Summary:

- I see Altria benefiting from the shift to smoke-free products as the NJOY and on! brands gain volume while cigarette sales fall.

- NJOY’s device shipments tripled in Q3 2024 with the FDA approving its menthol e-cigarettes, improving its market share to 6.2%.

- The proliferation of illicit e-vapor products and the ongoing patent fight with Juul pose significant risks to Altria’s market share and growth.

- Altria’s 7.57% forward dividend yield is very attractive for income investors; however, the stock trades at 10.9x sales, which doesn’t look particularly cheap.

- I maintain a cautious buy rating mainly due to the company’s smoke-free portfolio expansion and high dividend yield.

RyanJLane

Altria Group, Inc. (NYSE:MO) has seen its share price jump by more than 7% following the release of Q3 2024 earnings results.

The company is leaning into the growing trend toward smoke-free products as traditional cigarette volumes declined in the past quarter.

In my view, there’s a clear shift in consumer preference from traditional cigarettes to smoke-free products.

As a matter of fact, Altria’s smoke-free bands, NJOY and on!, have gained significant traction in the past quarter, with NJOY tripling its device shipments and capturing a larger market share.

Additionally, the FDA’s recent approval of NJOY’s menthol flavored e-cigarettes has improved its market position.

In this article, I will cover these, and more factors, that led to my buy rating. Additionally, I will discuss some risks that, I admit, make me sweat. This includes the ongoing patent fight with Juul, for which a decision is expected in December.

Expansion of smoke-free portfolio

There is no doubt there is a shift in consumer preference towards the so-called non-combustible products (in other words, vapes, nicotine pouches, and heated tobacco devices).

I covered the details of this shift in my British American Tobacco article.

Considering this shift, I was not surprised to see Altria’s volume growth in its NJOY e-vapor products and on! oral nicotine pouches.

As a matter of fact, Altria’s smokeable products segment experienced a 3.3% revenue decline in the nine months ending September 30. For the same period, its main brand, Marlboro, experienced a 9.4% volume decline.

A similar downtrend was visible in the combustibles segment of British American Tobacco. Therefore, I have a high conviction in the shift towards smoke-free products.

And I believe there is a high chance management has a similar conviction. They acquired NJOY, an American manufacturer of electronic cigarettes and vaping products, back in June 2023 for $2.9 billion.

This acquisition was slightly after NJOY achieved a significant milestone by obtaining FDA marketing authorizations for its NJOY ACE and NJOY DAILY products, making them among the first e-vapor products to receive this approval in the US.

More recently, in June this year, the FDA authorized four NJOY menthol-flavored e-cigarette products, marking them as the first non-tobacco flavored e-cigarettes to receive FDA marketing authorization.

In Q3 2024, NJOY reported a 15.6% YoY increase in consumables shipment volume and a tripling in device shipment volume to 1.1 million units.

Let this sink in. They sold 3x more devices in Q3 2024 than in the same period last year!

This growth has pushed NJOY’s retail share of consumables in the US multi-outlet and convenience channels to 6.2%, a 2.8 percentage point increase from the previous year.

However, there is a caveat.

In the last quarter, the company implemented retail promotions to increase the number of NJOY products sold. As a matter of fact, these promotions led to an 85% increase in volume during the promotional period.

Therefore, it all points out that the volume growth was not organic.

On the positive side, after the promotions ended, NJOY retained more than half of this increased volume, which I find quite impressive considering the proliferation of illicit disposable e-vapor products in the US; a topic I discuss in the next section.

Moving on, the on! nicotine pouch brand experienced a market share increase of 8.9% in Q3, a gain of 2.0 percentage points from the prior year. Additionally, the company reported a 40% YoY increase in repeat purchasers for on!.

As a matter of fact, repeat purchases accounted for over 80% of on!’s volume in Q3. I have to admit that I am very impressed with the high level of customer loyalty for this brand.

According to the latest 10-Q, oral nicotine pouches account for 43.9% of the US oral tobacco market, up from the previous year by 11.4 percentage points. This is yet another strong indication of the shift in consumer preference toward non-combustible products.

Crackdown On Illicit E-Vapor Products

One of the biggest challenges that Altria is facing is the proliferation of illegal e-vapor products imported from China in the US.

The FDA requires that e-cigarette products (this includes e-liquids, devices, and pods) undergo a so-called Premarket Tobacco Product Application (PMTA) process before they can be legally sold.

Illicit brands like Breeze Pro and Elf Bar sell these e-cigarettes in the US, representing over 30% of sales in stores. These products not only violate FDA regulations by not having a PMTA, but they also violate custom regulations.

Therefore, companies like Altria and British American Tobacco, which adhere to FDA regulations, have actively engaged in efforts to combat the proliferation of illegal e-cigarettes.

As a matter of fact, in October 2023, NJOY filed lawsuits against 34 manufacturers, distributors, and online retailers of illicit disposable e-vapor products.

