Summary:

- Altria Group (MO) has surged over 40% in 2024, with potential to exceed $60 by year-end and $70 in 2025.

- Lower interest rates and Republican control of legislative branches are bullish for MO, reducing operating expenses and potential tax savings.

- MO’s strong Q3 performance and robust market share in tobacco and NJOY products support its undervaluation and dividend growth prospects.

- MO’s consistent dividend increases and potential for further buybacks make it an attractive income-producing asset with a yield exceeding 7%.

PM Images

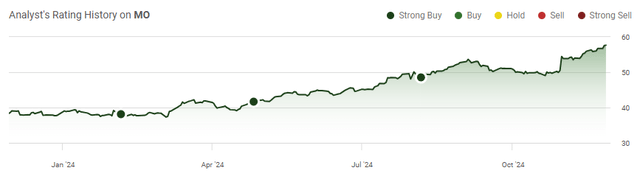

Shares of Altria Group (NYSE:MO) are finally showing signs of life again. Long-term shareholders of MO have experienced a perpetual downtrend, with every rally being short-lived as a correction followed. 2024 has been the opposite of what shareholders have experienced in the past as MO started the year around $40 and has appreciated by more than 40% to $57.75. While the tobacco industry has been controversial to some investors, there is no denying that companies such as MO are generating tens of billions in revenue each year as its products are in demand. I have been bullish on MO for a long time as I felt too much downside was priced in based on individual beliefs about morality rather than assessing the company on its revenue and profitability. Some investors were able to lock in yields around the 10% level, and even though shares of MO are in a bullish trend, I believe that there is still an opportunity to generate capital appreciation and large amounts of dividend income. I believe that there is a chance that MO can finish the year above $60 and run past $70 in 2025. There is still time to pick up shares of this Dividend King while it exceeds a 7% yield.

Seeking Alpha

Following up on my previous article about Altria Group

I have been bullish on MO for some time, and I am not just jumping on the bandwagon because they’re on a bullish trend. I was bullish around the $40 level the same way I was bullish at $50 and even here at $57.75. In my previous article I wrote at the beginning of August (can be read here), I discussed why I was still bullish as shares approached $50. Since then, shares have appreciated by an additional 16.99% compared to the S&P 500, climbing 15.68%, and when the dividends are factored in, MO’s total return over this period is 19.29%. A lot has changed with my outlook now that there is a new administration coming in, and the Fed is starting to cut rates. My outlook is based on MO, which is built on the metrics from Q2, where the Marlboro brand maintained a 42% market share and consumable products for the NJOY device increased by 14.7% YoY. I think there is a lot to be excited about, as we are likely to see less regulation and lower rates in the future.

Seeking Alpha

Risks to investing in Altria Group

While I am bullish on shares of MO, there are several risk factors to consider. MO operates one of the largest tobacco businesses in the country, and many individuals know someone who has been impacted by cancer. There is a chance that the recreational use of tobacco products will decline and that more investors shy away from MO because of their moral beliefs. If tobacco products become less popular, it will negatively impact MO’s top and bottom line. There are also environmental risks to tobacco crops that are completely out of MO’s control. If we have unfavorable growing conditions, MO could see prices of tobacco increase as there could be less on the market. We could also see regulation risk as RFK is going to play a large role in the future of the Trump Administration. There is a possibility that while we see a deregulated business environment, bans on menthol cigarettes go into effect. There is no telling if this would cause menthol smokers to quit or switch tobacco types. Please do your own due diligence and consider these risk factors before making any investments in MO.

The macroeconomic environment is changing heading into 2025, and it’s beneficial toward Altria Group

