Summary:

- MO’s stock has outperformed the wider market, while still offering a rich forward dividend yield of 8.99% compared to its peers and sector median.

- While MO’s execution in the Smokeable and Smoke-free segments has yet to impress, we believe that it is still early days in the game.

- If anything, NJOY has started to report growing retail share, with H2 ’24 likely to bring forth improved numbers as guided by the management.

- The growing popularity of PM’s Zyn may also spill over to MO’s on!, as more cigarette smokers transition to smoke-free tobacco offerings.

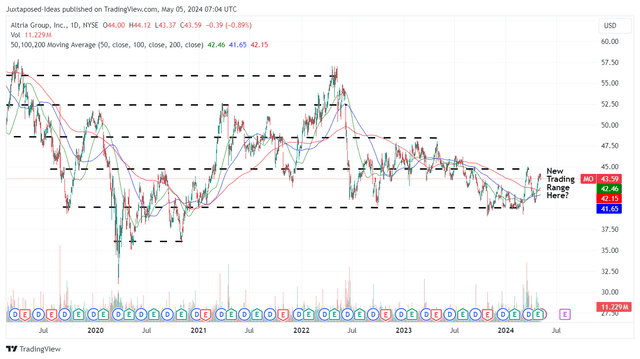

- Finally, MO’s established trading range of between $40s and $44s offers dividend-oriented investors with an improved margin of safety.

Guido Mieth

We previously covered Altria (NYSE:MO) in February 2024, discussing why we had maintained our Buy rating then, with the stock consistently supported at the $40s. At the same time, investors only needed to be patient as the NJOY acquisition was likely to bear results by H2’24.

Combined with the robust profitability and the management’s sustained share repurchases, we believed that the tobacco company’s dividends remained safe throughout the slow but sure transition.

Since then, MO has already recovered by +8.7%, well, outperforming the wider market at +2.6%. Despite so, we are maintaining our Buy rating here, due to its relatively rich forward dividend yields of +8.99% compared to the sector median of 2.69% and the 5Y historical mean of 5.07%.

Combined with NJOY’s growing retail share, the reiterated FY2024 profit guidance, and the established trading range at between $40 and $44, we believe that the stock remains a Buy for dividend oriented investors.

MO’s Investment Thesis Remains Compelling – Thanks To Its Secure Dividends

For now, MO has reported a mixed FQ1’24 earnings call, with overall net revenues of $4.71B (-6.1% QoQ/ -1% YoY) and adj EPS of $1.15 (-2.5% QoQ/ -2.5% YoY).

Most of the top/ bottom-line headwinds are attributed to the secular decline in the Smokeable segment, with a reduced volume of 16.86B sticks (-9.4% QoQ/ -9.8% YoY) and deteriorating market share of 46.4% (-0.4 points QoQ/ -0.6 YoY).

It is apparent from the Smokeable segment revenues of $4.9B (-7% QoQ/ -3.7% YoY) that there is a limit to how much the management has been able to raise prices before the volumes sold are adversely impacted at a time of elevated interest rate environment.

Combined with the minimal growth reported for the Oral Tobacco segment at $651M (-3.4% QoQ/ +3.6% YoY), it is apparent that MO has yet to successfully monetize its smoke-free segment.

The same has been observed in its new acquisition, NJOY, with 10.9M in FQ1’24 consumables shipment volume (-1.8% QoQ) and 1M in device shipment volume (+11.1% QoQ), with the lower consumable volumes implying slower ramp-up in consumer adoption.

Even so, the MO management continues to reiterate the FY2024 adj EPS guidance of $5.11 at the midpoint (+3.2% YoY) with most of its growth supposedly weighted in H2’24, with the assumption of “limited impact on combustible and e-vapor volumes from enforcement efforts in the illicit e-vapor market.”

Interestingly, there is a good chance that readers may see an upward adjustment in the tobacco company’s FY2024 profitability, since the regulators have finally started to crack down on the illicit e-vapor market while potentially penalizing sellers/ distributors, as reported here and here.

While the battle against illicit markets may be prolonged, we believe that this progress is worth celebrating with any illicit losses likely to trigger a volume growth for authorized e-cigarette products.

