Summary:

- Altria’s recent price divergence from the broader market is yet another demonstration of its hedging role.

- The role is very timely judging by the odds of a recession, its Q2 sales data, and the recent price elasticity data of its products.

- The combination of high yield and low P/E further enhances the potency of its hedging role.

peshkov

MO stock: a hedge against hard landing

I last analyzed Altria Group (NYSE:MO) in mid-July. As you can see from the screenshot below, I wrote an article titled “2 Misconceptions About Altria” on July 16, 2024, on MO stock. As the title suggests, the goal of the article was to clarify two common misconceptions surrounding the stock, and I argued why the stock’s upside potential is underestimated because of these misconceptions. More specifically, I explained why:

The bears’ argument regarding the declining cigarette volume only considers half of the equation and neglects MO’s pricing power. The bulls’ argument regarding the high dividend yield is incomplete. Total shareholder yield is what matters and includes cash dividends, buybacks, and debt paydowns. These misconceptions thus either exaggerated the risks or underestimated the return potential from the stock in my view.

Since then, there have been two key new developments surrounding the stock. First, the stock has released its 2024 Q2 earnings report (ER). The ER provided updated financial and key progress it has made in the past quarter. Secondly, there was a sizable change in the overall market price and sentiment. As seen, the overall market lost about 9% since then. To wit, the job report for 2024 July showed that the unemployment rate rose again and subsequently heightened the market’s fear of a hard landing and triggered a broad selloff. In contrast, MO’s price stayed quite robust during such a market panic (it actually advanced a bit since my last writing).

With these new developments, it is therefore the goal of this article to provide an updated analysis of the stock. In this follow-up article, I will switch my focus from the long-term view in my previous article and focus on the immediate term. In the remainder of this article, I will A) review the key catalysts and risks from its Q2 ER, and B) explain why the stock is a very timely hedge against a potential recession judging by sales data (especially Cigarette Price Elasticity data) of its recent products.

MO stock Q2 recap

Overall, the company reported a solid quarter in my view. EPS from Q2 (on a non-GAAP basis) dialed in at $1.31 and narrowly missed market expectations (by $0.03, or about 2%). Revenue totaled $5.28B and also narrowly missed market expectations (by $110M, or also about 2%). Looking ahead, the company narrowed its 2024 full-year guidance range. The updated guidance now points to an adjusted and diluted EPS between a range of $5.07 to $5.15. To better contextualize things, consensus expects an EPS of $5.10, and the updated range translates into an annual growth rate between 2.5% to 4.0% from a base of $4.95 in 2023. Looking further out, the market consensus also expects an annual growth rate in the lower single-digits for the next few years (more on this later).

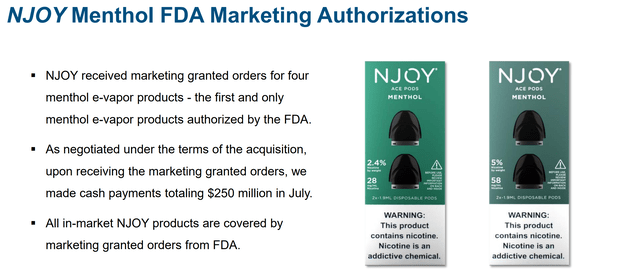

Diving into the numbers further, smokeable products kept their decline. Shipment volume declined 11.8% YOY. Better pricing partially offset the volume decline and segment revenues decline “only” 4% YOY. The impacts from the smokeable volume were further softened by the new products. In particular, the on! franchise was a key driver and maintained its growth momentum in Q2. Other key developments include the marketing authorizations NJOY received from the FDA (see the slide below). Four of MO’s NJOY e-vapor products are covered by the authorization (the first and only menthol e-vapor products authorized by the FDA), paying the way for further market penetration and growth.

Next, I will explain why these new developments are timely given the ongoing market turbulence.

MO stock Q2: Cigarette Price Elasticity in focus

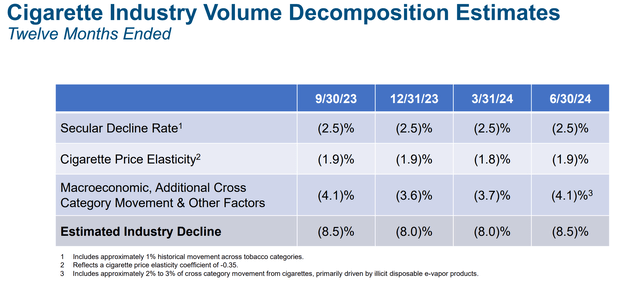

Thanks to the unique nature of MO’s products and the growth of its new categories, I expect the stock to show excellent resilience in the case of a hard landing. As a reflection of such resilience, the next chart below shows the recent data on the price elasticity of MO products (together with the secular decline rate caused by the smokeable products as aforementioned). As seen, the bad news, once again, was that the secular decline rate has been negative at around -2.5%. However, cigarette price elasticity ranged from -1.8% to -1.9% in recent quarters, indicating a small impact of price changes on consumption. If you read the footnote too, you would see the cigarette price elasticity coefficient is -0.35.

