Alphabet’s Clear Plan To Monetize AI: Why I’m Reiterating My Buy Rating

Summary:

- Alphabet’s market cap exceeds $2 trillion after strong Q1 earnings, with revenue and EPS beating estimates.

- The company has a clear plan to monetize AI, focusing on research leadership, infrastructure, innovation in search, and global product reach.

- Alphabet’s valuation suggests the stock may be slightly overvalued based on P/S ratio but undervalued based on P/E ratio and shareholder yield.

JHVEPhoto

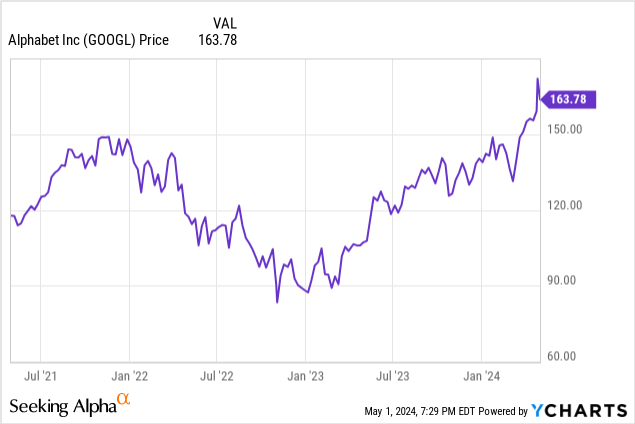

Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) recently reached another milestone when its market cap exceeded $2 trillion for the first time on April 26, the day after it reported first-quarter 2024 earnings. When I last discussed Alphabet, I recommended that investors buy the stock after its third-quarter 2023 post-earnings dip. Since then, the stock has been up 34.90% compared to the S&P 500’s 23.60% rise. The company’s rock-solid first quarter is why I believe further upside exists.

The company grew revenue 15% year-over-year, beating analysts’ first-quarter estimates by 2.3%. Management also showed they could make the company more efficient and reduce costs, leading to margin expansion and beating analysts’ earnings-per-share (“EPS”) estimates by 25%. Following the results, Wall Street analysts only modestly raised their FY 2024 revenue estimates by 1% to $346.16 billion but raised FY 2024 earnings estimates by 10.6% to an EPS of $7.52.

Let’s not forget about Artificial Intelligence (“AI”). Despite the generative AI hype over the last year, generic large language models (LLMs) like GPT-4 from Microsoft (MSFT) and Gemini from Google have been difficult to monetize. Kjell Carlsson, the head of data science strategy at Domino Data Lab, said in an interview published on AI Business, “In most cases, companies will not be able to use the giant, generic GenAI [generative AI] models from the tech giants because they are too slow, costly and inaccurate and because they do not meet the data security needs of many organizations.” However, during Alphabet’s first quarter earnings call, management told investors how the company was positioning itself in AI and gave investors a clear, believable plan on how Alphabet plans to monetize AI.

This article will discuss how Alphabet plans to cash in on AI, review its latest earnings, highlight a few risks, discuss its valuation, and why I am reiterating my Buy call on Alphabet.

How Alphabet will monetize AI

Alphabet was among the first companies to declare that AI is central to its growth strategy. As far back as 2016, Chief Executive Officer (“CEO”) Sundar Pichai believed in a future where AI was more important than the smartphone, declaring Google an AI-first company. Fast-forward to 2024, and although some perceive Microsoft as taking over leadership in AI, it is still early days. Harvest Portfolio Management co-chief Investment Officer Paul Meeks said recently on CNBC:

The only thing I worry about Microsoft is that I always felt that they have to show evidence that CoPilot is actually going to be a thing. When I say be a thing it has to show that it’s a moneymaker. I am worried that they still talk about CoPilot their AI assistant in these grand PR type terms but don’t show any financial results.

Among the reasons Meta Platforms (META) was down 10.5% after delivering its results was its plans to invest even more in AI, weak revenue guidance, and no clear indication about when its AI investments will pay off. One possible reason that some investors believe that there is an AI bubble that’s about to burst is that some companies have poured huge sums into generative AI, and the returns so far have been sparse.

