Summary:

- During Q3 earnings, Altria showed strong price appreciation thanks to continued growth in NJOY and on!.

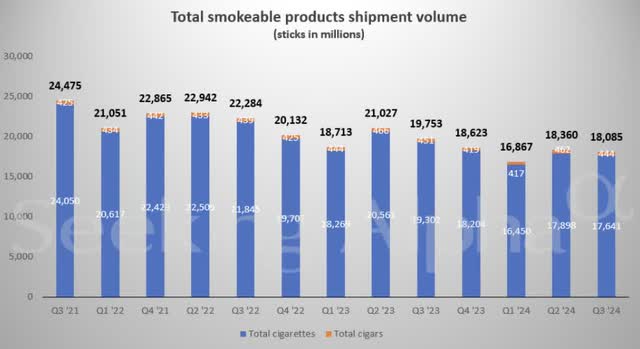

- Smokeable products continued to see lower volumes due to consumers becoming more health conscious, which will continue to be a risk for the company going forward.

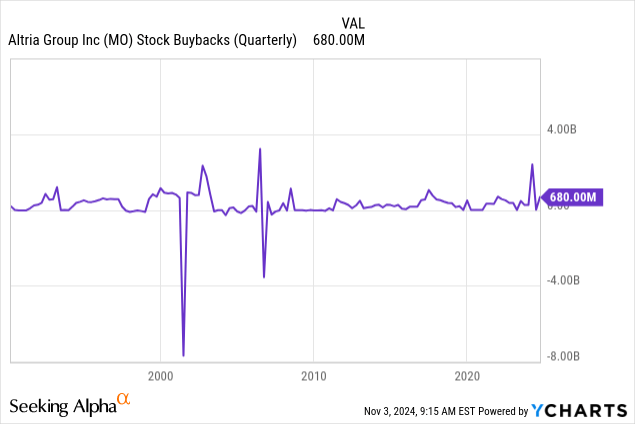

- Altria was able to offset this with accelerated buybacks, significantly higher than the previous year’s quarter.

- Altria also expects to implement a cost savings plan which is anticipated to save the company $600 million over the next 5 years.

- This, along with their balance sheet and frequent share buybacks, will likely allow the company to continue increasing the dividend for the medium term at least.

Bambu Productions

Introduction

Altria (NYSE:MO), one of the most prominent dividend payers, recently announced their third quarter earnings that saw the company deliver a strong quarter, opposite to their previous, which I’ll touch more on later in the article.

Although their headwinds still persist, particularly in their smokeable products segment, MO continues to operate strategically to continue delivering strong dividend growth to its shareholders.

In this article I discuss the company’s recent earnings, NJOY acquisition update, and why investors should sit back and enjoy the dividends that are likely to continue for the foreseeable future.

Previous Thesis

I last covered Altria this past August in an article titled: Executing Beautifully On Its NJOY Acquisition. Fast-forward to the third quarter, and NJOY is continuing to be a strong growth driver for the company. As a result, the stock is up more than 4.5% at the time of writing, outpacing the S&P who is up slightly over 2%.

During the second quarter, Altria missed analysts’ estimates on both their top and bottom lines. EPS came in at $1.31 while revenue amounted to $5.28 billion, misses of $0.03 and $110 million, respectively. However, the smoke behemoth’s share price reacted positively as NJOY showed solid promise.

This was because management was able to triple NJOY’s footprint with shipment volumes of 12.5 million units during the quarter and 23.4 million through 2 quarters. Device shipment volumes were also solid totaling 2.81 million over the same period.

Strong NJOY & on! Growth Continues

In their latest Q3 earnings, NJOY continued to be a strong growth driver for the company. Altria managed to do a reversal from the previous quarter with a beat on both their top and bottom lines. EPS of $1.38 beat estimates by $0.03 while revenue of $5.34 billion beat by $10 million.

Both were also up solidly from the previous quarter’s $1.31 and revenue of $5.28 billion. Year-over-year EPS saw growth in the high single-digits at 7.8% while revenue grew 1.1% on an annualized basis. This was in comparison to peer Philip Morris (PM) who saw growth of 14.37% in EPS and 8.4% growth in revenue year-over-year.

|

Q3’24 |

Q3’23 |

|

|

MO |

$1.38 |

$1.31 |

|

$5.34B |

$5.28B |

|

|

PM |

$1.91 |

$1.67 |

|

$9.91B |

$9.14B |

This was likely due to the Altria’s frequent buybacks, which has successfully offset the sizable decline in traditional smoking. The company’s pricing power has also played a significant role as they are able to increase prices due to their product inelasticity.

