Summary:

- Alphabet reported solid first quarter results, with top and bottom line growing – only free cash flow declined due to high capital expenditures for AI infrastructure.

- Especially YouTube and Google Cloud are contributing to growth, but the spotlight is on artificial intelligence and the rivalry between Google and OpenAI.

- The stock is certainly not cheap, but when held for a decade or longer, it might still be a good investment with decent returns.

Kenneth Cheung

Similar to other major technology companies in the United States, I have also been rather cautious about Alphabet Inc. (NASDAQ:GOOG) – similar to my perspective on Microsoft’s (MSFT) or Amazon’s (AMZN) stock. However, it seems like I have been wrong in the last few quarters and underestimated the recovery from the previous decline, which lasted much longer than anticipated.

Since my last article was published, Alphabet increased 28% and compared to only 5% value gained for the S&P 500 (SPY) the stock clearly outperformed. In the following article, I will provide an update on Alphabet’s business and try to answer the question if Alphabet is a good investment now and if it was a mistake not to invest in 2022.

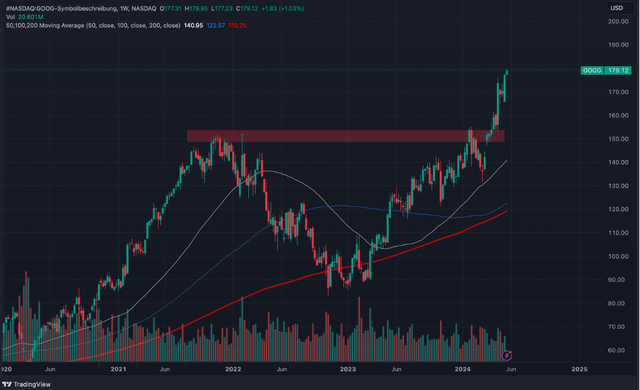

Technical Picture

One of the reasons I was rather cautious about Alphabet in my last article was the chart. Alphabet was trading close to the previous all-time high it set at the end of 2021 and due to the risk of a potential double top I argued to be rather cautious about an investment in Alphabet. But in the meantime, the stock has marched past the previous all-time high, and it seems like the stock is on its way towards higher prices.

Alphabet Weekly Chart (TradingView)

At this point, the chart looks quite bullish, and Alphabet might be on its way towards higher prices. This does not exclude pullbacks and corrections that could be rather steep. For example, it seems likely for the stock to pull back to the breakout level around $150 before finally moving higher.

Intrinsic Value Calculation

Aside from looking at the chart, we can also look at the simple valuation multiples and determine an intrinsic value for the stock. And here we can make the argument to be rather cautious. But I made the argument several times in the past that valuation by itself is not reason enough for individual stocks or the entire stock market to decline. Especially in the short to mid term, sentiment is setting the direction of the stock market and irrationality (or an extremely bullish sentiment) can last longer than we might anticipate.

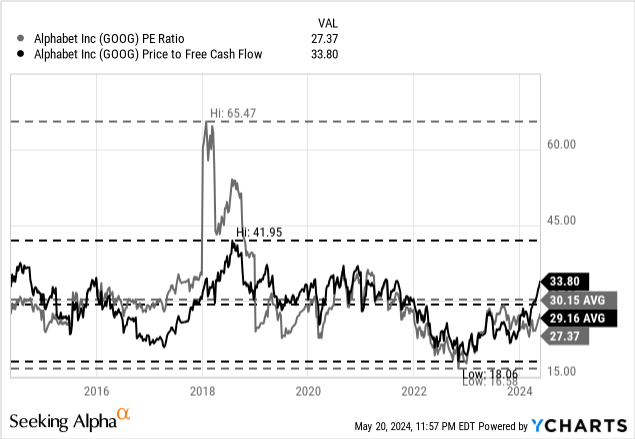

Nevertheless, Alphabet is currently trading for 27 times earnings and 34 times free cash flow. And while the stock is currently trading slightly below the average P/E ratio of the last ten years (which was 30.15), it is trading slightly above the average 10-year P/FCF ratio (which was 29.16).