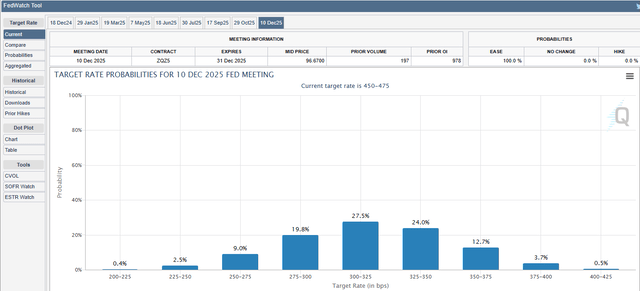

A lot has changed since August, when my last article was published, as the Fed started cutting rates and Republicans took control of all 3 legislative branches. I believe that both aspects are bullish for MO and will provide tailwinds into 2025. The Fed pivoted on monetary policy in September by cutting rates by 50 bps and followed up with a 25 bps reduction in November. CME Group is projecting that there is a 66% chance that the Fed will cut rates by another 25 bps in December and reach the Fed goal of 3.5% by the end of 2025. MO currently has $23.57 billion in debt on its balance sheet and has paid $1.17 billion in interest expenses over the trailing twelve months (TTM). If the Fed continues to lower rates and reach 3.5% in 2025, then 3% in 2026, as their Fed Dot Plot indicates, MO could be a large beneficiary. MO would be in a position to issue new debt at lower rates and repurchase all of its higher-yielding debt. This could reduce its annualized interest expenses by hundreds of millions each year, which would drop directly into earnings before taxes. A rate-cutting environment is bullish for MO as it can help it reduce its overall operating expenses while providing an easier landscape to borrow from if it wants to expand its business.

CME Group

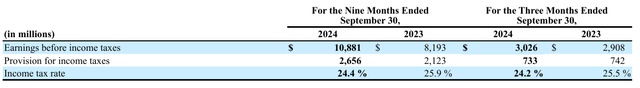

From a political aspect, it is more bullish that the 3 legislative branches will be controlled by Republicans for MO than if the elections went the other way. Republicans have typically subscribed to the free market belief of business, which includes fewer regulations or interference by the government. Having republican control across the board could ease taxation regulations on the tobacco industry, especially since tobacco is one of the agricultural drivers in the South. When Vice President Harris was on the campaign trail, she was campaigning to raise the corporate tax rate to 28%. In 2024, MO paid $2.66 billion in taxes, which is a 24.4% tax rate on their earnings. Over the TTM, MO has generated $13.62 billion in earnings before taxes and paid $3.33 billion in taxes, which is an effective tax rate of 24.46%. Former President Trump ran on lowering corporate taxes to 15%, which could save more than $1 billion annually for MO, which drops directly to the bottom line. MO has 1.69 billion shares outstanding, so for every $1 billion they save it would be the equivalent of roughly an additional $0.59 in EPS.

Altria Group

MO has had a strong year, breaking out past $50, but I think that 2025 could be just as big, and shares could break out above $70 if several things occur. If rates continue to decline and corporate taxes are reduced to 15%, MO will have an optimal operating environment. If fears of increased regulations are off the table, debt can be refinanced at lower rates, and lower tax bills are generated, then we could see MO increase its buybacks and dividends further while trading at a more favorable P/E. I think a lot of risk is off the table at this point due to the elections, and 2025 could be a strong year for the tobacco industry. MO is already a cash cow generating almost $10 billion a year in free cash flow (FCF), and if its profitability increases, it will likely lead to larger amounts of capital being returned to shareholders.

Altria Group posted a strong Q3 and it makes me believe that shares are undervalued and they will achieve their dividend goals

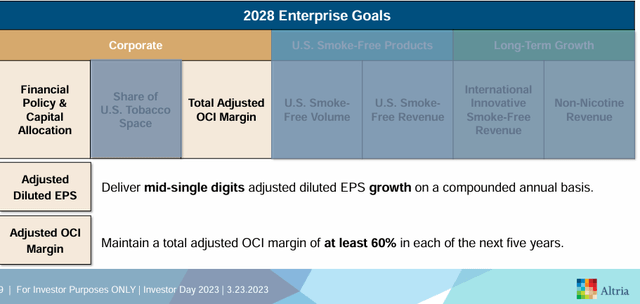

MO generated $5.34 billion in revenue during Q3, which was a top-line beat of $17.8 million while producing $1.38 of EPS, which was $0.03 ahead of the consensus estimates. Management reaffirmed its guidance of $5.07 to $5.15 in diluted EPS, which is an adjusted diluted EPS growth rate of 2.5% to 4% based on its 2023 level of $4.95. This aligns with MO’s 2028 enterprise goals that they discussed at their investor day last year, where MO would deliver annualized diluted EPS growth in the mid-single digits. Despite revenue decreasing by 2.5% in the first 9 months of 2024, its diluted EPS increased by 1.6% to $3.84, which was driven by buybacks and lower adjusted operating company income.

