Summary:

- On a sector level, technology has shown positive momentum, while the information technology services industry specifically has had a more modest performance.

- Alphabet is the leader in online search and digital advertising, while Microsoft dominates the productivity software market and owns 22% of the worldwide cloud infrastructure market.

- ChatGPT and AI peers face challenges; Microsoft’s investment boosts ChatGPT hype, while Alphabet’s Gemini competes with OpenAI, signaling a new era in innovation.

- This article concentrates on long-term investment prospects through comprehensive fundamental analysis, presenting two valuation models designed to accommodate various potential scenarios.

- While investments in AI can potentially return significant profits to investors, it comes down to how capable the companies are of capturing the potential in the long term while mitigating the considerable risks involved.

Vertigo3d

The technology sector has reported substantial positive momentum in the past three months, being the leader also on a yearly retrospective. However, the information technology services industry has reported a more modest performance over the past 12 months, with infrastructure software running out of steam over the past few months. Despite closely following the technology sector in its yearly stellar performance, the communication services sector has slowed down significantly over the past three months, with companies in the internet content and information industry turning to laggards from their leadership position.

Alphabet and Microsoft compete in many industries and businesses, owning significant market shares in specific segments. Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) is the virtually unchallenged leader in online search, as its search engine, Google, processes over 91% of search volume worldwide, and the company’s share of global digital advertising revenues is estimated at 39%. Microsoft’s (MSFT) search engine, Bing, is processing only 3% of search volume, and the digital advertising market share it achieved with its search engine and through LinkedIn is about the same size. Microsoft’s lion’s share of its revenue is generated through server products and cloud services, its Microsoft 365 and Windows software suite, and increasingly by its gaming segment, but the company’s office productivity suite is challenged by Google’s Workspace, which counts over 3 billion users. However, the majority of these are likely Gmail users. According to Gartner (IT) estimations, Google is taking 1% to 2% market share per year, while Microsoft dominates the productivity software market with over 89% market share estimated in 2020. Microsoft’s Azure cloud infrastructure holds about 22% of the worldwide market share, second only to Amazon (AMZN), which leads with 32%, followed by Google Cloud with 11%.

Furthermore, the two giants are both heavily investing in Artificial Intelligence [AI], a technology that will directly or indirectly affect many, if not all, of their products and services and will be determinant for the future of both companies. Alphabet has significant potential to monetize its AI efforts by leveraging its product portfolio, such as its search engine, YouTube, Google Cloud, or Android platform. The company has disclosed important customers using its Google Cloud services, including 70% of GenAI startups valued at more than $1B and companies such as Anthropic, Midjourney, Cohere, or Character.AI. The latter is in talks for a significant investment from Alphabet in hundreds of millions. At the same time, Anthropic declared having received an upfront investment of $500M and a commitment of up to $2B investment, as Alphabet recognized the opportunity in its chatbot Claude to be a valid rival to ChatGPT, owned by the company OpenAI, backed by Microsoft with an investment of up to $13B for a 49% stake of its profit sharing.

Taking into account the consensus from a wide range of published studies, the global IT service market is projected to grow on average at a 9.43% Compound Annual Growth Rate [CAGR] through 2030; the global cloud service market is estimated to grow significantly faster at 16.60% CAGR through 2031, with the cloud-based office productivity software solutions segment seen accelerating at 25.50% CAGR by 2030, with China leading the expansion at 30.80% CAGR. Major growth drivers include global investments in smart cities, with the integration of Internet of Things [IoT] technologies, AI, and increasing demand for cyber security; the rise of automation to enhance business operations and decrease resource waste, as well as increased adoption of cloud platform services by SMEs and in developing regions. The global AI market size is estimated at $242B in 2023, with the healthcare, finance, and manufacturing industries, business and legal services, and transportation representing more than 67% of the market share. It is expected to grow at 17.30% through 2030, resulting in a market size of $7390B, led by developments in machine learning, natural language processing, computer vision, autonomous and sensor technology, and AI robotics.