For readers new to the concept, the price elasticity (PE) of a product measures how sensitively the quantity demanded changes with respect to its price. The PE is negative for almost all products, as the demand always tends to fall for higher prices (and MO’s products are no exception here). The key lies in the RATE at which the demand falls.

Judging by its recent PE of -0.35 (which is far less than one in absolute value), MO’s products are very inelastic. In other words, changes in its price have a relatively small effect on the quantity demanded. Every 1% price increase only leads to about 0.35% decrease in quantity consumed, leading to excellent earning resilience despite the secular volume decline and also the potential of a recession.

Other risks and final thoughts

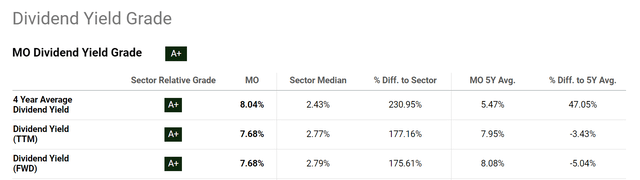

A discussion on MO won’t be complete without mentioning its dividend yield, which is another key upside risk and substantial downside protection in the case of a recession. To wit, the chart below shows MO’s dividend yield compared to its historical average and also sector median. As seen, MO has an overall A+ dividend yield grade, indicating an exceptionally attractive yield. Indeed, its current dividend yield (TTM) of 7.68% is very high either in absolute or relative terms. Moreover, the dividend yield still understates its attractiveness by ignoring share repurchases and debt paydowns (the focus of my last article).

The dividend is also more attractive than on the surface once growth is factored in. As aforementioned, its updated full-year 2024 guidance points to an annual growth rate between 2.5% to 4.0%. Looking further out, the market consensus expects a CAGR of 2.5% too for the next 5 years. A quintessential dividend stock like MO is the perfect place to apply the PEGY ratio in my mind for the following reasons Peter Lynch promoted:

For dividend stocks, Lynch uses a revised version of the PEG ratio – the PEGY ratio, which is defined as the P/E ratio divided by the sum of the earnings growth rate and dividend yield. The idea behind the PEGY is very simple and effective (most effective ideas are simple). If a stock pays out a large part of its earnings as dividends, then investors do not need a high growth rate to enjoy healthy returns. And vice versa. And similar to the PEG ratio, his preference is a PEGY ratio of 1x or below.

For MO, with an FY1 P/E of 10x, a dividend yield of 7.68%, and an expected growth of 2.5%, the PEGY ratio worked out to be 0.98x.

In terms of downside risks, two primary risks shared by MO and its peers include declining consumer demand for traditional tobacco products as already mentioned, and also regulatory changes. These risks have been a frequent topic of other SA articles. Given the near-term focus of this article, I will focus on an immediate risk. As MO reported its Q2 (see the slide below),

We are beginning to see increased illicit activity across multiple tobacco categories, including nicotine pouches and cigarettes. The FDA’s inaction, lack of enforcement and slow pace of smoke-free authorizations continue to enable bad actors, who are blatantly disregarding regulations.

Such illicit activities not only create risks of lost sales for MO, but also heighten the regulatory risks. Illicit products with inferior quality and health concerns could potentially cause reputation damage for ALL similar products – MO’s legit and approved products included – and invite increased regulatory scrutiny.

All told, my overall conclusion is that the upside risks far outweigh the downside risks given the progress the company reported in its Q2 and heightened downside risks in the broader equity market. In particular, MO offers a timely and effective hedge against a potential recession, judging by its Q2 sales and the price elasticity of its products. In addition, its high yield and low P/E further enhance the potency of its hedging role.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Envision Early Retirement to navigate such a turbulent market.

- Receive our best ideas, actionable and unambiguous, across multiple assets.

- Access our real-money portfolios, trade alerts, and transparent performance reporting.

- Use our proprietary allocation strategies to isolate and control risks.

We have helped our members beat S&P 500 with LOWER drawdowns despite the extreme volatilities in both the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too. You do not need to pay for the costly lessons from the market itself.