And while we can’t make the case for Alphabet being extremely expensive at this point and trading more or less in line with previous valuation multiples, we also can’t make the case that Alphabet is a bargain either. Alphabet is at a point where valuation multiples could be justified by high growth rates, but we also should not take these valuation multiples for granted as investor sentiment can change with investors suddenly deciding 30 times free cash flow is not justified anymore.

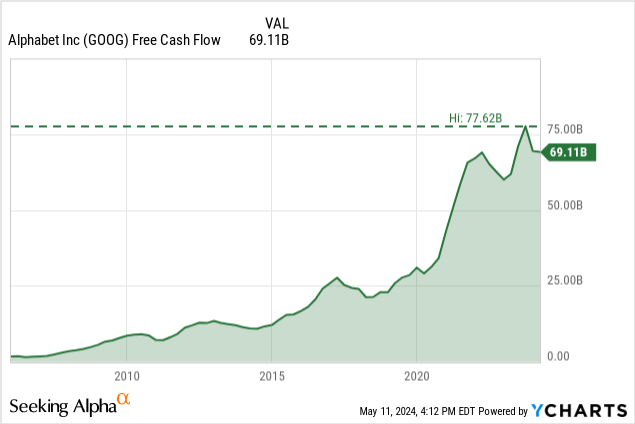

Aside from simple valuation multiples, we can also use a discount cash flow calculation to determine what growth rates are necessary for Alphabet to be fairly valued at this point. As always, we are calculating with a 10% discount rate and use the last reported number of shares outstanding (12,527 million). Additionally, we can use the free cash flow of the last four quarters ($69.11 billion) as the basis for our calculation, as the amount seems reasonable. When calculating with these assumptions, Alphabet has to grow 9% annually in the next 10 years, followed by 6% growth till perpetuity.

It certainly makes sense to use the slightly lower free cash flow from the last four quarters, as we can expect free cash flow growth struggling a bit in the next few quarters. Management pointed out during the earnings call that capital expenditures increased due to the necessary spendings in infrastructure to run AI models and applications.

Right now, the remaining question is if Alphabet can grow 9% annually for the next ten years. And to answer the question if 9% growth is realistic for the next ten years, we can look at the last quarterly results for a first hint.

Quarterly Results

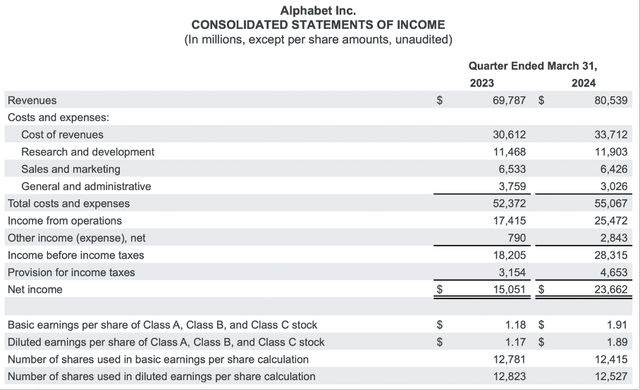

A little more than two weeks ago, on April 25, 2024, the company reported first quarter results for fiscal 2024. Revenue increased from $69,787 million in Q1/23 to $80,539 million in Q1/24 – resulting in 15.4% top line growth for Alphabet. Income from operations increased even 46.3% year-over-year from $17,415 million in the same quarter last year to $25,472 million this quarter. And finally, diluted earnings per share increased 61.5% year-over-year from $1.17 to $1.89.

Alphabet Q1/24 Earnings Release

So far, we saw high growth rates for revenue and especially earnings per share. Free cash flow, however, declined slightly from $17,220 million in Q1/23 to $16,836 million in Q1/24 – resulting in a 2.2% year-over-year decline. The reason for the declining free cash flow were mostly the higher capital expenditures, which had almost doubled from $6,289 million in the same quarter last year to $12,012 million this quarter.