A credible plan to monetize AI has become necessary as investors have become increasingly aware of the difficulties of profiting from AI and dislike investing in companies with long, uncertain payback periods. CEO Sundar Pichai shared Alphabet’s game plan during its first quarter 2023 earnings call (emphasis added):

Now, let’s look at how well we are positioned for the next wave of AI innovation and the opportunity ahead. There are six points to make. One, research leadership. Two, infrastructure leadership. Three, innovation and search. Four, our global product footprint. Five, velocity in execution. Six, monetization paths.

Let’s review those points.

1. Research leadership

Alphabet has always had research leadership. While it didn’t invent LLMs, it has been on the front lines of the technology’s development. On the earnings call, Pichai gave Gemini 1.5 Pro, an example of the company’s latest innovation. One of the main benefits of Gemini 1.5 Pro is long context understanding, which can increase the relevance and accuracy of its responses. It also means that the AI model can process far more information. A Google blog stated (emphasis added), “We’ve been able to significantly increase the amount of information our models can process — running up to 1 million tokens consistently, achieving the longest context window of any large-scale foundation model yet.” A token represents a “unit of information.” If Gemini 1.5 Pro’s benefits are valid, the perception that Microsoft is ahead of Google in generative AI may dim.

2. Infrastructure leadership

The company, now known as Alphabet, opened the Google search engine to the public in 1998. So, it has a long history of developing purpose-built applications, starting with Search. Today, the company is a leader in designing purpose-built AI infrastructure. Alphabet was the first cloud company to design hardware for its data centers and cloud. Today, the Tensor Processing Unit (“TPU”), a chip it started using internally in 2015 to process AI workloads more efficiently compared to off-the-shelf hardware, is in its fifth generation. The company designed its newest TPUs to process its next-generation AI models. Google trained Gemini 1.5 on fifth generation TPUs.

3. Innovation and Search

Over the last year, Alphabet has experimented with Search Generative Experience (“SGE”), its efforts to bring generative AI into its Google Search results. CEO Pichai said about SGE on the earnings call (emphasis added):

We have already served billions of queries with our generative AI features. It’s enabling people to access new information, to ask questions in new ways, and to ask more complex questions. Most notably, based on our testing, we are encouraged that we are seeing an increase in Search usage among people who use the new AI overviews as well as increased user satisfaction with the results.

Google recently introduced an innovative idea called Circle to Search, a way to initiate a search on an Android phone by circling an object in an image or video and receiving a response through an AI-generated overlay. One huge advantage Alphabet has over Microsoft and Amazon (AMZN) is that it has Android, which allows it to introduce innovative Search and AI ideas. At the same time, Amazon and Microsoft lack a meaningful mobile phone presence. Since around 60% of searches are mobile, Microsoft and Amazon’s search products need help to gain traction.

4. Global product footprint

Another advantage that Alphabet has over some of its competitors is the number of global products it can infuse with AI features, making the products even more attractive. CEO Pichai said the following about its product portfolio on the earnings call (emphasis added):

We have six products with more than 2 billion monthly users, including 3 billion Android devices. 15 products have 0.5 billion users, and we operate across 100-plus countries. This gives us a lot of opportunities to bring helpful Gen AI features and multimodal capabilities to people everywhere and improve their experiences.

While Pichai didn’t fully identify those six products on the earnings call, he is likely referring to Google Search, Android, Chrome, Gmail, Google Play Store, and YouTube. Other popular products likely over the 0.5 billion threshold are Google Drive, Google Maps, Google Photos, Google Translate, Google Calendar, Google Workspace, and Google’s Office product suite (docs, sheets, slides, and forms).

5. Velocity in execution

Google’s AI product development efforts have been more siloed until recently. A siloed approach to product development could have several negative impacts, including slowing product development times and inefficiencies that eventually show up in increased research and development (R&D) spending. The company has now broken down all the siloes by organizing all AI product development under Google DeepMind. Pichai said the following about improving the company’s execution in AI:

We’ve been really focused on simplifying our structures to help us move faster. In addition to bringing together our model building teams under Google DeepMind, we recently unified our ML infrastructure and ML developer teams to enable faster decisions, smarter compute allocation, and a better customer experience. Earlier this year, we brought our Search teams together under one leader. And last week, we took another step bringing together our platforms and devices teams. The new combined team will focus on delivering high quality products and experiences, bolstering the Android and Chrome ecosystems, and bringing our best innovations to partners faster.

