Summary:

- Altria Group currently has a dividend yield of 9.55%, which is above its historical average and among the highest levels in a decade.

- Its valuation ratios (e.g., P/E and P/cash) also indicate extraordinary discounts.

- Usually, these signs point to unsustainable dividends and/or terminally ill business fundamentally.

- But our conclusion is that neither scenario is likely and thus consider the stock a good contrarian investment opportunity.

JamesBrey

MO is yielding 9.55% now

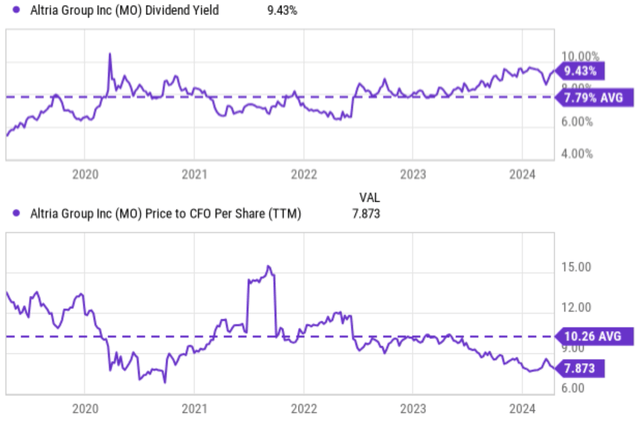

Altria Group (NYSE:MO) is currently undervalued by a large margin, as you can tell from the charts below. The chart shows its dividend yield compared to its historical average and its price-to-operation cash flow (“CFO”) ratio compared to its historical average. In terms of dividend yield. Its current yield, as shown in the top panel of the chart, is about 9.43% and 9.55% on an FWD basis as of this writing (BTW, it is a dividend champion). It is not only far above the historical mean (7.79%) but also among the highest levels in a decade. In terms of P/CFO, it is trading at 7.9x only, compared to its past 10-year average of 10.2x and also among the lowest level in 10 years.

When the yield and valuation are so out of whack, our experience has taught us to check if one of the following two scenarios is likely:

- The dividend payouts are unsafe, and a cut is imminent.

- The underlying business is chronically unprofitable and likely to stagnate permanently.

After digging into these issues, we conclude that neither scenario is likely, as detailed next.

Dividend safety

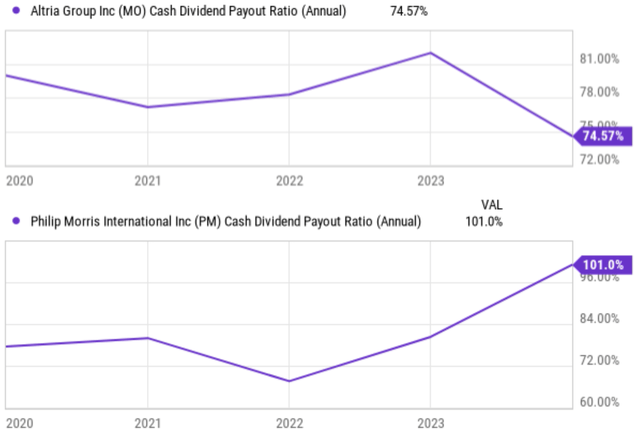

My projection for its cash payout ratio is about 75% for FY 2024 and 2025, among the lowest level in its historical range, as you can see from the chart below. Tobacco stocks can maintain a much higher payout ratio thanks to their excellent profitability (more on this later) and high cash-earning conversion ratio. To better contextualize things, an example of Philip Morris’ (PM) payout ratio is shown in the bottom panel.

Another key factor that can impact dividend safety is the company’s financial strength. Payout ratios do not include this angle. Thus, we always urge dividend investors to look beyond the simple payout ratios and examine the balance sheet carefully, too.

For MO, the news is all good the way I see it. Its credit ratings are in the upper medium end of the investment grade range, with either a stable or positive outlook. For example, Fitch Ratings has assigned Altria’s senior unsecured notes a “BBB” rating with a stable outlook, and you can read the full details following this report.

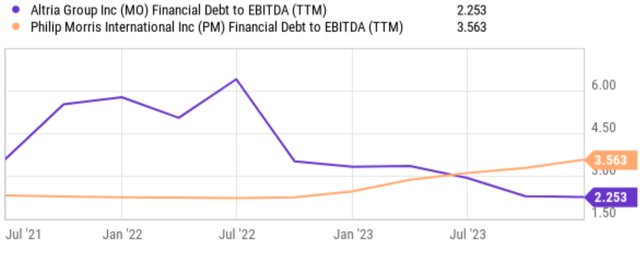

To have a more concrete view of its financial strength, the chart below shows MO’s debt-to-EBITDA ratio in comparison to that of PM. As seen, MO’s debt-to-EBITDA ratio has steadily decreased from approximately 6x in July 2021 to around only 2.2x currently. A lower debt-to-EBITDA ratio suggests that a company is less leveraged, has a greater ability to service its debt obligations, and also more capital allocation flexibility, e.g., towards dividends and share repurchases – a topic I will revisit later. The contrast against PM better highlights MO’s financial position. The orange line shows that PM’s debt-to-EBITDA ratio has been increasing over the same period. Currently, PM’s debt-to-EBITDA ratio is approximately 3.56x, almost 60% higher than MO’s ratio.

