Summary:

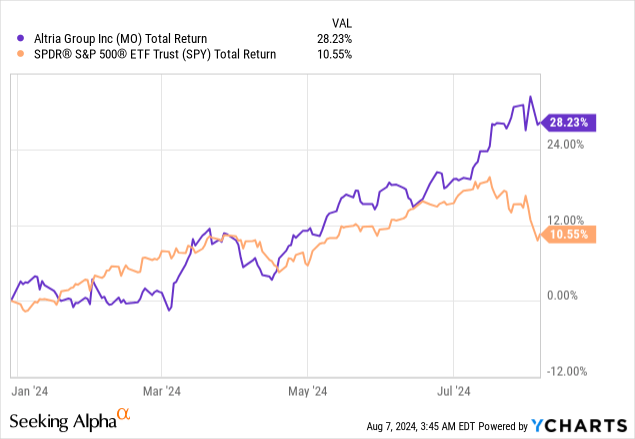

- Altria Group has outperformed the market with a 28.2% total return this year, despite missing the latest earnings estimates.

- While the firm’s smokable segment has not performed too well, the growth in the oral tobacco category and the firm’s new NJOY product category indicates meaningful growth potential.

- Using a dividend discount model, MO’s fair value is estimated well-above the current share price, indicating significant upside potential for investors.

- We assign MO a “buy” rating.

mariusFM77

Altria Group, Inc. (NYSE:MO), through its subsidiaries, manufactures and sells smokable and oral tobacco products in the United States. Its most iconic and recognisable brand is Marlboro.

Since the start of the year, MO has generated a total return of 28.2% for its shareholders, significantly outperforming the broader market, which has returned roughly 11% in the same period.

The aim of our article today is to assess whether there is any upside potential left after this price run up. To answer this question, we will first look at the key takeaways from the firm’s most recent quarterly earnings report, and then try to estimate MO’s fair value using a dividend discount model. To validate our evaluation, we will also take a look at a set of traditional price multiples.

Quarterly earnings

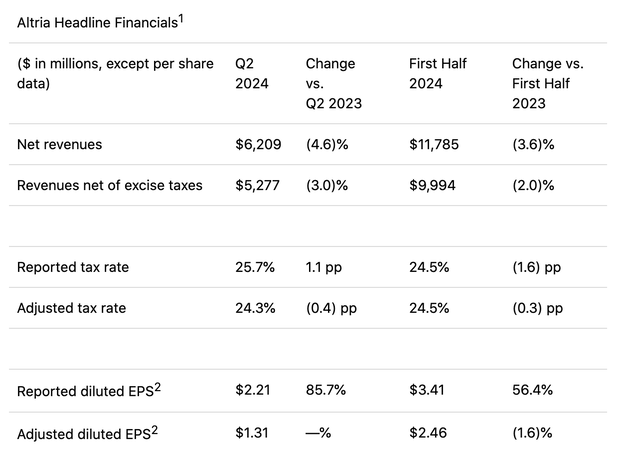

MO has missed analyst estimates, both top and bottom line, in the most recent quarter. Revenue came in at $5.28 billion, approximately 3% lower than in the prior year, and $115 million below analyst expectations. EPS totalled in $1.31 or $0.03 below what was initially forecasted.

To understand, however, what factors have been driving these sales dynamics, we have to understand the composition of the sales and the major segments of the business.

Smokable product segment

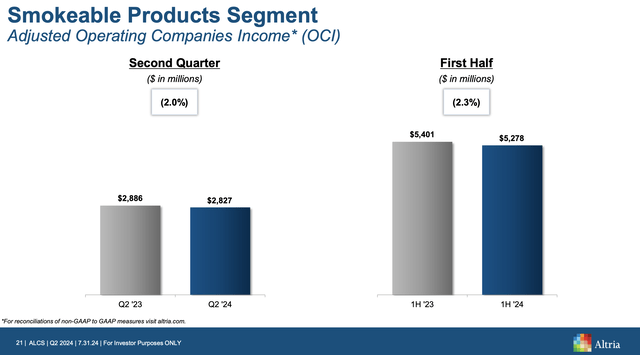

The smokable product segment is the segment where we see and expect the least growth going forward. This segment is all about traditional cigarettes.

We can see from the following slide that both in the previous quarter and also in the first half of 2024, operating income has been declining.

