Summary:

- Altria missed expectations in Q2 amid continual revenue challenges in the combustible segment. NJOY momentum, however, remained favorable again.

- I expect MO to raise its dividend by 4.0% in the third quarter, which would give shares a forward dividend yield of 8%.

- I am now neutral on valuation, and downgrade shares to hold, given that they have reached my fair value target price of $49 per share.

krblokhin

Altria Group (NYSE:MO) submitted a solid earnings sheet for the second fiscal quarter, although the tobacco firm missed on both the top and the bottom line. Strong NJOY momentum, driven by growing distribution and product uptake, continues to support the company’s earnings growth projection and the e-cigarette market opportunity is growing for Altria. On the other hand, Altria’s combustible segment is still struggling as smokers turn away from traditional tobacco products. From a dividend coverage perspective, however, I believe Altria’s 8% dividend is reasonably safe, and the tobacco firm is set to announce its new quarterly dividend for Q3 later in August. From a valuation point of view, I believe Altria is about fairly valued now, and I don’t expect much in terms of upside.

Previous rating

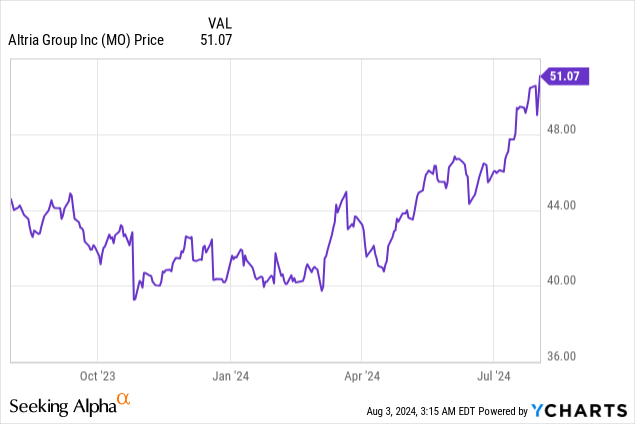

I recommended shares of Altria in April 2024 — Top Dividend Value — due to success in alternative product categories as well as a previously announced $1.0B stock buyback that provided support to the tobacco company’s share price. In my opinion, shares of Altria, given its steep increase in the share price lately, is about fairly valued, which is why I am down-grading shares to hold. The dividend, however, should remain well-supported by adjusted earnings.

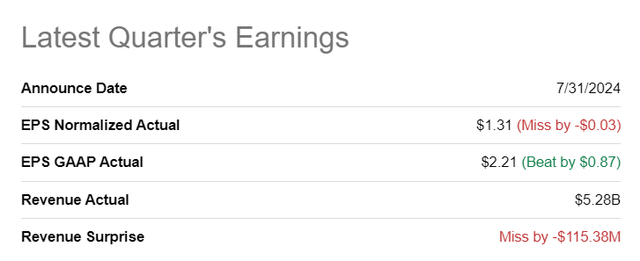

Altria missed estimates

Altria delivered a top and bottom line miss for its second fiscal quarter, chiefly because of persistent pressure in the combustible segment. The tobacco company had adjusted earnings of $1.31 per-share, missing the average Wall Street estimate by $0.03 per-share. The top line came at $5.28B, which missed the consensus prediction by about $115M.

Pressured combustible segment, NJOY momentum

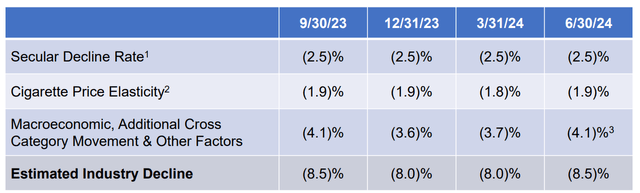

Higher prices for all kinds of products, ranging from food to gas, have put pressure on the budgets of consumers in the last two years, which created headwinds for Altria’s top line. As a result of surging inflation, cigarette trips have become more expensive and combustible industry volumes have fallen quite significantly. Cigarette industry volumes fell 8.5% in the second quarter, which was slightly worse than in the previous quarter.

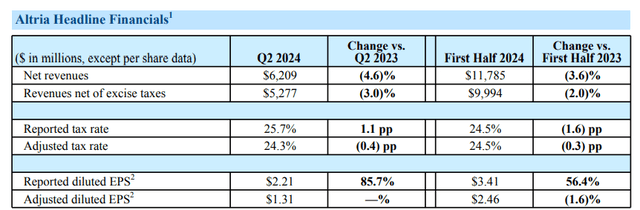

Pressure in the combustible segment expectedly led to a decline in Altria’s top line in the second quarter. Total revenue, net of excise taxes, slumped 3% Y/Y to $5.3B in the second quarter, while adjusted diluted EPS remained flat year over year. However, Altria is still seeing significant momentum for its alternative category NJOY products.

While the combustible segment experiences a long-term decline trend, which was exacerbated in the last two years due to surging inflation, Altria’s e-cigarette brand NJOY is seeing strong momentum. This momentum comes from the growing acceptance of cigarette alternatives and increasing product up-take of e-cigarettes, the kind that Altria acquired last year from NJOY Holdings for $2.8B.

