Summary:

- The Altria Group stock price decreased by ~3% after the Q2 2024 earnings release.

- MO continues to struggle within its smokeable product portfolio and cannot offset negative volume effects with positive price/mix effects.

- Smoke-free products hold significant potential. However, much work remains before this potential can be properly realized.

- What’s concerning is that the Company has fallen behind its competitors when it comes to navigating market shifts.

- For now, I am holding my stake in shares and keeping MO on my watch list while waiting for more business development or more opportunistic valuation.

KanawatTH

Introduction & Investment Thesis

Once again, let’s start with a statement: I own a certain stake in Altria Group (NYSE:MO). I recently published an MO article and stated that it was a ‘hold’ for me. To emphasize further – I didn’t, and I don’t intend to sell my position.

Since publication, the stock price has increased by ~5.4%. On July 31st, Altria Group reported its Q2 2024 results, which led to a stock price decrease of ~3%. In this article, I examine MO’s business development during the last quarter and provide a rationale for upholding my ‘hold’ rating based on the current valuation and the most recent business data. Should you wish to get a better grasp of the development of my take on Altria Group, you can refer to the link below:

Seeking Alpha – Cash Flow Venue

Two main points differentiate MO from its peer, Philip Morris International (PM), which I covered recently (Philip Morris International Conquers The Ever-Changing World):

- MO continues to struggle within its smokeable product portfolio and remains unable to offset negative volume effects with positive price/mix effects (contrary to PM)

- Smoke-free products hold significant potential. However, there’s still a lot to be done before this potential can be properly realized. What’s concerning, MO has fallen behind its competitors when it comes to navigating the market shifts, for example – PM, which conquers the ever-changing world

I’ve provided more color on the above factors within this analysis. For more clarity:

- I am not concerned about the upcoming dividend payments

- I don’t recommend selling MO’s shares and don’t intend to do so

- I need to see more business development on the smoke-free front or a better valuation to add more to MO. For now, I prefer to build my positions in other businesses and keep MO on my watch list

Therefore, that is a ‘hold’ from me. Enjoy the read!

Smokeable Segment – The Struggle Magnifies

The headwinds faced by traditional tobacco products are no secret to anybody, and such knowledge doesn’t require an interest in the tobacco industry – we can observe the social sentiment for smoking shifting in our day-to-day lives. However, it’s important to understand that the dynamic of these changes varies from market to market. To illustrate this point, let’s discuss the business of Altria’s close peer – Philip Morris. PM’s key cigarette markets in Q1 2024 were:

- Indonesia

- Turkey

- Russia

- European countries (e.g. Germany, Italy, France, Poland, and Spain)

During the 2019-2023 period (with 2018 as a base year), PM’s cigarette volumes declined at a CAGR of 3.7%, which is substantially slower than MO’s 6.9% for the same period. This significant difference is due to the US market being a leader in the changes underlying the tobacco industry. PM’s markets are less susceptible to these market shifts. Therefore, PM has more time to establish a non-smokeable portfolio before its traditional segment suffers.

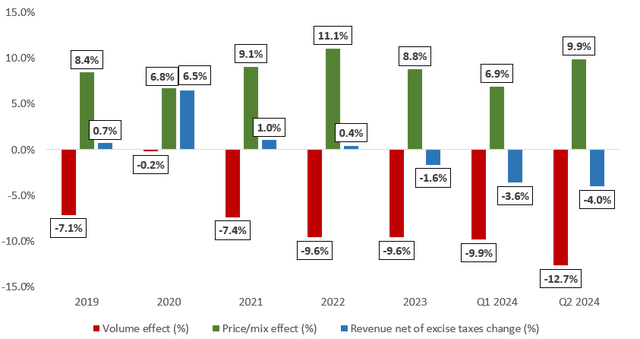

PM still manages to grow its net revenue derived from the smokeable segment (3.5% in Q1 2024 vs Q1 2023 and 1.2% in Q2 2024 vs Q2 2023), whereas MO doesn’t have as much time as it has already experienced noticeable revenue declines. PM’s pricing/mix/currency effects were enough to offset the negative volume effects. On the other hand, MO’s positive price/mix effects weren’t sufficient to offset negative volume effects. Such a phenomenon wasn’t true for 2019-2022 (especially 2020 with a 6.5% increase in revenue net of excise taxes on a year-over-year basis), but it started to turn around in 2023 and is evident in the Q1-Q2 performance of 2024. To be precise, in Q2 2024, MO’s smokeable products segment generated ~4% less revenue (net of excise taxes) when compared to Q2 2023 as a result of:

- negative (12.7%) volume effect

- positive 9.9% price/mix effect

For details, please refer to the chart below with:

- negative volume effects marked as red

- positive price/mix effects marked as green

- net effect marked as blue

It’s worth noting that the negative volume effect increased substantially quarter-over-quarter, and even the considerably stronger positive price/mix effect wasn’t enough to offset it.

