Summary:

- Alphabet’s Bard entry into the AI space looks promising, while Microsoft’s collaboration with OpenAI and expansion to AI supercomputers position it for substantial growth in the AI market.

- Alphabet is well-positioned for long-term growth due to its continued investment in AI, expansion of its online video and streaming market offerings, and focus on cost management.

- Microsoft’s strength remains its cloud offerings, particularly Azure. In addition, it focuses on building long-term customer loyalty and aligning its cost structure with revenue growth.

- GOOG is a strong buy due to its more attractive valuation point and improving outlook, while MSFT earns a buy rating but with less upside potential.

da-kuk

Investment Thesis

The tech giants Alphabet Inc. (GOOGL) (NASDAQ:GOOG) and Microsoft Corporation (NASDAQ:MSFT) continue to innovate and expand their offerings. However, some investors might wonder which stock offers a more attractive risk/reward ratio amidst the current AI wars.

ChatGPT, the human-like AI language model, has amassed over 100 million users just two months after its release, making it the fastest-growing consumer product in history. Following OpenAI’s success, Microsoft has invested an additional $10 billion in it and designated Azure, a cloud infrastructure service, as OpenAI’s only computing provider. On the other hand, Alphabet introduced Bard to compete head to head with ChatGPT and added AI capabilities on Google Workspace, comparable to what Microsoft currently provides Office 365 users.

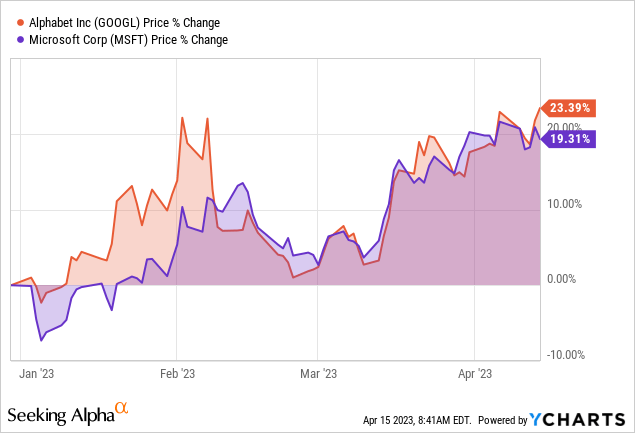

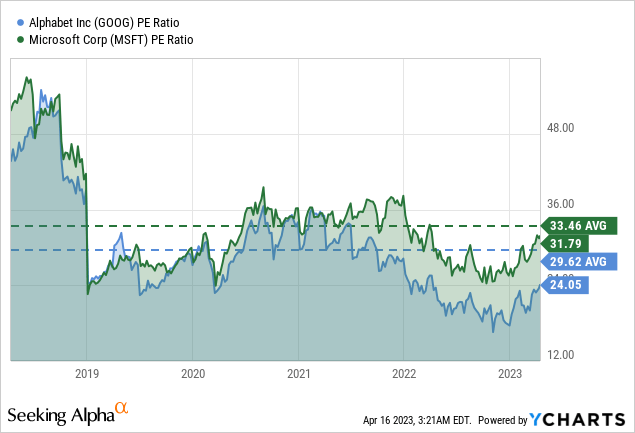

Undoubtedly Microsoft has taken the lead, which has already been reflected in its valuation, but GOOG’s AI prospects have not yet been fully recognized, suggesting current mispricing in the market. Nevertheless, GOOG remains a positive contributor to Yiazou’s model portfolio. Although it has returned more than 24% in a short time, I still see further upside supporting my strong buy rating for the stock. On the contrary, even though MSFT earns a buy rating as it still trades below historical averages, it has recently caught up in value, leaving less room for growth and suggesting a less favorable risk/reward profile.

