Summary:

- Alphabet has experienced a significant decline, now down 21% from its all-time high, making the stock undervalued.

- Antitrust lawsuits are a risk, but I believe the valuation, strong fundamentals, and growth potential make up for the risk.

- Alphabet has successfully navigated lawsuits in the past, and a potential breaking up of Alphabet’s business can actually unlock upside potential.

- LLMs like ChatGPT didn’t end up eating into Google’s revenue as some people originally thought would happen, and AI Overviews can help Google stay competitive.

Justin Sullivan/Getty Images News

Search engine giant Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) is now down 21% from its all-time high. The stock has been falling due to the overall tech sector sell-off recently, with the Invesco QQQ Trust ETF (QQQ) down about 11% from its all-time high, and also because it is facing headwinds from antitrust lawsuits. However, I believe that it can navigate the antitrust issues, as it has in the past, although I recognize that it’s a risk. There’s also the question of how LLMs like ChatGPT and Perplexity can affect Google’s ad revenues, but it seems like Alphabet has been handling the competition quite well.

Overall, Alphabet remains a high-quality compounder with more growth ahead (especially from Google Cloud), and it’s trading at a discount to its historical valuation multiples. When I see such a dominant growth company trading at a discount, I become bullish. Consequently, I rate GOOGL stock as a Buy.

Starting With The Lawsuits… Should You Worry About Them?

Alphabet is involved in some antitrust lawsuits right now, but I don’t think it’s anything worth worrying about, as this isn’t the first time Alphabet has been involved in antitrust lawsuits. It has successfully navigated them in the past, as I’ll explain below. But first, let’s get into the current lawsuits.

As a refresher, last month, judge Amit P. Mehta ruled that Google is guilty of illegally monopolizing the search market, violating antitrust law for over a decade to maintain its search engine dominance. On September 6, more news came out. The news is that by August of next year, the judge will share his decision on how to remedy Google’s dominance. This can include “breaking up Google” and/or a “potential ban on the company paying phone makers to pre-install Google search,” per The Washington Post.

Also, recently, the Competition and Markets Authority found that is engaging in anti-competitive behavior in open-display ad tech.

Can Breaking Up Google Be Good For Shareholders?

The short answer is yes. If Alphabet were to be forced to spin off its businesses, such as YouTube, Google Advertising, Google Search, Google Network, and potentially even Google Cloud, the total value of the separate entities could be higher than the current value of the combined entities, unlocking value for shareholders. Spinoffs are generally believed to create value for that reason, and this situation would be no different.

Past Lawsuits Alphabet Has Navigated

In 2018, Google was fined €4.34 billion (about $5 billion) by the European Commission for abusing its dominance through the Android operating system. The press release from the European Commission stated, “Since 2011, Google has imposed illegal restrictions on Android device manufacturers and mobile network operators to cement its dominant position in general internet search.”

In 2017, Alphabet was hit with a €2.42 billion fine after it “abused its power by promoting its own shopping comparison service at the top of search results.”

The moral of the story here is that Alphabet ended up just fine, and those who feared the lawsuits missed out on big gains from the stock. Still, I will admit that the current lawsuits are larger in nature, as they directly target Google’s Search business, so the risks are there. But again, there’s also upside potential if spinoffs happen. Thus, what will happen remains to be seen, and it’s something that I’ll be monitoring but won’t lose sleep over.

Alphabet Continues To Show Solid Growth Despite LLM Competition

Remember when everyone was afraid that ChatGPT and other LLMs would make Google obsolete? Well, that hasn’t played out in the financials, and it might not happen at all. While it’s true that some people (including myself) use Google less often these days in favor of a quick ChatGPT query, that doesn’t mean Alphabet is done.

Take the recent results, for example. In Q2 2024, revenue in the Google Search & Other segment increased to $48.509 billion from $42.628 billion in Q2 2023, a 13.8% increase, and total Google Services revenue (which includes the section I just mentioned) grew by 11.5% year-over-year to $73.928 billion. Total company-wide revenues grew by 13.6%. Alphabet wouldn’t be growing by double-digits if LLMs were truly a problem.

Additionally, Alphabet now has AI Overviews, which will keep people on the Google ecosystem. AI Overviews provide AI-generated responses to regular Google Searches using sources across the web. For now, the feature is only available in the U.S., but it will be made international eventually. In the most recent earnings call, Alphabet’s CEO, Sundar Pichai mentioned the following about AI Overviews:

“People who are looking for help with complex topics are engaging more and keep coming back for AI overviews. And we see even higher engagement from younger users, aged 18 to 24, when they use search with AI overviews. As we have said, we are continuing to prioritize approaches that send traffic to sites across the web. And we are seeing that ads appearing either above or below AI overviews, continue to provide valuable options for people to take action and connect with businesses.”

Based on the quote above and the financial results, it’s clear that Alphabet continues to innovate to stay on top of its game, and ads will still show up with AI Overviews.

