Summary:

- Cigarette volumes keep declining, which is especially concerning given MO’s recent inability to offset the negative volume effect with pricing power.

- The Company tries navigating the market with alternative product categories, and there’s some positive news regarding that.

- However, the alternative product segments also face some headwinds (NJOY), or MO is yet to launch its first products (heated tobacco sticks).

- The dividends are not endangered.

- MO’s current valuation is given the state of a business doesn’t indicate a buying opportunity.

Arsgera

Investment thesis

To avoid any misunderstandings, let me start with this statement: I own a certain stake of shares in Altria Group (NYSE:MO). I don’t believe it’s a “sell” and I don’t intend to abandon my position. However, the current state of the business with the current valuation has put me on hold with any possible additions, as:

- The Company has recently been unable to offset the negative volume effect with its pricing effect within the core business

- Although there is some positive news regarding new product categories, the Company also faces some headwinds (discussed in the later sections) and the alternative segments still have a long way to go until they reach a significant share of MO’s revenue

MO’s strategy certainly has potential, but I need a little bit more movement in the business metrics before I feel comfortable with the current valuation. I intend to hold onto my stake of shares as I don’t consider the dividends endangered and possibly add once the valuation approaches certain levels (also discussed further). Therefore, that is a “hold” rating from me.

Introduction

As Benjamin Franklin once wrote:

in this world, nothing is certain except death and taxes

I believe adding another “certain” element to the list is fair – change. With the ever-changing economic and business landscape, there are naturally industries that are more or less susceptible to changes regarding:

- consumer preferences

- legislation

- technology

- demographics

- social norms

- etc.

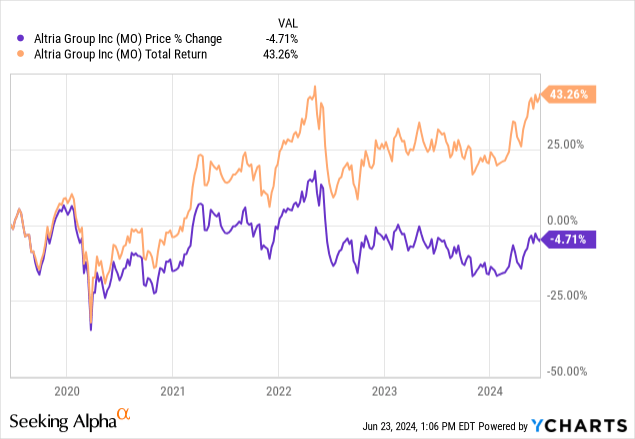

Altria Group operates within a broad tobacco industry that is accompanied by an advancing secular trend – a shift in social norms regarding smoking due to increasing health awareness, which resulted in a dynamic reduction of cigarette usage. Naturally, the above trend surrounds MO’s business and is a great concern for many investors especially considering that in 2023, MO’s pricing power wasn’t enough to offset the volume declines (we will discuss this in more detail in the later section). These headwinds have been responsible for MO’s stock price development over the past years, which has been relatively stagnant (which unsatisfied many investors). Nevertheless, Altria should be regarded as a “cash cow” for income-oriented investors who believe in its ability to navigate the changes occurring in the industry as the Company rewards its shareholders with high dividends and share repurchases.

With an attractive ~8.6% yielding dividend accompanied by unfavourable (business-wise) secular trends, there are some natural questions that may arise:

- Is the dividend well-covered?

- Is the Company capable of offsetting the volume declines?

- Is MO on the right track to navigate the market shift to other product segments?

- Is the current valuation attractive?

Let’s investigate – enjoy the read!

MO’s Pricing Power Is Not Enough To Offset Volume Declines Within Core Segment

Altria Group distinguishes three operating segments:

- Smokeable tobacco products, which include combustible cigarettes, cigars, and pipe tobacco

- Oral tobacco products

- Other (including, inter alia, NJOY)

The smokeable tobacco products remain at the core of MO’s operations as its share in revenue (net of excise taxes) in 2023 and Q1 2024 amounted to 87.2% and 86.3%, respectively. As I’ve mentioned earlier, MO has faced dynamic volume declines within this segment in recent years. During the 2019 – 2023 period (with 2018 as a base year) the shipment volume of smokeable products declined at a compound annual basis of 6.9%. While cigars shipment volume saw some growth at a CAGR of 2.1%, this operating segment is dominated by cigarettes (97.7% of total smokeable products shipment volume), which declined at a compound annual rate of 7.0% during the indicated period.

