Summary:

- Alphabet is one of the world’s largest multinational conglomerates, which could face increased pressure from European Union antitrust authorities.

- Due to increased competition from TikTok, Alphabet continues to open up new markets and niches.

- On April 25, 2023, Alphabet released financial results for the first three months of 2023, which not only beat analysts’ expectations but demonstrated that revenue from Google Services continues to grow.

- Moreover, Alphabet is looking to diversify its cash flow sources and invest tens of millions of dollars in developing augmented reality and virtual reality technologies.

- Alphabet is initiated with a “hold” rating for the next 12 months due to its financial position.

metamorworks/iStock via Getty Images

Alphabet (NASDAQ:GOOGL, NASDAQ:GOOG) is one of the world’s largest multinational conglomerates, created as part of a corporate restructuring in 2015, and whose main product is Google Search, which processes tens of thousands of requests every second. Among other things, the company’s essential and popular products are YouTube, Gmail, Google Drive, and Google Chrome, and the Android operating system acquired by Google in 2005 and installed on most smartphones.

The company is focused on two segments Google Services and Google Cloud. The Google Cloud segment includes Google Cloud Platform, which offers cybersecurity tools and data analytics, and Google Workspace, whose revenue is generated by using various cloud computing services by customers that improve their productivity, including by facilitating communication among workers.

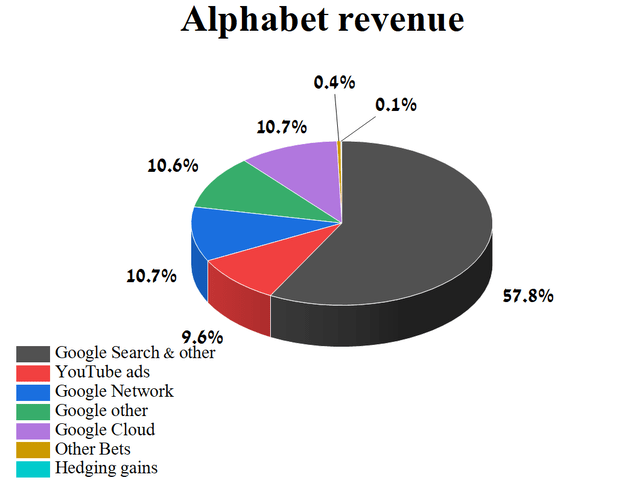

As a result, we believe that demand for Google Cloud, which generated about 10.7% of Alphabet’s total revenue in 1Q 2023, will continue to grow significantly, despite the decline in its business activity in Russia due to its invasion of Ukraine in February 2022.

Author’s elaboration, based on 10-Q

On April 25, 2023, Alphabet released financial results for the first three months of 2023, which not only beat analysts’ expectations but demonstrated that revenue from Google Services continues to grow despite a slight drop in YouTube advertising revenue. The strengthening of the US dollar and the reduction in advertiser spending are experiencing difficulties during a period of higher central bank interest rates, leading to lower investment in new projects, economic activity, and investment in advertising.

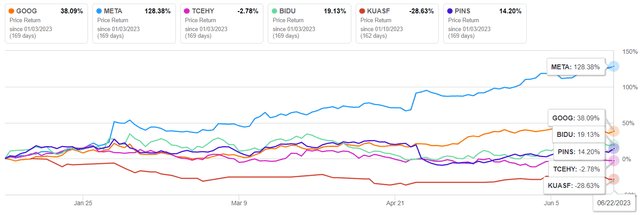

But despite this, since the beginning of 2023, Alphabet’s share price has shown growth of about 38%, significantly better than that of major competitors in the communications sector, such as Baidu (BIDU), Walt Disney (DIS), and Pinterest (PINS).

Author’s elaboration, based on Seeking Alpha

We initiate our coverage of Alphabet with a “hold” rating for the next 12 months.