Growth outlook

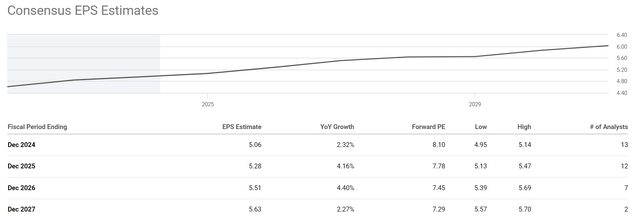

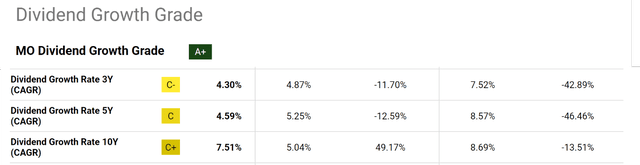

Now let me address the growth issue. At its current FWD P/E of 8.1x, my interpretation is that the market expects the stock to be terminally stagnant. As seen, consensus projects an average of ~3% annual growth rate in the next few years, largely sufficient to just keep up with inflation. Such a projection is too conservative, both compared to its historical track record and also compared to my own estimates. As a dividend champion, its dividend payouts provide a reliable indicator of its true economic earnings, in my view and such earnings. As seen in the second chart below, it has maintained an average dividend growth rate of more than 7.5% in the past 10 years and about 4.6% in the past 5 years.

My approach for estimating its long-term growth rate is detailed in our blog article. Here, I will directly quote the end result:

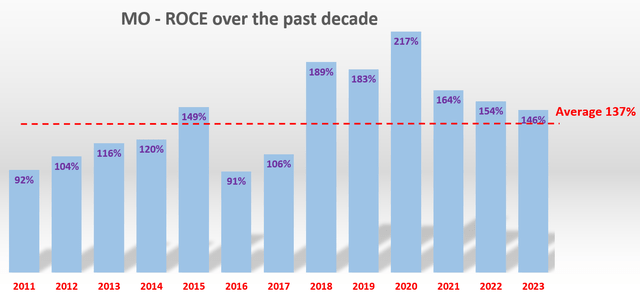

The long-term EPS growth rate of a business is governed by the product of its ROCE (return on capital employed) and its reinvestment rate (“RR”). For MO, its RR is 4% based on my analysis. With its average ROCE of 137% in recent years (see the next chart below), the long-term EPS growth rate would be about 5.5% (4% RR x 137% ROCE ~ 5.48% growth).

If you are used to growth stocks, a 5.5% annual growth rate is certainly nothing exciting. But with a single-digit P/E, a 5.5% annual growth rate could deliver terrific returns in the long run.

And there are indeed a few important growth areas for MO to invest in. The top catalysts are its oral tobacco and other new products. The Oral Tobacco division posted solid showings in recent quarters, with sales up 7% in the December 2023 quarter. To make the news even better, the segment has also demonstrated pricing power and lower promotional investments in recent quarters. Looking ahead, I expect the momentum at the Oral Tobacco Products division to continue. I also think the company’s subsidiary, e-cigarette producer NJOY, has good potential to expand. Management recently strengthened NJOY’s global supply chain to provide support for the expected increase in volumes of these e-vapor products – a timely investment in my view that will pay dividends for years to come (both figuratively and literally).

Other risks and final thoughts

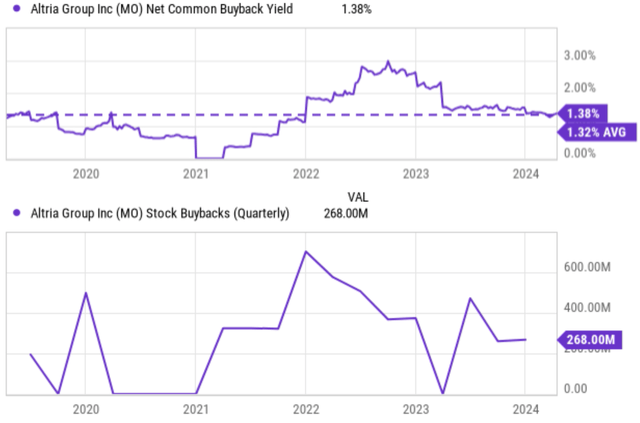

One last upside risk involves share repurchases. The company has been a consistent buyer of its own shares (see the next chart below). Recently, the board of directors entered into an accelerated $2.4 billion stock-buyback program. At the same time, the board also announced its intent to sell a portion of its investment in Anheuser-Busch InBev. I expect Altria plans to use the proceeds for additional share repurchases too. I view such an accelerated program as a very effective use of its capital given the favorable valuation ratios. Such buybacks would further increase the EPS growth rates and be highly accretive to total shareholder returns.

In terms of downside risks, MO faces largely the same risks generic to the tobacco sector, such as regulation risks, the decline of smoking products, litigation risks, etc. However, due to its product concentration, MO is more reliant on traditional cigarette sales compared to some peers who are diversifying into alternative nicotine products. Its Smokeable Products segment remains the largest source of sales by far and contributed about 89% of its 2023 sales. This makes MO more vulnerable to a decline in cigarette smoking rates.

All told, MO’s current yield and valuation ratios are among the most attractive levels in a decade. Such extraordinary levels suggest that the dividend payouts are unsustainable and/or the underlying business is likely to stagnate terminally. With the analyses above, we conclude that neither scenario is likely, and thus consider the stock a good investment opportunity under current conditions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Envision Early Retirement to navigate such a turbulent market.

- Receive our best ideas, actionable and unambiguous, across multiple assets.

- Access our real-money portfolios, trade alerts, and transparent performance reporting.

- Use our proprietary allocation strategies to isolate and control risks.

We have helped our members beat S&P 500 with LOWER drawdowns despite the extreme volatilities in both the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too. You do not need to pay for the costly lessons from the market itself.