Summary:

- Altria Group’s unique selling point is its 9.5% dividend yield. Going by the earnings outlook, this can at least sustain, if not increase as well.

- A price uptick is also due, considering its competitive GAAP and forward P/E compared to the tobacco industry.

- With a limited presence in the tobacco alternative market, existential questions surround Altria over the long term, even though there’s a clear Buy case for it as of now.

Joe Raedle

Tobacco company Altria Group (NYSE:MO) has had a poor year at the stock markets with an 11.6% decline in share price, which is in stark contrast with the near 25% increase in the S&P 500 (SP500) index.

But MO still stands out for having the highest dividend yield among all S&P 500 stocks, at 9.5%. And it’s no unreliable dividend either, with the company’s impressive 54-year track record of consistent dividend payments.

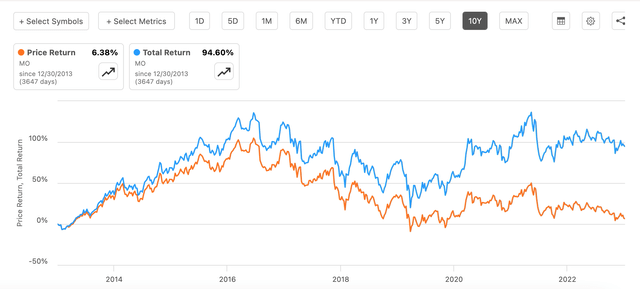

In fact, over the past decade, it has nearly doubled investor money because of the lucrative dividend payouts, even though the price returns are a small 6.4% over this entire time (see chart below). Can it repeat the same performance over the next decade, though?

Price and Total Returns (Source: Seeking Alpha)

Progressive dividend policy

To start with, the company’s dividends look good, at least for the next year. It has a stated focus on passive returns to investors. It says, “A strong and consistently growing dividend remains a top priority for us.”. To achieve the same, it targets “a new progressive dividend goal that targets mid-single digits dividend per share growth annually”.

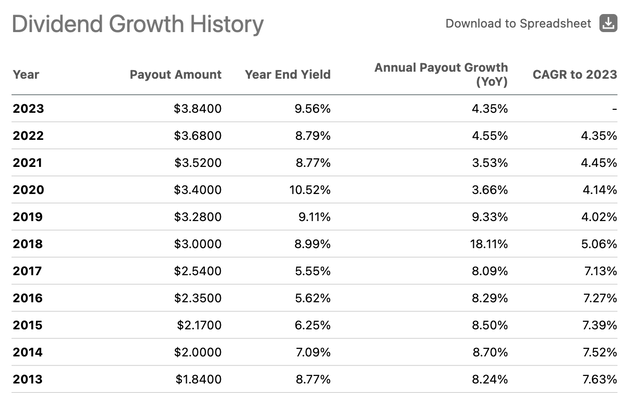

In any other case, I would still be doubtful, considering its unsustainable dividend payout ratio of 114.5% for the year ending December 2022. But it has a record to back up its promises. Over the past decade, it has consistently grown its dividends yearly (see table below). Its dividend yield has remained rather healthy over this time as well, with the lowest year-end yield at 5.6% in 2017 and the highest of 10.5% in 2020.

Positive dividend outlook

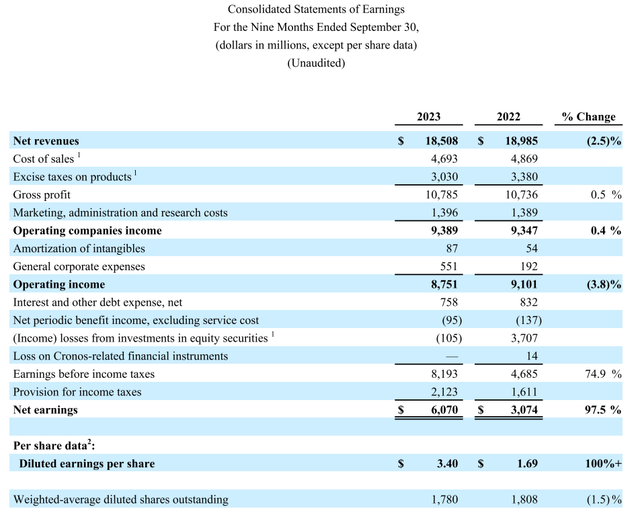

The next year might be no different. For one, for the trailing twelve months [TTM], its dividend payout ratio has cooled down to 77.8%. This is supported by industry beating earnings growth. For the first nine months of 2023 (9M 2023), its reported diluted earnings per share [EPS] have doubled (see table below) on account of an income from investments in equity securities as opposed to a loss last year. The adjusted diluted EPS rose by 3.3% as well.