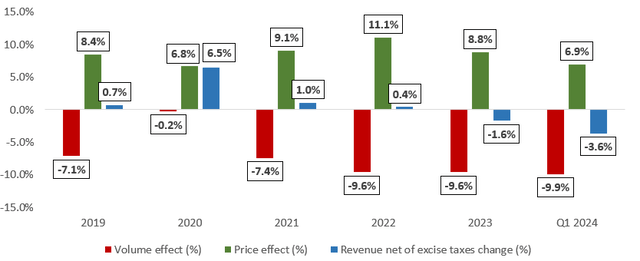

However, the Company managed to grow its smokeable-related revenue (net of excise taxes) at a modest but positive CAGR of 2.1% during the 2019 – 2022 period… until 2023, when the revenue (net of excise taxes) declined by 1.6%. The scale of the revenue decline went even further during Q1 2024 when the revenue fell by 3.6% on a year-over-year basis.

How did MO manage to keep growing this segment during the 2019 – 2022 period? It increased prices. What changed in 2023 or Q1 2024? Did the Company seize utilizing its pricing power? No, it just was not enough to uphold the revenue growth. To better present this matter, I’ve prepared a chart depicting the negative volume effect (marked red), positive price effect (marked green), and the net percentage revenue (net of excise taxes) change of the smokeable products segment. Please review it below.

Chart 1: Revenue net of excise taxes change – decomposition of smokeable products segment

Own compilation based on MO’s SEC filings

As indicated in the British American Tobacco’s (BTI) 2023 Annual Report (bolded bracket added):

In the U.S., industry volume declined 7.5% (comment regarding the combustible products), having declined 10% in 2022, largely driven by macro-economic pressures impacting consumer behaviour

Therefore, MO’s smokeable products’ volumes declined at a higher than the industry rate (9.6%) in 2023.

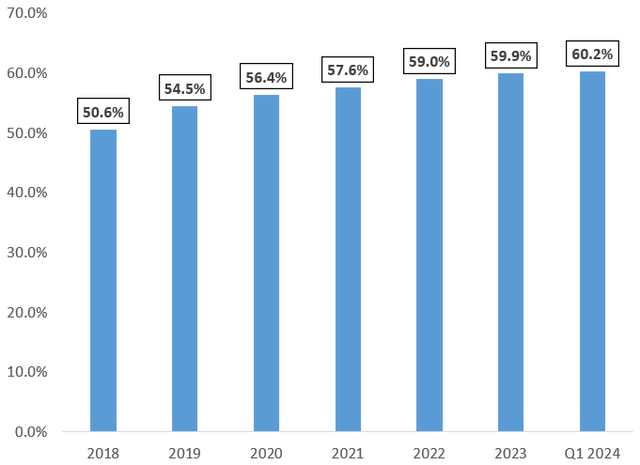

However, there is a positive aspect to MO’s leading segment and pricing policy. The Company has managed to grow its adjusted operating companies income (OCI) margin consecutively during the 2019 – Q1 2024 period, starting from 50.6% adj. OCI margin in 2018 to 59.9% and 60.2% during 2023 and Q1 2024, respectively. This is the crucial factor allowing MO not only to uphold but also to further grow its dividends.

