Summary:

- Altria’s 8% forward dividend yield is rock-solid, supported by a strong financial position and impressive profitability, making it a top dividend play.

- The company is successfully transforming with innovative smoke-free products like on! nicotine pouches and NJOY e-vapors, capturing market share and driving growth.

- Altria’s valuation is attractive, with a fair share price indicating significant upside potential even with conservative discount rate assumptions.

- Despite potential long-term health-conscious trends, Altria’s strong brand-building expertise and financial resources ensure continued success in evolving market niches.

krblokhin

Introduction

I had a ‘Strong buy’ recommendation for Altria (NYSE:MO) published in April. This one aged well as the stock returned 22% to investors over the last six months compared to +10% from the S&P 500.

Altria’s forward dividend yield is still massive at 8%, and my fundamental analysis update reveals that the dividend is rock-solid. The business successfully transforms in line with the evolving environment where people smoke less traditional tobacco products. Financial performance is impressive, and Altria’s prospects look bright. The stock is still very attractively valued, and I am inclined to reiterate a ‘Strong buy’ recommendation.

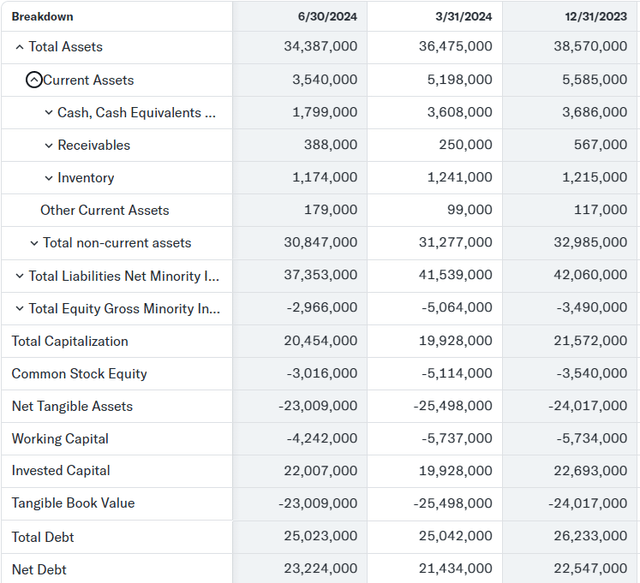

Fundamental analysis

I praise Altria’s stock as one of the top dividend plays. Therefore, let me first focus on sharing my insights about the dividend safety. Altria finished Q2 with $1.8 billion in cash and total debt that was $1.2 billion lower compared to the beginning of 2024. A $25 billion total debt is several times lower than the company’s $87 billion market cap. Therefore, the dividend looks safe from the perspective of Altria’s financial position.

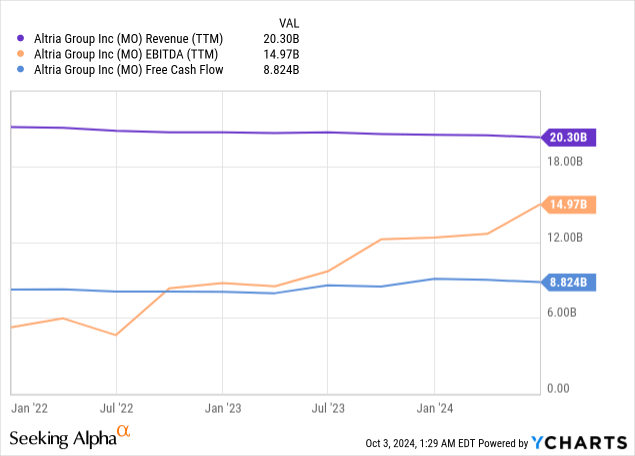

On the other hand, QoQ changes in outstanding cash and debt balances significantly depend on a company’s financial performance. Despite revenue stagnation due to unfavorable secular trends for traditional cigarettes, Altria’s profitability is improving. The EBITDA consistently demonstrates strong growth, which also helps to drive the free cash flow growth. With that being said, Altria’s financial performance is poised to continue cementing the company’s financial position.

