Summary:

- Recent marketing authorisation by the FDA for its NJOY vaping products gives hope that Altria might finally be able to transition to tobacco alternatives, where its lagging behind peers now.

- However, this can take its time. Even with far bigger rise in volume shipments for NJOY, the revenues could take a few years to make a meaningful revenue contribution.

- For now, the stock’s likely to be guided by its dividends, which look good even as MO’s price can see correction in the short-term.

krblokhin

Altria (NYSE:MO) might be the second biggest tobacco stock by market capitalisation, but it has woefully lagged behind peers ike Philip Morris (PM) and even British American Tobacco (NYSE:BTI) in the transition towards tobacco alternatives. There’s some hope for change now, though.

In late June, the company received marketing authorisation for its NJOY vape brand’s menthol products in the US. This resulted in an accelerated price rise for MO, by 12% since, which was supported by share repurchase worth 2.75% of the stock’s current market capitalization. For perspective, until then, its price had risen by 10% year-to-date (“YTD”).

However, here I argue that it’s quite likely that NJOY will take time to start making a meaningful contribution to revenues. In fact, there might be a short-term price correction for MO, though the stock still looks good because of its dividends.

NJOY’s negligible revenue impact..

MO’s price rise following the market authorisation from the US FDA was to be expected considering that the US is the biggest vape market in the world. It has projected revenues of $8.8 billion for 2024, which is 33% of global revenues. British American Tobacco, which too, received similar authorisations has seen a speedy price rise following the news.

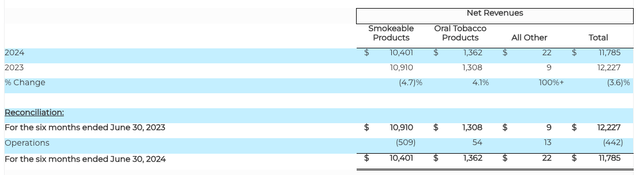

But a sentimental price impact is one thing, a financial impact quite another. Right now, Altria makes negligible revenues from tobacco alternatives. The table below shows a segment-wise break down of Altria’s net revenues in the first half of 2024 (H1 2024).

Smokeable products still bring in a bulk of the revenues, at over 88% of the total, at this time. Oral tobacco brought in some 11.6% while revenues from the ‘All other’ segment, that includes NJOY, were only 0.2% of the total.

Net revenues by segment, H1 2024 (Source: Altria)

…but progress is visible

That said, on its own the segment has made progress. The revenue from the ‘All other’ segment jumped by 2.4x YoY in H1 2024. NJOY’s shipment volume figures are encouraging too as evident from the following:

- Consumables’ shipment volumes was at 23.4 million units in H1 2024. This is a 1.8% increase from the June 1, 2023 (when the brand was acquired) to the end 2023 last year. Further assuming that last year’s shipment figures are equally split up over each of the months, sequential growth in H1 2024 from H2 2023 is a far bigger 18.7%.

- NJOY devices’ shipment volumes were at 2.8 million in H1 2024, an even bigger increase of 2.15x from June 1, 2023 to the end of the year. Making the same assumptions as for consumables on the monthly breakup of shipments, the sequential increase from H2 2024, is even bigger at 2.5x.

Can NJOY make a meaningful revenue contribution?

Whether this translates into revenue growth, however, remains to be seen. My estimates for potential revenues from NJOY for the remainder of the year show that that tobacco alternatives, defined as the ‘All other’ category in this case, are unlikely to see a significant rise in contribution to revenues.

To make these estimates, here I’ve assumed the following:

- The entire All other segment revenue is on NJOY’s account in H1 2024.

- For the sake of simplification, the revenue per unit is the same across consumables and devices. This results in a revenue per unit of $0.8 per unit in H1 2024.

- The sequential increase in volumes in H2 2024 is the same as in H1 2024.

The resulting revenue figure would then be at $29.2 million in the H2 2024. The full year revenue would come to $51.2 million. If Altria’s total net revenues come in at the average of analysts’ estimates on Seeking Alpha in 2024 of $20.4 billion, the share of the All other segment would rise to just 0.25%.

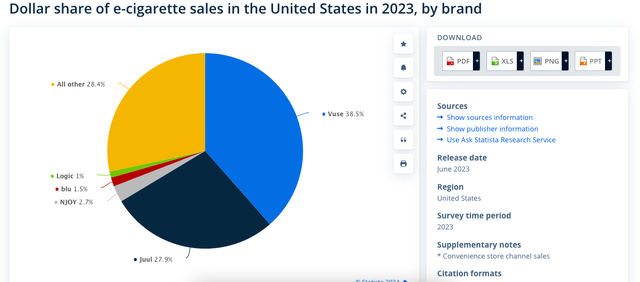

Put it another way, for NJOY to contribute to 1% of Altria’s net revenues in 2024, shipment volumes would have to see an 767% sequential rise in H2 2024. Even with the marketing authorisation in place, this looks doubtful, especially as NJOY faces competition in the US market from far more established brands like British American Tobacco’s Vuse and Juul, in which Altria earlier had a stake (see chart below).

Based on the present estimates and the market environment, it will take at least until 2026 before NJOY can contribute to at least 1% of the revenues. In other words, Altria is likely to continue lagging behind competition in its transition to tobacco alternatives.

EPS outlook and market multiples

Outside of the sentimental impact of NJOY related developments, though, this means that the price will be guided by the company’s performance for smokeable products, which bring in the earnings.

As far as these go, there is positive news on the earnings guidance. From the initial guidance range of $5-5.15 for the adjusted diluted earnings per share (“EPS”), the range has now been narrowed to $5.07-5.15. This puts the forward non-GAAP price-to-earnings (“P/E”) ratio at 10.1x, which is higher than the stock’s five-year average of 9.6x.

This indicates that the price can drop by 5% from the current levels. However, there are dividends to consider too, and in fact are the key investor draw for MO. The forward dividend yield is at 7.6%. There’s little risk to this projection as well, considering that the payout ratio is expected to be at 51% for 2024. This means that even after a price drop, investors can still see a net positive return of 2.5% in the foreseeable future.

What next?

The indicated net return might be positive, but it’s not compelling. At the same time, dividend investors are unlikely to be considering just returns for 2024. If Altria’s earnings’ compounded annual growth rate (“CAGR”) of 11.5% over the past five years continues into the future as well, its dividends can continue growing too. And purely from the passive returns perspective, this still makes it a Buy.

But for investors looking to make capital gains after MO’s recent rapid price rise, this isn’t the time. Especially not since NJOY’s revenue projections don’t show a convincing turn towards tobacco alternatives.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—