If these efficiency improvements are effective, the days of people saying Microsoft or any other company is ahead of Google in AI or product development may soon be over.

6. Monetization paths

CEO Pichai highlighted three AI monetization efforts that Alphabet is laser-focused on advertising, cloud, and subscriptions. I believe advertising is one of the best near-term ways to monetize AI. Since Alphabet is one of the best, if not the best, ways to advertise on the Internet, it makes sense that Alphabet is putting a lot of effort into monetizing AI through advertising. Chief Business Officer (“CBO”) Philipp Schindler highlighted Google’s automated ad campaign tool Performance Max, which helps advertisers reach people throughout Google properties, including Search, YouTube, Gmail, Maps, Display, and Discovery. CBO Schindler said the following on the earnings call (emphasis added):

Look at Performance Max [P-Max]. In February, we rolled Gemini into P-Max. It’s helping curate and generate text and image assets so businesses can meet P-Max asset requirements instantly. This is available to all US advertisers and starting to roll out internationally in English and early results are encouraging. Advertisers using P-Max asset generation are 63% more likely to publish a campaign with good or excellent ad strength. And those who improve their P-Max ad strength to excellent see 6% more conversions on average.

Improving advertiser results could potentially increase Google’s ad revenue. By monitoring Google Advertising revenue, investors can indirectly monitor whether the company’s AI efforts are helping improve the ad business.

Next, Alphabet plans to monetize AI, particularly generative AI, through the cloud. Management believes the key differentiating factor between Google Cloud Platform (“GCP”) and its competitors is the AI Hypercomputer. A blog on GCP’s website describes AI Hypercomputer in the following way:

A groundbreaking supercomputer architecture that employs an integrated system of performance-optimized hardware, open software, leading ML frameworks, and flexible consumption models. Traditional methods often tackle demanding AI workloads through piecemeal, component-level enhancements, which can lead to inefficiencies and bottlenecks. In contrast, AI Hypercomputer employs systems-level codesign to boost efficiency and productivity across AI training, tuning, and serving.

What the blog is saying in plain English in the above quote is that Google built a closely integrated AI system from the ground up that was designed specifically for the most demanding AI workloads. Competitors like Amazon’s AWS and Microsoft Azure have sophisticated hardware for customers, but have yet to build a tightly integrated system to run AI workloads as effectively. The development of the AI Hypercomputer is an example of how GCP may be slightly ahead of its competitors in building dedicated AI infrastructure and a potential competitive advantage in attracting companies interested in generative AI. Today, GCP appears to be gaining popularity among companies developing or using generative AI. CEO Pichai said during the earnings call, “Today, more than 60% of funded Gen AI startups and nearly 90% of Gen AI unicorns are Google Cloud customers.“

The last AI monetization effort mentioned on the earnings call was subscriptions. Google introduced Gemini Advanced using its Ultra 1.0 model in February 2024. The following is an excerpt from a blog describing Gemini Advanced (emphasis added):

In blind evaluations with our third-party raters, Gemini Advanced with Ultra 1.0 is now the most preferred chatbot compared to leading alternatives. With our Ultra 1.0 model, Gemini Advanced is far more capable at highly complex tasks like coding, logical reasoning, following nuanced instructions and collaborating on creative projects. Gemini Advanced not only allows you to have longer, more detailed conversations; it also better understands the context from your previous prompts.

Google One members can sign up for a free two-month trial of Gemini Advanced, and the cost after two months is $19.99 per month. For a monthly fee, Google One provides customers additional storage across Google Drive, Gmail, and Google Photos. Suppose the market decides that Google’s Gemini Advanced is a superior chatbot to competitors. In that case, it will make being a Google One member more valuable and create a higher switching cost for Google Drive, Gmail, and Google Photos users.

Since OpenAI introduced ChatGPT in late 2022, some investors have invented a thesis that Alphabet was behind in AI and that its Search business would be destroyed by a reinvigorated Microsoft using OpenAI’s technology. However, since the beginning of 2023, Alphabet’s stock has been up almost 85%. So, the market may not fully believe that narrative. Alphabet must be doing something right.