Dividend and Share Buybacks

One of the major new stories was Alphabet following the footsteps of Meta Platforms. Recently, Alphabet also announced a quarterly dividend of $0.20. And of course, this is only a small dividend and is resulting in a dividend yield of 0.5% for the stock and for such a dividend yield no dividend investor will buy Alphabet. And when comparing an annual dividend of $0.80 to diluted earnings per share of $6.52 in the last four quarters, we get a payout ratio of only 12%.

Aside from the dividend, Alphabet is continuing to focus on share buybacks. Since about 2018, Alphabet reduced the number of outstanding shares from above 14 billion shares to about 12.5 billion shares right now. In the last four quarters, Alphabet spent $62,643 million on share buybacks and assuming a similar amount in the next four quarters and the same stock price as right now, Alphabet can repurchase about 370 million shares (and reduce the number of outstanding shares by almost 3%). And the board also announced another share buyback program of $70 billion.

Economic Moat

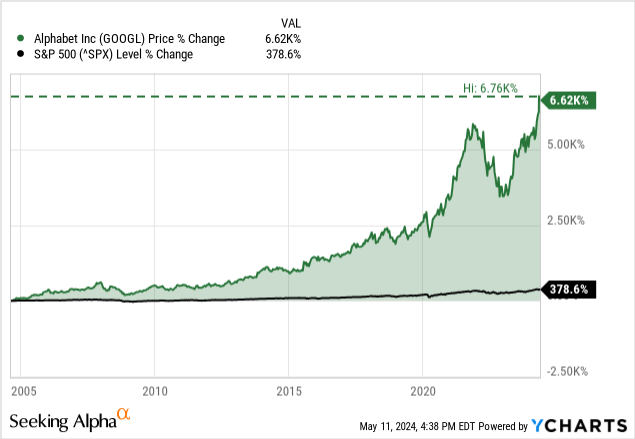

At this point, it seems important to mention the wide economic moat once again that Alphabet has around its business. A first hint for the wide economic moat is the clear outperformance of the stock vs. the S&P 500 and since the IPO of Alphabet, the S&P 500 increased “only” 379%, while Alphabet increased more than 6,600%.

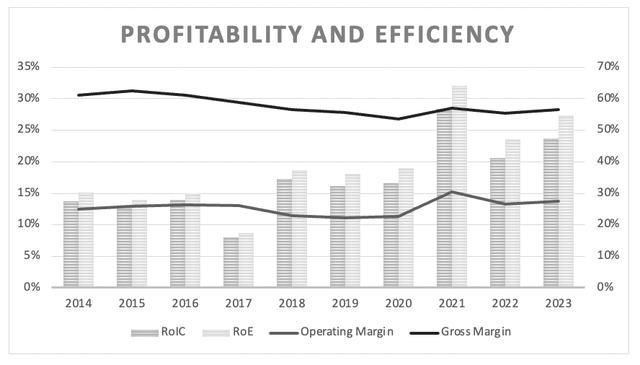

But not only the stock outperformance is hinting towards a wide economic moat around Alphabet. When looking at the last ten years, we also see margins which are more or less stable. Gross margin declined slightly in the last few years, but we can still make the case for high stability and consistency. Operating margin increased in the last ten years, and we also don’t see huge fluctuation, which is a good sign for a stable business with a wide economic moat.

Alphabet: Gross margin, operating margin and RoIC (Author’s work)

Aside from stable margins, it is especially the return on invested capital, which is a very important metric to answer the question if a business might have a wide economic moat or not. And in the last ten years, Alphabet reported on average a RoIC of 17.13% and in the last five years this number even improved and Alphabet reported a RoIC of 21.09%.

So far, we looked at quantitative hints for a wide economic moat, but that is not enough. We also must be able to describe the economic moat in a qualitative way to make sure a business was not just able to report impressive metrics for one decade and being unable to repeat that success in the years to come.