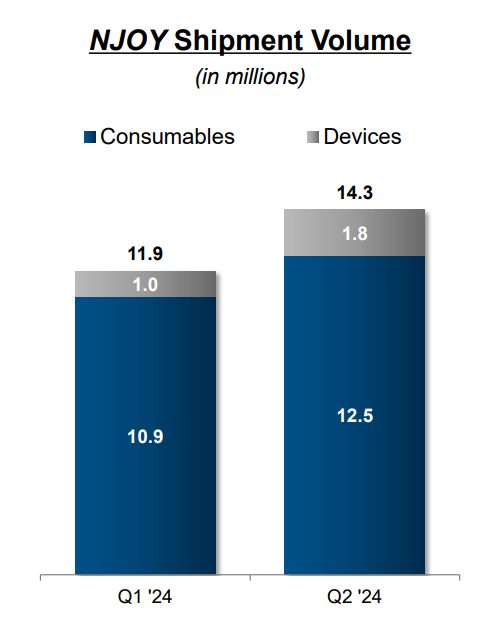

NJOY shipment volumes have risen strongly in Q2’24, in part due to growing distribution. NJOY products were available in over 100k stores in the U.S., which was triple the company’s footprint in the year-earlier period. NJOY shipment volumes surged 20% year over year in Q2’24 with device shipments leading the way (+80% Y/Y).

Altria

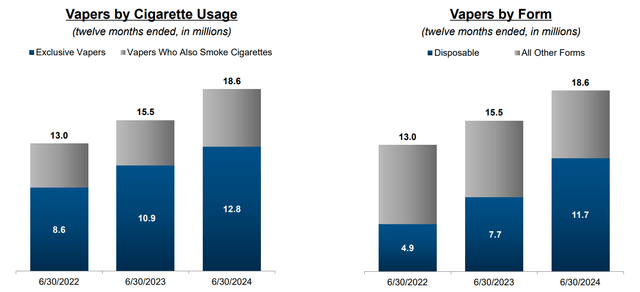

Growing acceptance of e-cigarette products is driving an expansion in the market size for NJOY. With more people turning to vape/e-cigarette products, Altria has sustained tailwinds in its alternative products business. The amount of vapers rose to 18.6M (including cigarette smokers) at the end of the second-quarter, according to Altria, which implies a year-over-year growth rate of 43%.

Dividend decision

Altria is set to announce its customary annual dividend raise in the third-quarter which, in my opinion, will result in the company announcing a $1.02 per-share quarterly dividend (+4% Y/Y). Altria raised its dividend by $0.04 per-share each year in the last three years and given the expected growth in EPS, I expect a similar-size increase this year.

Altria narrowed its adjusted EPS guidance last week and now projects earnings to fall into a range of $5.07 to $5.15 per-share. This updated EPS range implies between 2.5% and 4.0% year-over-year earnings growth and, assuming a $0.04 per-share dividend increase in Q3 (in-line with the past dividend increases), a forward dividend coverage ratio, at the mid-point, of 1.25X. If Altria raises its dividend by only $0.02 per-share (+2%), the dividend coverage ratio would be 78%.

Altria’s valuation

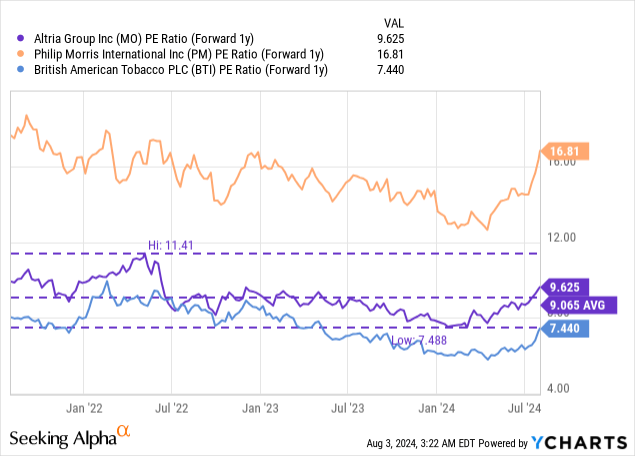

Altria’s shares have risen 17% since my last work on the tobacco company was published in April. The tobacco company’s shares are currently trading at a P/E ratio (based off of FY 2025 earnings) of 9.6X, which is above the company’s longer term P/E average ratio of 9.1X.

Philip Morris International (PM), which is mainly focused on growth in emerging markets, is trading at a P/E ratio of 16.8X. Since shares of Philip Morris have also had a very good run lately, I down-graded Philip Morris’ shares to hold last week as well: 5% Yield Is Now Too Expensive. The best value for income investors in the tobacco industry, in my opinion, is represented by British American Tobacco (BTI)… which has the lowest P/E ratio, considerable new product category momentum and whose shares also pay an 8% yield: An 8% No-Brainer Income Stock.

In my last valuation update in April, I stated that I saw a fair value of $49 per-share for Altria, given its historical valuation averages. I still stand by this and currently see shares of the tobacco company, which are trading at $51.07, as slightly overvalued. I am holding MO here for income, but I am not planning on adding to my investment here. I would consider purchasing more shares if shares became available at a discount to my fair value estimate of $49 per-share.

Risks with Altria

Altria has a lot of risks, although I don’t expect them to affect the company’s dividend coverage in the near term. The biggest risk for Altria, obviously, is a continuing shift in consumer attitudes towards smoking. Although Altria has invested in alternative product categories such as NJOY, clearly consumers don’t buy as many cigarettes as they used even one decade ago. Contracting industry shipment volumes, in my opinion, are therefore the biggest operational challenge for Altria.

Final thoughts

Although Altria is seeing persistent top line pressures in a market that is (and will remain) challenging for traditional tobacco companies, the tobacco company generates a solid and stable amount of core earnings that it can distribute to shareholders. Altria is also nearing its dividend announcement for the third fiscal quarter, which is when the tobacco company sets its dividend rate for the coming year. I believe we are going to see a ~4% raise in the dividend later this month, which, if correct, would translate to a forward dividend yield of 8% and a dividend coverage ratio of 1.25X. I am more neutral on valuation now, given the steep increase in the share price lately, and therefore change my rating to hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO, BTI, PM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.