As a result, management reaffirmed their 2024 EPS guidance of $5.07 – $5.15, a growth rate of 2.5% – 4% and 3.2% at midpoint from $4.95 in 2023. For those who may not remember, MO’s Q3 last year was not as strong, forcing management to narrow full-year guidance to $4.91 – $4.98, representing a growth rate of just 1.5% to 3% from EPS of $4.84 the year prior.

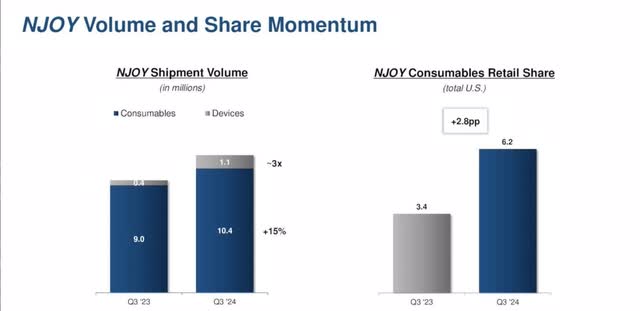

During the quarter shipment volume for NJOY grew double-digits by 15% to 10.4 million units. Device shipment volume nearly 3x’ed from the year prior to 1.1 million units. They were also able to increase market share to 6.2 share points, up 2.8 share points year-over-year.

As mentioned previously in my prior Altria article, I was excited to now see NJOY in convenience stores. I’ve never been a smoker but decided to buy one from a friend who vapes.

After months, he finally provided feedback. Although he liked the design, he wasn’t fond of the strength. He also stated the menthol flavor or taste was minimal, and he didn’t like the fact the pods were separate from the device. He compared it to someone being a regular smoker of Marlboro’s and switching to Marlboro Lights, now known as Marlboro Gold.

From my observation, most vapes come in one piece. So, is this something Altria could change with the device in the future? If so, it could result in further retail share growth.

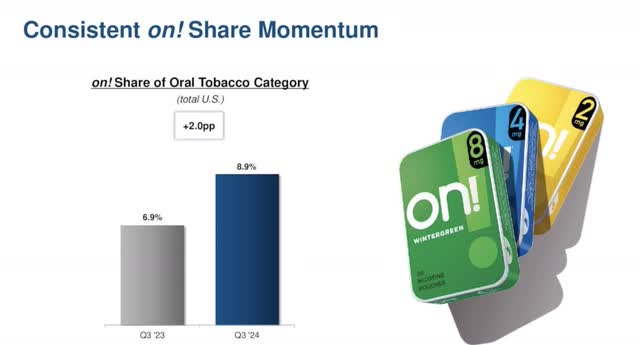

On! also continued its strong momentum, growing its share of the oral tobacco category to 8.9%. This stood at 6.9% in Q3’23. So, strong growth in both products continue to be drivers for Altria, and this will likely continue into the foreseeable future.

Risks & Challenges

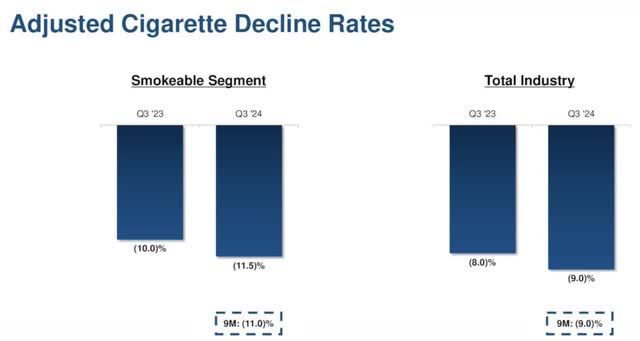

Headwinds from the decline in smokeable products continue to plague the company due to lower volumes. During Q3, this declined 8.6% and 10.6% through 3 quarters. However, the decline during the quarter was lower than the previous year’s quarter that saw a decline of 11.6%.

Through the first 9 months, however, this ticked up slightly from 10.5%. And while Altria continues to offset this successfully with product price increases and share repurchases, this will continue to be a headwind for the company as consumers are seemingly more health conscious.

There’s also the lawsuit against the company regarding patent infringement from JUUL against NJOY which will likely present a compelling challenge going forward. Similarly, MO filed a patent infringement against JUUL as a counter.

