Summary:

- Altria Group is monetizing its stake in Anheuser-Busch InBev to fund share repurchases, creating shareholder value.

- MO’s decision to sell BUD shares makes sense due to BUD’s unconvincing growth, high valuation, and low dividend.

- By selling BUD shares and buying back its own shares, Altria can increase earnings per share and make its dividend more sustainable.

Andrii Yalanskyi

Article Thesis

Altria Group, Inc. (NYSE:MO) is a leading tobacco player in North America. The company trades at an undemanding valuation and offers a very nice dividend yield of almost 9%, with more dividend increases being expected for the current year and beyond. The company’s recent decision to monetize its stake in Anheuser-Busch InBev (BUD) in order to free up cash for buybacks is creating a lot of shareholder value, I think, which is why I like Altria at current prices.

What Happened?

Altria has been a shareholder of Anheuser-Busch InBev for many years, but it was forbidden to sell its shares up until a couple of years ago. Now, Altria has decided to sell a portion of its stake in the beer company. The proceeds are being used to fund share repurchases, as Altria has ramped up its current buyback program by $2.4 billion.

How To Create Shareholder Value

Anheuser-Busch InBev saw some controversy last year with its Bud Light brand, but even without that, Altria’s decision to monetize its BUD stake to fund share repurchases makes a lot of sense to me.

Today, Anheuser-Busch InBev trades with an earnings multiple of 18, which pencils out to an earnings yield of 5.6%. Of course, as a shareholder in BUD, Altria does not get a 5.6% yield on its investment directly. Instead, the cash return that Altria generates with its BUD investment is 1.4%, based on an annual dividend of $0.82 that BUD pays out right now. In other words, Altria generates the same cash return on its investment, in relative terms, as every other BUD shareholder — during times when low-risk Treasuries offer cash yields of more than 4%, BUD’s 1.4% dividend yield isn’t attractive. The broad market’s dividend yield is comparable, and that is despite the fact that many of the market’s behemoths do not pay any meaningful dividends at all, such as Nvidia (NVDA) or Amazon (AMZN).

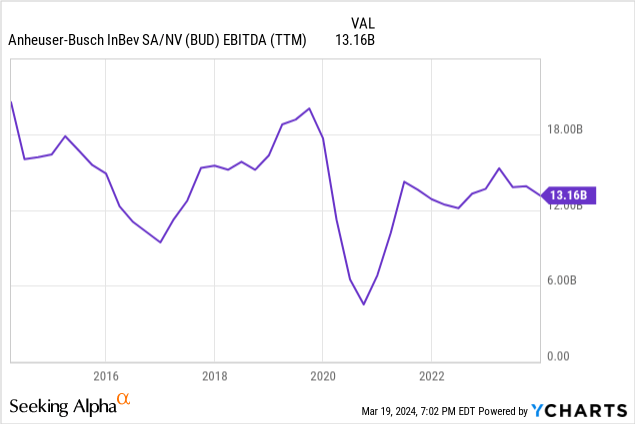

While Altria has made a nice return on its beer investment since it became a partial owner of SABMiller, which eventually merged with Anheuser-Busch InBev, the return on Altria’s current investment in BUD is rather unappealing. There is a pretty slim dividend, and BUD isn’t exactly a value pick at 18x forward profits, nor is BUD a fast-growing company — EBITDA actually is down over the last decade, as we can see in the following chart:

I believe that it is fair to say that BUD isn’t a great investment thanks to its combination of unconvincing growth, a rather high valuation, and a pretty low dividend.

When Altria has the chance to sell its stake in the beer company, either partially or entirely, it should do so, as the proceeds can be better deployed elsewhere.

The most obvious opportunity for Altria to deploy the cash proceeds from the sale of any BUD shares is to buy back its own shares. After all, Altria’s shares are looking much more attractive compared to those of BUD, I believe:

– Altria trades at 9x forward earnings — or just half the valuation BUD trades at.

– Altria has better growth than BUD, as its EBITDA has risen by a little more than 50% over the last decade, while BUD saw its EBITDA decline.

– Altria’s shares offer a dividend yield of around 9%, which is an incredible ~6.5x higher than the yield BUD trades at.

