Summary:

- Altria has a 9% forward dividend yield and is diversifying its product portfolio to address the declining number of conventional cigarette smokers.

- The company has a strong position in the U.S. e-cigarette/vape market and the nicotine pouches market, both of which are expected to experience significant growth.

- There are potential risks, such as an ongoing patent fight and the increasing health consciousness of consumers, but overall, Altria’s dividend yield and upside potential make it a “Strong Buy.”.

Mario Tama

Introduction

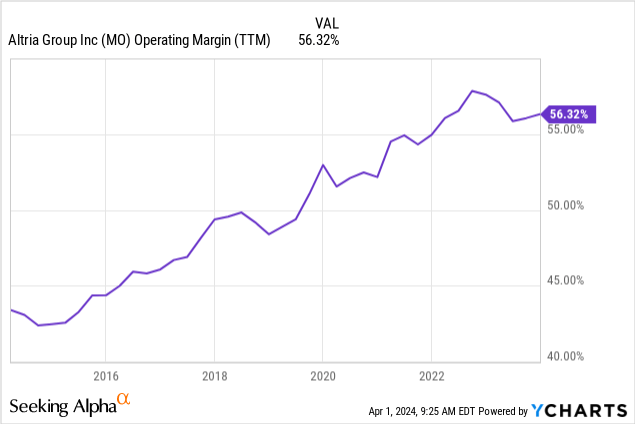

I continue exploring dividend opportunities to diversify my portfolio and Altria’s (NYSE:MO) 9% forward dividend yield was too attractive to avoid diving into the stock analysis. As people across the world are becoming more health conscious about the harm of cigarettes and cigars, the number of smokers is in the secular decline. However, smokers are not giving up their habit completely, but switch to less harmful alternatives like electronic cigarettes, vapes or nicotine pouches. I think that Altria is dealing with the evolving environment exceptionally as the company continues improving profitability despite its legacy business faces adverse secular shifts. The company is likely to generate lots of synergies by mixing its unmatched legacy distribution with solid strategic positioning in new emerging products. The 9% forward dividend yield is safe in my opinion and the stock is between 20-30% undervalued, which makes it an obvious “Strong Buy” for me.

Fundamental analysis

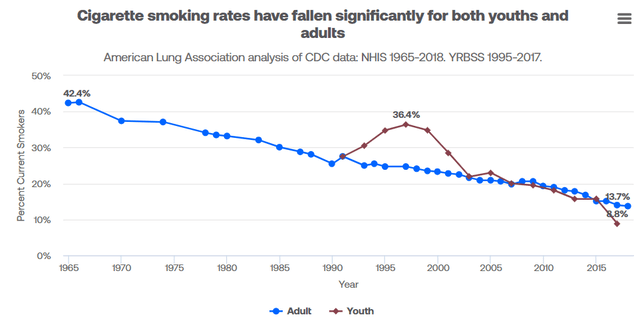

Altria is a leading cigarette tobacco company, and this industry is evolving because people are becoming more health conscious. According to American Lung Association, the portion of people smoking cigarettes has declined significantly over the last 50 years.

To address the evolving environment, Altria has been diversifying its product portfolio in recent years. As a result, the company has already built solid strategic positioning as a smoke-free player with offerings in the e-vapor, oral tobacco and heated tobacco markets.

I see great opportunities for Altria here, because the U.S. e-cigarette and vape market is expected to compound with almost a 30% CAGR by 2030. Altria has a wide moat in the U.S. e-cigarette/vape market since its NJOY business is currently the only e-vapor manufacturer to receive market authorizations from FDA, according to the 10-K report. The company’s extensive distribution network and NJOY’s strong positioning in the emerging industry is a strong combination which will highly likely help Altria to dominate in this space over the long-term.

