internet, and we all know how big internet companies are 35 years since then. The good thing is technology grows at an accelerating rate, and investors may not have to wait as long for Alphabet to be in a position to capitalize on the gains it has made in quantum computing.

If Alphabet is able to build a position similar to Nvidia’s in the artificial intelligence chips market of having 80% market share and 50% profit margins, then that’s over $100B in additional revenues and $50B of fast-growing profits by 2035. Quantum computing’s potential and its potential benefits to the company are difficult to quantify, yet the future appears promising with limitless technological advancements.

Valuation – Median Multiple and Technical Analysis

After considering all the factors that will serve as tailwinds to Alphabet stock, namely the stellar performance of the Google Cloud segment, the innovation with the Quantum Computing, Gemini leapfrogging GPT-4o as the best Generative AI model, and unfounded pessimism around artificial intelligence chatbots replacing traditional search engines, it is time to arrive at a valuation for Google.

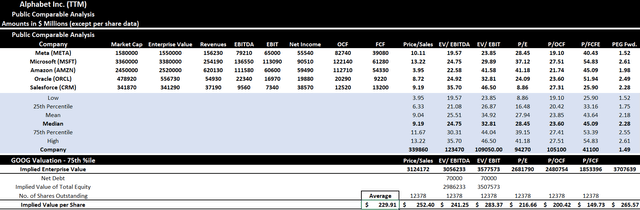

Fundamentally, I am choosing a median multiple valuation technique for Google. The comparable companies considered are Meta, Microsoft, and Amazon—all of which have dominant positions in their specific industries: social media, computer operating systems, and online retail, respectively. Additionally, the latter two also have a common segment in cloud computing. The other comparable companies are Oracle and Salesforce since both have cloud-based businesses.

The various valuation multiples include price/sales, EV/EBITDA, EV/EBIT, price/earnings, price/operating cash flow, price/free cash flow, and forward PEG. Alphabet was undervalued versus its comparable companies on all measures except price to free cash flow, which is likely due to the heavy capital expenditure that the company is pursuing, investing in artificial intelligence chips as well as setting up infrastructure facilities in the form of its data center campuses.

Based on this analysis, the price target for GOOG is ~$230, which suggests a potential 15% upside, prompting a Buy rating on the stock. The below image shows the median multiple valuation used.

Median Multiple Valuation (Seeking Alpha Peer Valuation)

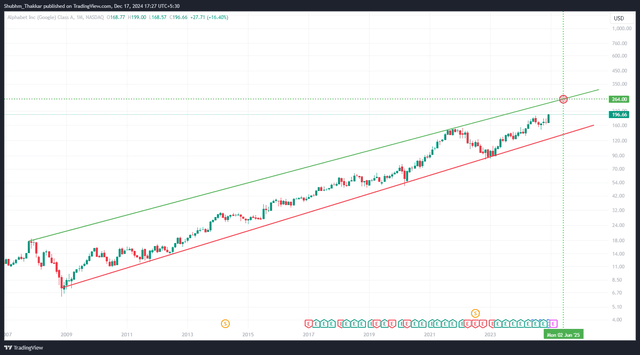

Additionally, I am also performing technical analysis on the monthly chart of Alphabet to arrive at a possible price target at which the stock can be expected to peak out.

The red trendline is drawn by joining all the bottom points, which are price levels where traders and investors have deemed the stock to be undervalued. The stock hit this trendline in the aftermath of the financial crisis, the US sovereign debt downgrade, during the COVID bear market, and during the 2022 bear market.

While the stock lies between these two trendlines, in a raging bull market like the current one, concrete fundamentals, strong tailwinds, and weaker-than-priced-in headwinds, as well as undervaluation relative to peers as suggested by the median-multiple valuation, it is extremely likely that the stock is headed for the green trendline rather than the red one. Based on the stated available evidence, the price can move much higher to levels of $264 by the end of June 2025, which is before the final judgment pertaining to the Chrome divestiture.

GOOGL monthly chart (TradingView)

Risks

Chrome divestiture fears

One major risk factor to my bullish thesis is the risk of Alphabet having to potentially divest out of Google Chrome and possibly forcing restrictions on Android.

Google has nearly 90% market share in the search engine business, and a key contributor to this is the Google Chrome browser, which helps drive traffic to the Google search engine. Chrome itself has a near 68% market share, and combined with Safari’s 18%, these two browsers combined account for nearly all of the market share of Google, the search engine.

Alphabet’s search business is the biggest contributor to their revenues, accounting for nearly 57% of their revenues in the first three quarters of 2024 (image attached below). It is tough to estimate how much of this can be attributed to Chrome directly; however, it cannot be denied that without Chrome, Google’s market share in the search engine space would be much lower, and thereby Alphabet’s overall revenues would be affected as well. Chrome is a crucial strategic asset that links other Google services such as YouTube, Gmail, and other apps in the Google product suite that all help drive traction from users and help enhance Google’s ad-targeting capabilities, which in turn attracts advertisers to pay premium prices, which is what Google’s moat is.

Google revenue breakdown (Google Q3 2024 10-Q)

Alphabet can make the argument that Chrome does not directly generate revenue for the company. Additionally, Google can take a pro-consumer stance and make the case that search quality would deteriorate and its integration into the broader search ecosystem would be impacted, thereby negatively impacting its consumers—both users who search and advertisers alike.

Once President-elect Donald Trump takes office, I would expect his core policy themes of deregulation and a pro-business administration to spread across all departments of government. While it was the Trump administration that brought on this litigation and the second administration is likely to be very pro-business, I do not expect them to completely withdraw the case, as it would make the administration appear weak. The likely outcome in August 2025 would be moderate, enough to display a hawkish administration that helps other American companies be more competitive but also lenient enough that it does not hurt the experience of users, as well as allows them in general – and Google, in particular – to retain competitiveness on a global scale.

The threat of a divestiture from Google Chrome hangs over Alphabet stock, but it appears to me that these fears are overblown, and once that is cleared from above the stock, it would unlock some value and make room for the stock to head higher.

Conclusion

I conclude this report with a Buy rating on Google with a price target of $246 based on an equally weighted average of price targets derived from fundamental and technical analysis, with a time horizon of 6–9 months.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.