Let’s examine Alphabet’s latest earnings to see how it is handling competition from Microsoft and others.

Excellent earnings report

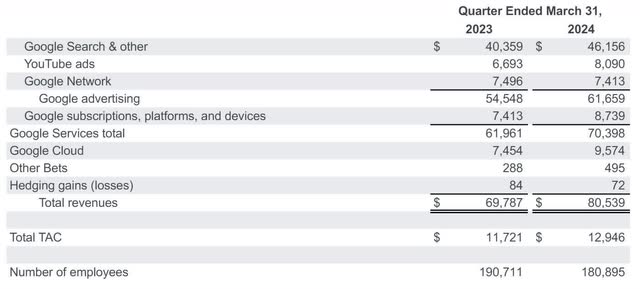

The following image from Alphabet’s first-quarter earnings release shows that business segments that ChatGPT was supposed to harm still thrive. Google Search, its largest revenue segment, grew by around 14%, and overall advertising grew by 13% over the previous year’s comparable quarter. Google Cloud is now its fastest revenue growth segment at 28.4%. Another thing to note is that Alphabet reduced its employee count by 5% year-over-year, helping it save money on salaries, benefits, and other personnel costs. The company further reduced its workforce on May 1, laying off several hundred workers and moving some jobs overseas. Although the company has reduced its headcount, it is still interested in hiring the best talent to further its AI ambitions. Chief Financial Officer (“CFO”) Ruth Porat said the following on the earnings call, “As we have discussed previously, we are continuing to invest in top engineering and technical talent, particularly in Cloud, Google DeepMind, and technical infrastructure.“

Alphabet First Quarter 2024 Earnings Release

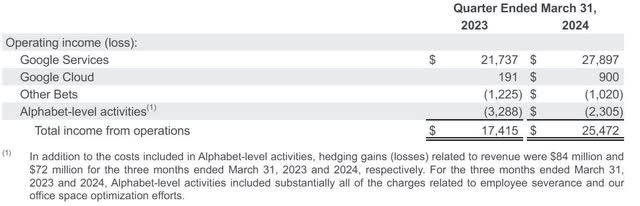

The following image shows Google’s operating segment results. Several years ago, some analysts, investors, and financial news media thought that Google Cloud would never become profitable. The company defied those assumptions. Google Cloud’s operating income increased 371% year over year to $900 million in the first quarter.

Google First Quarter 2024 Earnings Release

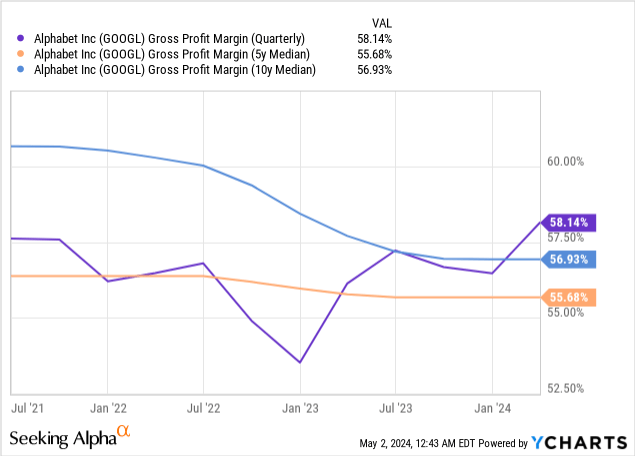

Let’s examine the company’s growing profitability. Alphabet’s consolidated gross margins were up around 200 basis points (“bps”) to 58.14% year-over-year, above its five—and ten-year median.

Alphabet is on a campaign to reduce operating expenses. CFO Ruth Porat said the following on the earnings call (emphasis added):

Looking ahead, we remain focused on our efforts to moderate the pace of expense growth in order to create capacity for the increases in depreciation and expenses associated with the higher levels of investment in our technical infrastructure. We believe these efforts will enable us to deliver full-year 2024 Alphabet operating margin expansion relative to 2023.