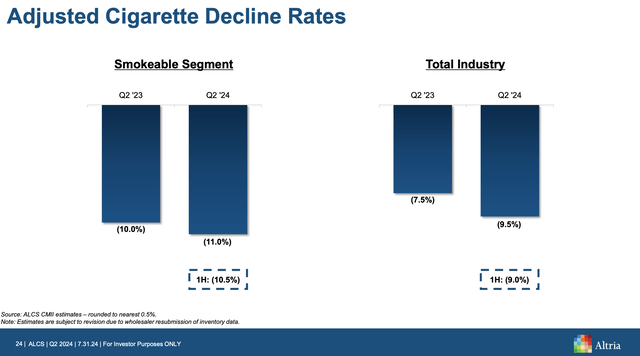

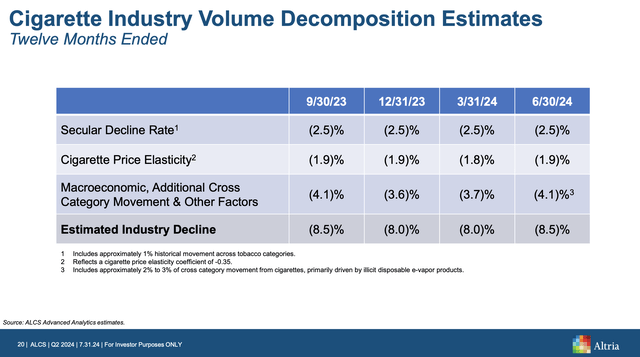

Obvious that this segment is not likely to be the growth story behind the company in the years to come. The decline of cigarettes, especially when we are talking about the smokable segment, has even accelerated compared to the prior year.

Decline rates (MO) Volume decomposition (MO)

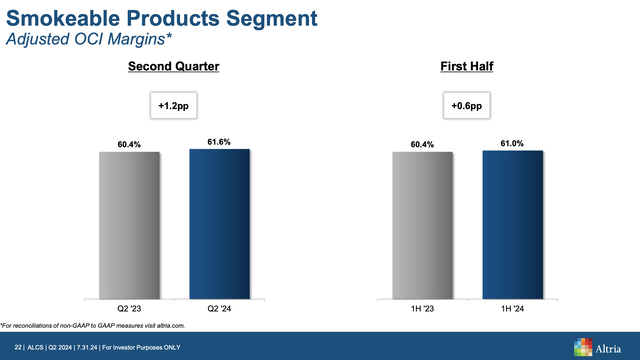

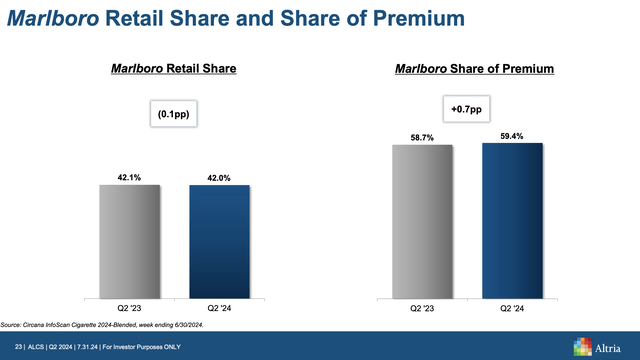

But, important to highlight that despite the lower operating income, the firm has managed to expand its margins and gain market share in the premium segment.

Margins (MO) Market share (MO)

Smoke-free products

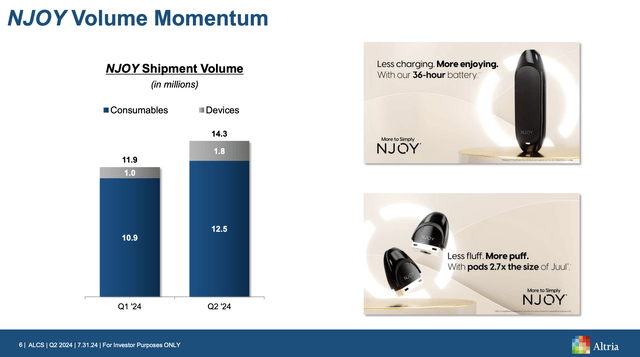

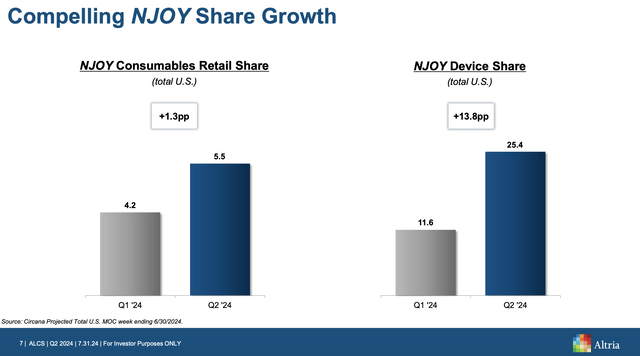

When talking about smoke-free products, we have to start our discussion with one of MO’s fast-growing products, the NJOY. MO has managed to grow the demand for this product significantly quarter over quarter. Both in terms of consumables and devices.