YouTube

One of the segments where Google seems to have a wide economic moat is YouTube. It is clearly profiting from network effects (more creators will be on YouTube if more viewers are on YouTube, and more creators will come with more viewers). And the numbers are clearly showing the dominant position of YouTube and that the network is still growing. Right now, viewers are watching over 1 billion hours of YouTube content daily and in 2023, more people created content on YouTube than ever before. And in the last three years, Google paid out over $70 billion to its content creators. Additionally, YouTube surpassed 100 million music and premium subscribers globally in Q1/24 (including trailers) and YouTube TV has now more than 8 million paid subscribers.

During the last earnings call, chief business officer Philipp Schindler gave his reasons why he thinks people are using YouTube and will continue to use it:

Viewers are watching YouTube because they expect to access everything in one place across screens and formats, their favorite creators, live sports, breaking news, educational content, movies, music, and more. And advertisers continue to lean in to find audiences they can’t find elsewhere.

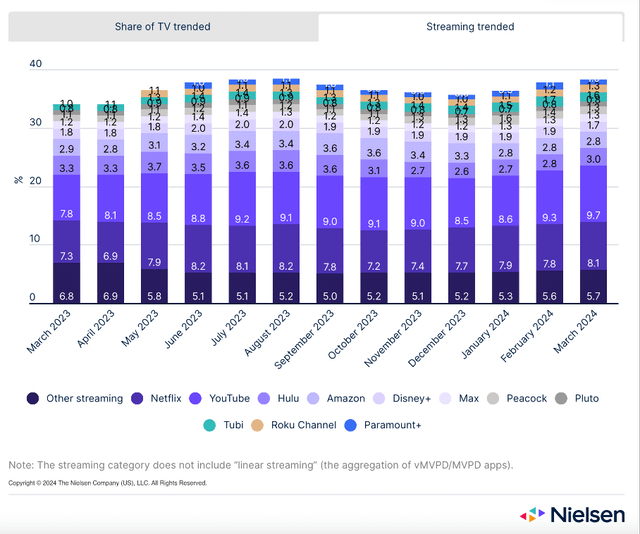

And this is also visible in different metrics and not just a statement by management. When looking at the numbers reported every month by Nielson (March 2024 in this case) we see streaming gaining market shares from 34.1% in March 2023 to 38.5% in March 2024.

And when looking at the results in more detail, we can not only see that YouTube is constantly leading the streaming category in the last few quarters, but the market share also improved from 7.8% in March 2023 to 9.7% in March 2024 and YouTube alone gained almost half of the market share streaming took from broadcast and cable.

Cloud

Another segment for Alphabet with a wide economic moat around the business is Google Cloud. And it is also one of the segments that has to match high growth expectations. In the last quarter, revenue for Google Cloud increased from $7,454 million in Q1/23 to $9,576 million in Q1/24 – resulting in 28.5% year-over-year growth. Especially, operating income increased at a high pace and almost quadrupled from $191 million in the same quarter last year to $900 million in Q1/24.

Especially for its cloud business, Google is embedding tools and advancements from artificial intelligence R&D and in total, Google added more than 1,000 new products and features to its cloud business in the last eight months. The company now offers more than 130 models – including the company’s own models, open-source models and third-party models.

CEO Sundar Pichai also pointed out that he is seeing Google being a leader in cybersecurity:

Our Cloud business is now widely seen as the leader in cybersecurity. I saw this firsthand when I went to the Munich Security Conference in February. Cybersecurity analysts are using Gemini to help spot threats, summarize intelligence, and take action against attacks, helping companies like American Family Insurance aggregate and analyze security data in seconds instead of days.