Next, let’s look at operating expenses as a percentage of revenue. The following table shows that operating expenses have lowered as a percentage of revenue, showing that the company has indeed slowed down expense growth relative to earnings.

| Metric | Q1 2024 | Q1 2023 |

| Operating Expense as a % of revenue | 26.52% | 31.18% |

| R&D as a % of revenue | 14.78% | 16.43% |

| S&M as a % of revenue | 7.98% | 9.36% |

| G&A as a % of revenue | 3.76% | 5.38% |

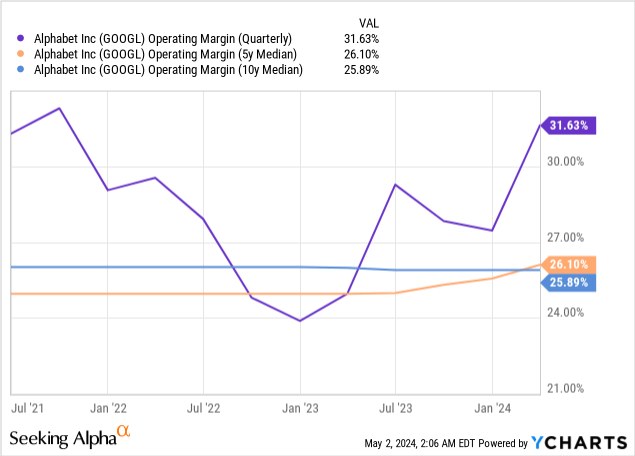

The company’s cost reduction efforts helped consolidated operating margins expand approximately 700 bps year-over-year to 31.63% in the first quarter, well above its five- and ten-year median.

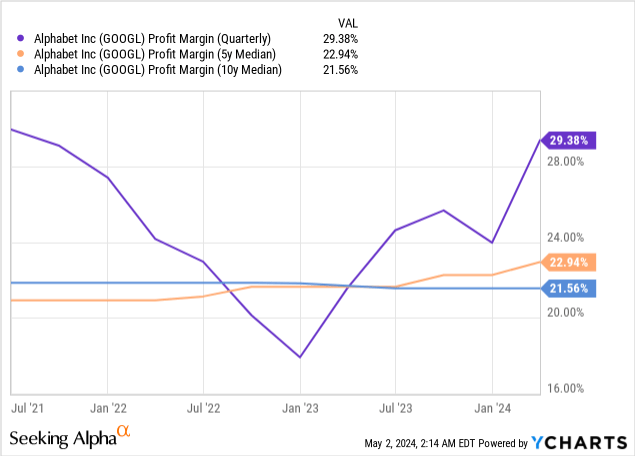

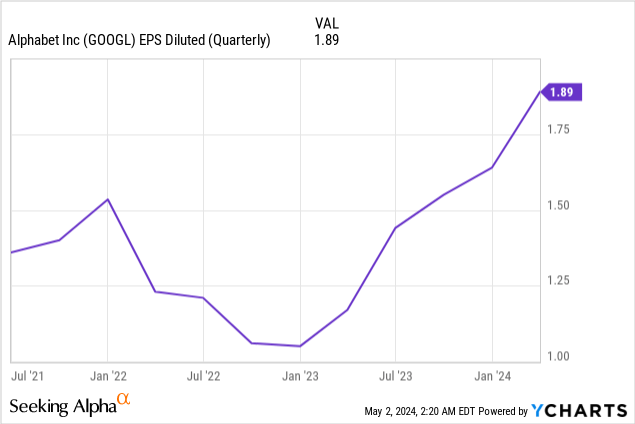

Alphabet’s net profit margin expanded 800 bps to 29.38%, well above the company’s five- and ten-year median. Its margin expansion helped EPS grow 56% to $1.89.

The following image shows analysts forecast solid double-digit EPS growth over the next six years, including this year. This future bottom-line growth potential is attractive to prospective investors.

