Summary:

- Alphabet sees itself as an AI company.

- It isn’t… It’s really an advertising company.

- I worry about companies that mis-perceive their own businesses.

- Even so, I recognize that it has too many fans to justify a Sell recommendation.

- So I say Hold but with a very tight trailing stop loss.

Flying broccoli/iStock via Getty Images

“Who do we serve?”

HB, then head of the Multex.com consumer group, posed that question in 2000. This is how he meant to launch a strategy confab involving the group’s flagship asset, MultexInvestor.com.

(Don’t try to look up either URL. They are, and have long been, defunct.)

That seemed easy. So, I just blurted out… “We serve investors.”

Oh, my God.

Have you ever been in a crowded conference room in which everybody else is simultaneously jumping down your throat and treating you as if you were the biggest idiot on the planet? Trust me if you haven’t. It’s not pretty.

That hullabaloo ended with the group’s having driven home to me what to them was the obvious point. “We don’t care about investors. We serve our sponsors and advertisers.”

That turned out to be an unfortunate corporate identity crisis.

The team exercised its right to not care about investors. Investors exercised a reciprocal right to not care about, or visit, MultexInvestor.com.

Sponsors and advertisers wound up with little or no traffic and monetary return on their spending. So, they went away. And eventually, ditto MultexInvestor.com.

Now, suppose Alphabet’s (NASDAQ:GOOG) (NEOE:GOOG:CA) (NASDAQ:GOOGL) top brass were to hold a similar gathering and open by asking “What’s our top priority?”

I’m guessing the consensus answer will be something like “AI.” Or it might be more elaborate. Perhaps it might be something like “Infuse AI into everything we do.”

I bet it won’t be “Help users find the information they seek.”

Maybe, someone might say “Help advertisers get great returns on their spending.” The GOOGL literature (the latest SEC filings, the latest conference call transcript) has references to this.

But I find the overwhelming weight of management verbiage, skimpy as it is, overwhelmingly supporting a tech centric answer. That was especially so in its 1Q 2024 conference call.

Alphabet seems eager to see itself as an AI company.

But it isn’t an AI firm…

Alphabet is an Advertising Company

Don’t take my word for that. Look no further than the company’s own SEC filings.

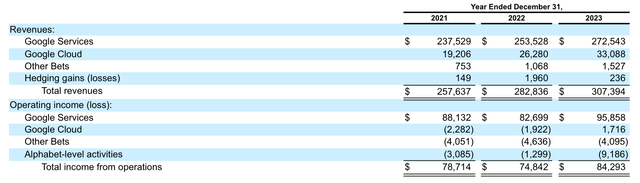

Here are the Revenue and Operating segment drill downs from page 86 of Alphabet’s most recent (2023) 10-K filing.

Clearly, the company is Google Services, and other stuff.

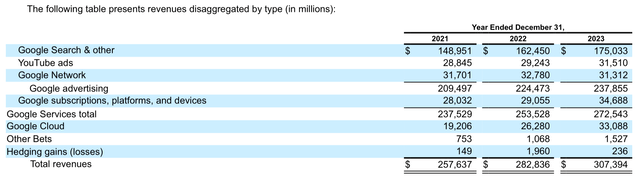

The following segmentation, from page 63, doesn’t show operating profits. But it does show more detail on Google Services.

The overwhelming majority of Google Services is advertising.

Pages 34 and 38 of the latest (Q1 2024) 10-Q paint much the same picture.

Google Services accounted for 87% of company revenues. Advertising was 88% of Services, and 77% of the company total.

Also, the 10-Q reports $27.897 million as Google Services operating profit. The company total was $27.777 million. Cloud earned $900 million. Other Bets, the sexy visionary things, lost $1,020 million.)

(I excluded $2.305 million worth of “Alphabet-level activities” relating to things like severance payments and “office optimization expenses.”)

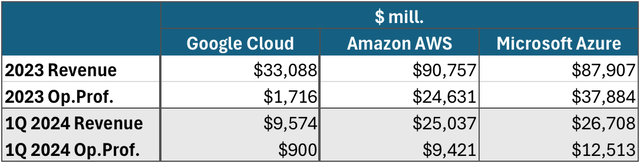

Management talked glowingly in the latest conference call about wonderful growth, 28%, in Cloud Services in the latest quarter.