This past August a judge sided with JUUL and extended her review of NJOY’s case against JUUL to December 6, 2024. The U.S. International Trade Commission also granted an initial review and is scheduled to issue a decision in the case against NJOY next April.

Buybacks, Dividends, & Cost Savings

As previously mentioned, Altria continues to offset this with their frequent buybacks. In Q3, management repurchased 13.5 million of its shares for a total of $680 million. This was significantly higher than the previous year’s quarter that saw them buyback 5.9 million shares for $260 million.

Moreover, these accelerated buybacks will not only likely drive earnings and free cash flow growth, but this will also allow the company to continue its dividend streak of more than 55 years, ultimately positively impacting their share price in the future. Additionally, Altria had $310 million remaining on their current program, which they expect to complete by the end of this year.

This past August management increased their dividend by $0.04 to $1.02, further solidifying their expectations and confidence in their earnings and cash flow growth in the coming years.

And while share repurchases are a huge part of this, management also announced a plan to save at least $600 million in costs over the next 5 years.

This is a result of streamlining processes as well as leveraging artificial intelligence. This is something great to see and will also ensure the dividend will likely remain safe and grow moving forward.

Balance Sheet Enhances Dividend Safety

Altria’s balance sheet was also solid with well-staggered debt in the coming years. Aside from 2025, when the company has some debt due, their next maturity isn’t until 2027. But their liquidity was solid with no balance on their $3 billion revolving credit facility and $1.9 billion in cash.

At quarter’s end MO’s long-term debt stood $23.5 billion with a net debt to adjusted EBITDA of 2.1x, flat from the previous year’s quarter, and in-line with management’s target of 2.0x.

This was in comparison to peer Philip Morris who had a ratio of 3.0x and long-term debt of $44.2 billion. Moreover, PM plans to deleverage towards a 2.0x target by the end of 2026.

Long-Term Upside Potential

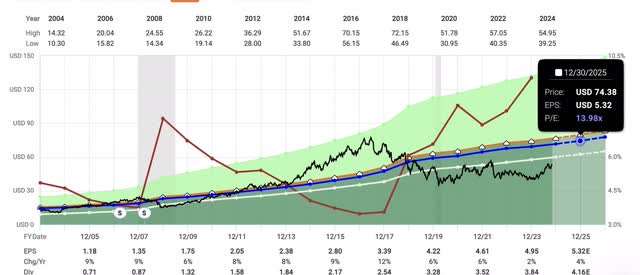

During my previous thesis, I mentioned how Altria deserved to trade at least at a P/E of 12x with a price target of $64 a share. With a forward P/E of 10.54x, thanks to strong price appreciation over the past week or so due to solid earnings, Altria still appears attractively valued for long-term investors.

Peer Philip Morris International has a much higher forward P/E of 18.99x, likely due to their strong growth in Zyn. Moreover, MO’s on! continues to see solid retail share growth as well as NJOY. If both continue trending upward, Altria’s share price will likely continue seeing solid price appreciation in the coming years.

FAST Graphs has a normal P/E of roughly 14x for the stock, implying strong price appreciation over the long term, with a price target over $74 a share by the end of 2025. One thing to note is Altria’s price could become impacted and see downside as the company is usually under scrutiny from regulators like the FDA as well as the CDC.

This is also not too far off from Wall Street’s high price target of $73. And while this may seem a bit optimistic, in a lower interest rate environment and strong economy, Altria could see a higher valuation.

This is due to investors rotating back into the market as safer, fixed-rate investments like money market funds and certificate of deposits become less attractive.

For me, I see Altria’s P/E moving towards 12x – 13x if NJOY growth continues to show solid results in the coming quarters. If so, this still implies double-digit upside to a price target range of $62 – $66 a share.

Takeaway

Although headwinds persist for Altria due to declining volumes in their smokeable products segment, management continues to execute to offset this with frequent buybacks and implementing a cost savings plan to save $600 million in the next 5 years.

This ensures the company’s prestigious dividend track record of more than a half of a century will likely continue for at least the medium term. Moreover, NJOY and on! continue to be growth drivers, showing solid promise with their retail share growth in the company’s latest quarter.

If management continues to successfully execute while implementing cost savings initiatives, this will likely lead to further share price appreciation over the long term. With lower interest rates likely to also serve as a catalyst, I continue to rate Altria a buy due to their double-digit upside potential and attractive dividend profile.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.