A New Hustle: Bard Vs. ChatGPT

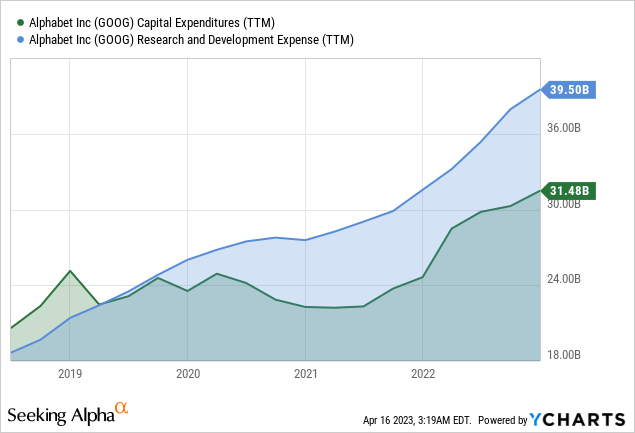

Alphabet’s focus on creating custom chips for AI training using the Tensor Processing Unit (TPU) technology is a strategic move that places the company in a favorable position for long-term growth in the AI market. With its TPU technology being faster and more power-efficient than Nvidia’s equivalent systems, Alphabet is already working on a new TPU to compete with Nvidia’s latest graphics chip for AI workloads. However, the launch of Google’s chatbot, Bard, has been challenging, and the wrong answer during the promotional video has caused a significant loss in market value for the company.

Meanwhile, Google’s entry into the AI chatbot space with Bard is a significant move, but compared to competitors ChatGPT and Bing, its responses are often basic and lack originality. This is mainly due to Google’s cautious approach in releasing an early experiment, which has impacted the accuracy of the chatbot. However, Google’s investments in research and development (R&D) and its responsible approach to AI development may positively impact its long-term performance and valuation. Furthermore, as the shift towards AI continues, Google’s emphasis on safety measures and responsible development may position it as a trusted player in the AI space.

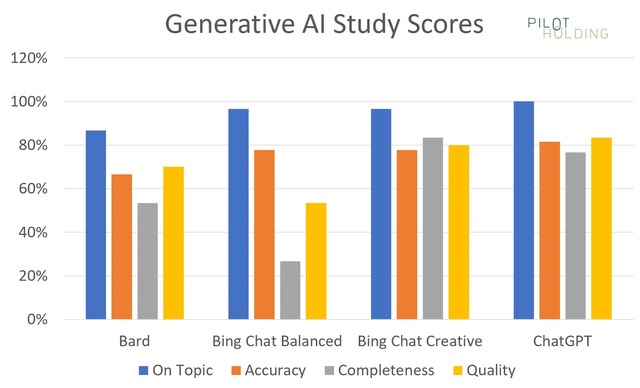

Not surprisingly, ChatGPT has outperformed every other AI chatbot, including Bard, in any category (on topic, accuracy, completeness, and quality);. At the same time, Google Bard will be better at surfacing information pertinent to questions, and ChatGPT will be better at summarizing content. Of course, since both tools are still in their infancy, only time will tell which performs better, but ChatGPT takes the lead for now.

Furthermore, Microsoft’s decision to monetize its AI-powered Bing search service suggests a positive outlook for further growth. As per Microsoft’s CFO, one point of search advertising market share is worth about $2 billion in annual revenue. The integration of ads into Bing’s chat version may increase revenue, although concerns about using publishers’ content without compensation have been raised. However, Microsoft’s intent to split the revenue with publishers through its Microsoft Start Publishers Program alleviates this concern. An optimistic view of Microsoft’s potential in generative AI is based on its ability to bring AI products and its extensive product portfolio that could benefit from AI integration.

Alphabet’s AI-Powered Growth Strategy

Alphabet, by leveraging AI, is developing innovative products and services with the potential to enrich existing offerings and attract new users and customers. This includes AI-powered advertising solutions that could drive significant campaign improvements and add value for advertising partners, as well as specific AI solutions for various sectors (like life sciences, manufacturing, and retail) that could attract more customers and lead to revenue growth. Specifically, marketers can gain from Google AdWords’ new capabilities by making their ads more relevant, connecting them with new consumers, and ultimately improving campaign effectiveness.