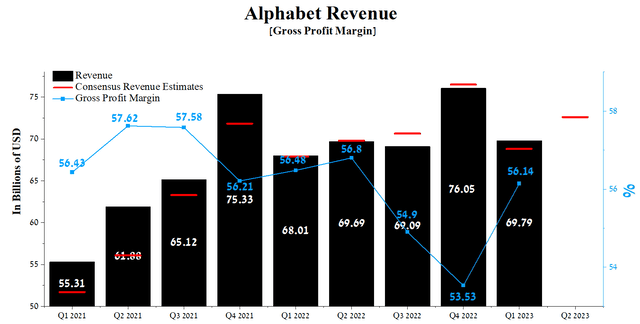

Alphabet’s Financial Position

Alphabet’s revenue for the first three months of 2023 was $69.79 billion, down 8.2% from the previous quarter and up 2.6% from the first quarter of 2022. Despite signs of stabilization in the global advertising market, the rise in central bank interest rates in recent years still leads to reductions in marketing budgets for companies. As a result, Alphabet’s actual revenue has beaten analysts’ consensus estimates in only six of the last nine quarters.

Author’s elaboration, based on Seeking Alpha

Despite the company’s year-over-year revenue growth, Google advertising revenues continued to decline for the second consecutive quarter, despite an emerging search trend driven by two factors, user growth and increased use of the company’s services via mobile devices. At the same time, strengthening in the US dollar against foreign exchange rates continues to put additional pressure on Alphabet’s revenue since more than 50% of sales are generated outside the US. For example, YouTube ad revenue was about $6.69 billion in the first three quarters of 2023, down $1.27 billion from the previous quarter.

Despite this, the company’s management does not plan to stop the development of the platform, and on June 30 this year, YouTube will launch an online shopping channel in South Korea, which will provide commercial customers with a platform and allow people to experience the pleasure of purchasing thirty brands by broadcasting information about them.

Due to increased competition from TikTok, Alphabet continues to open up new markets and niches. So, on November 4, 2021, CME Group (CME) and Google Cloud announced a ten-year cooperation deal, according to which the largest derivatives exchange operator will gradually transfer its technological infrastructure to Google Cloud and thereby accelerate the launch of new products and services to the market. In early April 2023, Alphabet continued its expansion into the financial sector by entering into a partnership agreement with MSCI (MSCI). The ultimate goal of this alliance will be to create a cloud-based financial data collection and development platform that will use advanced AI and natural language processing technologies so that MSCI can remain competitive in a rapidly evolving investment world.

Alphabet’s revenue for Q2 2023 is expected to be $70.69-$74.33 billion, up 5.5% from analysts’ expectations for Q1 2023. We believe that most of the revenue growth will come from the greater adoption of AI, which continues to grow under the auspices of DeepMind.

Increasing competition in the technology sector is driving up investment and the need to innovate. So, in early February 2023, Alphabet introduced Bard, an artificial intelligence chatbot and an improved version of the LaMDA. At the moment, Bard continues to evolve and get new features. Its gradual integration into Alphabet’s services, such as Google Maps and Google Search, together with geographic expansion, will allow the company to remain a leader in the industry and thereby increase demand for the company’s products.

Moreover, Alphabet is looking to diversify its cash flow sources and invest tens of millions of dollars in developing augmented reality and virtual reality technologies. In February 2023, the company announced a partnership with Samsung (OTCPK:SSNLF) and Qualcomm (QCOM), which will create a device and platform based on extended reality technologies that will be able to compete with Apple (AAPL) in this promising market.

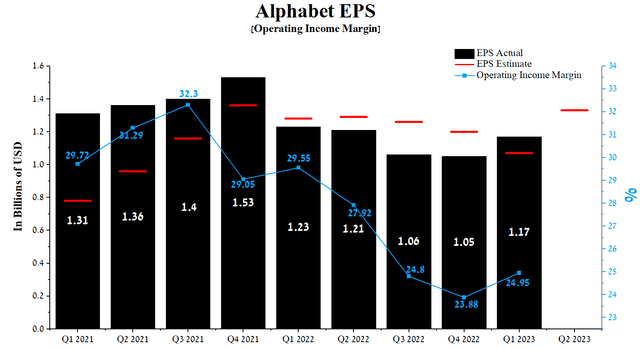

Alphabet’s Q1 2023 operating income margin was 24.95%, down significantly from the previous year, but we are seeing signs of its stabilization and slight growth from the prior quarter. Moreover, this financial indicator is significantly higher than that of the communications sector and competitors such as Pinterest, Baidu, and Kuaishou Technology (OTCPK:KUASF), which is one of the factors that attract long-term investors. We forecast that Alphabet’s operating margin will reach 28.5% by 2023 and rise slightly to 30.1% by 2024, driven by improved business processes, layoffs, slower hardware replacement rates, and lower inflation in the US and Europe.