Chart 2: Adj. OCI margin of the smokeable products segment

Own compilation based on MO’s SEC filings

Navigating The Market Shift

Oral tobacco products

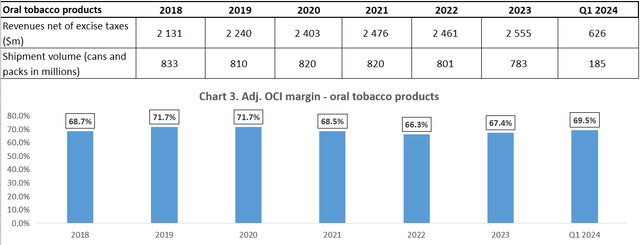

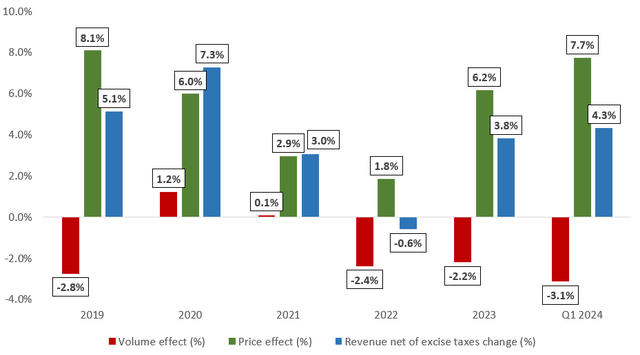

The share of oral tobacco products in the total revenue net of excise taxes amounted to 12.5% in 2023. During the 2019 – 2023 period, the Company grew the segment’s revenue with a CAGR of 3.7%; however, the shipment volume declined at a compound annual rate of 1.2%. The decline is related to the segment’s leading brands, Copenhagen and Skoal, which marked a revenue decline of 3.7% and 6.7% on a compound annual basis during the indicated period, respectively. However, other MO’s brand – on! keeps on growing its market share and shipment volume. Its shipment volume grew at a CAGR of 53.7% during the 2022 – 2023 period (with 2021 as a base year), and Q1 2024 brought a shipment volume increase of 32.1% year-over-year. During Q1 2024, on! reached 7.1% retail share (up 0.7% since Q1 2023). This brand should continue growing its market share as the Company has recently introduced a new retail program, which secured on! premium positioning within 80% of contracted stores. The sector has a relatively high profitability on an adj. OCI margin basis, which amounted to 67.4% and 69.5% during 2023 and Q1 2024, respectively.

Own compilation based on MO’s SEC filings

The Company upholds a substantial pricing power within the oral tobacco segment, which ensured revenue growth (net of excise taxes) during almost every year (excl. 2022) of the 2019 – 2023 period, despite generally negative volume effects (especially during the 2022 – Q1 2024 period). Please review the details on the chart below with analogous marking of data.

Chart 4: Revenue net of excise taxes change – decomposition of oral tobacco products segment

Own compilation based on MO’s SEC filings

Other initiatives – NJOY and heated tobacco

MO completed the acquisition of NJOY on June 1st, 2023. The Company sees great potential within its e-vapor business. As we are approaching the anniversary of NJOY acquisition, let’s recap the business developments discussed by the management during the previous Earnings Calls for Q4 2023 and Q1 2024. Altria’s actions within the e-vapor market were concentrated on:

- strengthening the NJOY supply chain

- introducing retail trade programs

- addressing the dynamic spread of illicit products

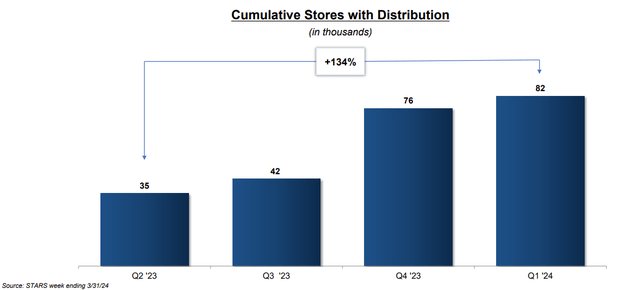

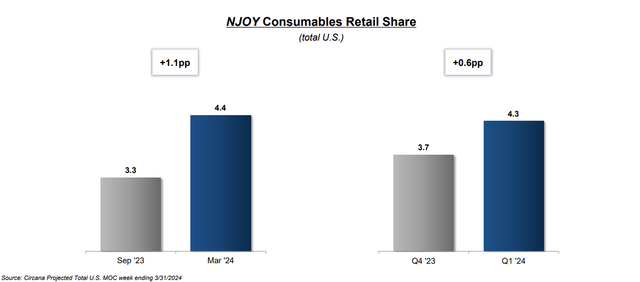

During Q4 2023, MO introduced the first retail trade program, which turned out to be successful as ~70% of stores have options that ensure a better positioning of NJOY, which should help its visibility and retail fixture space. Also, MO keeps on growing the distribution chain of NJOY – the Company has exceeded its target of 70 thousand stores at the end of 2023 and managed to grow the cumulative number of stores with distribution to ~82 thousand in Q1 2024. MO expects the store count to reach 100 thousand by the end of 2024. The Company also closed the inventory gaps in retail, which helped to establish NJOY for future growth and promotional activities.