Moving Beyond Smoking – Unfortunately, Slowly

One can’t deny the impressive track record of MO, the number of dividends paid to investors, and its place in many of our portfolios (including mine). However, we have to admit that MO was left behind its peers in navigating the market shift toward smoke-free products.

Let me provide you with a few numbers for PM:

- revenue share of smoke-free products in 2024 – 38.3%

- revenue growth of smoke-free products in Q1 2024 (vs Q1 2023) – 21.1%

- revenue growth of smoke-free products in Q2 2024 (vs Q2 2023) – 16.4%

Let’s see similar numbers for MO:

- revenue share of smoke-free products in Q2 2024 – 13%

- revenue growth of oral tobacco products in Q1 2024 (vs Q1 2024) – 3.7%

-

revenue growth of oral tobacco products in Q2 2024 (vs Q2 2023) – 4.6%

The oral tobacco segment is weighed down by declining Copenhagen and Skoal volumes (-9.6% and -12.0% in Q2 2024 vs Q1 2023, respectively). However, on the bright side, on! continues its growth dynamic and recorded a shipment volume increase of 37.3% in Q2 2024 and 32.1% in Q1 2024 (vs analogical periods of the previous year).

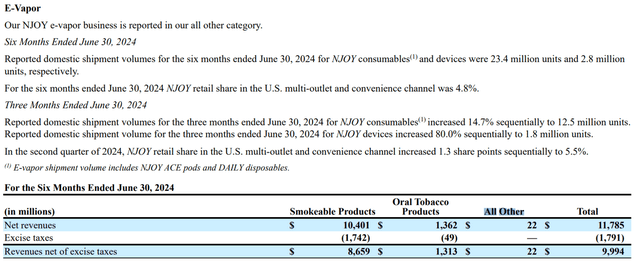

On another bride side, MO has emphasized the development of its e-vapor category, led by NJOY. To quote from the Q2 2024 Earnings Call:

We strengthened NJOY’s supply chain to enable our expansion plans. Tripled NJOY’s retail footprint to over 100,000 stores, secured premium positioning at retail and more than 80% of contracted stores through NJOY’s first trade program. Launched a variety of trial-generating activities with compelling results and introduced a new brand equity campaign with impactful consumer messaging.

As a result of these efforts, NJOY saw continued traction at retail during the second quarter and first half as evidenced by volume momentum and share growth. NJOY consumables shipment volume was approximately 12.5 million units for the second quarter and 23.4 million units for the first half. NJOY’s device shipment volume was approximately 1.8 million units for the second quarter and 2.8 million units for the first half. Both consumables and device shipment volumes increased sequentially with consumables increasing by 14.7% and devices by 80%.

However, it’s important to remember that NJOY is reported within Altria’s ‘all other’ segment, which still had a negligible impact on its business in the first half of 2024.

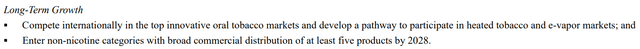

Altria certainly holds a lot of potential and strives to develop within attractive market segments to properly address the trends underlying the tobacco industry. As stated within its 2028 goals, MO intends to build its presence within e-vapour and heated tobacco product segments as part of its long-term growth. However, there’s still a lot to accomplish on that front, especially compared to other players, such as PM.