But look at the segment results above. The operation is tiny. Super-normal growth from such a base is to be expected. In fact, I wonder why the growth hasn’t been stronger.

Consider where Google Cloud is relative to its two main rivals, AWS from Amazon.com (AMZN) and Azure from Microsoft (MSFT).

Author’s compilation based on latest GOOGL, AMZN and MSFT 10-K and10-Q reports

Google Cloud is a pipsqueak.

Sure, GOOGL is investing heavily in it. But do we think AMZN and MSFT are sitting on their hands waiting for GOOGL to build up and grab away the business?

So, let’s put the hype aside and openly say what GOOGL is… It’s an advertising company (plus some other stuff).

That raises the next question…

AI’s Role in Alphabet’s Business

GOOGL spoke (on the latest earnings call) about how AI enhances its cloud related businesses.

I’ll assume that’s so.

But look again above at the size of this business relative to the rest of GOOGL and its main rivals. We’re dealing with small potatoes here. And aren’t the others also likely to be using AI!

Management also expects to infuse AI into all of the company’s other offerings, Gmail, Google Drive, Google Office, etc. They aren’t clear on how they’ll do it and if or how that would generate more revenue.

But again. Look at the above segment information. (This is the portion of Google Services revenue for which is labeled “Google subscriptions, platforms, and devices.” And GOOGL doesn’t disclose its operating profits or losses.)

Presumably, this includes whatever subscription money Google is collecting for its Gemini AI offering.

This collection of businesses, in sum, isn’t as tiny as Google Cloud. But it still looks too small to move the overall company needle any time soon.

That brings us back to what Alphabet really and truly is… an advertising company.

AI isn’t the business. It’s more appropriate to say AI is a tool (or set of tools) Alphabet can use to make this business better. I’ll address that below.

But first, let me acknowledge the good things.

About GOOGL’s Excellent Fundamental and Growth Track Records

This is where I remove my hat and bow humbly to GOOGL. Its core business, search-based advertising, is magnificent.

Internet advertising has traveled down an interesting path.

First, it had to fight for respectability and relevance. Back in its early days, many advertisers struggled to take it seriously as a legitimate medium.

Old-time banner ads, especially the more graphic laden, delayed page loading. (That was in the days when many still connected via dial-up modem.)

Early users often found the ads distracting. Ditto later adaptations, including tower ads running down a vertical side of the web page and squared versions sprinkled throughout.

Eventually, the world got used to it. And more advertisers came aboard.

But also, web users got angrier as the ads became dramatically more intrusive.

That was especially so with video ads, pop-up ads and worst of all, page takeovers. (With the latter, a full-page ad would appear and completely block content users wanted to see).

User disdain probably contributed to unwillingness to click on the ads and transact with the advertisers. Deteriorating ad productivity pushed prices down.

Google led the way to creation of a whole new paradigm.

People go to the web to look for something. But finding what they want can be a challenge.

Stored bookmarks can turn into complicated tree structures. And they often need to be revised.

Also, bookmarks can only get users back to sites about which they already know. They still need help discovering new (to them) content.

Google brought search to a newer and spectacularly more effective level. Users input what they want to see. Google immediately produces lots of results.

But it’s not just a matter of showing users many things. The company’s programmers developed spectacular algorithms that identified and sorted by relevancy.

Better still for the company, it found a way to respect both users’ desire to see what they want and advertisers’ desire to communicate relevant messages to potentially viable customers.

That’s how GOOGL makes money.

It’s more than just a business. It’s a work of art. It’s a business masterpiece.

Google did what previously seemed impossible… It found and supports common ground between internet users and advertisers.

Camps which once seemed to be intractable enemies turned into allies, much to the financial benefit of GOOGL for having created this unity of interest.

Many now imitate GOOGL.

But rivals still aren’t remotely close to beating it. Microsoft’s Bing is getting much attention today. That’s because of its competing AI efforts.