MO’s Q1 2024 Investor Presentation

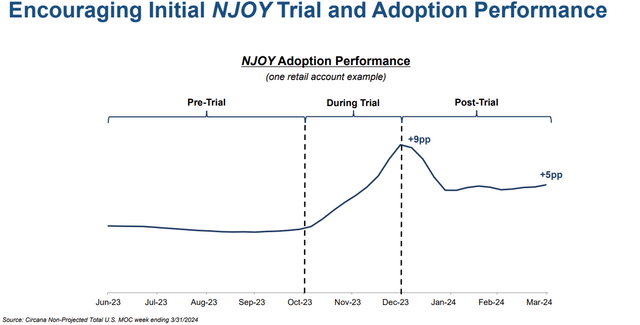

Regarding promotional activities, MO introduced expanded promotional offers in retail to attract consumers and generate the first trials of NJOY-branded products on a broader scale. The Company feels confident in NJOY’s quality and ability to grow into consumers’ awareness as MO saw early signs of such a phenomenon. As the Enterprise’s CEO, Billy Gifford explained with an example during the Q1 2024 Earnings Call:

Diving into one retail account example, share grew by over nine percentage points versus the pre-promotional period. In the first quarter, we reduced promotions in the account and NJOY retained over 50% of the share gain during the trial period, settling five percentage points higher than the pre-promotion period. We believe these results speak to NJOYs appeal once consumers try the product.

MO’s Q1 2024 Investor Presentation MO’s Q1 2024 Investor Presentation

However, the legitimate manufacturers operating within the e-vapor industry are facing headwinds as the market is flooded by illicit products. As the CEO explained during the Q4 2023 Earnings Call:

Looking more broadly at the e-vapor category, we continue to believe that the current state of the market is intolerable for both legitimate manufacturers and consumers. As I previously stated, the total nicotine space grew in 2023, largely because of illegal flavored disposable e-vapor products. These products are being distributed by companies violating virtually every rule and guidance the FDA has issued since 2016.

FDA intensified its actions in recent quarters as it issued 452 e-vapor-related import refusals (up 72.5% on a quarter-to-quarter basis). FDA also issued 60 and 48 civil monetary penalties for unauthorized e-vapor products in Q4 2023 and Q1 2024, respectively. While the numbers may seem promising at first sight, even the Company itself doesn’t consider the magnitude of this pushback against illicit products to be enough, as the CEO commented during the Q1 2024 Earnings Call:

While these actions represent signs of progress, we believe they are wholly inadequate. Illicit markets are a threat to public health, and we believe the FDA’s enforcement approach is not of the scale or scope needed to bring about fundamental change in the marketplace.

As a result, we identified to the agency specific steps we believe they can take to build a more effective compliance and enforcement program to address the illicit market, including imposing direct liability on the large manufacturers, importers, and distributors of illicit products, focusing on import prevention and clearing up widespread confusion in the marketplace about the FDA’s enforcement priorities.

Regarding the heated tobacco products, Altria fell behind its peers when it came to product development, as they already have strong brands operating within certain markets (as Statista summarized). Nevertheless, this segment may become one of the pillars of MO’s pathway in moving towards safer alternatives as the category is nonexistent in the US, however, the Company hasn’t launched its products yet. To quote the CEO’s comments regarding this product category from the Q4 2023 Earnings Call:

In heated tobacco, we believe our compelling portfolio of products will appeal to the millions of adult smokers seeking innovative and scalable alternatives to e-vapor products. We are continuing regulatory preparations to bring heated tobacco stick products to the U.S. market through Horizon, our joint venture with JT.

We remain on-track to follow-up PMTA for Ploom in the first half of 2025. And we are making continued progress on our heated tobacco capsule product SWIC. While we believe heated tobacco products can play an important role in achieving harm reduction, the category remains nonexistent in the United States.