Financial Stance

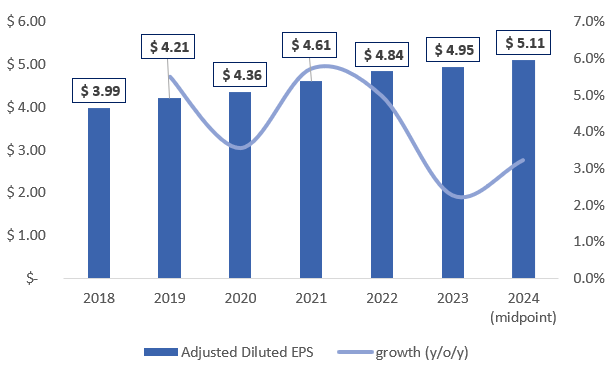

The first half of 2024 was in the range of MO’s management’s expectations, with adjusted diluted earnings upheld in Q2 2024 vs Q2 2023 and down by 1.6%, looking at the first half of 2024 vs the first half of 2023. The Company has narrowed its adj. diluted EPS guidance for 2024 to $5.07 – $5.15, leaving the midpoint guidance intact at $5.11, representing an expected annual growth of 3.2%. Please refer to the chart below for details regarding the adj. diluted EPS and its annual growth rates.

Author based on MO

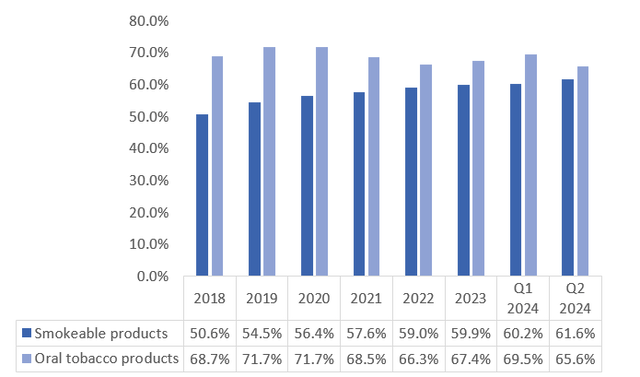

On the bright side of the smokeable products segment, MO improved its OCI margin (on smokeable products) from 60.2% in Q1 2024 to 61.6% in Q2 2024. On the other hand, adj. OCI margin regarding tobacco products declined by 4.9 percentage points, but still stood at a solid 65.6%. There was a substantial adjustment within the oral tobacco segment referring to the impairment of the Skoal trademark amounting to $354m – a non-cash item. Please refer to the chart below, depicting adj. operating margin by MO’s key operating segments for details.

MO maintained its balance sheet strength and credit ratings, ranging from BBB to A3 (depending on the agency). Its debt-to-EBITDA ratio amounted to 2.1x (the same as at the end of Q1 2024), which was slightly above MO’s target of ~2.0x. Considering MO’s profitability and the strength of its balance sheet, I remain confident about upcoming dividend payments.

Valuation Outlook

As an M&A advisor, I usually rely on a multiple valuation method, which is a leading tool in transaction processes. This method allows for accessible and market-driven benchmarking. Numerous metrics are available for valuing a company, with EV/EBITDA being a rule of thumb for most sectors, especially mature ones.

That said, the forward-looking EV/EBITDA stood at:

- 8.7x for MO

- 7.3x for British American Tobacco (BTI)

- 14.5x for PM

- 9.5x for Japan Tobacco (OTCPK:JAPAF)

Recent stock price increases of MO were impacted (to some degree) by positive inflation data updates and increasing hopes for the upcoming interest rate cut. Considering the above, as well as recent developments of MO’s business (increasing struggles within the traditional segment and still modest development of the smoke-free segment), I believe MO doesn’t hold substantial upside potential resulting from the multiple appreciation. I expect it to trade within the 7.5x – 8.5x range.

The Bottom Line

- MO’s struggles regarding the smokeable product portfolio increased in Q2 2024 when compared to Q1 2024 on the volume and revenue front. On the bright side, the Company keeps on improving its margin

- As mentioned before, alternative products hold significant potential. However, there’s still much to be done before this potential can be properly realized. What’s concerning, MO has fallen behind its competitors when it comes to navigating the market shifts

- I don’t consider dividends to be endangered. MO remains capable of not only upholding but also growing its dividend payments

- I am not surprised by the business update coming from the Q2 2024 results release. I uphold my ‘hold’ status on MO as the valuation and the status of smoke-free product development don’t align from my perspective

- Despite its significantly higher valuation, I prefer to gradually build my position in PM, as PM conquers the ever-changing world. I am happy to hold my current stake in MO and consider adding upon more business development or seeing a more opportunistic valuation

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information, opinions, and thoughts included in this article do not constitute an investment recommendation or any form of investment advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.