Summary:

- Altria Group is facing several challenges which are reflected in its rock-bottom valuation, but it has some core strengths which make the stock a Buy.

- The biggest issue is the secular decline in shipment volume of its smokeable products, which declined by a staggering 10 percentage points YoY in the recent quarter.

- However, the company is making up for these lost volumes with price increases, and the worst-case scenario for volume decline is also not too bad for the long-term EPS trajectory.

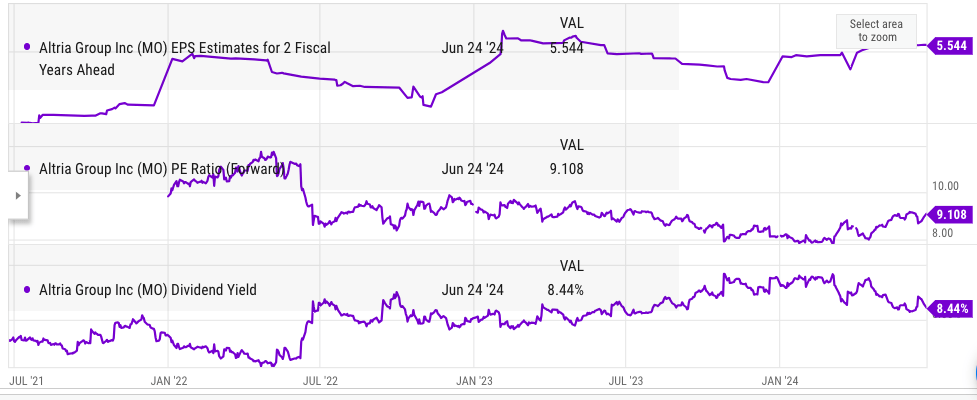

- The forward PE ratio is only 9 while the EPS projection for 2 fiscal years ahead is also quite stable at $5.5.

- Beyond the short-term doom and gloom sentiment, the company has good fundamentals which can easily beat S&P 500 returns, especially if we face a recessionary environment.

krblokhin

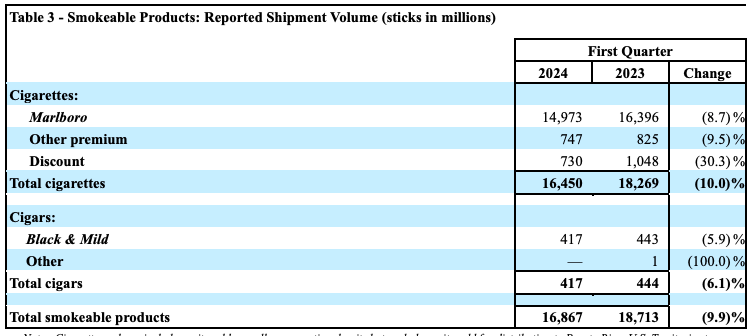

Altria Group (NYSE:MO) has shown some bullish rally in the year-to-date but the stock price is still 40% below the past peak of $75 hit in 2017. One of the key reasons behind the negative sentiment towards Altria stock is the rapid decline in the shipment volume of its smokeable products. In the latest quarter, total cigarette volume declined by 10% YoY and its Marlboro brand declined by 8.7%. The shipment volume has been declining for most of the last decade, and this decline has increased over the past quarters. The shipment volume declined from 134 billion in 2012 to 76 billion sticks in 2023 which equates to a 5% annualized decline in cigarette shipment volume.

Even if we forecast a very bad scenario of 10% annualized shipment decline for the next 10 years, the company would still be in good shape to deliver a decent EPS trajectory if other products gain momentum. The stock is trading at 9 times forward PE ratio, which is a great bargain in the current market condition. The EPS estimate for 2 fiscal years ahead is $5.5 and the stock is 8 times this metric. If we see a recession or macro challenges in the next few years, Altria stock could be a very good hedge. It has already proved a good option to hold in the past recessions. While the shipment decline is an issue, investors could still gain a market-beating return from Altria stock due to high levels of shareholder returns and the cheap valuation.

The elephant in the room

Altria’s long-term decline in cigarette shipment volume is the biggest issue facing the company. There is no short-term cure for this decline, as regulators and consumers are slowly moving away from smokeable products. In the recent quarter, Altria reported a 10% YoY decline in shipment volume, which is higher than the average 5% decline it has reported over the last decade.

Company Filings

Figure: Rapid decline in shipment volume. Source: Company Filings

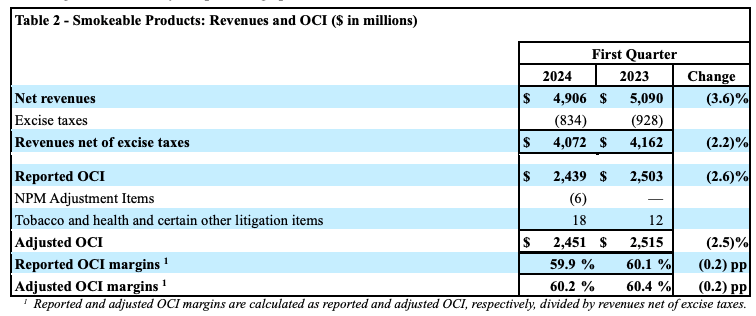

However, investors need to look at the larger picture and see the impact it has had on the net revenue. The YoY decline in net revenue was 3.6% as it fell from $5.09 billion in the year-ago quarter to $4.9 billion. The decline of revenue net of excise taxes was lower at 2.2%.

Company Filings

Figure: Revenue decline in revenue is smaller than the shipment volume. Source: Company Filings

The company is able to raise prices above the average inflation rate, reducing the negative impact on its shipment volume.