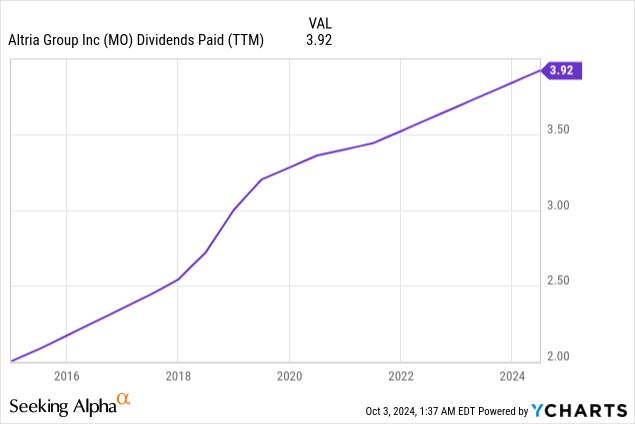

Therefore, the current 8% forward dividend yield looks rock-solid. Moreover, the company raised dividend by solid 4.1% in late August. This indicates that the management is confident in the company’s future prospects. Altria’s unparalleled payouts consistency and robust dividend growth over the last decade is another vital factor supporting my confidence in dividend safety.

Recent developments suggest that there are various reasons to be confident in Altria’s ability to maintain its solid financial performance. As I mentioned earlier, the tobacco industry is being disrupted by an unfavorable trend of less people smoking traditional cigarettes. Thanks to its commitment to innovate and deliver returns to shareholders, Altria is shaping the future with smoke-free products.

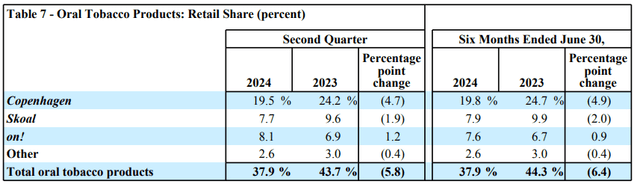

Altria’s on! nicotine pouches are gaining traction. The U.S. nicotine pouch category has expanded to 41.6% of the total oral tobacco market, with on! capturing a larger market share in 2024 so far compared to the same period in 2023. The below table suggests that on! gained its market share at the expense of competitors, which is a strong indication of the product’s high appeal. This is a crucial bullish sign because nicotine pouches industry is thriving and is expected to observe a 31.7% CAGR by 2034. Altria is seeking opportunities to improve its product and submitted an application to get an FDA approval for its ‘on! PLUS’ nicotine pouches.

Altria’s Q2 earnings press-release

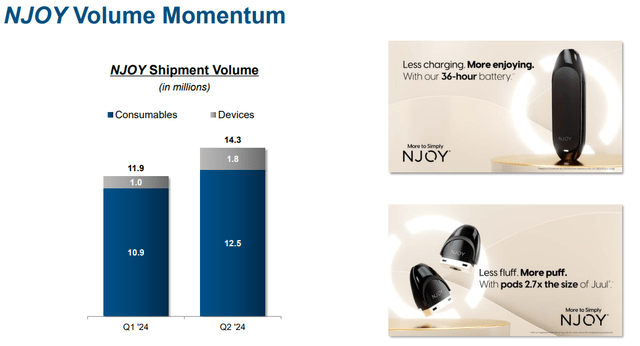

A thriving nicotine pouches niche is not the only potential long-term growth driver for Altria. For example, the U.S. e-cigarette and vape market is expected to compound with almost a 30% CAGR by 2030. In this niche Altria has a flagship NJOY product, which is also gaining traction. According to the latest earnings presentation, NJOY’s shipment volumes of both consumables and devices demonstrated strong momentum in Q2.

Altria’s Q2 earnings presentation

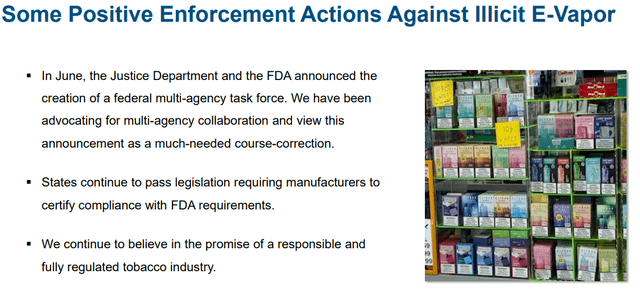

The company also works on improving its NJOY offerings by adding new flavors and improving technical characteristics of the device with more durable charging. Since NJOY is an FDA-approved product, its sales suffer from cheaper illicit products. However, I have to highlight that there are some positive enforcement actions against illicit e-vapors.