We occasionally see stories trumpeting Bing’s growing market share. But please, folks… keep things in perspective.

In May, Google’s overall market share clocked in at 95%. Bing had 0.7%. Bing’s best number was 17.6%. That was for U.S. desktops. But even there, Google’s share here was 75.4%.

There is much to like about Microsoft. And I may eventually write it up.

But I’ll tell you right now, I wouldn’t build a bullish case for MSFT based on Bing taking business from Google.

I don’t care about Google’s market share in one segment or another slipping a few basis points. Common sense tells us a company so dominant will lose market share every now and then.

What’s important is the magnitude of Google’s dominance. And that’s massive.

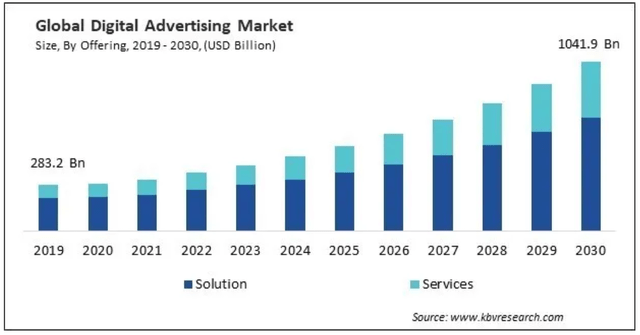

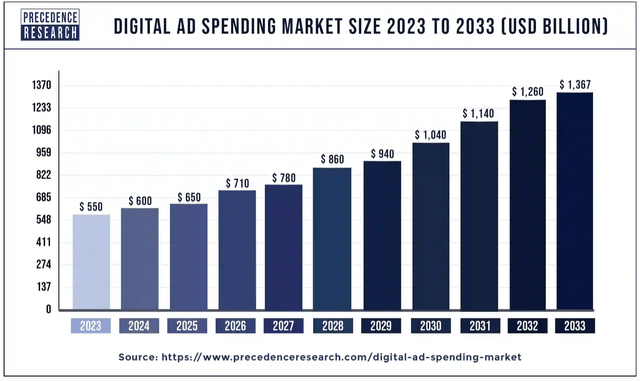

Better still, GOOGL is dominating a still-growing market.

Here’s one depiction of digital advertising growth.

Here’s another, one that projects a bit further forward.

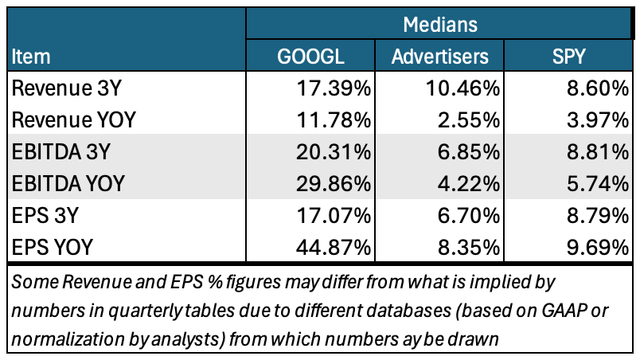

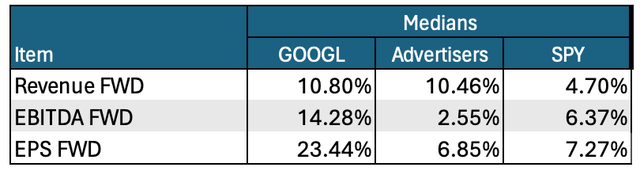

Historically, GOOGL’s dominance of a growing market has translated into financial excellence.

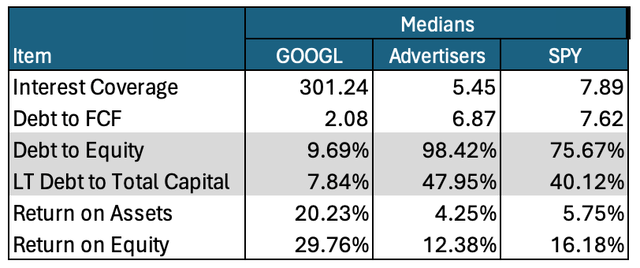

In the tables below, I compare GOOGL to the constituents of the SPDR S&P 500 ETF (SPY).

