Summary:

- Altria has an impressively long and consistent dividend growth record.

- Altria’s stock price has been stagnant, but the company offers a high dividend yield for investors getting in at these levels.

- The company’s dividend growth has been consistent but low for the last couple of years with the coming August hike likely to end up at 4%, as usual.

- Investors should get paid handsomely by way of dividends while waiting for growth rates to pick up.

FotografiaBasica

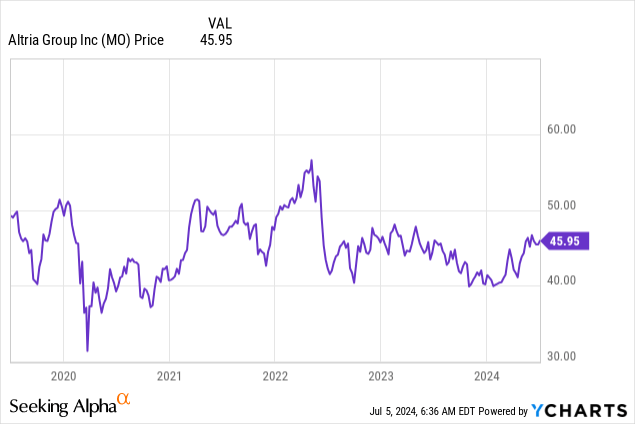

Altria Group, Inc. (NYSE:MO) was once known for both paying juicy dividends and robust growth — a killer combination for dividend growth investors. In recent years it has kept up the juicy dividends, but growth has been lacking, as evidenced by the static share price since my last article on the company.

The company now has several growth initiatives going on but the market is skeptical, which means the stock price is languishing and the dividend yield is almost up to double-digits. Investors in Altria therefore have an opportunity to buy one of the few dominant companies out there with a low P/E ratio, offering them a fat dividend while they wait for future growth projects to pay future dividends.

Did I say a static share price? Sure it moves up and down a bit, but five years ago it was almost exactly where it is today. Fortunately, investors have gotten an annual yield of 8-9% over the period which has made sure investors have gotten approximately long-term stock market returns after all.

Even so, long-time Altria investors remember the better days of old, when they could get double-digit stock returns in addition to a 4-5% dividend yield. That nice period peaked with the stock price reaching just above $77 back in the summer of 2017.

Historical Dividend Growth

If there’s one place Altria really excels, it is at consistent historical dividend growth. It has increased its dividend 58 times for 54 years running. It is pretty nice to know as an investor that your flow of dollars from this company is almost guaranteed to increase each and every year. Barring a few exceptional years, like the high inflation year of 2022, investors can be pretty comfortable that their purchasing power of the dividends coming from their investment will increase every year as well. Sounds like a stock made for retirees.

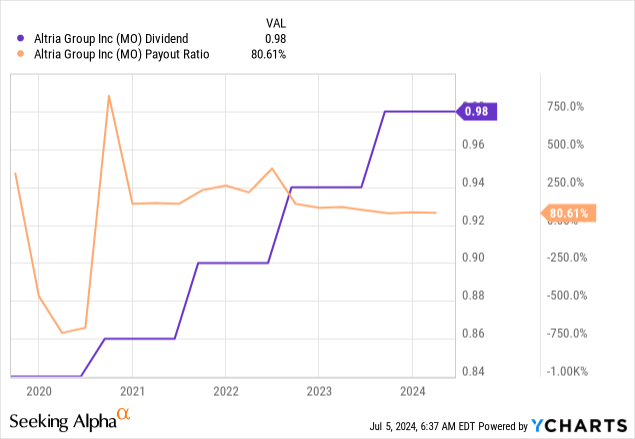

Looking at the chart we see that this Board has been pretty consistent. Except for the scary COVID-19 year of 2020, when the dividend was increased by $0.02, it has been consistently raised by $0.04 per share per quarter every year since. Consistency is nice, but of course, the same dollar amount each year means the percentage-wise growth will decrease.

Over the last five years, the dividend has increased from $0.80 to the current level of $0.98, which is an average annual growth rate of 4.1%. Last year the hike was 4.3%, down from 4.4% the year before. The historical rate of about 4% and the policy of paying out mid-single digits both point out a pretty clear expectation for investors going forward.

On a slightly fun note, for many years the Board targeted an 80% payout ratio, which we can see from the graph above they seldom reached. Now, though, when that policy is no longer in place, the company is pretty much right on the old target. Historically there have been a lot of one-off items for Altria, which has messed up reported earnings and thus the payout ratio. Going forward, things will hopefully be a bit more stable. The old catastrophes of JUUL and Cronos Group Inc. (CRON) are all but behind it and written down.

To sum up: The unadjusted payout ratio has been erratic while the dividend growth rate has been as consistent as can be.

August Dividend Hike

Long-time Altria investors know that August is the month they can look forward to the annual ritual of the dividend hike announcement. The only uncertainty is how much larger their dividend check will be. In order to increase the dividend, certain fundamentals should be in place. If earnings are not rising, dividends shouldn’t be rising either. So to that end, let’s look under the hood for a bit.