An in-depth company comparison

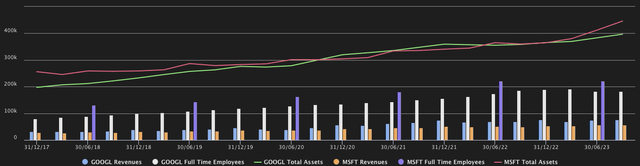

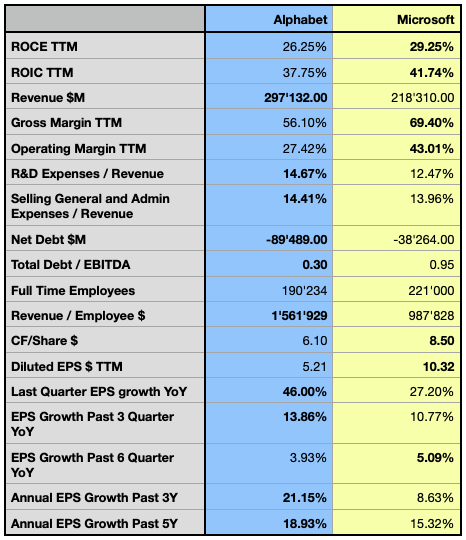

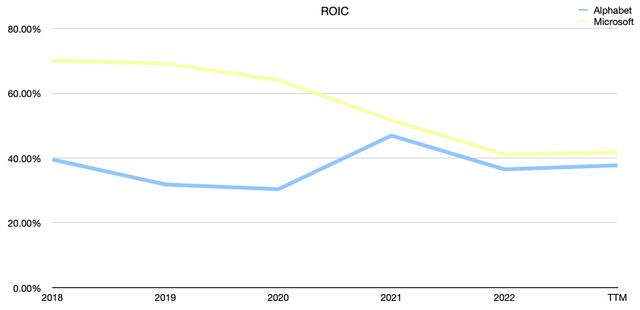

Author, using data from S&P Capital IQ

The financial comparison highlights the two competitors’ significant relative strengths and weaknesses. Regarding Return on Invested Capital [ROIC], a crucial metric in my investment considerations, as it signifies a company’s ability to generate value consistently, Microsoft has demonstrated more robust capital allocation efficiency in recent years, even though this metric has shown a tendency to soften. Conversely, Alphabet has reported a more resilient capacity in this regard. The significant spread between the companies’ ROIC and their Return on Capital Employed [ROCE] implies that their core business is highly efficient regarding capital allocation. Still, the actual returns accrued to investors could be even higher by employing their prominent idling cash positions. Alphabet reported $119.93B and Microsoft $143.95B TTM cash and marketable securities at the end of Q3, and both reported a substantial negative net debt. Microsoft’s debt exposure, measured by total debt to EBITDA, is three times higher than Alphabet’s, but both companies have plenty of capacity to repay their debt or source more capital from lenders at suitable conditions.

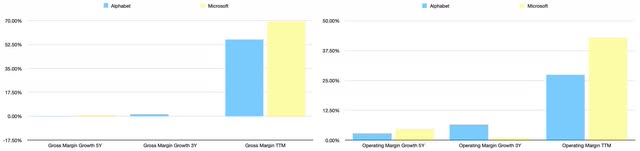

Author, using data from S&P Capital IQ

Alphabet’s gross margin growth has slightly increased from -0.14% CAGR in the past five years to 1.53% CAGR in the past three years, while Microsoft’s gross margin growth decelerated from 1.04% CAGR to 0.24% CAGR over the analyzed time. Alphabet’s gross margin is smaller overall, suffering from a lower-margin products and services mix compared to Microsoft’s, as the latter generated more than 50% of its revenue with its very profitable cloud business, with a 73% gross margin.

On the operational side, the companies have an even more divergent profile. Microsoft’s operating profitability is significantly higher, although the company has seen its profitability growth slowing down from 4.75% in the past five years to 1.11% in the past three years, while a more favorable development has been observed in Alphabet’s operating margin growing 6.63% over the past three years, up from 2.85% over the past five years.

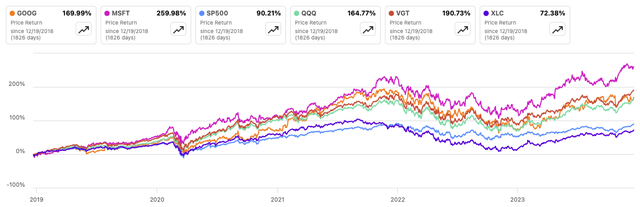

Author, using data from S&P Capital IQ

Microsoft reportedly has a more cash-rich business than the analyzed peer and is paying a quarterly dividend, while Alphabet has never returned profits to its shareholders through a dividend. Alphabet has instead repeatedly performed stock buybacks, with over $45B returned to its shareholders in the current year, in line with the announced repurchase program of up to $70B. Microsoft is completing the $60B share buyback program unveiled in September 2021 and could launch a new program, as the company has been announcing such buybacks every three years since 2013.

