Summary:

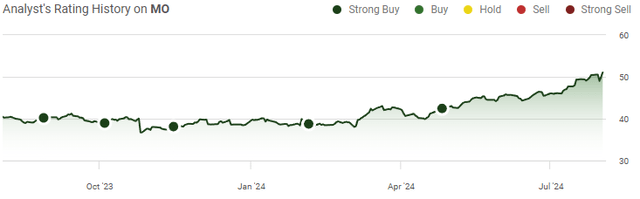

- Altria Group has seen a strong year with shares up over 26% in 2024, breaking the $50 barrier after years below.

- Despite risks and negative stigma, MO’s Q2 results show a profitable business with strong margins and growth potential in non-combustible products.

- MO’s high dividend yield of 7.68% and commitment to annual dividend increases make it an attractive investment for income-producing portfolios.

PM Images

2024 hasn’t just been good for technology companies able to capitalize on the AI boom, it’s also been strong for companies that produce things. Companies of yesterday that are often regarded as boring, including The Coca-Cola Company (KO) and Exxon Mobil Corporation (XOM), are up more than 15% YTD. One of my favorite companies that many investors had written off is having a great year, and I believe it will get better in the 2nd half of 2024. Altria Group (NYSE:MO) has been a battleground stock on Seeking Alpha and in private conversations I have had. Some people are unwilling to invest in MO because of its business, while others, such as myself, are willing to invest in this sin stock. It’s taken some time, but MO has finally broken the $50 barrier after spending more than 2 years below this threshold. Shares of MO reached $39.07 in 2024 and have finally worked their way out of the $40s, and I believe it’s because the investment community is starting to look past the narrative around being in the tobacco industry. Even as shares of MO have gained more than 26% in 2024, I believe there is still more room to run as MO is trading at just 10 times 2024 earnings. Investors can still grab a 7.68% yielding dividend with growth on the horizon while they wait for an investment in MO to continue playing out. I was buying MO throughout the $40s, and I still believe there is a substantial upside going forward as we are about to enter a lower-rate environment.

Seeking Alpha

Following up on my previous article about Altria Group

When others didn’t want to touch MO, I was discussing why I was gravitating toward this investment. Big tech was grabbing headlines, and while I have participated in investing throughout different segments of technology, I have also been investing in companies that make things and have hard assets. Since my last article in April (can be read here), MO has appreciated by 17.73% while the S&P 500 has climbed 4.84%. When MO’s dividend is taken into consideration, the total return is 20.30%. Now that Q2 earnings are out, I am following up with a new article to discuss why I am still very bullish on MO after the recent runup. I think there is still an opportunity, and while MO is no longer yielding close to 10%, I think there is still a strong case for adding MO to an income-producing portfolio.

Seeking Alpha

Risks to investing in Altria Group

Investing in MO comes with a different set of risks than other companies. Public perception about MO is unlikely to change, and that could deter many individual investors and some funds from allocating capital toward MO. MO also faces evolving regulations and companies deciding they will no longer sell tobacco products. Between the negative stigma on tobacco companies, and changing regulations and legislation, investing in MO can be difficult as you never know when the next hurdle will appear. MO is finally getting back to the $50s, but shares can easily fall back into the $40s regardless of profitability. Anyone who is considering investing in MO should be well aware that this is an investment that is hasn’t done much during the bull market cycles over the past decade from a price standpoint, and it may never get a lucrative valuation. While I am bullish on MO, there are many risks to the investment thesis, and investors should be ready for increased levels of risk going forward.

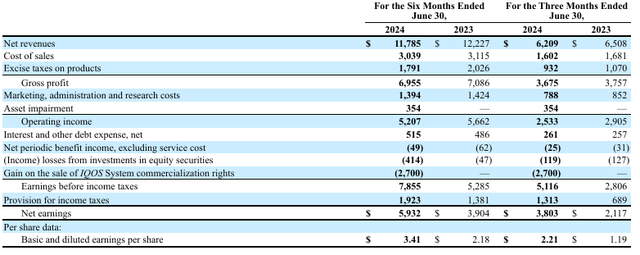

Despite the recent price appreciation, Q2 results are continuing to make a compelling case for shares of MO to continue higher

This was another strong quarter for MO, and despite anyone’s opinions on the tobacco industry, MO is operating a highly profitable business with fantastic margins. During Q2, MO generated $6.21 billion in net revenue, which only cost $1.6 billion to produce, and after the taxes on its products, MO was left with $3.68 billion in gross profit. In Q2, MO operated at a 59.19% gross profit margin, and for the first 6 months of 2024, MO operated at a 59.02% gross profit margin. This is one of the reasons why I am very bullish on MO. After the excise taxes on MO are factored in, they are still operating at above a 50% gross profit margin, which leaves a tremendous amount of room for bottom-line profitability. After the cost of running the business, MO generated $2.53 billion in operating income. On a net income level, MO would have generated $2.416 billion in net income during Q2, placing its profit margin at 38.91%, but they sold the rights to the IQOS system and gained $2.7 billion on the transaction, which took their Q2 net income to $5.12 billion. MO’s profitability is still incredibly strong despite decades of campaigns targeted to reducing the demand for its products. MO is definitely a sin stock, and I can understand why some investors would want to stay away, but for those who are not opposed to investing in tobacco, it’s a very lucrative industry.