Altria Group

From a business perspective, MO is still very interesting. The NJOY segment increased shipment volume by 15.6% to 10.4 million units. The NJOY device shipment volume increased to 1.1 million units, which is recognized as a 100% growth rate. In the first 9 months of operations, NJOY’s consumable shipment volume has been 33.8 million units, while 3.9 million devices have been shipped. MO now controls 5.3% of the retail share of consumables in the U.S. So far in 2024, the Marlboro market share of cigarettes was 41.9%, and it controlled 59.3% of the premium cigarette market. MO is also gaining ground in the oral tobacco segment as it shipped 197.1 million units of its different brands, which represents a 1.2% YoY increase.

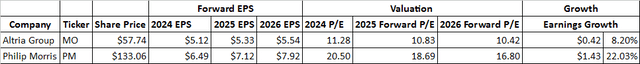

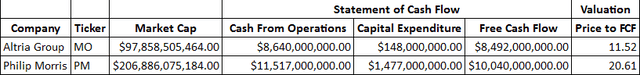

MO’s business metrics are allowing it to reach its dividend goals while remaining undervalued. MO is expected to generate $5.12 of EPS in 2024, putting its 2024 P/E at 11.28. MO’s EPS is expected to increase to $5.54 in 2026, which is 8.2% of growth over the next 2 years, and it will place its 2026 forward P/E at 10.42. Philip Morris (PM) is expected to generate $6.49 of EPS this year and grow its EPS by 22.03% over the next 2 years. While PM has more growth on the horizon, its shares are trading at 20.50 times 2024 earnings and 16.8 times 2026 earnings. MO looks very undervalued, considering it’s trading at less than 12 times 2024 earnings. When I look at the FCF of both companies, MO has generated $8.49 billion of FCF in the TTM, while PM has produced $10.04 billion in FCF. MO is trading at 11.52 times its FCF, and PM trades at 20.61 times its FCF. MO isn’t a company that in an earnings decline, and I think shares trading at under 15 times earnings is undervalued, considering the amount of cash they are generating.

Steven Fiorillo, Seeking Alpha

Steven Fiorillo, Seeking Alpha

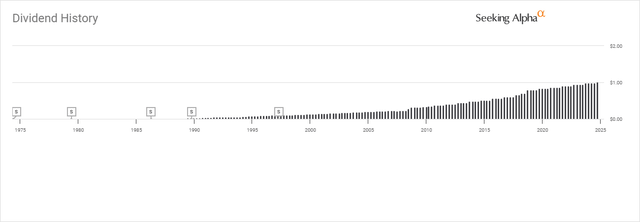

MO is a Dividend King that has increased the dividend for 55 consecutive years. In Q3, MO paid $1.7 billion in dividends while raising the quarterly dividend by 4.1%, marking its 59th increase over a 55-year span. MO is currently paying a dividend of $4.08, which is a yield that exceeds 7%. As MO continues to buy back shares and increase its EPS, there is no reason why it can’t keep increasing the dividend by 4.1% going forward on an annual basis to meet their 2028 enterprise goals. We could see the dividend increase to $4.25 in 2025, then to $4.42 in 2026, $4.60 in 2027, and $4.79 in 2028. Income investors could experience an additional $0.71 being paid on the dividend, which would increase by 17.44% over the next 4 years if this trend continues. I believe that MO will continue to be an attractive income-producing asset as the years progress.

Seeking Alpha

Conclusion

I am not going to walk back my very bullish rating because shares of MO are up over 40% in 2024. I think that we could see more of the same in 2025, and shares can break out above $60 and make a run on $70 next year. MO continues to increase its EPS, and we haven’t even felt the effects of a lower monetary policy or a reduced corporate tax rate. I think there are a lot of reasons to be bullish on MO, and they could continue to outperform. After going through the numbers, MO could be in a position to save over $1 billion annually from lower rates and a lower corporate tax rate. If this occurs, they could allocate that capital toward buybacks, which will reduce the overall dividend payments while boosting the EPS and making the shares of MO look more attractive than they already are. MO is a Dividend King that I want to own more of, as the days of exceeding a 7% yield could be a thing of the past.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO, PM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.