Alphabet’s EPS growth rate has been significantly accelerating over the past few quarters and the most recent years, while Microsoft has reported more modest growth in the recent quarters and even a slowdown in the growth trend on a yearly comparison.

The stocks’ performance

Considering both stocks’ performance in the past five years, MSFT outperformed all the analyzed references, reporting a massive performance of 260%, while GOOG performed less impressively, returning 170%, or just slightly more than the Nasdaq technology index, tracked by the Invesco QQQ ETF (QQQ), yet significantly outperformed the S&P 500 (SP500). Two selected industry references with exposure to the stocks, such as the Vanguard Information Technology ETF (VGT) and the Communication Services Select Sector SPDR Fund (XLC), show a mixed performance, hinting at a somewhat divergent performance among peers.

Author, using SeekingAlpha.com

While both stocks display periods of relative strength, especially from the pandemic-related market crash in 2020, MSFT reported a much superior performance and significant resilience after every major drop, while GOOG is struggling to overcome the peak reached in 2021. In the following section, I will discuss the projected direction for both companies in the coming years and evaluate whether the current stock prices present attractive opportunities. Additionally, I will analyze potential risks across various scenarios.

Valuation

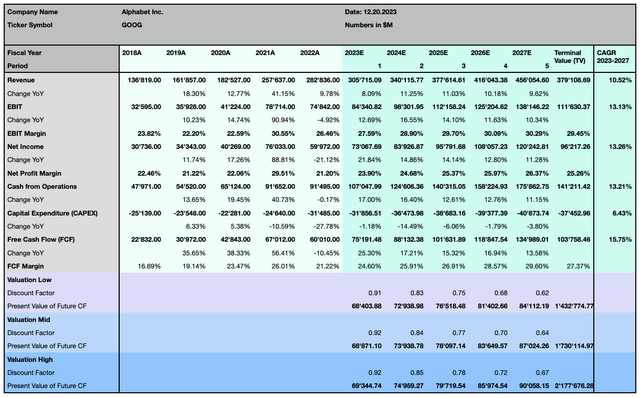

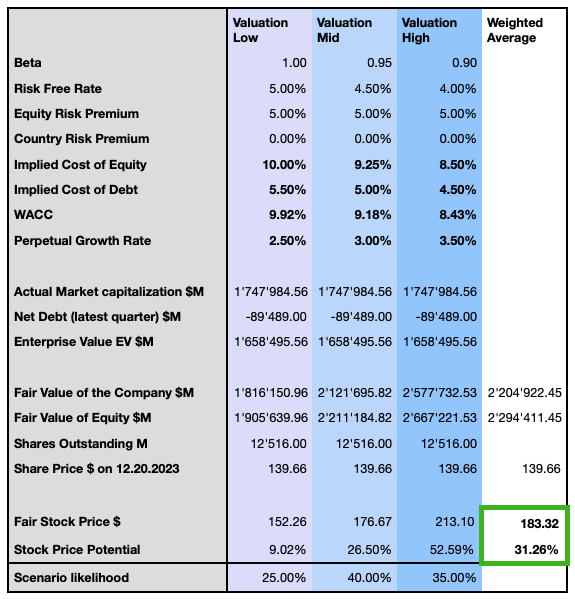

I employ the Discounted Cash Flow [DCF] model to ascertain the fair value of both companies’ stock prices. This model spans a forecast period of five years and encompasses three distinct sets of assumptions, ranging from a more conservative to a more optimistic scenario. These assumptions are based on the metrics influencing the Weighted Average Cost of Capital [WACC] and the Terminal Value [TV]. As forecasted by the street consensus, Alphabet is anticipated to generate 15.75% Free Cash Flow [FCF] CAGR over the coming five years, with its operating and net profitability increasing at 13.13% and 13.26% CAGR, while its revenue is projected to expand at solid 10.52%, slightly above the expected growth in the global IT service market.

Author, using data from S&P Capital IQ

The valuation considers various scenarios related to monetary policy, which will influence the weighted average cost of capital and exert a substantial impact on the potential performance of the stock price.

Author

I compute my opinion in terms of likelihood for the three different scenarios, and I consider the stock to be significantly undervalued with a weighted average price target with 31% upside potential at $183.