Seeking Alpha

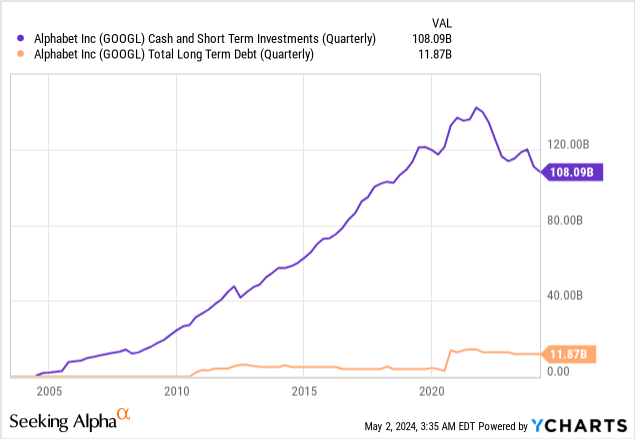

The company is also in great financial shape. Alphabet has $108 billion in cash and short-term investments and $11.87 billion in long-term debt. It has a debt-to-EBITDA ratio of 0.22, meaning it can easily cover its long-term debt with earnings from its core operations. Generally, a number below one indicates a company at low risk of defaulting on its debt. Alphabet’s quick ratio is 2.15, meaning the company can easily cover its short-term obligations.

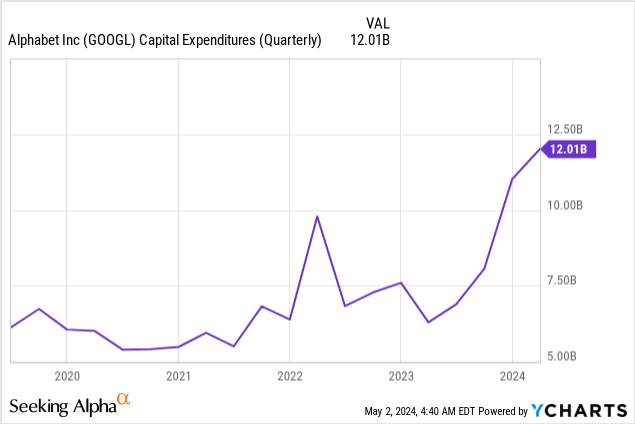

Like other large-cap tech companies, such as Meta Platforms, Amazon, and Microsoft, Alphabet is investing heavily in AI infrastructure, reflected in its capital expenditures (“CapEx”). The following chart shows how CapEx has jumped significantly over the last year.

CFO Ruth Porat also spoke on CapEx spending during the earnings call (emphasis added):

With respect to CapEx, our reported CapEx in the first quarter was $12 billion, once again driven overwhelmingly by investment in our technical infrastructure with the largest component for servers followed by data centers. The significant year-on-year growth in CapEx in recent quarters reflects our confidence in the opportunities offered by AI across our business. Looking ahead, we expect quarterly CapEx throughout the year to be roughly at or above the Q1 level, keeping in mind that the timing of cash payments can cause variability in quarterly reported CapEx.

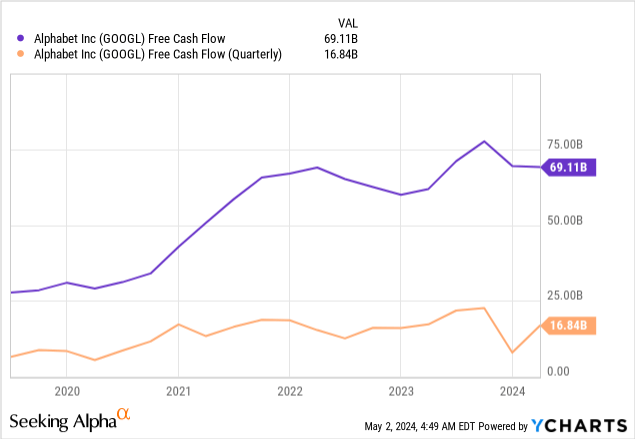

This relatively high CapEx spending will dampen free cash flow (“FCF”) growth throughout the year. The following chart shows FCF on a trailing 12-month and a quarterly basis.

Once Alphabet slows down or ends its AI infrastructure build-out, its FCF may receive an additional boost from lower CapEx.

Risks

One of Alphabet’s most significant risks remains competition. Although Alphabet may have some advantages in AI infrastructure with ideas like AI Hypercomputer, companies like Microsoft, Amazon, and Apple (AAPL) are not sitting still. Recently, Seeking Alpha reported that Apple is building an AI “dream team” for some unknown product(s). And don’t forget OpenAI. Seeking Alpha published an article recently about Apple and OpenAI negotiating to integrate ChatGPT into the iPhone. People who invest in Alphabet must constantly monitor the competitive landscape.

