Summary:

- Altria is a popular stock among dividend investors with over 50 years of dividend increases and a strong share price performance the past 3 months, up double-digits.

- The NJOY acquisition has shown promise, with significant growth in shipment volume and market share, offsetting the decline in smokeable products.

- Despite risks from smokeable products, I expect management to continue expanding NJOY and rewarding investors with dividend increases for the foreseeable future.

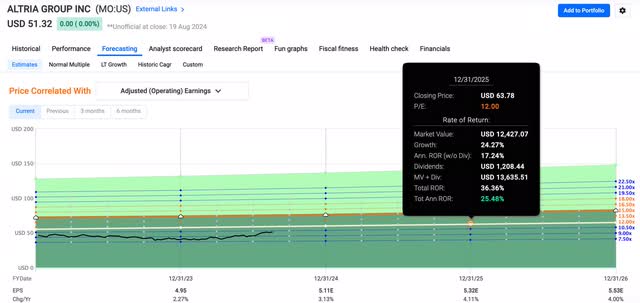

- If MO can continue executing successfully, I think it’s reasonable for the stock to trade at 12x earnings over the next year.

- This gives investors double-digit upside to their price target of roughly $64 a share.

Ivan Pantic/E+ via Getty Images

Introduction

Altria (NYSE:MO) is currently one of my largest portfolio holdings and a very popular stock amongst dividend investors. And for good reason. The stock has more than 50 years of dividend increases and looks to add to that record soon with another one.

The stock has performed well, thanks to growing market share and a seemingly successful venture into the e-vapor category. This is something I have been excited about since the announcement. In this article I discuss the company’s latest earnings, NJOY acquisition, and why I think the stock could see more upside over the long term.

Previous Thesis

I last covered Altria this past April in an article: Buybacks & Smokeless Products Will Continue To Be Growth Drivers. In the article, I touched on the company’s successful integration of NJOY that saw them gain market share and successfully distribute NJOY in 80,000 stores during the quarter.

On! also saw strong growth with nicotine pouches growing 13.8 share points at the time, a 40% increase. Because of this and other reasons I’ll touch on later during the article, MO’s share price has seen strong upside since then, up double-digits at 17.28% at the time of writing. This is almost double the S&P which is up a little over 9%. With this, Altria is roughly 11% away from my price target of $57 at the time.

NJOY Continues To Show Promise

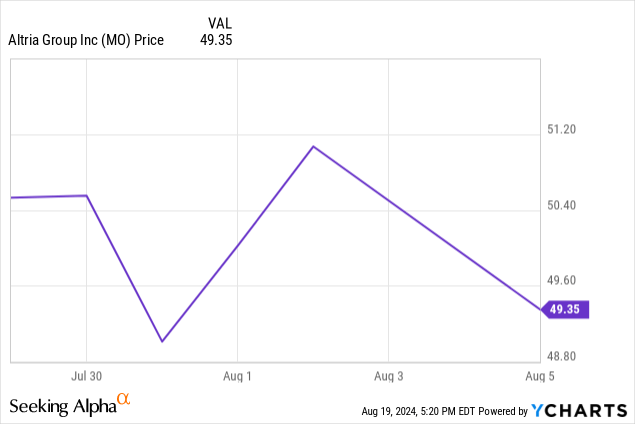

Altria announced their Q2 earnings at the end of July, with a miss on its top and bottom lines. EPS of $1.31 missed estimates by $0.03 while revenue missed by $110 million. When their earnings were announced, you can see the market didn’t react negatively to the miss. The share price actually went up before coming back down. But why?

Usually, if a company that has faced headwinds experiences a miss on both its top and bottom lines, the share price will see some downside. This is similar to Starbucks (SBUX) facing their fair share of headwinds with a horrible second quarter earnings report, missing earnings estimates by $0.12 and revenue by $600 million. The stock dropped to a new 52-week low shortly after.

But the reason the market didn’t react negatively to the miss is the company’s growth in NJOY. Finally! This is probably what the market was thinking after the tobacco giant’s unsuccessful venture into the e-vapor category with JUUL previously.

At quarter’s end, MO managed to triple NJOY’s footprint. Shipment volume was 12.5 million units and 23.4 million for the first 2 quarters combined. Device shipment volume was 1.8 million units for the quarter and 2.81 million for the first half.

This marked four full quarters of NJOY ownership in June and on an annualized basis, consumables and device shipment volume grew 14.7% and 80% sequentially. NJOY significantly increased its exposure in multi-channels and convenience stores to 25.4 share points.

When the company first announced the acquisition last year, I was optimistic, as they were focused on closing the distribution gaps. The product lacked visibility, with 95% of stores lacking complete inventory during the time. I touched on this in an article you can read here.

But now, the product is in more than 100,000 stores, so there will be more eyes on the prize (product). So, I can say I’m NJOY’ing the turnaround. And I can tell you firsthand the visibility the product now has. Because Altria is one of my largest holdings, I personally pay close attention whenever I’m in convenience stores.

On my recent road trip this past weekend, I was happy to see plenty of NJOY products behind the counter. On the way home, I saw NJOY again at a different convenience store, something I had never seen before.