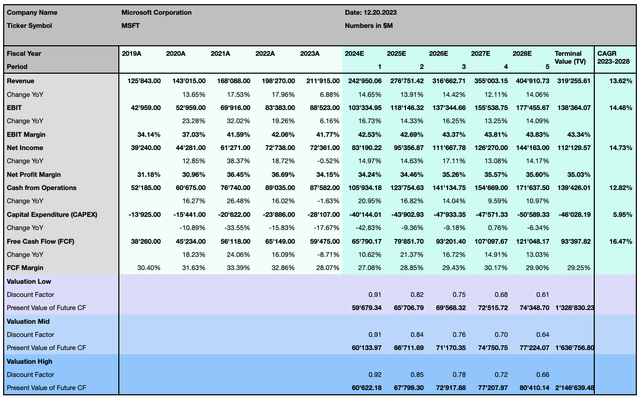

Microsoft is forecasted to expand faster than its peer, with its revenue growing at 13.62% CAGR over the next five years, faster than the global IT service market. Its operating and net profit margins are expected to accelerate substantially by 14.48% and 14.73%, respectively. The company’s FCF is anticipated to increase sequentially, totaling 16.47% CAGR through 2027.

Author, using data from S&P Capital IQ

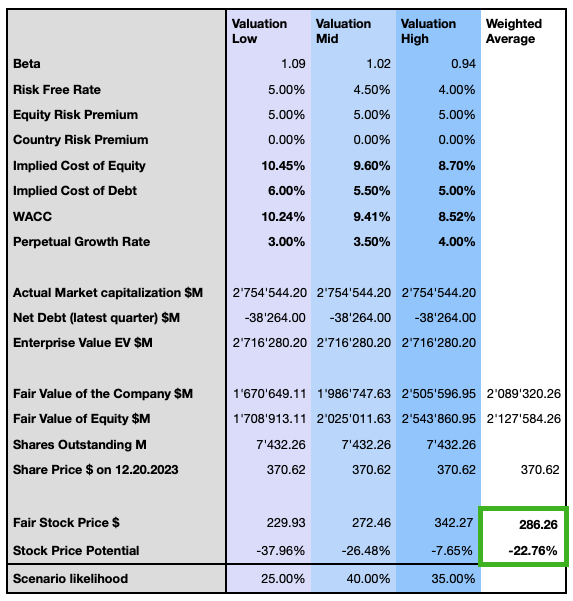

I subsequently assess the three identical scenarios influenced by the company’s fundamentals and external factors.

Author

Although this is a promising outlook, MSFT is overvalued in all three scenarios, leading to a weighted average price target with 23% downside risk at $286, with the most pessimistic scenario considering the stock overvalued by more than a third of its actual valuation. The two modelizations suggest that GOOG may be rated as a buy position, while MSFT is seen as a hold or sell position. Interestingly, in GOOG’s modelization, all three scenarios forecast a positive return, emphasizing the divergence in the companies’ forward expectations.

Investors should remember that these forecasts hinge on relatively conservative assumptions, encompassing perpetual growth rates, elevated discount rates, and the prevailing trend of rising interest rates. This trend reflects the current situation and anticipates potential scenarios. A reversal of this trend could alter this perspective, leading to a higher valuation for the company.

Outlook and risk discussion

Both companies have massive opportunities to leverage their existing capacities and product mix to build new competitive advantages, reinforce their market share, or enter new segments. These opportunities are multiplied by the integration with AI and the numerous applications in the relevant industry verticals. Alphabet’s overdependence on revenue from advertising is threatened by the widespread adoption of advertising-blocking software, a stricter global legal framework, and growing privacy concerns, as well as by the tendency of declining cost-per-click prices the industry is facing with increasing competition. Since the public launch of OpenAI’s chatbot ChatGPT on November 30, 2022, Alphabet’s Google DeepMind AI unit has scaled up its efforts to develop its own AI software to rival the Microsoft-backed company and finally announced its most potent AI model, Gemini, which includes a suite of three different sizes: Gemini Nano, targeting specific tasks on mobile devices; Gemini Pro recently released to its cloud users, which supports 38 languages in more than 180 countries, and is used by Google’s ChatGPT-like chatbot Bard; and Gemini Ultra, it most capable version designed to run in data centers. The update comes after the company’s launch of Bard earlier this year, which has yet to be as successful as the company might have been expecting. Alphabet also announced a new generation of its custom-build tensor processing units [TPUs] Cloud TPU v5p, more scalable and designed to train large AI models, and a new supercomputer architecture AI Hypercomputer to boost productivity across AI training, tuning, and serving.