I also created a benchmark group I call “Advertisers.”

The latter is my 300-plus selection (using the Seeking Alpha screener) of companies in industries drawn from the Consumer Staples and Consumer Discretionary sectors. I didn’t use the entirety of either sector. I selected among industries containing companies I thought most likely to advertise directly to consumers.

I decided not to compare Google to others in its own assigned industry (Interactive Media). I was less interested in others that use similar technologies. I’m more interested in seeing Google, the recipient of ad dollars, compared to companies that spend ad dollars.

(And as those familiar with my work know, I prefer medians since these aren’t impacted by wild distortions often caused by unusual data items, even in big companies that can dominate weighted averages.)

Author’s computations and summary from data displayed in Seeking Alpha Portfolios Author’s computations and summary from data displayed in Seeking Alpha Portfolios Author’s computations and summary from data displayed in Seeking Alpha Portfolios

AI In the Google Core Advertising Business

First, let’s make sure we understand what, exactly, artificial intelligence is. I define it as computers doing things traditionally done by human brains.

My conventional Google search quickly and easily led me to another slicker definition. “Artificial Intelligence (AI) makes it possible for machines to learn from experience, adjust to new inputs and perform human-like tasks.”

The differences lie in the fanciness of the inputs and the difficulty of the tasks (including the volume of things to consider).

Netflix (NFLX) has long used AI. When it recommends content based on what it thinks you’ll like (based on your observed and remembered behaviors), that’s AI.

Amazon.com (AMZN), too, has been using this sort of AI. That’s how it learns your habits and tastes (from what you do on the site). And that’s how it shows you products it thinks you might like to buy.

AMZN and NFLX have long been stupendous in their application of what previously wasn’t but now seems to be called AI.

I can’t begin to count how much video content I consumed and how many books I bought and read based on it.

Even the often-appreciated but occasionally-despised auto-complete is AI. That’s when systems finish words and clauses based on what you start to type.

The system notices your behavior. Based on remembered data, it finishes your thoughts… sometimes accurately and other times laughably.

So, I don’t at all doubt GOOGL management when it bragged “We’ve been an AI-first company since 2016.” But lots of others were.

Let’s now focus on generative AI. This is really capturing a lot of hype.

Another quick Google search led me to a simple definition. It’s “a type of AI that can create new content and ideas, including conversations, stories, images, videos, and music.”

Google’s Gemini and OpenAI’s ChatGPT became business celebrities. They did so by pushing basic offerings to consumers for free. Supposedly better models are available for modest monthly fees.

The artistic outputs produce great gee-whiz results. But working with the verbal content gives us a clear window into what this stuff really does.

It produces output that’s one-step above the conventional searching we do on Google. It’s also similar to the kinds of searching I’ve been doing since the mid-1990s on LEXIS/NEXIS (legal and news research tools).

Type in a question or task. The AI will write a report, article, or outline, or something like that. You can, if you wish, ask the tool to disclose its sources. It will comply.

And that’s what betrays its simplicity. The sources it summarizes are legit. But as of now, they are few. I typically see more through conventional Google searching.

Sometimes, AI’s sources are among the best available. Other times, they aren’t.

The only thing that’s actually new here is that generative AI summarizes the sources, rather than making me do that myself.

That can become valuable in the future. But right now, I find it meh at best.

Purveyors of generative AI are being publicly bashed for hallucinations, false answers.

But here’s scoop… These are NOT program errors. Instead, these are business errors.

Consider the widely publicized New York lawyer who was disciplined by a local federal court for having cited fake precedents (Case # 1:22-cv-01461 PKC in the Southern District of New York). He found them through ChatGPT.

An AI consultant submitted a legal memorandum (a proposed Amicus Curiae brief) in support of the lawyer (Document 50-1 from that case record). On page 9 of that brief, the consultant described the “iterative process” through which OpenAI CEO Sam Altman developed the company’s AI.