The company is focused on making Google a core part of shopping journeys and improving the overall consumer experience through more immersive search and a shoppable YouTube. It is also investing in YouTube’s creator ecosystem and multiformat strategy to drive long-term growth, focusing on ramping up shorts and investing in subscription offerings.

In the fiscal year 2022, Alphabet brought in $282.8 billion, a 10% increase over 2021. The primary source of revenue for the corporation continues to be Google search. Google controls 93% of the market for global search, and since more people use the internet on mobile devices and about one-third of the world’s population has never used the internet, traffic, and sales are projected to grow at a healthy rate over time.

Notably, Alphabet’s focus on expanding its offerings in the online video and streaming market positions it as a one-stop shop for various types of video content. By investing in subscription-based services such as YouTube Music & Premium, YouTube TV, and Primetime Channels and securing multi-year agreements to distribute NFL Sunday Ticket, Alphabet is poised for growth in the e-commerce market.

While Alphabet faces several challenges in the short term, such as regulatory issues, tough comparisons, and foreign exchange headwinds, the company remains optimistic about the longer-term prospects of mobile apps and gaming, YouTube subscriptions, and Google Cloud’s market opportunity. In addition, Alphabet’s commitment to investing in opportunities for long-term revenue growth, such as advances in AI and more compelling creative content for advertisers, along with efforts to re-engineer its cost base, will assist driving growth and profitability in the future.

In 2023, Alphabet announced that it would adjust the estimated useful lives of servers and specific network equipment, which is expected to impact its operating results by around $3.4 billion. In addition, CFO Ruth Porat highlighted the company’s focus on optimizing the cost of computing and investing in technology infrastructure to support investments across Alphabet, particularly in AI and cloud. Despite the higher cost of the higher compute intensity of AI tools, Alphabet is keen on optimizing the cost of computing and has a sharp focus on using AI and automation to improve the productivity and efficiency of technical infrastructure, increasing technological infrastructure investments, and decreasing office facility CapEx.

However, Alphabet’s commitment to delivering sustainable financial value means that expense growth cannot exceed revenue growth. The company is focused on revenue growth, especially within Google Services, where AI advancements are improving advertiser ROI and the search user experience. Alphabet is also committed to durably re-engineering its cost base by slowing the pace of hiring, prioritizing products, improving economics in hardware, managing spend with suppliers and vendors, and optimizing how and where they work.

Overall, Alphabet’s strategic focus on developing sustainable, growing businesses, including its emphasis on cloud profitability, continued momentum in differentiated products, and AI and ML solutions, positions the company for long-term growth. Alphabet remains committed to delivering sustainable value while investing in long-term opportunities that drive growth and profitability.

Microsoft’s Cloud Dominance & Innovative Offerings

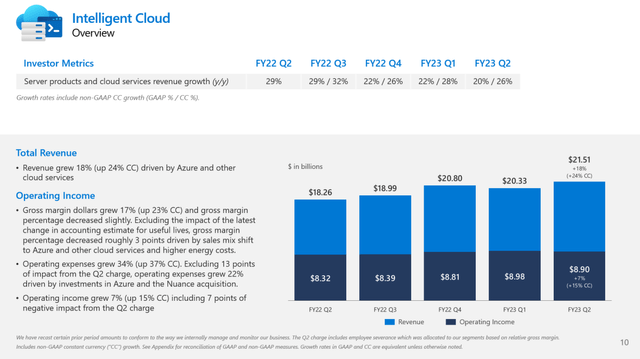

Microsoft is one of the largest tech companies in the world, and its recent FY23 Q2 earnings report shows that it continues to be a vital participant in the industry. Despite macroeconomic uncertainty, Microsoft is focused on building customer loyalty customers and aligning its cost structure with revenue growth. The company’s investments in AI, Azure, data, and other innovative technologies drive its growth and financial performance.

