Summary:

- My previous bullish thesis about Altria aged well as the stock substantially outperformed the broader market over the last several months.

- I think that the major strength of this stock is its 7.92% forward dividend yield, which I consider very safe based on the company’s robust financial performance.

- The company is likely to sustain its strong financial performance for longer, despite the secular decline in traditional cigarettes, due to its rapid expansion into new, thriving niches.

krblokhin

Investment thesis

My previous bullish thesis about Altria (NYSE:MO) aged extremely well as the stock delivered a total 16% return since May, compared to +2% demonstrated by the S&P 500 (SPX). Today I want to refresh my thesis as lots of development occurred, and I must share my insights about them. The company’s performance is moving in line with the management’s strategic initiatives, and the valuation is still very attractive. All in all, I reiterate my “Strong Buy” rating for MO.

Recent developments

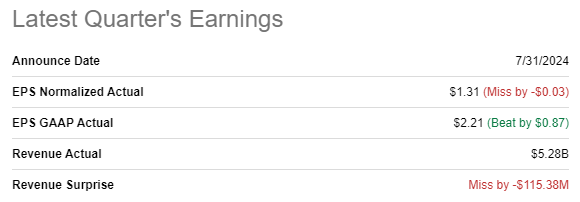

The latest quarterly earnings were released on July 31, when there were slight misses both in revenue and in terms of the EPS. Revenue decreased by 3% YoY, but the adjusted EPS stayed flat at $1.31.

Seeking Alpha

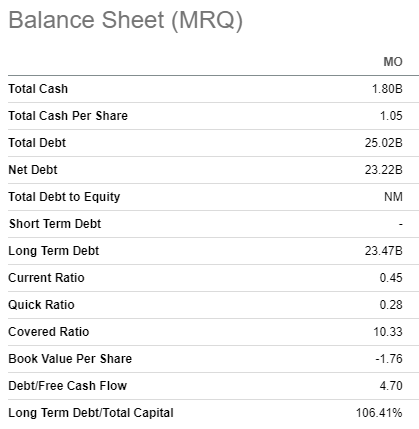

Altria’s net debt position increased by around $1.9 billion in Q2 compared to Q1. Nevertheless, Altria’s balance sheet is still robust, and the total debt is still quite low compared to the company’s $84 billion market cap. Altria’s healthy balance sheet is a vital bullish indicator for MO because its stellar forward 7.92% dividend yield is the stock’s major competitive advantage. Therefore, I think that the stock’s dividend is safe and Altria is poised to maintain its exceptional dividend consistency.

Seeking Alpha

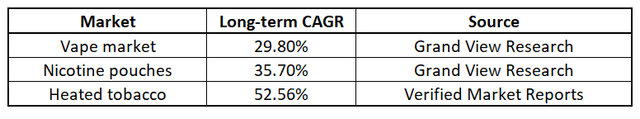

Altria’s diversification away from traditional smokeable products is crucial in the company’s long-term success because traditional tobacco consumption is declining, which is a secular trend. The company bets big on following emerging industries: e-vapors [vapes], nicotine pouches, and heated tobacco. All these industries are growing and below I have summarized the expected growth rates for these industries.

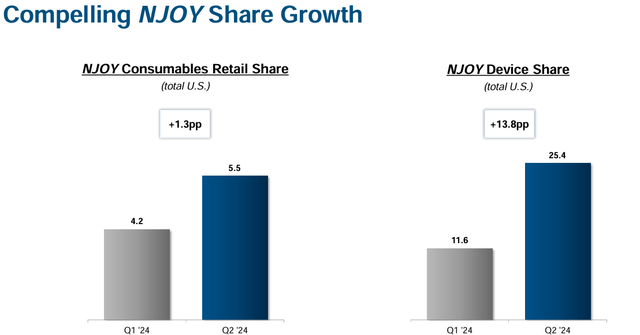

As we see above, all three industries are experiencing robust momentum, which is a big advantage for Altria as the company aggressively expands into these new markets. For example, the footprint of Altria’s e-vapor product, NJOY, is expanding rapidly as it has notably gained market share in Q2 both in consumables and device segments of the market. It is also vital to mention that NJOY ACE currently remains the only pod-based e-vapor product with marketing authorization from the FDA.