He offered the following quote from Altman’s testimony before a Senate Subcommittee:

Going off to build a super powerful AI system in secret and then dropping it on the world all at once, I think would not go well. So a big part of our strategy is while these systems are still relatively weak and deeply imperfect, to find ways to get people to have experience with them, to have contact with reality and to figure out what we need to do to make it safer and better.

That means the hallucinations are part of the development process. They, and the eventual corrections, are how AI is trained.

That’s proper.

The business decision was bad. All of us who use generative AI are really beta testers.

But such things should be done among a limited group of folks who understand their role as testers. That means giving feedback to help correct errors. It doesn’t mean publicly whining or laughing.

Introducing generative AI to the world, including many who don’t understand their role as contributing to development and training, is a problem.

Nobody should take generative AI answers seriously!

It’s a shame Bing and Google (via its new AI Overview) are rushing to make these AI essays conspicuous parts of search results.

And quality aside, it’s not clear whether advertisers will be harmed by pushing their content too far down on the search-results page. Nor is it clear if or how Google will be able to integrate ads into these overviews.

For more on this, check out the June 4th Seeking Alpha article by Geneva Investor.

Right now, the best kind of AI use for Google seems to be driving better and more relevant connections between ad-supported search results and customers likely to buy. NFLX, AMZN, and of course, GOOGL’s own history suggest further progress can be potent.

Management includes that among the things it says it’s doing with AI.

But I worry that Google, like others, is too distracted. I fear it’s being spun round by its own AI hype.

Pushing out products that aren’t ready for prime time doesn’t seem like a prescription for good things. Neither does devoting money to projects that aren’t likely to meaningfully impact the bottom line.

Speaking of the bottom line, I appreciate management’s commitment during the last conference call affirming “efforts to durably re-engineer (the) cost base …. (to boost margins and) investment in our technical infrastructure.”

If that means serving more AI more effectively and more quickly, bravo!

If it means trying to dethrone AWS and Azure … yuck.

Risk

Company financial risk is very low. It’s been buying back shares and will continue to do so. It also initiated modest dividend.

As a digital advertising company, I see two kinds of business risks.

One is cyclical. Don’t assume GOOGL isn’t just because it doesn’t run factories or do other old-economy things like that.

If or when consumers really struggle and clamp down on spending, advertisers will probably do likewise.

So, if the economy falls, so, too, will ad spending (especially after the Olympics and political elections, and their related ad spends, end). And so, too would GOOGL’s sales and profits.

The other risk is secular.

As noted, GOOGL (and other interactive advertisers) have been gaining market share against traditional off-line advertising. This is a still evolving.

We can’t assume digital ads will reach a 100% market share. So, the gains will stop sometime.

But we can’t know when that will happen… until after it happens.

What to Do About GOOGL Stock

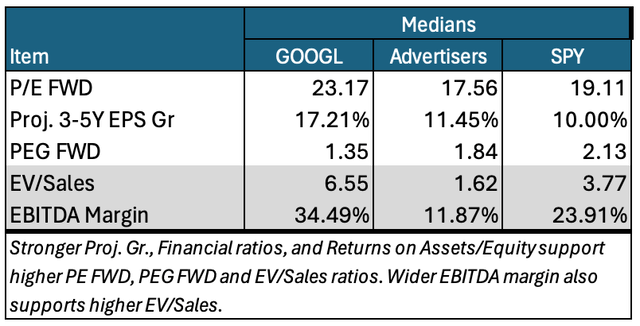

When it comes to earnings-based valuation, GOOGL is a bit high but acceptable. Its sales based valuation is very high. But given its margins, I’m not bothered.

Author’s computations and summary from data displayed in Seeking Alpha Portfolios

But there are bigger fish to fry here.

There are some things I love about GOOGL. Like much of the world, I’m hooked on Google search.

I’ve seen nothing from any rival that’s even remotely tempting me to switch my habits. GOOGL’s latest market share numbers suggest many agree with me.

But I absolutely despise the company’s identity crisis. I don’t think GOOGL would vaporize, as did MultexInvestor.com. But I could envision it eventually causing growth and returns on investment to deteriorate.