Google Cloud Is Exceptionally Strong And Becoming More Relevant

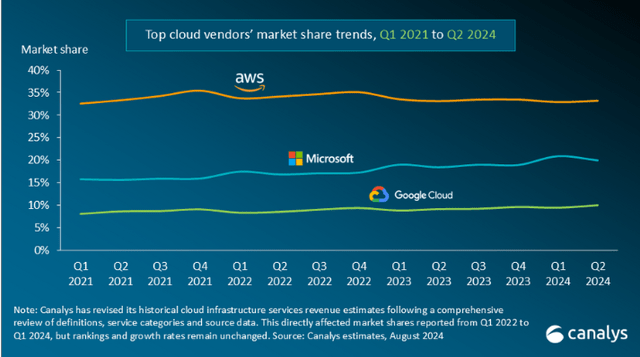

For each quarter that passes, Google Cloud becomes a more relevant part of Alphabet’s business. In Q2, 2023, the segment made up 10.8% of company-wide revenues and 1.8% of total operating income. In the most recent quarter, it made up 12.2% of revenues and 4.3% of operating income. Notably, Google Cloud’s operating margin grew from 4.9% in Q3 2023 to 11.33% in the most recent quarter, and the segment’s revenue grew by 28.8% to $10.347 billion.

Also, Google Cloud’s market share in the cloud infrastructure services market continues to grow, now at 10%, according to Canalys. In Q1 2022, it was 8%. Therefore, Google Cloud is not only outpacing the competition, but it’s also rapidly improving its profitability in the process.

Google Cloud Market Share Comparison (Canalys)

Additionally, given that Amazon’s (AMZN) AWS operating margin was over 35% for Q2, Google Cloud can see lots of margin expansion, even if it only reaches half of AWS’s profitability. Overall, more growth is likely ahead for Google Cloud, especially with the cloud infrastructure services market expected to grow at a 17.3% CAGR from 2024-2033, according to Precedence Research. This, of course, should give GOOGL stock a long-term boost.

Is GOOGL Stock Undervalued?

Several metrics point to GOOGL stock being undervalued or at least reasonably priced at the moment. First, its P/E ratio comes in at 21.65x. This is notably lower than its five-year average of 26.7x. Second, its forward non-GAAP P/E (next 12 months) comes in at around 19x, compared to an average of 24.43x since October 2019. Third, its next-12-months price/FCF multiple is close to 22x, compared to an average of 23.75x since October 2019.

Note that the screenshot below states 23.09x as the last figure, but that doesn’t include today’s 4% drop, which brings the multiple closer to 22x.

GOOGL NTM FCF Multiple (tikr.com)

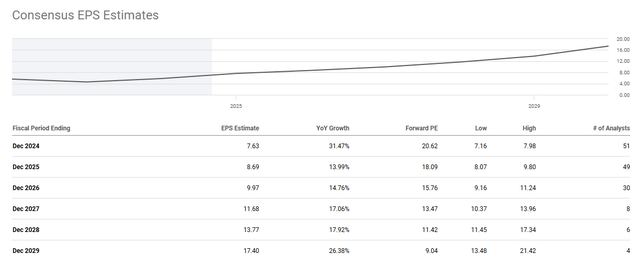

Therefore, there’s room for valuation multiple expansion with GOOGL stock (especially as interest rates eventually come down). However, even if you don’t believe that to be true, there’s still upside potential based on analyst estimates.

For December 2025, analysts expect GOOGL’s EPS to reach $8.69. That’s about 1-and-a-half years out from now. If GOOGL achieves that and even sees a slight decline in its P/E ratio to 21x, that would give the stock a share price of $182.49, or about 20.9% higher than the current price of $150.92. That’s not a head turner, but it’s also not a bad return in 1-and-a-half years (it’s roughly a 13.5% return annualized) for a more “base-case” scenario.

GOOGL EPS Estimates (Seeking Alpha)

The Bottom Line on GOOGL Stock

Alphabet remains a high-quality, dominant large-cap stock with growth expected ahead. While there are risks associated with the antitrust cases, Alphabet has navigated these kinds of things in the past and has come out stronger. Also, a potential breaking up of the business can actually unlock value for shareholders via spinoffs.

Looking past the lawsuits, Alphabet has been able to grow despite concerns about LLMs making Google Search obsolete, and its Google Cloud business is firing on all cylinders. Google Cloud is becoming more and more relevant (and profitable) each quarter, with lots more room for margin expansion if it can catch up to AWS’s operating margins.

Finally, when analyzing the valuation, GOOGL stock seems undervalued. Its current and forward P/E, as well as its forward FCF multiple, are below historical averages, and even if the firm sees a slight decrease in its P/E multiple, it can still return over 20% in about 18 months or so if it meets EPS estimates. Therefore, I rate GOOGL as a Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, GOOG:CA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.