Not only the volume grew, but also the market share has expanded significantly. When talking about the devices, NJOY share in the United States has increased by 13.8pp QoQ.

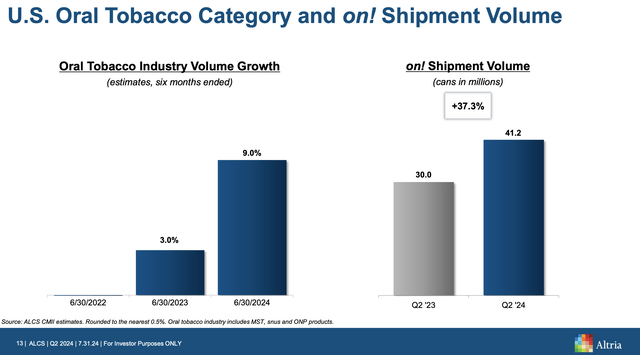

Another type of product category that is showing impressive growth is the oral tobacco category. The oral tobacco as an industry has grown rapidly over the past two years, and this growth has been benefitting MO’s on! products. Volumes have increased by more than 37% year over year.

All in all, we can clearly see that the tobacco industry is transforming. smokables are becoming less popular, and smoke-free products are starting to gain traction and are becoming more widely accepted. We believe that based on the latest quarterly figures, MO is successfully positioning itself for this transition, and it is poised for growth in the coming years. Despite the recent decline in revenue, we believe that the company can once again get on a growth trajectory, fuelled by its new and innovative products.

Valuation

MO got the attention of many investors primarily because of its exceptional dividend. The firm currently pays dividends quarterly, totalling in an annual payout of $3.92 a share – equivalent to a yield of about 8%. A yield of 8% is difficult to ignore. But there are three questions to ask at this point:

1.) Is the dividend sustainable?

2.) Is the dividend likely to grow and if yes, at what rate?

3.) Is it worth paying the current share price for this dividend/dividend growth?

So let us try to answer these questions one by one.

Dividend sustainability

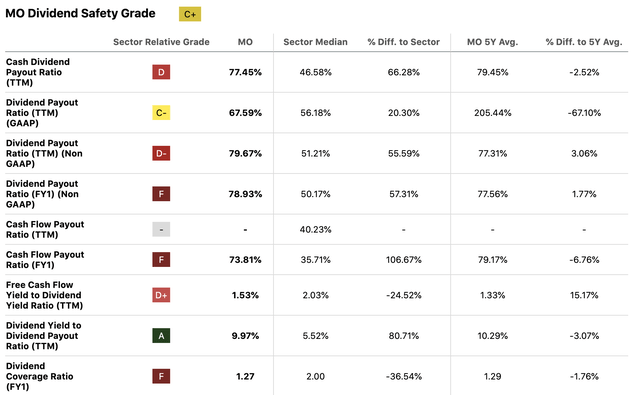

Based on various dividend payout ratios, MO’s current dividend appears to be safe and sustainable. While MO’s metrics may be higher than the consumer staples sector median, when comparing them to those of other firms in the tobacco industry, they appear to be normal.

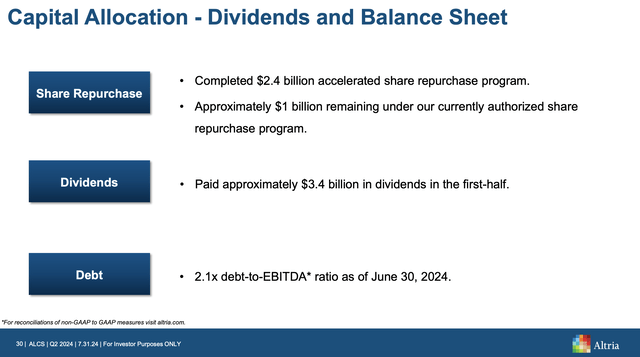

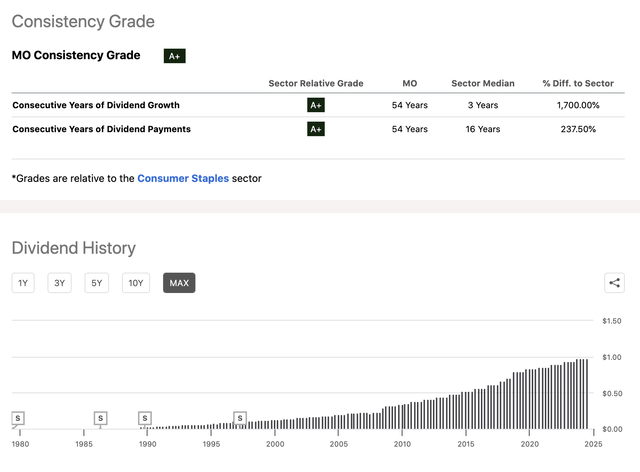

Further, from the latest earnings report, it is clear that MO is committed to return value to its shareholders both in the form of dividends and share buybacks. In fact, it is not only evident from the last quarter, but also from the last 54 years. MO has paid and increased its dividends each year in the last more than five decades.

