Summary:

- Altria reported Q4 earnings in line with estimates, with revenue slightly missing expectations.

- The smokeless tobacco segment continues to show strong growth, offsetting the decline in traditional cigarettes.

- The acquisition of NJOY has been successful, with increased distribution and strong shipment volume, contributing to future growth.

- The substantial amount of share buybacks will likely continue to increase earnings and reward shareholders with increased dividends for the long term.

- The pending menthol ban by the Biden Administration will likely continue to place downward pressure on Altria and its peers for the foreseeable future.

http://www.fotogestoeber.de

Introduction

Altria (NYSE:MO) is a very popular stock here on Seeking Alpha and for good reason. The company is a Dividend King that pays a large chunk of its cash flow to investors in the form of dividends. And as you can tell by my handle, I love collecting them! I’ve written on Altria a few times and it’s currently the largest dividend payer in my portfolio. In this article I discuss their recent Q4 earnings, one thing in particular I was paying close attention to, and why the company will continue to reward its shareholders for the long-term.

Previous Thesis

I last covered MO back in October in an article titled: Why Altria Just Became My Second Largest Holding. After their Q3 earnings, the stock fell 7% hitting a new 52-week low. And guess what this guy did? I doubled down and added, making them my second largest holding. The company missed on both the top & bottom line. Furthermore, to no one’s surprise, the smoking segment continued to be in a secular decline. For me that was nothing new and didn’t deter me from buying the stock. I understand Altria may not be everyone’s stock of choice for dividends but I plan to continue buying for the foreseeable future. Let me tell you why.

Q4 Earnings

Altria reported their Q4 earnings last week to wrap up the fiscal year and the company did what they normally do. Earnings per share of $1.18 was in-line with estimates while revenue of $5.02 billion missed by $60 million. Again, nothing spectacular, but MO investors probably expected something along those lines.

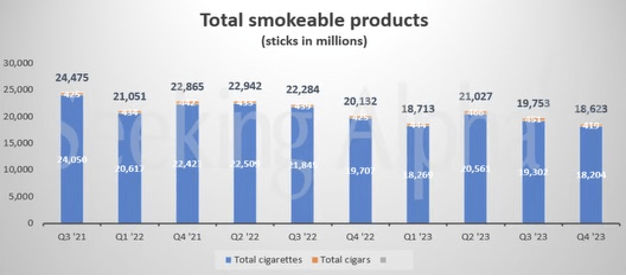

For what seems like forever, the smokeable products segment has continued on a secular decline. Again, this was no surprise to me. Industry cigarette volumes declined by an estimated 8% due to the historical downward slope and the growth of illicit vapor products, a battle that Altria has continuously battled.

Seeking Alpha

The Smokeless Segment Is Doing Just Fine

Despite the smokable products secular decline, the oral tobacco category continues to show strong growth with an estimated 7.5% growth in oral tobacco volumes in the U.S. in the past six months.

Pouches grew 11.8 share points year-over-year. On! saw some of this strong category growth as shipment volumes skyrocketed 33% in Q4 and 39% for the full-year. This strong growth led to the company introducing two new flavors which will likely continue to see some solid growth in the coming quarters.

Helix also continued its focus on volume growth during the quarter, which improved profitability. Orange retail price increased 47% vs a year ago and they also managed to grow their retail share by 1.1 percentage points. So, despite the secular decline in traditional cigarettes, the smokeless tobacco segment continues to show strong growth. Furthermore, the company remains on track for their Ploom launch next year.

NJOY’ing The Turnaround

Since Altria announced the acquisition of NJOY last year, I was optimistic about the deal. I even penned an article last August titled:

(E)NJOY The Turnaround Story. I’ll admit I find great value in companies attempting to transition or reinvent their business model for growth. One turnaround story I liked was Walgreens (WBA). But that didn’t pan out too well for the retailer, leading me to sell my position.

During Q3, Altria’s management said they planned to distribute NJOY to 70,000 stores by the end of the year. But they only made it to 43,000 (by the end of Q3), so this was the main thing I was keeping a close eye on. I’ll admit if the company had disappointed and missed their estimates by a sizable margin, I would have considered selling my position.

But the company outdid itself pushing NJOY in 75k stores, further strengthening NJOY’s supply chain. Their shipment volume for the quarter was 11 million units with 23 million to date. Their retail share also increased 0.6% which I think is tremendous for MO. These stores now represent 75% for e-vapor volume and 55% of cigarette volume sold in the U.S. multi-outlet & convenience store channel.

