Summary:

- Altria Group, Inc.’s 2024 Q3 once again highlights its core strengths.

- Non-traditional segments beginning to show early signs of promise.

- MO stock still appears undervalued, with a multiple of 10 and a yield of 8%.

krblokhin

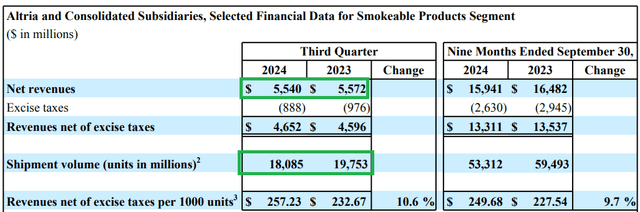

Altria Group, Inc. (NYSE:MO) has just released its FY 2024 Q3’s results as Seeking Alpha has covered here. While pre-market price action can be fickle, it looks like Altria investors are set for a day of treat instead of being tricked, as the stock is up more than 1% as of this writing. 1% may not seem like much until you factor in that the stock is up more than 25% YTD and many stocks recently have been punished despite a good earnings report.

My most recent coverage on Altria was more than two months ago, when I announced that I was trimming my position for portfolio reasons. In that article, I had cited three reasons (1) pricing power (2) operating discipline and (3) an increasing dividend as the cornerstones of my reasons to stay invested in Altria. Let’s evaluate the recent earnings report with an eye on the three reasons above and overall business health.

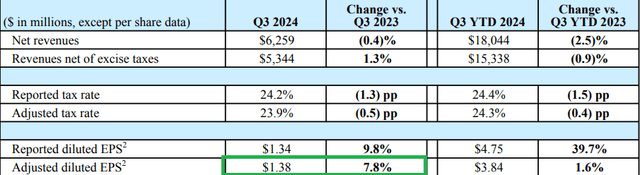

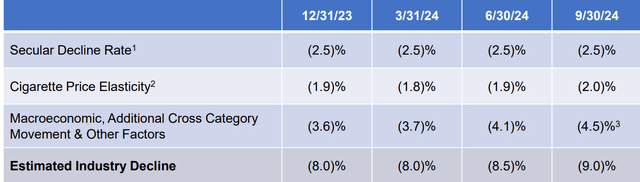

First up, even the most ardent Altria bulls like myself need to admit that the company is operating in a terminally declining industry. But as a testament to the company’s pricing power, Q3 once again proved that the pace of revenue decline lags way behind the volume decline. In Q3, shipment volume went down nearly 8.50% YoY, but net revenue went down by about 0.60% in the same period. The same trend can be observed for the first nine months of the year as well, where shipment volume went down more than 10% while revenue declined only by about 3%. So, it is quite obvious that Altria’s pricing power remains as strong as ever.

Volume Decline vs Revenue Decline (Altria.Com)

Next up, despite a slight dip in revenue, Altria’s EPS came in not only ahead of estimates but also ahead of 2023 Q3, by a handy margin. Increasing EPS YoY by nearly 8% with declining revenue only emphasizes Altria’s operating discipline, keeping cost of goods sold [COGS] as well as general expenses as low as possible.

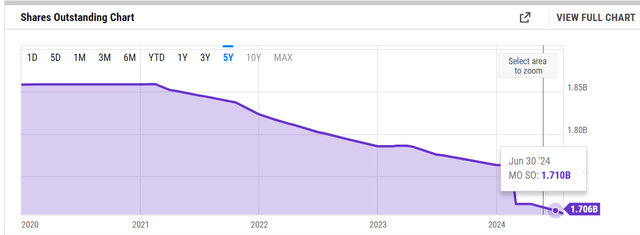

Last, but certainly not the least, Altria continues showering investors with both dividend increases and share repurchases. Readers may recall that the company’s accelerated share buyback program and, to the company’s credit, Altria’s share count has been gradually going down as shown below.

In the Q3 report, Altria indicated it repurchased 13.5 million shares, which should place the new shares outstanding at 1.69 billion. More significantly, the company plans to use the remaining $310 million in the buyback program by the end of 2024. The fact that Altria pays increasing dividends makes the impact of these buybacks more pronounced. For example, by retiring 13.5 million shares in Q3, the company saves $13.7 million each quarter until it (likely) increases dividends in the last quarter of 2025.

Altria Shares Outstanding (YCharts.com)

Overall, it is extremely fair and safe to say Altria’s Q3 has once again underlined the strength of my investment thesis in this stock. Let’s evaluate a few other positives and negatives from the report.

Positives

1. Altria reaffirmed its guidance for FY 2024, which at this point is just about Q4. Using the lower end of the guidance at $5.07/share, Altria’s stock is trading at a multiple of just 10, despite the 25% gain YTD. Add in the 8% yield, one can argue that the stock is still undervalued.

2. Altria announced a multiphase “Optimize & Accelerate” initiative as part of its Q3 report. Altria has used the buzz words, wait for it, Artificial Intelligence, for likely the first time in its history. Altria intends to use AI to optimize the company’s speed and efficiency. The initial cost savings from this initiative are expected to be at least $600 million.

3. After the company’s repeated e-cigarettes debacles, it is refreshing to see NJOY is settling in and bringing in some serious momentum with a 15% YoY increase in shipment volume.

Negatives

1. As stated earlier, volume decline is inevitable, but the percentage decline has at least flat lined. Even the strong Marlboro brand showed a 7.50% decline in Q3 YoY. Despite pricing power, at some point, customers may start feeling the pinch and hence it is imperative that Altria’s efforts in non-traditional products start showing more strength.

2. This is not directly related to Q3, but the stock seems to have lost a bit of momentum after reaching nearly $55. With political and economic uncertainties looming, no stock is a sure bet, not even one trading at a low multiple while yielding 8%. Does the pullback from the highs suggest that the stock is ready for a breather, or will the Q3 report be the spark the stock needed to resume its upward momentum? Let’s wait and see.

Conclusion

I’ve long stated that Altria sticks to what it does best and does that as best as possible. Q3 proved this is still the case but added intriguing AI possibilities into the mix. Could this be a case of tradition meeting modernism? I certainly hope (and believe) so, and retain my “Buy” rating on the stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.