Investors must also monitor threats from government regulators and court cases worldwide that could change Alphabet’s business model. For instance, the company recently lost a court case against Epic Games, which could significantly impact its revenue from the Google Play Store on Android.

Valuation

In my last article on Alphabet, I stated that it should trade at least a forward P/E of around 25, which called for a stock price of $143.59 at the time. Although the company has exceeded my fair value estimate and today trades above my October 30, 2023, fair value, I still believe the market undervalues the stock, as analysts have revised estimates upwards since then. For example, analysts estimated fiscal 2024 EPS of $6.65. Today, analysts forecast a fiscal 2024 EPS of $7.52.

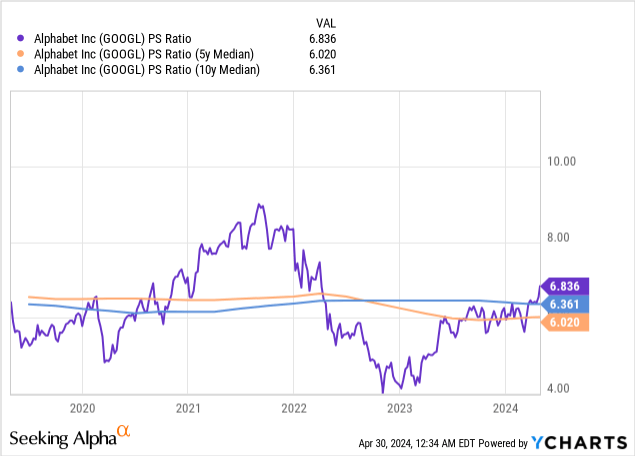

Alphabet’s price-to-sales (P/S) ratio is 6.836, slightly above its five- and ten-year median, suggesting the stock is selling slightly above fair value.

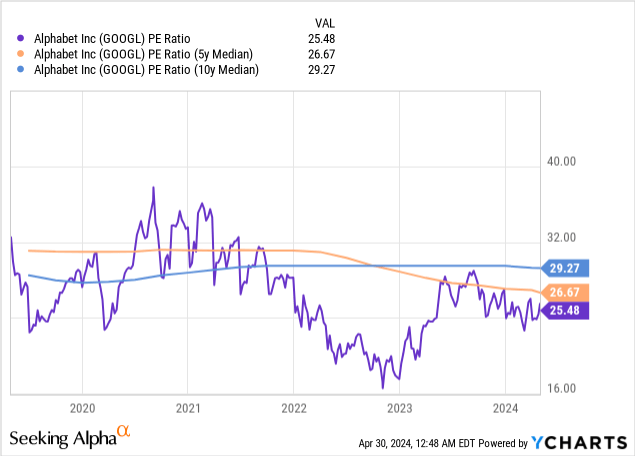

The following chart shows that Alphabet has a P/E ratio of 25.48, which is below its 5- and 10-year median, suggesting that even after the stock’s rise after earnings, the market may undervalue the stock. If it sold at its five-year median, the stock price would be $173.88, and at its ten-year median, the price would be $190.84, about 16.5% over its May 1, 2024 closing price of $163.86.