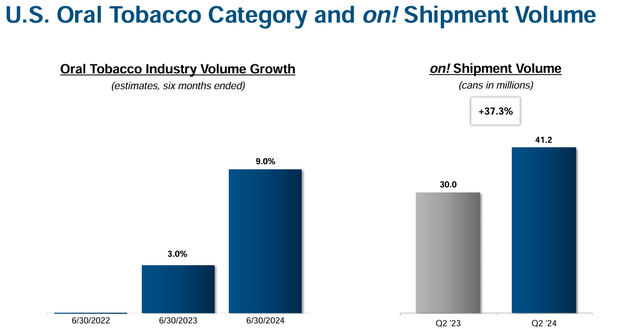

Altria’s latest earnings presentation

Altria’s oral tobacco [nicotine pouches] flagman, “on!” brand also demonstrates strong growth momentum. The product’s shipment volume skyrocketed in Q2 with a 37% YoY increase to more than 41 million cans shipped. It is also crucial to highlight that sequential growth is also robust since the company shipped 33 million cans in Q1 2024. This growth is notably beyond the market’s growth in recent quarters, meaning that on! is conquering market share at a rapid pace. According to the source, on! is the second-largest nicotine pouches brand by sales volume, which is a strong position. Altria’s vast experience and strong distribution network give me optimism that the company’s nicotine pouches business will be able to grow at least in line with the overall oral tobacco market, which is projected to compound with a 35.7% CAGR by 2030.

Altria’s latest earnings presentation

In another promising niche of heated tobacco, Altria is also making sound strategic steps. The company has a “Horizon” Joint Venture with Japan Tobacco International (OTCPK:JAPAY), which will be responsible for the U.S. marketing and commercialization of heated tobacco stick products owned by either party. Since it is a relatively new venture, there is still substantial uncertainty about its future prospects. However, Barclays forecasts U.S. cigarette and heated tobacco annual sales at around 122.79 billion sticks in 2030. Therefore, the heated tobacco market is likely to become comparable to the traditional cigarettes market. Since both Altria and JAPAY have vibrant histories and traditions of building successful distribution networks, I have a high conviction that their JV will be able to absorb positive industry trends in heated tobacco.

To conclude, I think that Altria boasts a robust fundamental mix of vast experience and brand power blended with rapidly expanding footprint across niches which are expected to thrive. That said, I believe that Altria’s stellar 7.92% forward dividend yield is safe.

Valuation update

The share price appreciated by around 13% over the last 12 months, slightly lagging behind the broader U.S. market. On the other hand, 2024 has been robust so far with a 24% YTD rally. MO has the highest “A+” valuation grade from Seeking Alpha Quant, which means that the stock is very attractively valued from the ratios perspective. Indeed, most of the valuation ratios look very attractive compared to the sector median and MO’s historical averages.

Since MO is a dividend aristocrat, I am confident that the dividend discount model [DDM] approach is the most suitable to continue with. I calculate the cost of equity using CAPM. The current 10-year Treasuries yield is 3.97%, which is the risk-free rate. According to Seeking Alpha, MO’s 24-months beta is 0.33. I use 2023’s U.S. equity risk premium, which was at 5.7%.

Author’s calculations

As we see above, MO’s cost of equity is 5.85%. This level will be used as a required rate of return for my DDM valuation. I take a 2% expected long-term dividend growth rate to be in line with historical inflation levels. Since I am calculating target price for the next 12 months, I am using FY 2025 consensus dividend estimate, which is $4.16.

Author’s calculations

According to my DDM simulation, MO’s fair share price is $108. This indicates that there is a 1166% upside potential from the stock’s last close. That said, the valuation is very attractive.

Risks update

The target price, which I have calculated based solely on quantitative factors, disregards qualitative considerations. The discount is also influenced by the industry in which MO operates. As there is a secular trend of reduced consumption of traditional cigarettes compared to previous decades, the company’s traditional tobacco business is expected to decline over time. Consequently, the assumption that the company’s legacy business will gradually lose its scale will continue to exert downward pressure on the stock price. While recent developments demonstrate the company’s success in aligning with changing customer preferences by expanding the footprint of new products, these ventures are relatively new, leading to significant uncertainty. Therefore, it might take several quarters of robust growth in new products before the stock starts moving closer to its fair value.

Investors should also be aware about certain details related to the U.S. e-vapor market. It is still young and there are loads of illegal products. Therefore, Altria’s success in this domain will significantly depend on legal actions from the U.S. authorities to ban illegal competitors from the U.S. market. Since there are thousands of illegal vapes flooding the market there is a substantial risk that some of them might stay in the market for longer and put pressure on Altria’s market share.

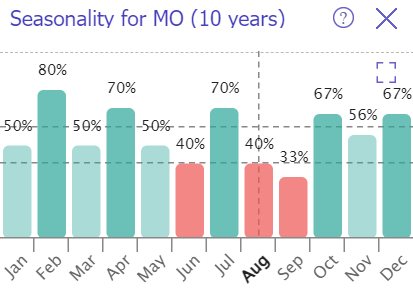

TrendSpider

The stock’s historical seasonality trends suggest that August and September are the weakest months for this stock. Therefore, there might be a pullback in the next few weeks before the stock returns to its growth trajectory.

Bottom line

To conclude, I like the trends MO demonstrates in its transition from legacy tobacco business to new ventures like e-vapors, heated tobacco and nicotine pouches. Altria’s profitability is still stellar and cash flow is stable. The stock is certainly attractively valued, and a 7.92% forward dividend yield looks like a gift for dividend investors. I think that MO deserves to remain a “Strong Buy”.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.