Altria Group

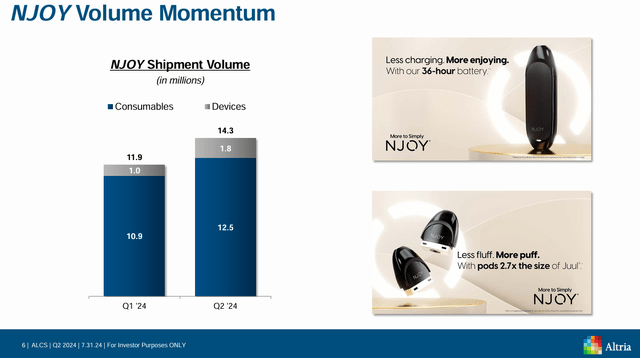

MO’s retail smoking business remained strong in Q2, as the Marlboro brand maintained a 42% market share and a 59.4% market share of the premium cigarette sector. MO is making a lot of headway in the smokeless transformation that is occurring within the tobacco industry. The NJOY devices shipped increased by 80% YoY from 1 million units to 1.8 million units during Q2. The consumable products for the NJOY device increased 14.7% YoY to 12.5 million units to 12.5 million units. NJOY is expanding its retail share in the U.S., adding 1.3 points and now representing 5.5% of the devices sold through multi-outlet and convenience channels. In the first half of 2024, NJOY shipped 2.8 million devices and 23.4 million consumable units. This could continue to expand as MO received marketing authorizations from the FDA for four menthol e-vapor products in June 2024. This could provide a large boost to MO’s non-combustible products, as MO will be selling the only menthol e-vapor products that the FDA has authorized. MO is also seeing a strong uptick in its oral tobacco products through Helix. The repackaging to on! and the campaign around the new brand have helped on! shipment volumes increase by 37.3% YoY to 41.2 million cans of oral tobacco in Q2. MO now has 8.1% of the oral tobacco industry, which is up from 6.9% in Q2 of 2023. MO continues to take market share in the smokeless tobacco category, and I expect that we will see further penetration as the year progresses.

Altria Group

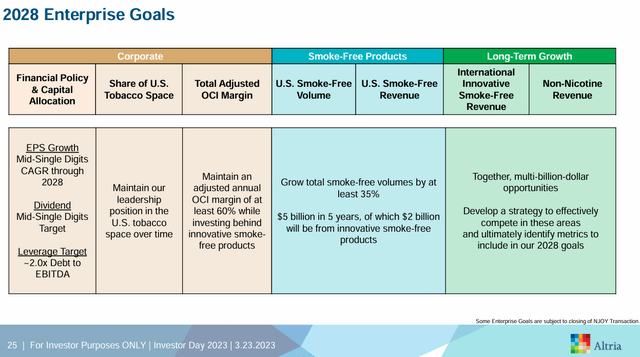

Putting opinions aside, MO is running a high margin and profitable business. MO’s progress into e-vapor and oral tobacco should continue to offset the decline in cigarette sales and provide a boost to EPS. MO’s CFO announced on the earnings call that they expect to generate between $5.07 and $5.15 of adjusted diluted EPS, which would be 2.5% – 4% growth from their 2023 level of $4.95. This includes the impacts of 2 less shipping days in 2024 and the obligations from the NJOY acquisition. MO is still on track to deliver mid-single-digit EPS growth to meet its 2028 enterprise goals. In the first half of 2024, MO has returned $5.8 billion to shareholders through dividends and share repurchases. MO repurchased $2.4 billion worth of shares in the first half of 2024 and still has $1 billion left on the current authorization. Buying back stock is one of the best ways to help increase profitability on a per-share basis because the earnings from operations are spread across fewer shares.