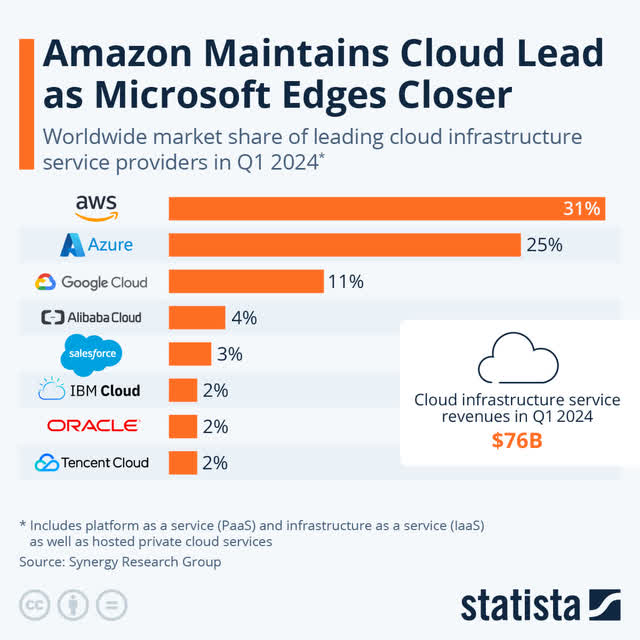

Although Alphabet remains third in third place among the major cloud providers worldwide – behind competitors Microsoft with 25% market share and Amazon with 31% market share – it is established as one of the three major businesses in this segment with a market share of 11%. And it will profit from the expected growth rates for this business(see studies from Mordor Intelligence or Grand View Research).

And during the last earnings call, management underlined its high ambitions and expectations for YouTube and the cloud business once again:

But in addition, we expect YouTube overall and Cloud to exit 2024 at a combined annual run rate of over $100 billion. This shows our track record of investing in and building successful new growing businesses.

Leader in AI?

The major topic everybody is talking about right now is still artificial intelligence. And in the 2010s – before OpenAI entered the stage – it seemed like almost everybody saw Google (or later Alphabet) as the clear leader in artificial intelligence. Since Open AI released ChatGPT 3.5 in November 2022, this social consensus suddenly called Alphabet’s AI dominance into question. Questions were raised if OpenAI could challenge Google’s moat, and for a few months it seemed like Alphabet’s management actually panicked. In the last few quarters, it seems like the tables turned again, and it became obvious that Alphabet is fighting back, and it is rather seen like a head-to-head race between OpenAI and Alphabet.

And although OpenAI (backed by Microsoft) can be seen as a worthy rival, we should not question Alphabet’s dominance in its core business – search – in any way. The company is also including generative AI features into its search business and is seeing an increase in search usage and an increased user satisfaction with the results. But OpenAI, on the other hand, is in talks with Apple (AAPL) to bring the technology to the next iPhone and AI features might be included in the next Apple device. While this is a great way for OpenAI to embed its applications into devices millions of people use every day, we should also not forget that Apple’s iOS has “only” 28% market share while Alphabet’s Android operating system has a market share over 70% – another clear economic moat the company has.

When talking about the rivalry between OpenAI and Alphabet, it often seems like there can only be one winner in the end – but that is far from true. A plausible scenario is both companies being among the leaders and both playing an important role. However, it seems unlikely that OpenAI can be a real threat to Alphabet – especially to the core, existing business.

And Alphabet might be able to wide its economic moat by adding new sources of revenue. So far, a huge part of Alphabet’s revenue is stemming from advertising, and by nature these revenue streams are cyclical. Over the long run, Alphabet can also monetize AI tools by new subscription plans and in Q1/24 the company introduced a new AI premium plan with Gemini Advanced and over the long run such subscription services might lead to additional revenue.

Conclusion

Without any doubt, Alphabet is a great business and certainly qualifies as a great long-term investment. Looking back, I regret not buying Alphabet when I published two rather bullish articles in May 2022 and October 2022, but I was too greedy at this point and hoped for even lower stock prices.

Now, Alphabet falls into the category of stocks that can be bought over the long run and will generate most likely a decent return. But the stock is neither cheap nor a bargain at this point, and therefore I will rate Alphabet with a “Hold” rating once again. But the current stock price is not completely unreasonable, and the company should be able to achieve the necessary growth rates to be fairly valued right now. Nevertheless, investors should have a time-horizon of at least 10 years, as the next few years might get bumpy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.