Summary:

- Altria stock surged 7.83% after beating Q3 earnings expectations, with 1.3% net revenue growth and 7.8% adjusted EPS growth.

- The company has long-term growth potential through smoke-free products like NJOY and rewards shareholder via dividends and buybacks in the meantime.

- Altria announced a cost-saving initiative called “Optimize & Accelerate,” which is expected to save the company at least $600 million over the next five years.

- Legal disputes involving Juul and NJOY present a risk for Altria.

- Despite the risks, the stock is priced as if its free cash flow per share will fall over the next 10 years and never grow after that, which seems unlikely to me. Thus, I believe it’s undervalued.

krblokhin

I recently wrote an Altria (NYSE:MO) article titled “Altria Stock: Still Smoking Hot Despite Declining Sales.” I still think this is true, and the stock was hot today. MO finished 7.83% higher today after beating Q3 earnings expectations, and the company actually saw a slight increase in sales.

In the previous article, I also mentioned how it would be prudent to wait for a dip too before buying a large position, and the dip happened. Now, I feel the same. I think Altria stock is a good Buy for the long term due to improving per-share figures, its low valuation, and its growth potential from smoke-free products, so that’s what I’m rating it as. Still, it would likely be prudent to wait for a dip again before buying in bulk. That’s just my opinion.

Nonetheless, the stock remains undervalued, with negative FCF/share growth being priced in, and this time, I’ll use reverse discounted cash flow analysis to prove it. There are also legal risks to consider, but I think the low valuation somewhat offsets these risks. Now, let’s start off by going over its Q3 results.

A Quick Overview Of Altria’s Q3 Results

In Q3, Altria reported revenue net of excise taxes of $5.34 billion, up 1.3% year-over-year, beating estimates by $10 million. Meanwhile, adjusted diluted EPS hit $1.38, up 7.8% year-over-year, beating the $1.35 estimate.

Shipment volume for NJOY (Altria’s e-cigarette brand) consumables grew by 15.6% year-over-year to 10.4 million units. As a result, NJOY consumables retail market share in the U.S. multi-outlet and convenience channel increased from 3.4% to 6.2%. Further, NJOY devices shipment volume grew from 0.4 million to 1.1 million, nearly a 3x increase.

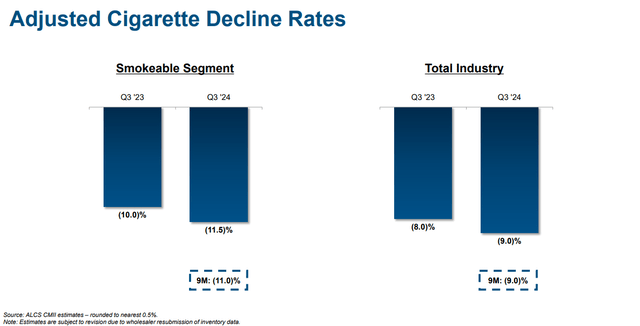

At the same time, its Smokeable Products division remained resilient, posting 1.2% revenue growth net of excise taxes. This is despite an adjusted cigarette decline rate of 11.5% in the Smokeables segment. Higher margins (adjusted OCI margins increased from 59.6% to 63.1% in the segment) and prices really do help offset volume declines.

Altria’s Q3-2024 Investor Presentation

Moving on, the Oral Tobacco Products segment grew its net revenues by 5.8% year-over-year to $695 million, although its adjusted OCI only grew 2% as its adjusted OCI margin dropped by 2.5 percentage points to 66.8%. The drop was due to “higher SG&A costs, higher promotional investments and mix change.” In this segment, its total retail market share fell from 41.8% to 37.6%, although it’s on, product continues to perform well, growing its market share from 6.9% to 8.9%.

Looking at the results as a whole, there are some strong points (NJOY growth, Smokeables revenue growth, EPS growth) and weak points (falling market share and margins in Oral Tobacco, cigarette volume decline greater than the total industry decline). But I’d still say the results were decent overall, as Altria managed to grow its net revenues and adjusted EPS while slowly diversifying out of Smokeables.

Outlook Reaffirmed

Altria reaffirmed its full-year guidance. It expects adjusted diluted EPS of $5.07-5.15, which suggests a growth rate of 2.5-4% compared to $4.95 last year. Although the growth rate is low, it’s a good growth rate relative to the valuation, which I’ll get to later.

Altria Continues To Reward Shareholders With Dividends And Buybacks

In the quarter, Altria bought back 13.5 million shares at an average price of $50.37. The total cost of doing this was $680 million. Its share count as of October 22 has come down to 1,694,812,982 compared to 1,706,224,328 shares outstanding in Q2 — or a 0.67% decrease.

Buybacks were a bit more aggressive on a year-to-date basis, as the company “repurchased 67.6 million shares at an average price of $45.68, for a total cost of $3.1 billion” in the trailing nine months. The share count was 1,763,461,775 at the end of last year, meaning that it has been reduced by 3.89% year-to-date.

$310 million was left in the repurchase authorization as of the end of September, and the company expects to complete the program by the end of the year. I assume that Altria will start a new buyback program after that.

Regarding dividends, they remain at $1.02/share per quarter (the dividend was raised by 4.1% in August), and the company is targeting mid-single-digit annual dividend growth through 2028. This is pretty good when you consider that the dividend yield is 7.49% after the recent gains. If the dividend grows by 5% for the next four years and the share price remains the same, the yield will increase to ~9.1%.

Cost Savings Are On The Way

Altria plans to launch a multi-phase “Optimize & Accelerate” initiative. The goal here is to speed up and improve efficiency across the organization. This plan involves “centralizing work, streamlining and standardizing processes, further using generative artificial intelligence and automation, and outsourcing certain transactional tasks,” according to the company.