This alone sets the stage for dividend growth next year. And the company’s earnings outlook further confirms it. Even though it has slightly adjusted its earnings guidance downwards in its latest earnings update, it still expects an increase in EPS.

It now sees adjusted diluted EPS to increase in the range of 1.5-3% YoY, with the midpoint of the range now being 2.25%. This compares to the earlier midpoint at 2.5%, for a range of 1-4% growth. In absolute terms, it expects the number to come in in the range of USD 4.91-4.98.

Assuming that dividend payouts grow at the decadal compounded annual growth rate [CAGR] of 6.7%, next year’s payout would be USD 4.1 per share. This indicates an even healthier forward dividend yield of 10.2% compared to the TTM yield of 9.6%. This estimate is higher than analysts’ estimate of 9.8% on average, but it’s worth noting that even this lower forward yield is higher than the TTM one.

Question mark on dividend longevity

Just because next year’s dividends look good, however, is not enough reason to assume the next decade would look equally good. And this is because smoking is increasingly falling out of favor. As British American Tobacco (BTI) estimates, the global tobacco industry has likely seen a 3% volume decline in 2023.

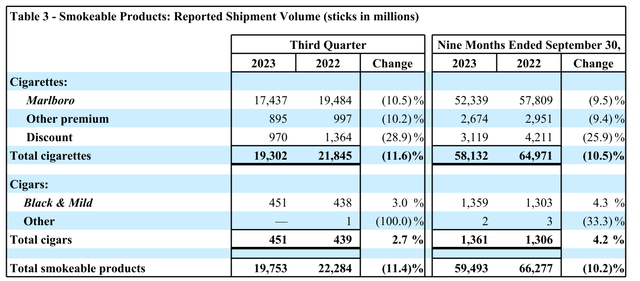

This is evident in Altria’s numbers as well. For 9M 2023, saw a 2.5% fall in net revenues because of weakness in the smokeable products segment, with the shipment volume of cigarettes falling by 10.5% (see table below). Not only do smokeable products contribute to 91% of the company’s revenues, but they are also key to keeping it profitable, accounting for 94.5% of the operating profits.

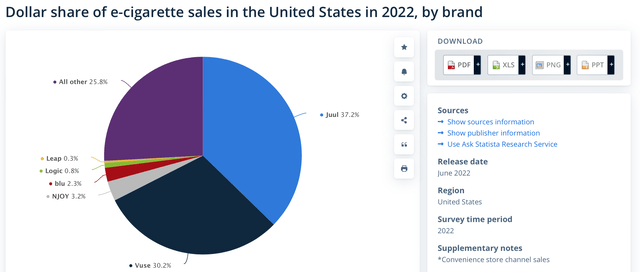

This can put Altria in a particularly precarious spot going forward. While it’s smoking alternative brand on! saw a 41% YoY volume increase for 9M 2023, in absolute terms it remains a small contributor to the total revenue. Further, the company exited its minority investment in Juul Labs after it was banned in the US for what has been termed as fuelling the “teenage vaping epidemic“.

It has acquired NJOY Holdings, however, to build a position in the vaping market but how that plays out remains to be seen. As the chart below shows, it has a far smaller share of the US e-cigarette market compared to Juul.

Attractive market multiples

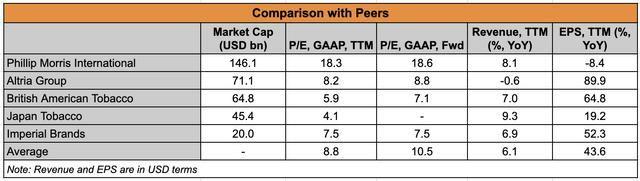

For now, though, along with the dividends, the market multiples look alright too. Its TTM and forward GAAP price-to-earnings (P/E) ratios indicate an upside to the stock compared to the average multiples for the tobacco industry (see table below).

There’s some case for Altria trading lower, in that it’s the only tobacco company to see shrinking revenues on a TTM basis. But what it lacks in revenues, it makes up for in earnings. It’s seen a huge 90% EPS increase in the past year, far outdoing the already healthy double-digit increase seen by three of its four peers.

On average, the P/Es suggest that there could be a 25% increase in share price going forward. But even a much smaller uptick would still make it a worthwhile investment for now going by the dividends.

What next?

The discussion makes it clear that over the next year, there’s a good reason to buy MO. Not only are its dividends likely to stay lucrative for investors, but there’s potential for a price uptick too. I would extend this argument to the medium term as well, based on the information available so far.

However, there are bigger existential questions for Altria when considering the long-term, which takes the next decade into account. The contribution from tobacco-free products is limited so far, and there’s no guarantee that it will succeed in the smoking alternatives market in the future either.

I’m going with a Buy rating keeping the short-to-medium term in mind, longer-term investors are best off watching developments for the company carefully going forward because this party might not continue forever.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—