On the face of it, things were not looking too good in the press release accompanying the Q1 2024 report. Revenues were down and adjusted EPS was down. Combustible cigarette volumes fell by 10%, which is a steep enough decline that it could not be entirely offset by price increases. Oral tobacco revenue is increasing but with such a low base, it is not enough to take over the baton for the smokeable segment. Perhaps no wonder then, that it focused heavily on NJOY and oral tobacco in the Q1 presentation material. It seems more and more like they really need to get this to work, as the legacy business is deteriorating faster than before. That was the bad news.

The good news is that the sale of part of its holding in Anheuser-Busch InBev SA/NV (BUD) led directly to an accelerated share repurchase program of $2.4 billion, which is approximately 3% of its market capitalization. This can be expected to boost EPS by the same number. This has probably also helped to underpin management’s guidance of a full-year 2024 EPS growth of 2% to 4.5% for a mid-range EPS of $5.11. If it were to end up at the latter number, EPS would increase by 3.2% year-over-year.

As we have seen, the payout ratio is pretty much right at the old target of 80%. Even though it is not an official goal, I would expect the Board to not veer too much off from the 80% level, not least because it is fairly high and a prudent Board should make sure to stay comfortably below 100%. Still, there is some leeway to increase the ratio in any single year. One of the stated reasons for the new policy, with mid-single digit increases, was precisely to increase predictability for investors. A mechanical approach would most likely end up at the expected mid-range EPS growth of 3.2%. However, this is not exactly mid-single digits. On the upper side, a 5% increase would mean an increase even higher than the highest expected EPS growth rate. As it has not offered a 5% increase in a long time, I view it as improbable for the Board to go that far. My prediction is therefore for another $0.04 per share dividend hike this year, for a new quarterly dividend of $1.02.

Risk Factors

The most obvious risk factor is the precipitous decline in smokeable product volumes. As it wrote on page 5 of its press release, cigarette volumes were down a whopping 10%. This means the foundation onto which this company is built is evaporating quickly. One could hope — but it’s just a hope — that the volume decline will decelerate, but there is nothing to stop it from continuing at this pace. The company is certainly cognizant of this problem and has launched several initiatives into other product categories in order to build new platforms of growth. Time will tell whether or not that will be sufficient. Moving from a well-known business model into new products with new competitors also entails risks. Consumers might like some new upstart better, like JUUL some years ago.

Litigation is always a risk in this industry, the most recent high-profile case for Altria being the JUUL case. More cases should be expected in the future as competitors are vying for market share within vaping and other reduced-risk products. The last risk I would like to highlight is macroeconomics. Sooner or later, a recession will hit the U.S. economy and people might trade down to deep discount brands, which is not where Altria has the strongest position. Furthermore, total industry volumes might decline even faster than they have recently.

Current Valuation

Most people care about the price they pay for what they buy and stocks should be no different. To that end, let’s look at the valuation of Altria compared to two of its closest competitors. I’ve chosen the two other large companies which have parts of their operations in the U.S., British American Tobacco p.l.c. (BTI) and Imperial Brands PLC (OTCQX:IMBBY).

| Altria | British American | Imperial Brands | |

| Price/Sales | 3.8x | 2.1x | 1.8x |

| Price/Earnings | 9.0x | 7.6x | 9.0x |

| Yield | 8.5% | 11.7% | 7.1% |

Source: Seeking Alpha

I would say all of these companies are offering nice value, and in fact, I do own all of them. Imperial Brands is the cheapest in terms of Price/Sales with Altria the most expensive of the lot. Amazingly, all of them are selling for less than 10x earnings. Single-digit earnings multiples for solid, hugely profitable businesses that are still growing — that’s pretty rare to see in this market with a Shiller P/E ratio of 35.5x.

When it comes to the dividend yield, all of these are offering fat yields. I would say I am a little bit unsure if I fully trust the sourced numbers for British American and Imperial Brands as the latter seems a bit low and the former a bit high. It might have to do with how British companies often pay dividends, with two fairly big quarterly payments and two smaller quarterly payments. Annualizing the latest dividend would then not be the correct course of action. Anyway, the fact remains that the yields are high and for the company in focus — Altria — I know the yield is right. At this level, even 1.5% long-term EPS growth will yield you total returns into the double-digits. It would therefore take a lot for this investment to not make you money over time.

Fortunately, Wall Street analysts expect the company to produce an average long-term EPS growth of 3.8%, noticeably higher than those others at 1.5%. If we assume no change to the already low earnings multiple and add in the dividend yield of 8.5%, we arrive at an expected long-term total annual shareholder return of 12.3%. Remember that 69% of that expected return comes from the dividend — cash in hand. The downside here is thus severely limited. A high likelihood of beating the market’s long-term returns with most of that received by way of dividends — that’s a buy in my book. You could be paid handsomely and being compensated for inflation annually while you wait for future growth to pick up. Conservative dividend growth investors should definitely add some Altria to their portfolios.

Conclusion

Altria has a long and storied dividend growth track record, with its 59th dividend hike in 55 straight years likely soon coming up. The company has had several years of unimpressive dividend growth, but on the plus side, the current yield is almost up at double-digit levels. It has its well-publicized problems, but also several growth initiatives well underway. At current price levels, I believe investors will get paid handsomely while they are waiting for growth rates to pick up in the coming years. This company should sit well with conservative investors looking for current income as well as dividend growth investors looking to invest in a company priced at low expectations but with the potential to surprise positively in coming years.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO, BTI, IMBBY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.