MO 5Y Stock Price

Trading View

For now, MO has also established a clear trading range of between $40s and $44s over the past six months, offering interested investors with the improved margin of safety.

At the same time, the stock continues to offer rich forward dividend yields of 8.99%, compared to the sector median of 2.69% and the 5Y historical mean of 5.07%.

Even when compared to the US Treasury Yields of between 4.50% and 5.39%, British American Tobacco p.l.c. (BTI) at 9.97%, and Philip Morris (PM) at 5.34%, it is apparent that MO continues to provide a robust dividend investment thesis.

Despite the secular decline observed in MO’s smokeable segment, the intensified new category investments, and the subsequent impact on its bottom-line, its dividends remain safe as implied by Seeking Alpha Quant at B-.

At the same time, thanks to the unlocking of value through the sales of Anheuser-Busch InBev SA/NV (BUD) shares, MO has retired 9M of its shares in FQ1’24 as part of the $2.4B accelerated repurchase program, with the management pledging another $1B through 2024.

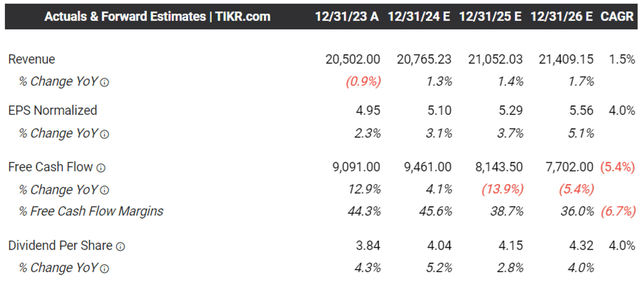

The Consensus Forward Estimates

Tikr Terminal

The same has also been observed in the promising consensus forward estimates, with MO expected to consistently generate robust Free Cash Flows through FY2026, allowing the management to consistently pay out !~$6.92B in annualized dividend obligations as of FQ1’24.

So, Is MO Stock A Buy, Sell, or Hold?

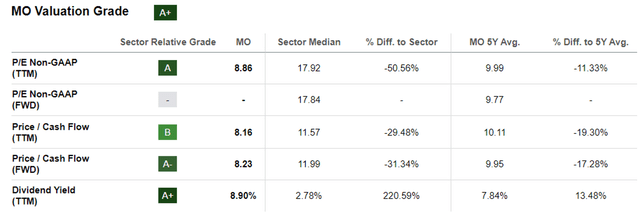

MO Valuations

Seeking Alpha

As a result of these factors, we believe that MO appears to be attractively discounted at FWD Price/ Cash Flow valuations of 8.23x, compared to its 1Y mean of 8.50x and its 3Y pre-pandemic mean of 16.40x.

The same discount may also be observed in BTI at 4.86x, with the outlier, PM at 14.87x, trading above the sector median of 11.99x.

As a result of these developments, we believe that MO remains a solid Buy for dividend oriented investors.

This is especially since we are starting to see promising results for NJOY, with it already commanding 4.3% of the US multi-outlet and convenience channels in Q1’24 (+0.6 points QoQ/ +1.6 YoY).

With MO also guiding the distribution of NJOY’s offerings in 100K stores by the end of 2024 (+33.3% YoY), up from the current 80K (+6.6% QoQ) in Q1’24, we believe that its future growth opportunities remain somewhat promising.

At the same time, PM’s nicotine pouches, Zyn, is increasingly popular with 145.7M in FQ1’24 shipment volume (+15.9% QoQ/ +79.2% YoY). In other words, MO’s nicotine pouches, on!, has a great potential for success, assuming that they are able to appeal to current cigarette smokers and other adult nicotine pouch users.

However, the MO investment thesis is not without risks as well, with PM set to launch the IQOS 3 in the US from May 2024 onwards, naturally intensifying the market competition for NJOY.

This is especially since PM is looking to “fine-tune its marketing approach in anticipation of at-scale launch of IQOS ILUMA, following authorization from the FDA,” speculatively in H2’25.

With IQOS ILUMA increasingly adopted in global markets while growing its market share, it goes without saying that MO investors need to monitor the management’s smoke-free execution closely moving forward.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.