Capital allocation (MO) Dividend growth (SA)

And this takes us to our next section: Dividend growth.

Dividend growth

To estimate the fair value of MO’s stock using a dividend discount model, we need to define two main parameters. Dividend growth rate and required rate of return.

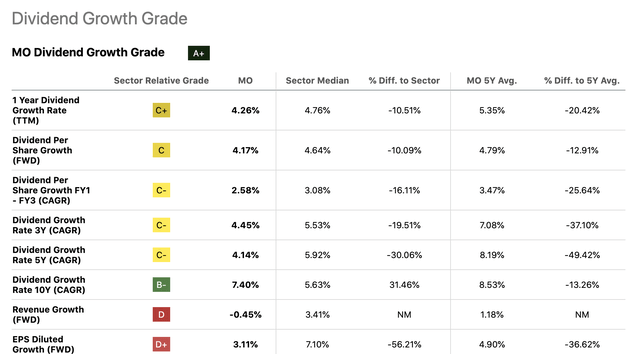

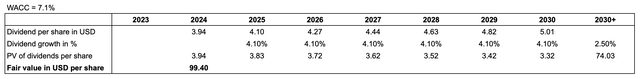

For such calculations, we normally like to assume the long term historic dividend rate of the firm. In MO’s case, this would be 7.4%. We, however, believe that assuming a dividend growth rate of 7.4% in perpetuity would be too aggressive an assumption and would result in an unrealistically high fair value. For this reason, we will choose the 5Y dividend growth rate of the company, which is 4.1% CAGR, until 2030, and use a perpetual growth rate of 2.5% beyond.

Dividend discount model

Now that we have assumed a dividend growth rate in perpetuity, we need to define a required rate of return in order to estimate MO’s fair value.

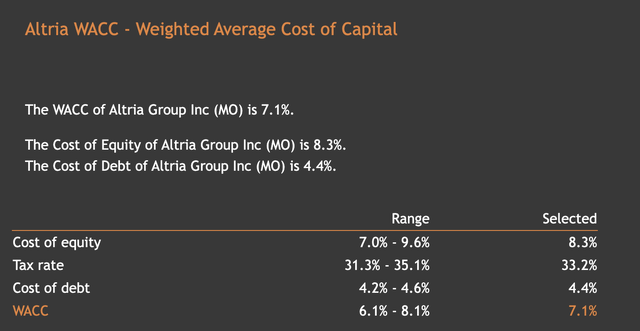

For the required rate of return, normally we like to use the firm’s weighted average cost of capital (WACC). According to the latest estimates, MO’s WACC is 7.1%.

Plugging these values into the dividend discount model, we get a fair value of $99 per share. This value is twice the current share price, indicating a significant upside.

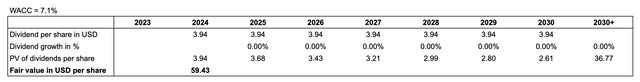

Now, some may say that due to the changing regulatory environment because of the changing smoking habits, and the changing perception of smoking, due to the need for continuous innovation to stay competitive, a dividend increase may not be warranted in the near term. But even if so, assuming a 0% dividend growth rate in our model still yields us a fair value, which is 20% higher than the current share price.

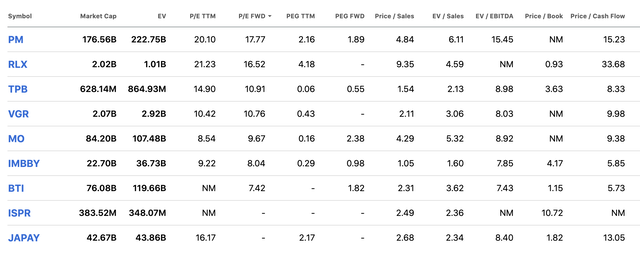

Looking at a set of traditional price multiples and comparing those within the tobacco industry also indicates that MO may be undervalued compared to the other firms.

All in all, based on our analysis, MO appears to be an attractive investment for dividend and dividend growth investors. Even when assuming no dividend growth, the upside still appears to be 20%. Based on other firms in the industry, the valuation multiples also suggest that a 20% expansion of the multiples may be realistic.

Conclusions

Despite missing analyst estimates, we believe that MO has delivered strong results in the smoke-free product categories. Both its NJOY brand and its oral tobacco products have been performing well.

The firm appears to be undervalued based on its dividends and also based on a set of traditional price multiples.

For these reasons, we believe that an investment in MO at the current price level could be attractive for dividend- and dividend growth investors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.