Altria’s Q2 earnings presentation

While momentum for these potential growth superstars is building up, Altria’s legacy smokable products ensure that the company generates superior profitability. Altria has strong experience in building brands. Its ‘Marlboro’ brand is worth $32.6 billion, retaining its position as the world’s most valuable tobacco brand for the tenth consecutive year. With vast financial resources and strong experience in building iconic brands, I have a high conviction that Altria’s management will be able to make NJOY and on! one of the most valuable brands in the industry over the long term.

Valuation analysis

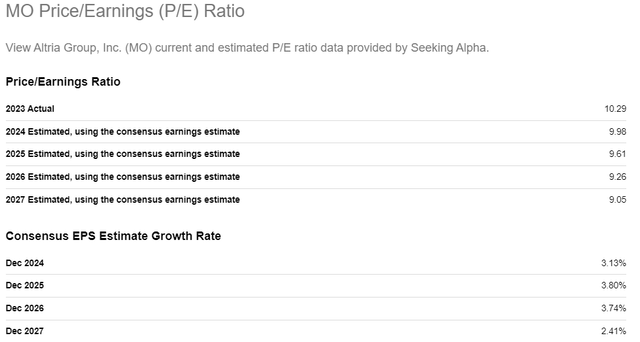

Altria’s valuation ratios are in line with historical averages, which means that the valuation is sound. The current non-GAAP forward P/E ratio is around 10, approximately in line with historical averages. If I take a 10 forward non-GAAP P/E and multiply it by the projected by consensus FY 2025 EPS of $5.30, I get fair share price of around $53. This is 5% higher than the current share price, meaning that Altria is undervalued from the P/E ratio’s perspective.

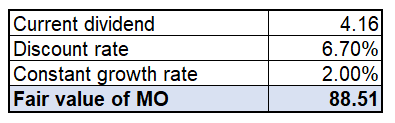

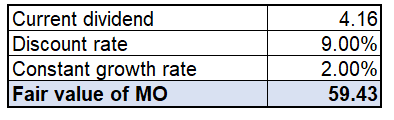

A dividend discount model should be simulated to figure out MO’s fair share price. Cost of equity is a discount rate, which is 6.7%. The FY2025 dividend estimate from consensus is $4.16. The constant growth rate is 2%, in line with long-term inflation averages.

Calculated by the author

With the above-mentioned assumptions, the fair share price is close to $89. This indicates a 75% upside potential, and this might be too good to be true. The above DDM might be underestimating the discount rate, especially considering Altria’s sky-high dividend yield of around 8%. The second DDM scenario that I simulated below assumes a 9% discount rate.

Calculated by the author

Even with an aggressive 9% discount rate, the stock is still very attractively valued. The second scenario suggests that Altria’s fair share price is almost $60, meaning there is a 17% upside potential.

Mitigating factors

Readers should be aware that MO is recommended as a dividend stock. This is a high-quality high-yield name, but do not expect massive capital gains from the stock. The below chart suggests that MO’s performance over the last decade has been nowhere near the broader market. Therefore, please plan weight of the stock among your holdings accordingly.

It is highly likely that e-cigarettes/vapes and nicotine pouches are much healthier than smoke products like traditional cigarettes or cigars. However, these products still do not benefit people’s health and are not completely harmless, in my opinion. According to McKinsey, the U.S. wellness market is booming. Such a trend indicates that Americans are likely becoming more health conscious, which might pose a significant long-term challenge if the critical mass of health-conscious people prevails.

Conclusion

Altria’s 8% forward dividend yield looks solid, backed by a fortress financial position and unmatched profitability. The company continues adapting to the changing environment and is building new promising brands in thriving niches. Moreover, the valuation is still very attractive.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.