Summary:

- Altria’s ~14% stock price rise YTD is supported by multiple factors like a high dividend yield, increased share buybacks and upgraded earnings outlook.

- These override any impact the otherwise weak Q1 2024 results might have had, especially as the adjusted earnings were impacted by shrinking revenues.

- Even though MO’s P/E has inched up this year, price gains are still possible, or at the very least, a price decline is unlikely and its dividend yield is robust.

intek1

Since I last wrote about tobacco company Altria (NYSE:MO) in February, its price is up by 11%. No surprises here. Just going by the company’s market multiples, it was evident even then that a price uptick was possible. This was further confirmed by its high, sustained dividends as well as a small increase in its adjusted diluted earnings per share [EPS] for the full year 2023.

Now, however, the gap between the stock’s forward non-GAAP price-to-earnings (P/E) ratio and its five-year average has shrunk significantly. Further, its adjusted diluted EPS also shrank in the first quarter (Q1 2024). These developments raise the question as to whether Altria is still a Buy. Here, I argue that it is. Here are three reasons why.

#1. Improved outlook

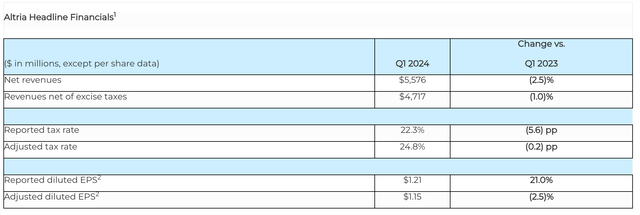

There’s no overlooking the fact that the company’s Q1 2024 results were weak. Both its net revenues and adjusted diluted EPS shrank by 2.5% YoY. The EPS contraction was really just a trickle-down from lower revenues to operating income and so forth. Even the encouraging reported diluted EPS increase of 21% was largely on a low base effect, as Q1 2023 was affected by loss on the sale of Altria’s investment in JUUL Labs.

Despite the weak operating results, though, the company’s earnings guidance has improved since February. As it happens, it upgraded the figure in March following its decision to sell some of its 10% share in the Belgian beer company Anheuser-Busch InBev (BUD), both through offerings in multiple geographies and repurchase by ABI, with the total amounting to USD 2.4 billion. Altria has also increased its share buyback programme by this amount for 2024, in addition to the USD 1 billion already planned.

With fewer shares in circulation, it now expects adjusted diluted EPS to land in the USD 5.05-5.17 range in 2024. At the midpoint of the guidance range, this is a 3.2% year-on-year (YoY) increase in EPS, compared to a 2.5% rise indicated by the previous forecasts.

This is particularly positive as the company has reduced its earnings forecast as the year rolled on in the past three years, (see the section on “Historical downward EPS revisions don’t bode well” in the first link in the article for details). It’s also encouraging for the stock both from a perspective of capital gains and dividends, as is discussed next.

#2. Some price rise is still possible

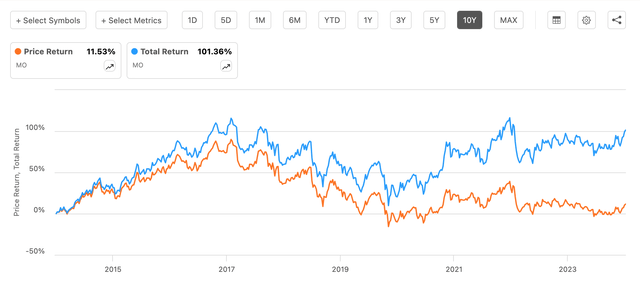

Before getting into the nuts and bolts of why the price can rise further, let me just say first that the real reason to buy MO is its dividend, not the capital gains from it. Over the past 10 years, total returns on the stock are 101.4% while price returns are just 11.5% indicating the significance of its dividends (see chart below).

Price and Total Returns, 10y (Source: Seeking Alpha)

At the same time, we can’t forget about the price either. If it declines enough, it may well drag total returns on a stock into negative territory even with healthy dividends. Luckily, that’s not the case for Altria, as seen with its ~14% year-to-date gains, the big share buyback underway and even now based on its P/E ratio too.

MO’s non-GAAP forward P/E is now at 8.93x compared to the five-year stock average of 9.74x. The upside has shrunk since I last wrote when the then P/E was at 8.17x compared to the five-year average of 9.99x. But even then, going by analysts’ estimates on Seeking Alpha, on which the forward P/E is based, there’s still a 9.2% price upside.

Note that these estimates are a shade lower than the midpoint of the company’s guidance range. If the final figure were to come in at the guidance midpoint instead, the forward P/E would be at 8.9x, indicating a slightly higher 9.4% upside.

Despite the latest upgrade, I’d also like to consider a more conservative EPS estimate, considering Altria’s downgrades in the past. Take the example of 2023. The adjusted diluted EPS finally came in at USD 4.95, which is ~2.1% below the midpoint of the initial guidance range. If the same were to happen this year, the forward P/E would rise to ~9.1x, but even this implies a 7% upside to the stock.

The key point is that there’s no risk of a decline in share price from here, which could affect total returns. There’s actually a possibility of some further uptick.

#3. Yield is high despite unchanged dividends

Next, the company’s trailing twelve months [TTM] yield at 8.53%, might have declined from the 9.5% levels when I last checked, but on its own, it’s still rather robust. Moreover, the yield decline is entirely due to the price rise in the meantime. The TTM dividend payout has actually increased by 1% since then as Altria maintained its dividend of USD 0.98 per share for the past three quarters, up from USD 0.94 up to Q2 2023. This brings the now TTM dividend level to USD 3.88 compared to the USD 3.84 level when I last checked.

Even if the company just sustains the present levels, its forward dividend yield for 2024 comes in at 8.61%, with the annual dividend at USD 3.92 per share. It is just a small 2.1% YoY increase, but weakness compared to the past decade’s average growth of 7.7% was to be expected going by the relatively small EPS growth forecast even now.

The transition risk

Even with all the positives to the stock, it’s hard to overlook the company’s softening revenue performance. Revenues have seen a YoY contraction for the past three quarters and have also fallen in eight of the last 10 quarters due to the waning popularity of cigarettes.

In Q1, 20024, net revenue from smokeable products, accounting for 88% of the total, fell by 3.6%. Oral tobacco, which accounts for the remainder of the revenue, fared better, with a 3.7% revenue increase. But it can hardly be depended on to drive revenues in the future. And the company’s presence in tobacco alternatives is essentially nothing. It has seen some pickup in NJOY recently, but it’s too small right now.

What next?

In sum, Altria looks good despite the contracting revenues, for now. The upgraded earnings outlook, still some price upside indicated by the forward P/E and a rewarding dividend yield all go in its favour. But for the company to sustain its edge, traction needs to be seen in its tobacco alternatives. Until then, it’s hard to be positive about it for the long term. But for now, I’m retaining a Buy rating on it.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.