Financial stance

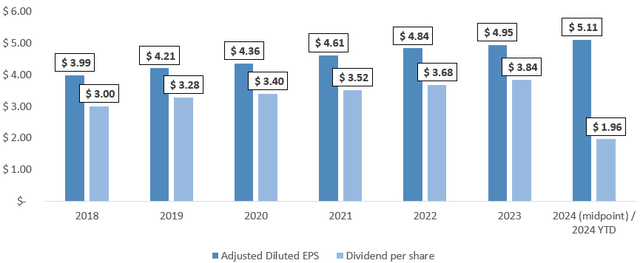

During the 2019 – 2023 period, MO delivered a solid adj. diluted EPS growth at a CAGR of 4.4%. At the same time, the dividend per share marked a CAGR of 5.1%. Its 2024 midpoint guidance assumes a 3.2% growth on a year-to-year basis and the Company upheld its quarterly dividend. I expect MO to grow the DPS in the next quarter as the Company intends to deliver mid-single-digit DPS growth on a compound annual basis through 2028. For details, please review the chart below.

Chart 5: Adj. diluted EPS and DPS of MO

Own compilation based on MO’s SEC filings

During Q1 2024, MO repaid its senior unsecured notes at maturity with a combined principal of $1121m, leaving its outstanding debt at $25.0b at the quarter’s end. As presented in the 10-k, the above repayment was the only debt maturing in 2024. Its debt-to-EBITDA ratio stood at 2.1x, which was in line with the Company’s mid-term goals to uphold this metric around the 2.0x level. MO’s credit ratings remain stable and range from BBB to A3 (depending on the agency). Given the high profitability of its business and solid balance sheet, I have no concerns about the upcoming dividends.

Risk Factors

Naturally, the most important risk factor surrounding MO’s business is the declining industry of smokeable products, especially given the limited ability of the Company to offset the negative volume effect with the price effect. A failure to successfully navigate the shift in consumer behaviour in the upcoming years could hurt MO’s financial performance and endanger its dividend payments.

Also, the industry is a highly regulated environment with many litigations, guidelines, and procedures involved. Moreover, upholding the high-interest rate environment could force MO to refinance or service debt at a higher cost.

Any other material adverse changes could hurt the Company’s fundamentals or lead to higher stock price volatility.

Valuation Outlook and The Bottom Line

As an M&A advisor, I usually rely on a multiple valuation method, which is a leading tool in transaction processes. This method allows for accessible and market-driven benchmarking. Numerous metrics are available for valuing a company, with EV/EBITDA being a rule of thumb for most sectors, especially mature ones. However, this method doesn’t just involve gathering the metrics. Understanding the business-related rationale for a given multiple is crucial. Without that, analyzing the market data is futile.

That said, the forward-looking EV/EBITDA stood at:

- 8.0x for MO

- 7.0x for BTI

- 13.0x for Philip Morris International (PM)

- 9.2x for Japan Tobacco (OTCPK:JAPAF)

Considering everything that was mentioned earlier, I believe that MO is fairly valued. We may still experience some multiple movements within the 7.0x – 8.5x range, and I’d be more likely to add more shares to my position in MO when its EV/EBITDA gets closer to the lower end of the indicated range.

To Summarize:

- The market trends continue to hurt MO’s core business segment, which is especially concerning regarding the recent inability to offset the negative volume effect with the positive pricing effect

- There is potential and there are some positive things happening in terms of alternative products such as on!, NJOY or heated tobacco products (still to be launched). However, investors have to remember that these segments still have a long way to go until they become significant in terms of revenue share and financial results

- I don’t consider dividends to be endangered. MO remains capable of not only upholding but also growing its dividend payments.

- Personally, I need to see more movement in the alternative product segments. NJOY and heated tobacco products seem to be promising. However, one is facing some market-related headwinds (illicit products), and the other has not yet been launched

- Therefore, I don’t consider the ~8.0x EV/EBITDA as a buying opportunity. I will consider adding more shares to my portfolio once the non-core business shows more colour or the valuation gets closer to the 7.0x EV/EBITDA.

That is a “hold” rating for me. Thanks for stopping by!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information, opinions, and thoughts included in this article do not constitute an investment recommendation or any form of investment advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.