They also introduced NJOY’s first retail trade program which will help the e-vapor company grow even further. The company also touched on submitting a PMTA for NJOY’s age-restricted Bluetooth device with non-tobacco flavors in the first half of the year.

I touched on this in the comments section in a prior article and many readers weren’t familiar with the move. This is huge for the company if this comes to fruition. The device is projected to stop underage users from unlocking the device and using it, which I think is great for the e-vapor company. This could be a game changer as federal, state and local governments look for ways to prevent underage usage.

Why The Dividend Is Secure And Will Continue To Grow

Unlike last quarter when the stock declined after earnings, Q4 (earnings) caused the stock to rise. One reason was the $1 billion buyback program the company announced. MO has been an avid repurchaser of its shares and I don’t see this slowing down any time soon. This also helps fuel future dividend growth as the company frees up cash flow by taking shares off the market.

During Q4 they repurchased 6.5 million shares at an average price of $41 and (repurchased) 22.7 million shares for the full-year. This will also increase earnings per share going forward. Especially if the share price remains suppressed or they experience some volatility for some unseen reason.

Some may wonder with the secular decline in the smokeable segment, how can Altria sustain its dividend for much longer? They can only raise the prices of their cigarettes for so long, right?

That is true, but the frequent buybacks the company does allows them to continue paying a large yield. With this over 9% currently, that’s $90 million yearly the company is saving in cash flow. And this cost savings frees up cash flow for them to either continue raising the dividend or reinvest back into the business. So, as the company continues to buy back shares, the dividend will continue to be safe & sound for the foreseeable future.

Valuation

Since the brief dip back in October, the share price has traded between $40- $42 a share. But as inflation eases and rates come down in the near future, I suspect the share price may rise. The strong growth of On! and NJOY will also help the share price move upward if the company sustains its growth trajectory and increase NJOY market share going forward.

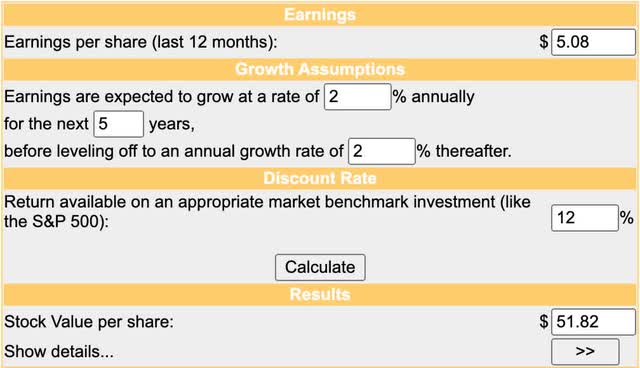

Using the Discounted Cash Flow Model (DCF) and the mid-range of management’s full-year guidance, the stock offers roughly 25% upside to its price target of $51.82. The 9% dividend yield along with their double-digit upside makes Altria a compelling buy currently.

And with the strong growth of NJOY and On!, I think Altria may get back to the once beloved stock it once was. Quant also gives MO a valuation grade of A, further signaling the stock is undervalued and an attractive buy here.

Risk Factors

As a cigarette company, Altria faces several risks. A recession which many say is still coming could cause tighter consumer spending as job losses rise and discretionary income face downward pressure. The continued secular decline in the smokeable segment is still a risk as well.

Although the business is inelastic, the company can only continue raising the prices of its products for so long before consumers move onto cheaper alternatives. Lawsuits and the pending menthol ban is still something that continues to plague the industry. But the Biden Administration delayed the ban until March of this year, giving the company more time to formulate a strategy for the pending menthol ban. If this goes through, it will likely cause Altria and several of its peers’ share prices to fall in the process.

Bottom Line

Altria recently showed during their Q4 earnings why the NJOY acquisition has so far turned out to be a great move in the transition away from smokeable products. The growth in On! and the distribution of NJOY products will only help the company if they can continue capturing market share, which I suspect they will do going forward.

Furthermore, the company announced an additional buyback program for $1 billion showing that they are committed to rewarding its shareholders with huge dividend increases for the foreseeable future. They also offer double-digit upside to their price target of nearly $52 a share. With the potential for capital appreciation, 9% dividend yield, and strong transition into the smokeless segment with NJOY’s strong distribution numbers, Altria remains a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.