Just a few months later, in January 2024, a US District Court in California dismissed most of these lawsuits. However, the case against IMiracle, the manufacturer of Elf Bar, is still ongoing.

Earlier in July, the FDA and CBP seized approximately three million units of unauthorized e-cigarette products coming from China, valued at an estimated $76 million. Additionally, the FDA issued warning letters to nine online retailers and one manufacturer for selling illicit e-cigarettes designed to resemble smart devices.

Finally, the last encouraging update I was able to find in regard to the crackdown on illicit e-vapor products in the US was the formation of a federal task force by the FDA and the Department of Justice.

This task force will use both criminal and civil actions, including prosecutions, seizures, and forfeitures, to address the sale of illegal e-cigarettes.

In my view, as authorities continue to crack down on illegal e-cigarettes, NJOY’s market share will expand.

Valuation

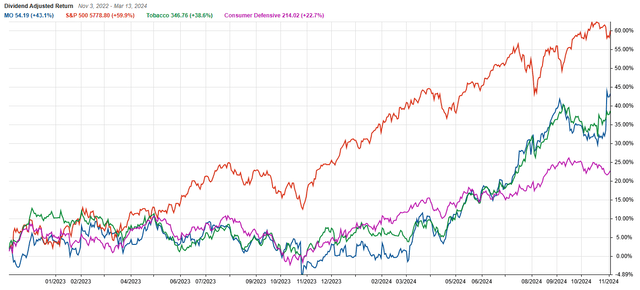

As seen in the chart below, the returns of the company are closely linked to the broader tobacco industry.

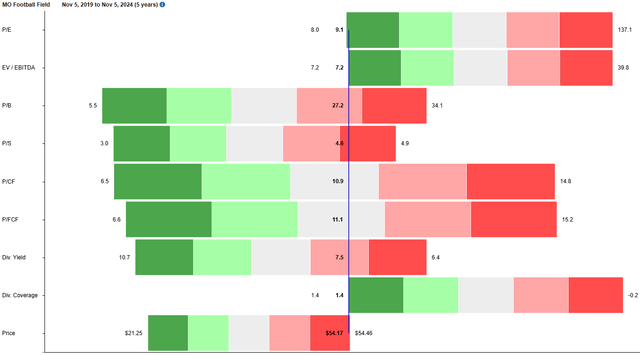

Considering the 7.8% increase in the share price after the release of Q3 earnings, most of the valuation ratios (particularly P/S and P/B) are trading close to the 5-year maximum.

To understand if the company is overvalued, I decided to compare it with its industry peers.

If we use P/S as the comparison metric, the company is the third most expensive in its group.

In my view, paying 10.9x sales is not cheap. However, when compared to Philip Morris, which is trading at 17.8x sales, Altria doesn’t look overvalued.

Additionally, one can’t overlook the high dividends that the company is paying. Its forward dividend yield is 7.57%, with a forward annual payout of $4.08.

To put things in perspective, their dividends are 150% above the consumer staples sector median.

Why I Can Be Wrong

As I already mentioned, the proliferation of illicit e-vapor products in the US is a key headwind to consider.

Despite the FDA and DOJ initiatives that I discussed above to crackdown on these illicit products, there is still a long journey ahead.

Altria estimates that the number of adult vapors using illicit disposable products has grown by 45% over the past year, reaching approximately 12.4 million users.

This issue not only cuts into NJOY’s market share but also affects the smokable products segment, as traditional smokers transition to unregulated disposable e-cigarettes.

In my view, this was the main driver behind the company’s 11.5% volume decline in combustible cigarette volumes.

Other risks that make me sweat include the patent infringement lawsuit with Juul.

Juul has claimed NJOY infringed on its patents, seeking an import ban on NJOY’s products. The International Trade Commission is expected to issue a final conclusion by December 2024, so I recommend keeping a close eye on the press release section of the company’s website.

Conclusion

To wrap up, I maintain a cautious buy rating for Altria, mainly due to its strategic expansion into the smoke-free portfolio and the high dividend payouts.

On the positive side, I am encouraged by the positive results in the NJOY brand, with device shipments tripling in Q3 2024 and a 15.6% rise in consumable volumes. I believe NJOY has a strong position in the market following the recent FDA approval for menthol e-cigarettes.

The on! nicotine pouch brand is showing strong customer loyalty, with repeat buyers accounting for over 80% of its Q3 sales and an increased market share of 8.9%.

However, there are some risks that make me sweat.

The main one is the ongoing flood of illegal e-vapor products, like the Elf Bar, eating into NJOY’s potential market share.

In my view, the impact of these illicit products could linger for at least a few more years, until the crackdown by the FDA and DOJ gains momentum.

Aside from that, the patent fight with Juul adds another layer of uncertainty until the expected decision in December 2024.

Therefore, after putting all these factors together, I maintain a cautious buy rating for this stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.