I was so excited, I actually bought the vape for $4.99, not including the pods. I don’t smoke nor have I ever, but I wanted to buy one to give to my friend who is a vaper and an avid dipper to get his take on the product. He uses Philip Morris’ (PM) products, especially ZYN. Whenever I would ask any of my friends if they ever heard of NJOY they always said no.

But I expect this will change in the coming years due to the product’s continued expansion and growth. Additionally, MO received marketing granted orders for 4 menthol products from the FDA. This marks the first and only menthol e-vapor products from the FDA, according to MO’s management.

They also submitted a PMTA for the NJOY ACE 2.0 device to incorporate age restriction technology to prevent underage smokers from using the product. I mentioned this also during my article last year, and this is a huge step in the right direction that will likely result in continued growth in market share.

On! Growth

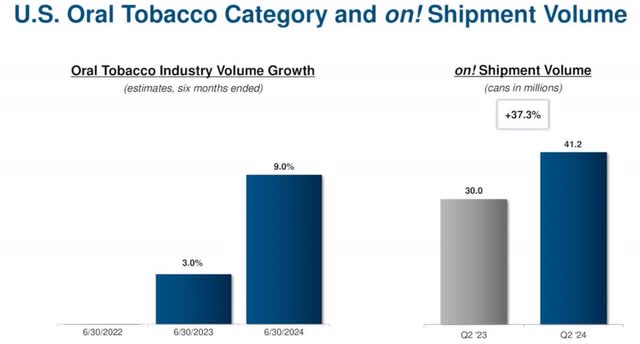

On! retail share grew in Q2 to 8.1% or 1.2 share points from 2023. On! plus also seems to be a hit internationally with growth in Sweden and the U.K. Management expanded distribution to 2,000 key retail accounts in both. Year-over-year, oral tobacco pouches grew 12.3 share points, now representing roughly 42% of the category.

Shipment volume growth was strong year-over-year, with 41.2 million cans shipped, up significantly from 30 million the year prior. For comparison purposes, Philip Morris’ ZYN pouch unit volumes were up 20% during their latest quarter. Shipment volumes grew 50% to 135.1 million cans. And PM is shooting for 560 to 580 million cans for 2024. So, MO’s on! clearly lags back their peers in terms of popularity and volume shipment and growth.

Risks From Smokeable Products

Although Altria seems to be making significant progress with NJOY and on!, their smokeable products continue to face headwinds due to the continued secular decline in their smokeable products segment and in the industry as a whole.

During the quarter, the smokeable segment declined double-digits by 10%. Adjusted operating companies’ income was down 2% to $2.827 billion. Marlboro’s retail share also declined slightly to 42%, down 0.1%. But their share of premium grew slightly from 58.7% to 59.4% on an annualized basis.

The total industry decline was down 2% to 9.5% year-over-year. And this is the biggest risk, investing in tobacco companies. Although e-vapor smokers are seeing growth, this may not be enough to offset the decline in traditional smoking. But with strong growth in NJOY likely to continue, I think the company’s dividend will likely remain secure.

Dividend & Valuation

If history repeats itself, then MO should be announcing a dividend increase in the near term soon. Last August, the tobacco giant announced a 4.3% increase to $0.98.

Over the past 5 years, Altria has conducted $0.04 increases. I say that to say if the company elects to do an increase less than what shareholders have grown accustomed to, the share price could potentially see some downside.

I’m expecting a $0.03 – $0.04 increase, but could this change due to the company’s narrowed guidance and miss during earnings? Could they be accounting for a slowdown in the economy going forward as well? It’s a possibility. During the quarter, management narrowed guidance slightly to a range of $5.07 – $5.15, down from $5.07 – $5.17 prior.

This still represents a growth rate of 3.4% from $4.95 in earnings they brought in the year prior. Using this, it gives Altria a forward P/E of 10.02x. This is well-below the sector median’s 17.79x, signaling the stock could be undervalued. For comparison purposes, peer Philip Morris has a much higher valuation while British American Tobacco’s (BTI) is lower:

- Philip Morris 19.90x

- British American Tobacco 7.64x

According to Fastgraphs, Altria’s fair value ratio is 15x earnings. And while the stock has traded this high in the past, I think if the tobacco giant can continue executing on its strategy with their smokeless tobacco products, I think a P/E of 12x is more reasonable over the next year. This still gives investors double-digit upside of 24.2% to their price target of roughly $64.

Bottom Line

Altria seems to have found their niche with the NJOY acquisition. And with a full-year under its belt, the tobacco giant seems to be executing nicely to offset the secular decline in smokeable products. Additionally, on! continues to show solid growth although they still lag behind peer Phillip Morris’ ZYN by a sizable margin.

However, I think Altria’s management will continue to expand NJOY’s products and reward investors with nice dividend increases for the foreseeable future. The market also seems to like the acquisition as MO’s share price is up double-digits over the past 3 months or so.

If management continues to execute on its strategy and expand NJOY into more stores, I think their share price will reflect positively, giving current investors additional upside. As a result, I continue to rate Altria a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO, SBUX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.