The company anticipates that the plan will help them save at least $600 million over the next five years. However, these cost savings exclude the “estimated total pre-tax charges for these initial phases of approximately $100 million to $125 million.” Those charges will be treated as special charges and not included in adjusted EPS.

But they are real expenses, so in reality, Altria should save closer to $500 million in the next five years. This is still good, although it’s worth noting that the cost savings won’t be a huge needle mover when considering its net income of over $10 billion.

The Current Valuation Prices In Per-Share Declines

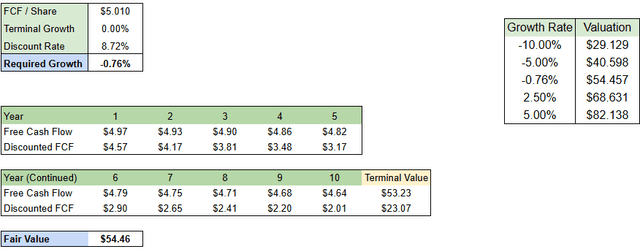

When calculating Altria’s trailing-12-months’ free cash flow, I got to a figure of $8.492 billion. Using the most recent share count of 1,694,812,982, that equates to FCF per share of approximately $5.01, and that’s what I used for the reverse DCF valuation below. The valuation shows how much growth is required in FCF per share to justify Altria’s current price.

Essentially, FCF per share would need to grow by negative 0.76% annually over the next 10 years and then grow at 0% in perpetuity. That gives you a fair value of $54.46. The table on the right hand size of the screenshot shows the different fair value calculations based on different 10-year FCF per share CAGRs.

Altria Stock Reverse DCF Valuation (Author)

For context, I calculated the discount rate of 8.72% using the CAPM formula and used a levered beta of 0.889, which I got from simplywall.st, in order to be consistent with my last article regarding the discount rate. And I don’t actually believe Altria will see 0% FCF per share growth in perpetuity, but I put it there to show how conservative the market is valuing the stock right now.

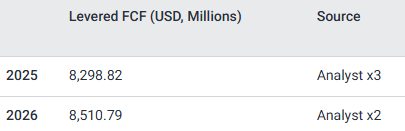

Analysts expect about $8.3 billion in FCF next year and $8.51 billion in 2026, which doesn’t quite match the consistent decline shown in the reverse DCF above. Additionally, you need to consider that per-share results will be better than nominal results due to buybacks.

Altria Stock FCF Estimates (simplywall.st)

All Altria needs to do is grow its FCF per share by 2.5% annually for the next 10 years, with no growth ever after that, and the fair value will jump to $68.63 (26% upside potential).

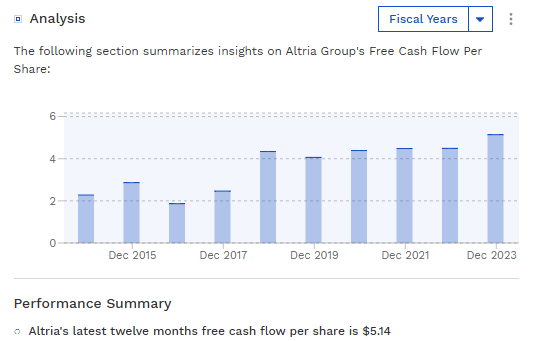

Based on its track record, along with buybacks and its growth potential outside of the Smokeables division, I think that growth rate is achievable, making the stock undervalued. You may have more confidence when looking at a chart of its FCF per share over the years, which has grown nicely.

Altria’s FCF Per Share (Finbox)

Legal Battles: A Risk To Watch

Currently, Altria is dealing with legal battles regarding NJOY’s patents, particularly with Juul. This could result in import bans or expensive litigation outcomes.

Here’s a quote from Altria’s CEO from the Q3 earnings call:

Before moving on, I want to mention our ongoing litigation before the U.S. International Trade Commission. As you know, Juul has asserted patent infringement claims against NJOY, and NJOY has done the same against Juul, with both parties seeking import bans. In August, the administrative law judge in Juul’s case against NJOY issued an initial determination supporting Juul’s allegations and recommending an exclusion order.

He also said:

We did file PMP exemptions for three out of the four patents and they were really for simple changes to the exterior of our NJOY product that we believe avoid those patents. And so we filed those.

Basically, NJOY has made simple design changes that will help them navigate three out of the four patent claims. The company is also working on finding a way to avoid the fourth patent.

However, the risk is that, as the CEO put it, “you never know how litigation would turn out.” The judge extended the deadline for the initial determination in the case to December 6, and the final determination will be in late December. Given that NJOY is a higher-growth area for the company, a legal battle that leads to import bans will undoubtedly hurt the company. Therefore, this is a risk worth considering before buying the stock.

The Bottom Line On MO Stock

As I said in my last article, Altria stock is attractive for the long term. It’s a company that generates lots of free cash flow, pays a growing and juicy dividend, and also buys back shares, enhancing per-share results even as revenue growth is challenged.

The company can offset its decline in Smokeables volumes through NJOY and its Oral Tobacco segment, providing long-term stability. Additionally, the “Optimize & Accelerate” plan can help improve the financials that much more, albeit by a small amount.

However, it’s important to monitor the legal disputes with Juul over NJOY’s patents, which can negatively impact NJOY’s growth depending on the outcome.

Despite these risks, the stock’s valuation implies negative free cash flow per share growth, which, I think, is too pessimistic, making the stock undervalued. Waiting for a dip before taking a larger position might still be a good approach, but the long-term investment case for Altria appears solid.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.