Interestingly, one of Microsoft’s biggest strengths is its cloud offerings. The Microsoft Cloud generated over $27 billion in quarterly revenue, up 22% and 29% in constant currency. Azure, in particular, is gaining traction as a preferred digital transformation tool for businesses, especially in healthcare and financial services, where AI has a significant impact.

In addition to its cloud offerings, Microsoft has several other products and services that are driving its growth in the long term. Dynamics 365 is gaining share and becoming a go-to tool for digital transformation, while Microsoft 365 and Teams are essential for organizations adapting to the new world of work. Teams have emerged as a first-class platform, and Microsoft Viva has created a new market category for employee experience and organizational productivity.

Furthermore, the Q2 FY23 report also highlighted several other growth areas. LinkedIn continued to be a platform of choice for professionals worldwide, with record engagement and newsletter creation up 10x YoY. The company’s focus on skills-based hiring has resulted in more than 45% of hirers using LinkedIn’s data to fill their roles.

In advertising, Microsoft continued to innovate across its first- and third-party portfolios. Bing gained a share in the US, and the “Start” personalized content feed’s daily users increased by over 30% YoY. Gaming also saw new highs for Game Pass subscriptions and monthly active users, with plans to launch exciting new titles from ZeniMax and Xbox Game Studios.

However, the Ofcom investigation’s findings raise concerns over high fees for transferring data from a cloud system, technical restrictions on using multiple providers, and committed spend discounts. The findings could significantly impact the long-term financial performance and growth of the market valuation for the major cloud providers.

Looking forward, Microsoft’s Q3 forecast is optimistic, and the company expects its productivity and business processes to improve between 11% and 13% in constant currency, while its LinkedIn revenue is expected to grow in the mid-single digits. In addition, revenue from intelligent clouds is expected to increase between 17% and 19% in constant currency, driven by Azure. In contrast, more personal computing is expected to generate between $11.9 and $12.3 billion in revenue.

Finally, Microsoft’s performance in its Q2 FY23 earnings report showcases its continued growth and strength in the industry. Its investments in cloud offerings, AI, data, and other innovative technologies drive its financial performance and position the company for long-term success. While the Ofcom investigation’s findings raise concerns, Microsoft’s solid growth in several optimistic, positive Q3 forecasts the company is well-positioned for continued success.

GOOG – A More Attractive Risk/Reward Profile

GOOG, with a current P/E of 24.1x, trades below its 5-year average of 29.6x and an EPS estimate of $5.09 for 2023; assuming that valuation can revert to its mean, the stock can trade at around $150 by the end of the year suggesting an upside of 37% from current levels. On the contrary, MSFT’s EPS forecast average stands at $9.35 for its fiscal year end of June 2023, and applying a 33.5x P/E multiple suggests a price of $313, a nearly 10% upside potential in the following months.

Takeaway

In conclusion, investors looking for a long-term investment opportunity in tech giants Alphabet and Microsoft can benefit from the emerging technological environment. Both companies have solid financial standing and focus on AI and cloud technology.

Moreover, Alphabet’s continued investment in AI has resulted in innovative products and services that drive growth, especially in online video, ads, searching, and streaming. On the other hand, Microsoft’s investment in AI, Azure, and data drives growth and financial performance. As a result, both companies are positioned for long-term financial success and market growth, and their stocks provide an attractive risk/reward profile at current levels.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.

![Search Engine Market Share in 2023 [Mar '23 Update] | Oberlo, Alphabet, Google, GOOG, GOOGL, Microsoft, MSFT, OpenAI, ChatGPT, Bard, AI, AI Wars](https://static.seekingalpha.com/uploads/2023/4/17/saupload_1679306526-search-engine-market-share-in-2023_thumb1.png)