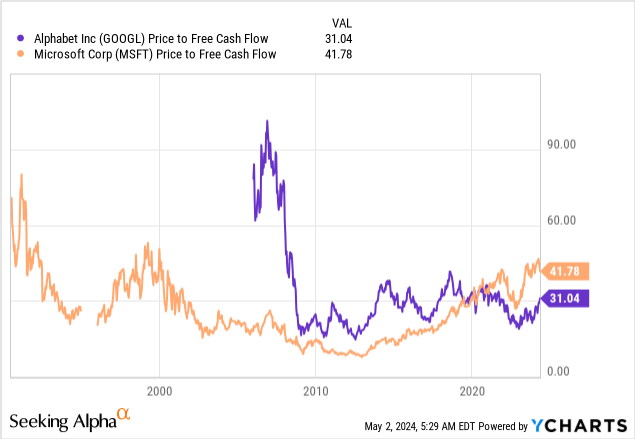

Microsoft and Alphabet are relatively similar companies, so comparing them on a price-to-FCF (P/FCF) ratio basis would be interesting. Alphabet and Microsoft have historically traded at relatively high P/FCF ratios. For instance, the tech sector’s P/FCF ratio is 18.42. Alphabet has a P/FCF ratio of 31.47 compared to Microsoft’s 41.78. The chart below shows that the market began valuing Microsoft’s business higher on a P/FCF basis around 2020. The difference between valuations started to open up when Microsoft more closely aligned with OpenAI and ChatGPT. One has to wonder that if it turns out that generative AI is not as much of an advantage for Microsoft over Google, would the P/FCF valuation gap begin to shrink?

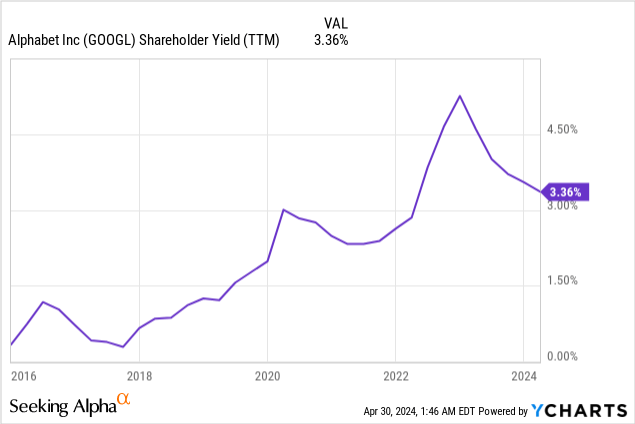

Suppose you add up what the company is giving back to investors in dividends, buybacks, and debt repayments; that metric is called the shareholder yield. The higher the shareholder yield, the better the value the company has. Alphabet was at its cheapest in 2023, when the shareholder yield was above 4.5%. According to the chart below, the company has a shareholder yield of 3.36%, which was before factoring in the company’s new dividend policy. While Alphabet is not currently at a bargain-basement valuation, the market still undervalues the stock based on shareholder yield.

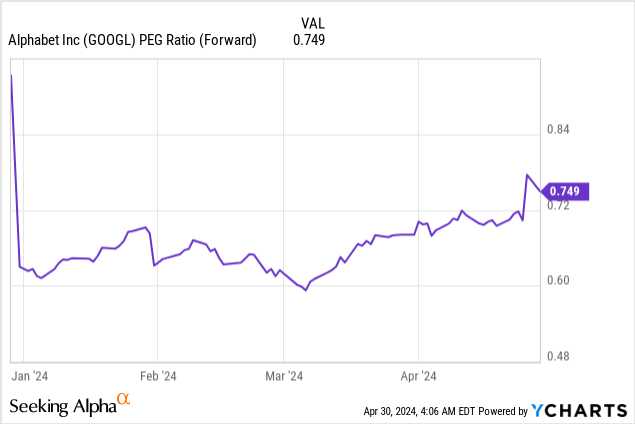

Alphabet has a forward Price/Earnings to Growth (“PEG”) ratio of 0.749, indicating that the market may undervalue the company’s projected earnings growth in 2024. Generally, investors like to see a company’s P/E ratio match the growth rate, producing a PEG ratio of one and indicating a fairly valued stock.

Even after Alphabet’s stock rose post-first-quarter earnings, the market may still undervalue this company’s EPS growth potential. Alphabet has a forward P/E ratio of 22.16, yet analysts estimate the company will grow 29.65% this year. My fair value for the stock is $222.68, which is what the stock would trade at if the forward P/E matched analysts’ estimated growth rate of 29.65%. My fair value price is 33.8% above Alphabet’s May 2, 2023 closing price of $166.62. This fair value is conservative as I base it on analysts’ estimates for fiscal 2024 EPS of $7.52. With most of Alphabet’s businesses doing well, there is a chance analysts may continue to revise estimates upwards if the company outperforms.

Maintaining my buy rating on Alphabet

If you thought you missed the AI revolution because of the inflated stock prices of companies viewed as AI beneficiaries, think again. Alphabet should benefit enormously from AI in general and generative AI, and it still sells at a reasonable valuation. I maintain my buy rating on Alphabet.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.