Summary:

- On August 19th, 2004, Alphabet shares IPO’d at a split-adjusted price of $2.13. In the 20 years since, the stock has been a top performer in many aspects.

- Simply looking at the top line, revenues have exploded from $512 million in Q4 2003 to $84.7 billion in the latest quarter.

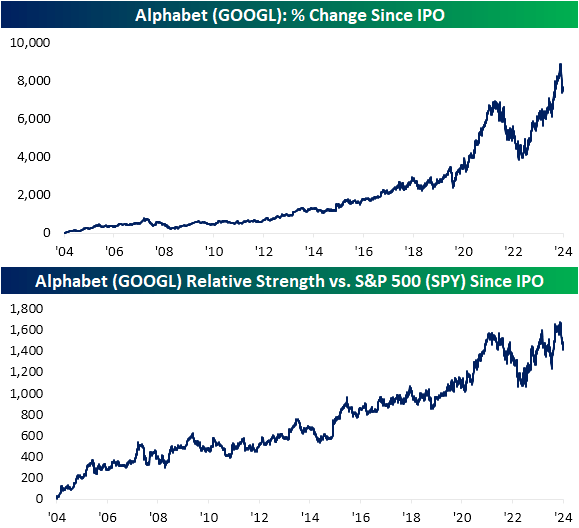

- Given its rise to become one of the six ‘trillion dollar market cap’ companies, the stock has ripped higher an astounding 7,669% from its IPO price.

400tmax

Twenty years ago to the day, the company running the world’s largest search engine went public. On August 19th, 2004, Alphabet (NASDAQ:GOOGL) shares IPO’d at a split-adjusted price of $2.13. In the 20 years since, the stock has been a top performer in many aspects. Simply looking at the top line, revenues have exploded from $512 million in Q4 2003 to $84.7 billion in the latest quarter. Given its rise to become one of the six “trillion dollar market cap” companies, the stock has ripped higher an astounding 7,669% from its IPO price.

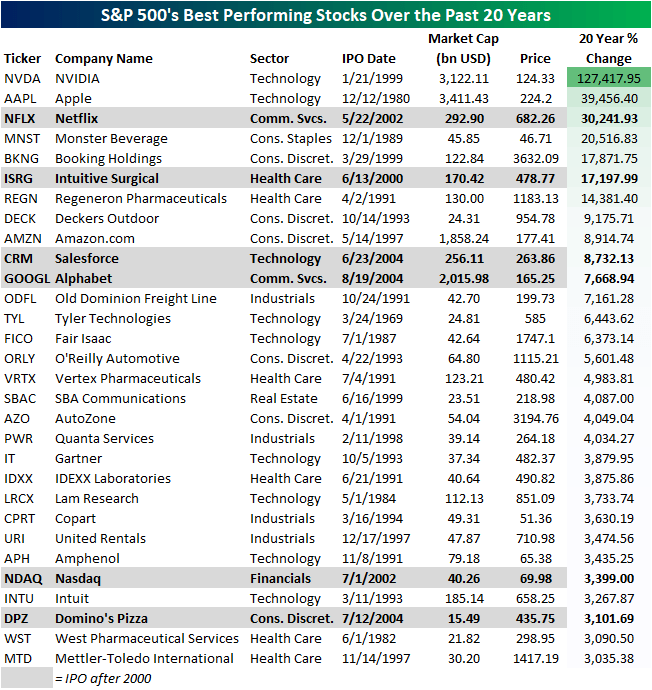

So how has Alphabet done in the 20 years since it went public versus other big winners in the stock market? Below is a look at the 30 stocks currently in the S&P 500 that are up the most over the last 20 years. As shown, these 30 names are all up more than 3,000% since GOOGL’s IPO, and GOOGL ranks as the 11th best. Unsurprisingly, the single best stock by a huge margin is NVIDIA (NVDA) with a gaudy 127,418% gain, but other mega-caps like Apple (AAPL) and Amazon (AMZN) have both put up better numbers than GOOGL as well. Additional names that have done better than GOOGL include Netflix (NFLX) with a 30,000%+ gain, Monster Beverage (MNST), Booking Holdings (BKNG), Intuitive Surgical (ISRG), Regeneron (REGN), Deckers Outdoor (DECK), and Salesforce (CRM).

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.