Selling shares of a low-yielding expensive company with weak growth to buy shares of a much cheaper, faster-growing company with a way better growth rate seems like a great choice. That makes sense on a personal level, e.g. when we make sales and purchases in our portfolios, but it also makes sense in this case, where Altria has the choice to sell shares in a different company to buy back shares of “itself”.

An example shows that this has a profoundly positive impact on Altria’s shareholders.

Before this recent decision to (partially) monetize its BUD stake, Altria held 197 million shares of BUD, equal to roughly 10% of BUD’s total shares.

For the following calculations, I will further use a MO share price of $44, a BUD share price of $60, a MO annual dividend of $3.92 per share, a BUD annual dividend of $0.82 per share, and earnings per share estimates for the current year of $5.06 and $3.37 for Altria and Anheuser-Busch, respectively [this data is from Seeking Alpha, see this link and the ticker pages for MO and BUD].

If Altria holds onto its shares of BUD, it will receive around $162 million in dividends from BUD per year. According to Altria’s most recent 10-K filing, its tax rate is around 26%, thus the after-tax profit from the BUD investment is around $120 million. There is the chance for share price gains for the BUD shares, but there is also a risk for share price declines. Over the last five years, BUD shares have declined by around 30%, thus there was no positive impact from share price appreciation. Whether BUD will see share price appreciation in the future is unknown for now.

Altria is forecasted to earn $9.0 billion this year, or $5.06 based on a share count of 1.78 billion. If Altria were to sell its entire BUD stake at the current price of $60 per share, then it would earn $8.88 billion per year going forward (without any underlying growth), as the after-tax dividend proceeds from BUD of $120 million per year would no longer flow towards Altria. This would make for a 1.3% reduction in Altria’s profits.

If Altria uses the (theoretical) proceeds of $11.8 billion (197 million shares at $60 per share) to buy back its own shares at a price of $44 per share, then Altria could reduce its share count by 268 million, to around 1.512 billion shares. Despite the fact that Altria’s net earnings would decline slightly due to the BUD sale, its earnings per share would rise substantially, from $5.06 to $5.87.

We see that freeing up money by selling a low-yielding investment in order to buy a much higher-yielding investment at a way higher earnings yield (Altria’s own shares) would be very accretive.

For now, Altria has only announced a partial sale of its BUD stake, thus the impact will be less pronounced. But the above example shows that it would be very highly accretive to sell as many shares of BUD as possible (at least if the MO can get anything close to $60 per share) and use the proceeds for buybacks.

Allocating capital in this way would not only boost Altria’s earnings per share by around 16%, all else equal, but it would also make Altria’s shares more valuable — earnings per share are a key factor for determining a stock’s fair value price, after all. Even better, allocating capital in this manner would also make the dividend a lot safer, as the payout ratio would decline and since Altria’s dividend would become significantly less costly overall: The share count reduction by 268 million shares from the above example would reduce the total annual dividend payment by just above $900 million. By foregoing $120 million in annual after-tax dividends from BUD, Altria could reduce its own dividend payments by almost $1 billion, even while keeping the dividend per share unchanged. Alternatively, Altria could decide to keep the total annual dividend unchanged, which would result in a major increase in per-share dividends. No matter what, Altria shareholders would benefit quite a lot from this, I believe. It thus is very positive news that Altria has decided to monetize the first tranche of its BUD investment while using the proceeds for buybacks, but ideally, Altria will continue to sell down its BUD stake in the future to buy back even more of its shares. The current $2.4 billion accelerated buyback program will reduce the share count by a nice ~3% already, but way more could be coming in the future — and I hope that is exactly what Altria plans to do.

Takeaway

Altria is not a very fast grower, but it delivers very reliable growth through price increases and margin initiatives. Add a dividend yield of almost 9%, and the total return outlook is quite nice, especially since Altria is very cheap, at just below 9x forward earnings.

The recent news about the BUD stake sale and increased buybacks is great, and I hope Altria remains on that track until all of BUD has been monetized, as this is a great way for Altria to generate shareholder value without any significant M&A or execution risks (think JUUL…).

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!