The company’s earnings per share for the first three months of 2023 was $1.17, up 11.4% quarter-on-quarter, and just as importantly, it has broken the trend of missing the Wall Street analyst consensus estimates in recent quarters.

However, Alphabet’s Q2 EPS is expected to be in the $1.06-$1.51 range, down 24.3% from the Q1 2023 results. At the same time, Alphabet’s Non-GAAP P/E [TTM] is 27.01x, which is 84.36% higher than the average for the sector and 1.29% higher than the average over the past five years. On the other hand, P/E Non-GAAP [FWD] is 22.61x, which indicates that the company is slightly undervalued in the current period of recovery in global economic activity.

Author’s elaboration, based on Seeking Alpha

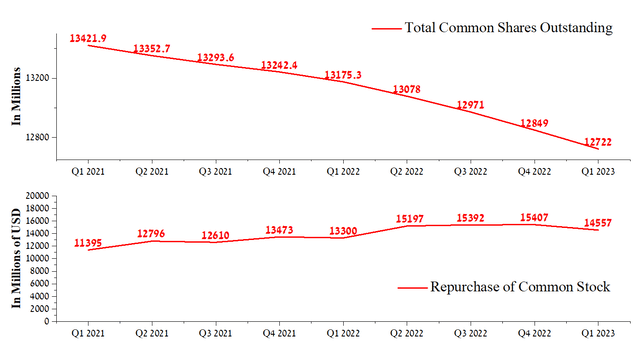

We believe that Alphabet’s beating of consensus EPS is primarily due to the active use of the share buyback program. For the first quarter of 2023, Alphabet repurchased about $14.56 billion of its shares, down slightly from the previous quarter. At the same time, the company has the authorization to buy back company shares for a total amount of $83.1 billion, which can help Alphabet offset the impact of increased volatility in the stock market that is currently observed.

Author’s elaboration, based on Seeking Alpha

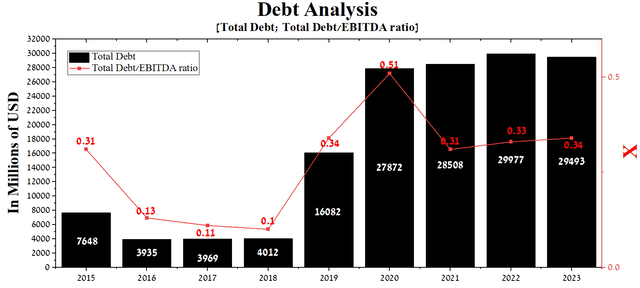

At the end of the first quarter of 2023, Alphabet’s total debt was about $24.49 billion, an increase of $988 million from 2021. Despite a slight drop in EBITDA in recent years, the company’s total debt/EBITDA ratio has only increased from 0.31x to 0.34x.

Author’s elaboration, based on Seeking Alpha

Given the meager total debt/EBITDA ratio, stable cash flow, and maturity dates of the senior notes, we do not expect Alphabet to have any problems with their redemption, and it will continue to invest billions of dollars in technology development and pursue an active share repurchase program.

Conclusion

Alphabet is one of the world’s largest multinational conglomerates, created as part of a corporate restructuring in 2015, and whose main product is Google Search, which processes tens of thousands of requests every second.

Increasing competition in the technology sector is driving up investment and the need to innovate. So, in early February 2023, Alphabet introduced Bard, an artificial intelligence chatbot and an improved version of the LaMDA. Moreover, the company continues to invest tens of millions of dollars in developing augmented and virtual reality technologies to compete with Apple Vision Pro and increase its share in this rapidly growing market.

Given the high likelihood that European Union antitrust authorities may require Alphabet to divest part of its advertising business to reduce its dominance in the industry, and given the relatively weak recovery in economic activity in Europe and Asia, there are significant risks to the company’s financial position that will lead to a correction in the price of the company’s shares in the range from $110 to $112. We initiate our coverage of Alphabet with a “hold” rating for the next 12 months.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.