Meanwhile, investment gurus often talk about the importance of good management. It’s usually hard for investors to truly assess this.

GOOGL is a rarity. Its identity crisis signals to me a management team I don’t want to back my money with.

My heart wants to say “sell” or “go short.”

But my brain reminds me we don’t have a stock market of one. GOOGL trades in a massive market in which I’m barely a nano-speck.

So, in the interest of responsible analysis, I’m going to use the behavioral finance “Keynesian Beauty Contest” approach.

I’ll act as if I’m a beauty contest judge. But I won’t vote for my favorite contestant. Instead, I’ll pick the one I think will be favored by most of the other judges.

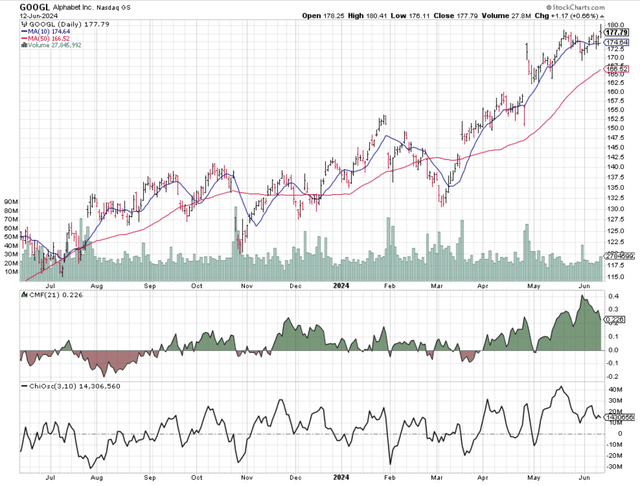

My simple chart-reading method helps me see what how most other market participants (the ones with all the money that drive supply and demand for shares) view a particular stock.

GOOGL stock is clearly much beloved.

The rising 10-day exponential moving average (EMA) remains well above the also-rising 50-day EMA.

Consider, too, Chaikin Money Flow (CMF) and the Chaikin Oscillator (CO). Both measure which party to trades is more motivated. CMF does it for institutional investors. CO does it for the market in general.

Both indicators very positive. Buyers are more motivated than sellers! That’s bullish.

I’m not crazy enough to say sell or go short in response to a chart like that.

But as long as I feel the way I do about what I see as the company’s identity crisis, I can’t bring myself to tell anyone to buy.

Yes, GOOGL may continue to rise. This is a blue chip stock that attracts a ton of passive index-investing money. But as long as the market stays strong, so, too will many other stocks.

So…

As I’ve said before, my investment stance depends mainly on whether I think a stock will be better than, in line with, or worse than market.

Here’s how I apply that to the Seeking Alpha rating system:

- “Strong Buy” means I see the stock as being better than the market and I’m bullish about the direction of the market.

- “Buy” means I see the stock as being better than the market but am not confident about the market’s near-term direction.

- “Hold” means I see the stock as moving in line with the market.

- “Sell” means I see the stock as being worse than the market but am not confident about the market’s near-term direction.

- “Strong Sell” means I see the stock as being worse than the market and I’m bearish about the direction of the market.

Based on this scale, I’m rating GOOGL as a “Hold.”

But if Mr. Market shows signs of cooling off, run to the exit.

I’m not usually a fan of stop losses. (My own past research suggests they often kick you out of stocks at or near significant bottoms.)

But here, I’ll indulge the emotional part of me that wishes Mr. Market would let me say Sell. So I’ll do the next best thing. I’ll recommend holding but with a trailing stop loss.

Historically, GOOGL has had a very modest Average True Range (ATR), often near 1%. Lately, it’s become more volatile.

Over the past year, it ranged from 3% to 4%. Upside volatility in response to the latest earnings report pushed it up to about 4.75%. (I get all of this from StockCharts.com.)

Based on this, I suggest that those holding set a very tight, say 5%, trailing stop loss.

A decline by that much for GOOGL would signal a meaningful decline in Wall Street enthusiasm … or a bear market in which case you could do a lot worse than selling GOOGL.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.