Summary:

- While Altria’s share price hasn’t particularly moved in recent months, there have been two crucial developments for it.

- One, the company’s dividend increase has raised the forward yield to 8.2%, which makes it second only to British American Tobacco among the big five tobacco stocks.

- Two, a patent infringement claim by JUUL against NJOY has gone in JUUL’s favor. While Altria continues to fight it out, there’s now a question mark on the brand’s future.

- All things considered, however, there’s still a Buy case for the stock for income investors with a medium-to-long-term investing horizon.

krblokhin

The price of tobacco giant Altria (NYSE:MO) hasn’t moved much since I last wrote about it in August. This is entirely in line with the expectation of a “short-term price correction” then (see chart below). But in no way does the limited price movement it implies that there haven’t been developments for the company in the past couple of months. It’s just that these developments have balanced each other out. Here’s how.

Price Chart (Source: Seeking Alpha)

Dividends increased

The big positive development for the stock is the increase in dividends announced in late August. When I last checked, its forward dividend yield at 7.6% was already attractive. With its quarterly payout increased to $1.02 from $0.98 earlier, the stock’s forward yield has risen by a whole 0.6 percentage points to 8.2%. This yield is only trivially helped by the recent price correction. Not only is this a lucrative yield in its own right, it stands out for three other reasons too:

- It’s now higher than the stock’s five-year average yield of 8.1%.

- It stands out even among the big five tobacco stocks by market capitalisation, as it’s second only to the 8.6% levels for British American Tobacco (BTI).

- The yield is also appreciably higher than the average yield of 6.5% for the same five stocks.

There doesn’t appear to be any risk to the dividends either. They are in line with both the company’s earlier dividend policy of a payout ratio of ~80% of the adjusted earnings per share [EPS] as well as the updated one which aims at a “mid-single digits dividend per share growth annually”.

For 2024, Altria expects the adjusted diluted earnings EPS to be in the range of $5.07-5.15. At the midpoint of the guidance, this brings the payout ratio to 79.8%. Also, the latest increase is of 4.1%, in line with the targeted growth.

Challenges for NJOY

However, there was little joy to be found for the stock price despite this development due to fresh challenges for its vaping brand NJOY. As a background, a big reason for the stock’s rise earlier in the year was the receipt of marketing authorisation for NJOY’s menthol products in the big US market. This, along with a similar authorization for some of British American Tobacco’s Vuse vape flavors, added to bullishness for the tobacco sector as such.

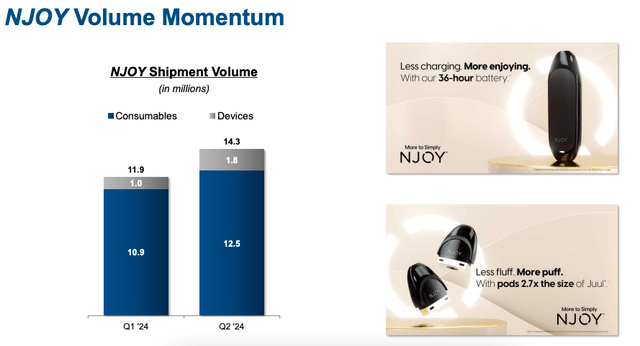

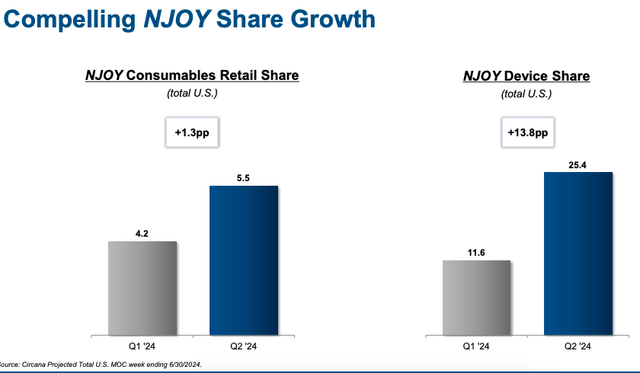

The approval was particularly important for Altria, which is falling behind in the transition to non-traditional nicotine products. Clubbed into the ‘All other’ revenues segment, it contributed to just 0.2% of the total revenues in the first half of 2024 (H1 2024). While robust growth was witnessed for NJOY during this time (see slides below), my estimates indicated that with the present rate of growth, non-traditional nicotine products would contribute 1% to revenues only by 2026.

This is a small share already in comparison with the likes of Philip Morris (PM) and British American Tobacco. But there’s now a question mark on whether it can even growth the small share, as NJOY remains locked in battle with JUUL Labs.

After NJOY alleged patent infringement against JUUL last year, JUUL returned the favor to NJOY. In August, a judge ruled in favour of JUUL, which could potentially ban Altria’s long-lasting NJOY ACE products from being imported to the US. Altria, of course, has moved against this, and will present its position, with the final decision expected by late December this year.

Even if the decision eventually goes in Altria’s favor, the fact is that it has already lost precious time in making a mark in next-generation nicotine products and could stand to lose more during the time the legal challenges continue.

Unconvincing market multiples

The stock’s market multiples don’t offer any support either. With the price correction in the past months, the stock’s forward non-GAAP price-to-earnings [P/E] has come off to 9.73x from the 10.1x level when I last checked, but it’s still a shade high. MO’s five-year average ratio is at 9.6x.

There’s some consolation here, though. The average forward P/E for the big five tobacco stocks is at 12.5x. Admittedly, this includes PM with a 20x ratio, which merits some premium due to its lead in non-smokeables. But even excluding it, the ratio is at 10.6x.

At the same time, it’s hard to miss that MO is still trading higher than BTI, which is at 7.5x, despite the fact that has a higher contribution from non-traditional nicotine products and also has a higher forward dividend yield. In other words, the case for MO based solely on market multiples remains unconvincing.

Earnings could provide some uptick

However, with the company’s upcoming earnings release for Q3 2024 on October 31, there could be some short-term uptick for the stock. Here’s why. If the adjusted diluted EPS for 2024 comes in at the midpoint of the guidance range, at $5.11, the figure for H2 2024 would be at $2.65 after the company clocked a figure of $2.46 in H1 2024.

Assuming that H2 2024 is equally divided across Q3 and Q4, the quarterly number comes at $1.33. This is a 3.5% year-on-year (YoY) increase, a marked improvement after a 1.6% YoY decline seen in H1 2024. Further, analysts’ estimates on Seeking Alpha also project ~1% YoY increase in revenue, which represents a turnaround after a contraction in H1 2024.

What next?

I wouldn’t hold my breath for a price rise on the day of the results, though. Not with the challenges underway for NJOY. Still, it would be worth looking out for the progress made in the past quarter for the brand. If there’s acceleration in its growth, there can be hope for a faster pivot for Altria away from smokeables, if its issues with JUUL get resolved in its favor.

In the meantime, the company’s dividend increase makes up for the limited support offered by its market multiples. In any case, the forward P/E for 2025 at 9.38x is already lower than the stock’s present five-year average. Further, with continued modest earnings growth expected over time, by 2028, the ratio drops to 8.56x. As a result, there’s still a case for medium-to-long-term income investors to buy MO, without fearing erosion of capital. I’m retaining a Buy rating on Altria.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—