Altria Group

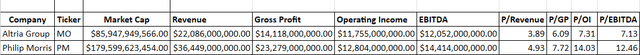

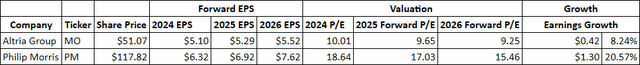

It’s hard to value MO against companies in other sectors because of the negative stigma on tobacco. While $1 of revenue and $1 of profit are $1 no matter what the companies’ goods or services are, the market values sectors differently. When I look at how MO is trading compared to Philip Morris (PM), I still see tremendous value in MO’s shares. MO is trading at 3.89 times sales, compared to 4.93 times for PM. Investors are paying 7.72 times for PM’s gross profit, 14.03 times for PM’s operating income, and 12.46 times for PM’s EBITDA. On a profitability level, MO trades at 6.09 times gross profit, 7.31 times operating income, and 7.13 times EBITDA. PM is trading at a vastly higher multiple on everything from revenue to profitability, and its margins are significantly lower than MO’s, as PM is operating at a 39.55% EBITDA margin and 35.13% operating margin compared to 54.67% and 53.22% for MO. When I look at the earnings growth over time, MO doesn’t have as much growth as PM, but it’s still trading at a deep discount compared to PM’s earnings. MO trades at 10.01 times 2024 earnings and 9.25 times 2026 earnings, while PM is trading at 18.64 times 2024 earnings and 15.46 times 2026 earnings. I think Q2 was a strong indication that MO will hit its projections, and I believe that the valuation is still too cheap after the recent share appreciation.

Steven Fiorillo, Seeking Alpha

Steven Fiorillo, Seeking Alpha

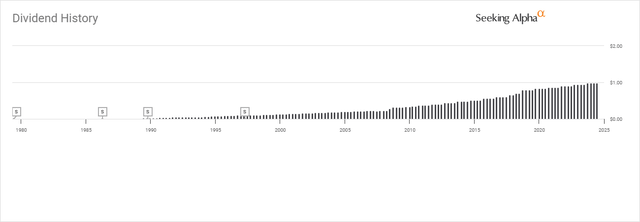

Altria Group’s dividend is still very lucrative at a 7.68% yield

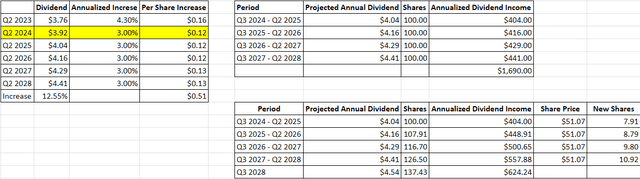

MO is still the highest-yielding Dividend King, as the dividend yield is 7.68%. Not many companies can sustain raising their dividend for over 50 years, and the fact that MO has a 7.68% yield with 55 years of consecutive dividend increases is a testament to their sustainable profitability. MO will go ex-dividend later this month, and shareholders have already received 4 quarterly dividends of $0.98. Based on MO’s commitment to the dividend and targeting an annualized increase in the mid-single digit range, I am expecting they will bring the dividend to around $4.04 and increase the annualized dividend by $0.12 or 3%. MO is projecting they will increase their Adjusted EPS by 2.5% – 4%, and based on their previous dividend increases and the 2028 Enterprise Plan, I think an increase of 3% is more than likely to occur for the Q3 dividend.

Seeking Alpha

If MO does an annualized dividend increase of 3%, the dividend will expand to $4.04 for the next 4 quarters and grow to $4.41 over the next 3 years. An investment of 100 shares in MO would cost $5,107 at the current valuation, and over the next 4 years at a 3% annualized dividend growth rate, MO would generate $1,690 in income, which is a 33.09% yield on investment. This doesn’t factor in if the dividends were being reinvested, either. Assuming that the share price were to stay static, on an annualized compounding rate, you would be able to purchase an additional 37.43 shares over the next 4 years by reinvesting the dividends. If MO increased the dividend by 3% again in Q3 of 2028, then you would have 137.43 shares generating $624.24, and your dividend income would have increased by $220.24 or 54.41%. The combination of a growing dividend and reinvesting the dividends can be lucrative as time goes on, and MO’s level of profitability should allow it to maintain a dividend growth rate of around 3%.

Steven Fiorillo

Conclusion

I believe that the negative stigma about investing in tobacco companies is easing as the ESG narrative isn’t nearly as vocalized as it once was. MO is expected to grow its EPS and dividend through 2028 and is committed to continuing its repurchase plan. While shares rallied in 2024 and recently broke out above $50, I still think there is value to be unlocked as MO is still trading at 10 times 2024 earnings while yielding 7.68%. As we enter a lower-rate environment, there is a possibility that we will see capital enter back into the market as the risk-free rate of return declines. MO could be a strong candidate for newly deployed capital as its yield is in the high single digits, it’s a Dividend King with 55 years of annualized increases, and there are several years of dividend growth on the horizon that management is committed to. I wouldn’t be surprised if we see MO trade in the $60s in 2025, and I am still very bullish on MO, as I will continue to compound my dividends into a larger stream of income over time.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO, KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.