Worst-case scenario

It is important to look at the possible long-term trends in this industry in order to gauge the return potential of the stock.

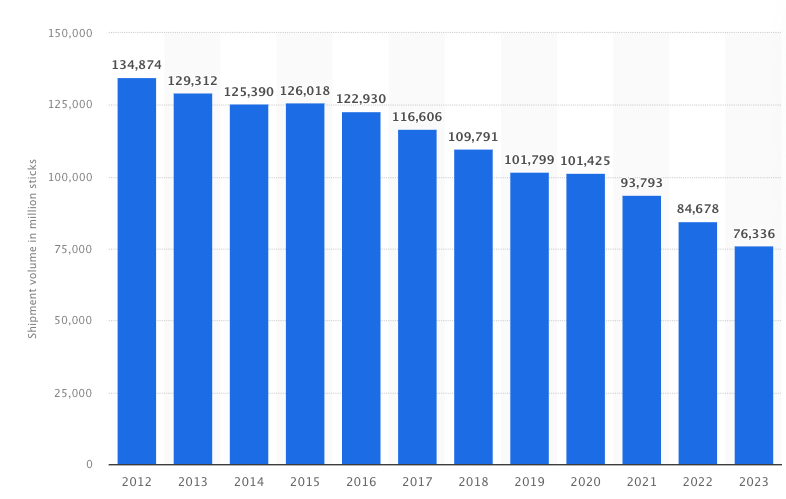

Statista

Figure: Past decline in shipment volume. Source: Statista, Company Filings

Over the last ten years, the annualized decline has been 5%. If we project a 10% annualized decline in shipment volume over the next 10 years, the shipment volume would fall by two-thirds of the current volume, or it will reach close to 25 billion in the next 10 years. This might seem catastrophic, but the company has shown a strong pricing leverage. In the recent quarter, the revenue net of excise taxes fell by only 2.2%. If this trend continues, the decline in this metric over the next 10 years would be 18%-20%.

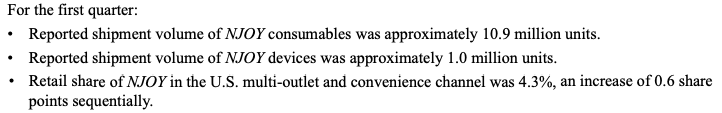

Company Filings

Figure: Growth in NJOY product. Source: Company Filings

The company is also showing good growth in NJOY. There are massive growth opportunities in new categories which could make up for the loss in the smokeable products. As the revenue share of these products increases, we should see a better revenue trajectory from Altria, despite the decline in the smokeable products.

Future upside potential in the stock

The forward PE ratio of Altria Group is only 9 despite the YTD bullish rally in the stock. The EPS estimate for 2 fiscal years ahead is $5.5 which shows that the stock is trading at less than 8 times the EPS estimate for 2 fiscal years ahead. The stock gives a dividend yield of 8.5% and the company has reduced the outstanding shares by 6% over the last 5 years through buybacks. Hence, the total shareholder return is quite good despite the revenue decline of the company.

YCharts

Figure: Key metrics of Altria stock. Source: YCharts

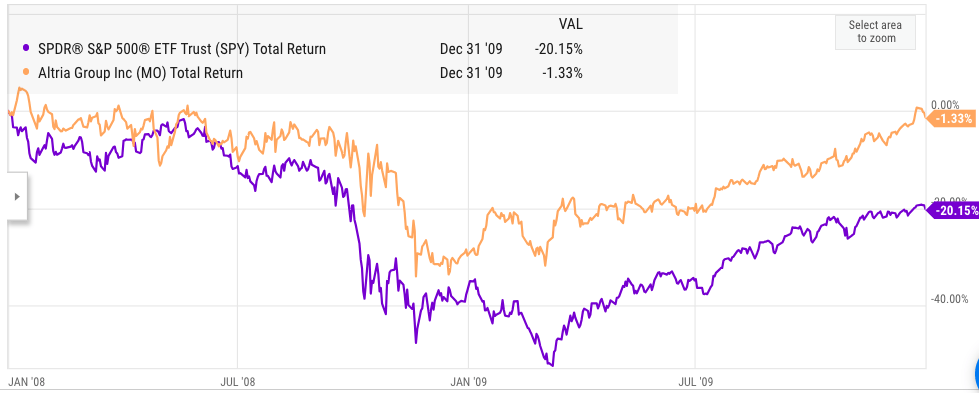

Another positive factor in favor of Altria is that it could perform reasonably well in a recessionary environment.

YCharts

Figure: Performance of Altria group in comparison to S&P500 in the last recession. Source: YCharts

During the Great Recession of 2008-2009, Altria stock easily beat S&P500 returns. We cannot predict when the next recession will hit, but the stock valuation is now close to the highest level according to famous Buffett’s market cap to GDP index. Investors could look at more defensive stocks as they hedge against possible market downturns.

The 8.5% dividend yield is quite good and the forward EPS projection is also stable. The dividends are easily covered by the cash flow and there is no threat to these payments in the near term. As mentioned above, Altria could turn the revenue trajectory if the new product categories gain momentum, which should more than make up for the revenue decline within smokeable products.

Investor Takeaway

Altria Group has seen a small bullish rally in YTD, but the stock is still 40% below its past peak in 2017. The rapid decline in shipment volume of smokeable products should be looked at closely. Even in the worst-case scenario of shipment decline, the company could still deliver revenue growth as new products increase their revenue share.

The shareholder returns from Altria stock are quite strong. The company can easily afford to pay its dividends, which have a yield of 8.5% and is also using buybacks to reduce the share count. The stock would be a good hedge if we see a recession or strong market correction in the near term, making it a Buy at the current price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.