Investors might ask how the companies will turn their AI efforts into profits. Both companies are introducing AI technology in their product portfolio to enhance the user experience and multiply their solutions’ capabilities and potential usage. Google is expected to launch its Search Generative Experience [SGE] to the general public, with the opportunity to redefine how users interact with its search engine, which is still a significant source of profit. Microsoft has announced that its Copilot solution, which leverages AI to enhance its productivity software suite, is already used by 40% of Fortune 100 companies, and over 37,000 organizations have subscribed to Copilot for Business; the technology finds its usage in many other applications such as the company’s tools for developers Power Platform, Power Apps, and Power Pages. Microsoft counts over 73% of the Fortune 1000 companies that use three or more of their data solutions, and over 18,000 organizations use Azure OpenAI Service. Copilot’s inclusion into Microsoft’s Windows enriches the operating system with even more AI-powered experiences accessible to 1.6B users worldwide. Alphabet’s answer to Copilot is priced at the same $30 monthly subscription price for each user, supporting the company’s gain in market share in the enterprise segment.

While Microsoft enjoyed the early benefits of the broadly followed launch of ChatGPT, projecting the company into a leadership position, the AI battle between the two giants is only in its early stages. Alphabet has successfully acquired companies and technologies and demonstrated its superior capabilities in developing disruptive technologies for a global audience. The company’s relatively high spending in R&D has led to the most significant patent portfolio among its peers, underscoring its strong competitive position. Despite Microsoft still holding more AI and machine learning patents than its rival, both companies are still far behind companies such as Baidu (BIDU) (OTC:BAIDF), Tencent (OTCPK:TCEHY) (OTCPK:TCTZF), IBM (IBM) and Samsung (OTCPK:SSNLF).

Microsoft’s investment in OpenAI valued the company at $86B, but the recent turmoil around the layoff of CEO Sam Altman and the subsequent dramatic reversal where he was reinstated under a new board of directors after 95% of OpenAI’s employees were to leave the company for joining him under Microsoft’s AI unit, revealed the fragility of the company’s structure. OpenAI LP now operates under an unconventional form called a capped profit corporation, where profits are capped at a maximum of 100 times any investment. The original OpenAI non-profit organization owns the returns beyond that amount. At the same time, no board member can own any equity to avoid any conflict of interest with the investors; the board controls the whole structure and does not answer to the investors or employees, citing “humanity” as their only concern. Strictly speaking, OpenAI investors don’t own it, and after the recent troubles, several investors were ready to write down their investment to zero.

It would be wise to view any investment in OpenAI Global, LLC in the spirit of a donation.

Alphabet’s strategic investment in Anthropic comes after rival Amazon announced an immediate investment of $1.25 convertible into equity, with the ability to increase its stake with an additional convertible note of up to $2.75B. At the same time, the option for the secondary note expires in the first quarter of 2024. The run for securing a part of the best and most promising AI technology while acquiring stakes in startup companies such as Antropic or OpenAI has just begun but emphasizes the importance cloud companies give to aligning with influential AI developers.

With the overall projected monthly probability of a US recession in the coming 12 months increasing to 52% in November, down from a peak level above 70% estimated in May, but up from 46% projected in October, investors should also consider the potential negative impact on the companies’ business and stock performance. A recession would hit the tech giant’s sales and expose shareholders to potentially significant losses, as seen during the last market crash in 2020, where both stocks lost about one-third of their valuation; however, considering MSFT’s relatively rich valuation and despite its impressive resilience, I would consider GOOG as being the safer choice.

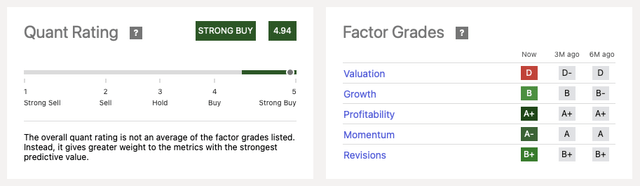

Alphabet has been chiefly rated with a strong buy or buy rating from Seeking Alpha’s Quant Rating since 2021 with sporadic periods of hold signals and holds the 2nd position out of 60 in the interactive media and services industry.

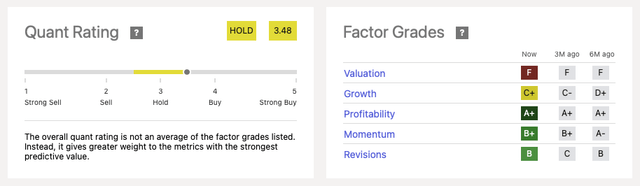

Since 2021, Microsoft has consistently been rated as a hold position, occasionally reporting buy signals. It occupies the 10th position out of 46 in the systems and software industry. Both companies, somewhat surprisingly concerning Alphabet, receive low rankings in terms of valuation. While profitability and momentum are viewed as positive factors for both, Alphabet appears more favorably positioned in terms of actual revisions and growth prospects.

The verdict: Which stock is the better buy?

From an investor’s perspective, evaluating a company’s capacity to generate value for its shareholders while mitigating risks is crucial. Past performance does not ensure future outcomes. Although both analyzed companies have demonstrated notable resilience in their stock prices, investors should assess the extent to which the company’s future potential has already been factored into its current valuation.

This comparative assessment magnifies the two stocks’ distinct risk/reward profiles. Although both companies operate in market segments with substantial growth potential, the critical determinant lies in their long-term capability to harness this potential. In this analysis, I highlight the prospective advantages and opportunities these companies can seize through their investments and advancements in AI. Both peers possess significant opportunities to capitalize on their existing portfolios and innovate new solutions, expanding the utility of their products and services for their current customer base while potentially gaining substantial additional market shares. However, each pioneering company faces notable risks, compounded by heightened competitive pressures from other global players, intensifying the competition to establish its technological dominance.

When examining the two product portfolios, it becomes apparent that each possesses strengths and weaknesses. These factors include vulnerability to overdependence on a single income stream, sensitivity to potential economic downturns, and the ability to innovate and establish new standards in the dynamically evolving technology sector. In terms of financial strength, both companies demonstrate a robust profile, boasting substantial positive ROIC and high current and projected profitability levels. Additionally, they consistently return substantial and regular profits to their investors.

AI chatbots like ChatGPT are a new technology with much space for improvement. In a recent research, Patronus AI highlighted the incapacity of AI models such as OpenAI’s GTP-4 and GPT-4-Turbo, Anthrophic’s Claude 2, or Meta Platform’s (META) Llama 2, to correctly interpret SEC filings, with a margin of error reaching 81%. The hype around ChatGPT since its introduction to the public in 2022 could likely follow the dynamic of the Gartner Hype Cycle. Microsoft’s investment in OpenAI and the general enthusiasm around its chatbot capabilities have led to a substantial surge in its stock price. Still, as Gartner’s model describes, after an initial peak of inflated expectations, the interest wanes, and implementations fail to deliver, leading to a distilled market presence of optimized technologies and efficient solutions if the provider continues to improve their products. Alphabet has the potential to revolutionize how users interact and benefit from the company’s products and services, owns massive resources, is the most data-rich company in the world, and billions of people will continue to adopt its solutions as their dependency on Google’s ecosystem is deeply rooted in their private and professional life. With Gemini, the company is ready to take on OpenAI’s AI model, having demonstrated offering a more comprehensive multimodal experience with better results in mathematical reasoning, coding, image and video understanding, and audio processing while having space to improve in intuitive everyday contexts. Gemini’s large-scale adoption will trigger another innovation cycle in the industry and start a new era for Google’s customers and inventors.

While I consider both companies appealing regarding their technologies and potential, my current stance designates GOOG as a buy and categorizes MSFT as a hold position. This decision stems from the perception that Microsoft’s stock appears overpriced, with recent gains already factoring in much of the foreseeable potential. Considering all factors, Alphabet presents more favorable opportunities with a lower risk profile. Additionally, when evaluating all three forecasted scenarios, Alphabet emerges as a strong stock choice for long-term-oriented investors interested in artificial intelligence.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

All of my articles are a matter of opinion and must be treated as such. All opinions and estimates reflect my best judgment on selected aspects of a potential investment in securities of the mentioned company or underlying, as of the date of publication. Any opinions or estimates are subject to change without notice, and I am under no circumstance obliged to update or correct any information presented in my analyses. I am not acting in an investment adviser capacity, and this article is not financial advice. This article contains independent commentary to be used for informational and educational purposes only. I invite every investor to do their research and due diligence before making an independent investment decision based on their particular investment objectives, financial situation, and risk tolerance. I take no responsibility for your investment decisions but wish you great success.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.