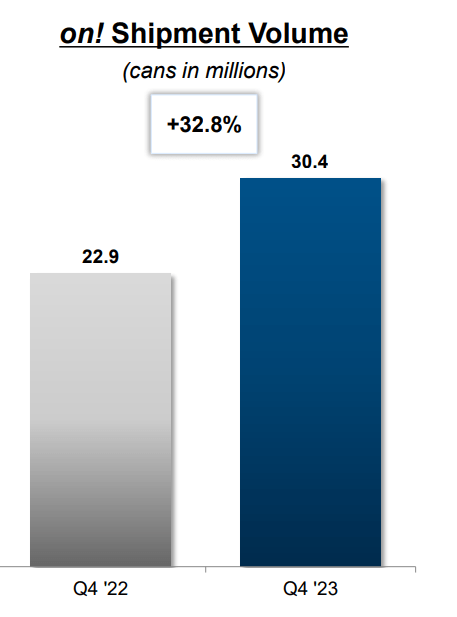

Nicotine pouches market, where Altria also has solid presence, is also a rapidly growing industry. According to Transparency Market Research, the global industry is expected to reach $52.6 billion by 2031. This means that the market is also expected to compound with a 30% CAGR, another massive tailwind for Altria. The company delivered 30.4 million “on!” cans in Q4 2023, recording a 32.8% YoY growth. Outpacing the broader industry’s growth pace is a strong indication that the company is expanding its market share.

Altria

Having strong positioning in two promising markets enables Altria to sustain and even expand its profitability even considering the big secular decline in its traditional smoke business. This is a solid indication of the business’s strategic resilience, and gives me a lot of optimism.

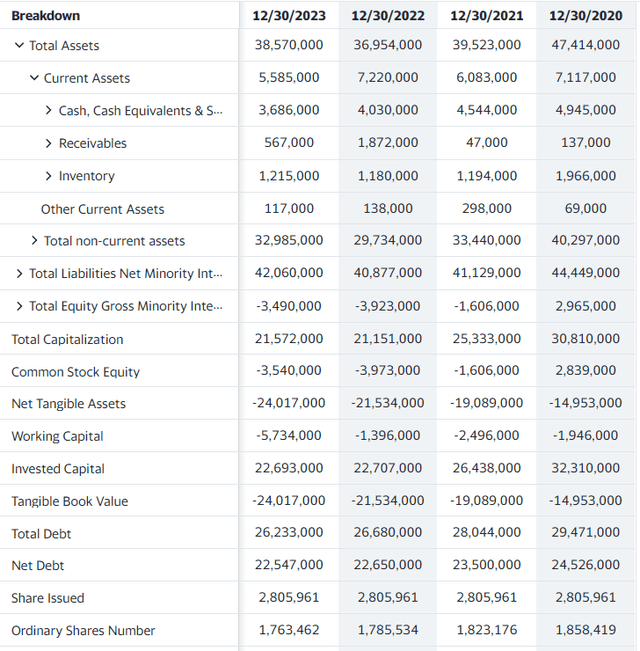

As I emphasized earlier, the stock offers a forward dividend yield that is close to 9%, which is very attractive even in the current reality of high U.S. treasuries yields. We have discussed above that the profitability is solid and expanding, which is beneficial for the dividend safety and growth. But I also want to highlight that the balance sheet is healthy and the capital allocation discipline is strong. The company’s liquidity is solid with $5.6 billion in current assets, and the major portion of it is cash and equivalents. Debt levels are also stable, as well as the outstanding shares count. The stability and prudent approach to capital allocation further enhance predictability and reliability to the company’s dividend payouts.

Valuation analysis

Altria’s valuation ratios are mostly lower than its last 5 years’ averages, which might mean that the stock is undervalued. The current non-GAAP forward P/E ratio is around 8.7, notably lower than the 9.9 historical average. If I take the historical 9.9 forward non-GAAP P/E and multiply it by the projected by consensus FY 2025 EPS of $5.22, I get fair share price at almost $52. This is 20% higher than the current share price.

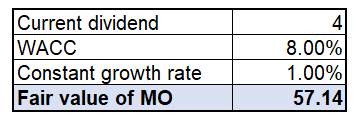

To cross-check my ratios analysis, I am also running a discounted dividend model (“DDM”). I take an 8% WACC for the DDM formula and project a very modest 1% constant dividend growth rate. I use a $4 as the current dividend, in line with the FY2024 consensus forecast. I have high conviction in my assumptions given Altria’s excellent dividend history.

Calculated by the author

The DDM suggests that the fair share price is slightly above $57. This is around 10% more optimistic than the outcome as a result of the forward P/E analysis. Therefore, I would say that I project the upside potential of MO between 20% to 30% over the next 12 months.

Mitigating factors

There is an ongoing patent fight between NJOY and JUUL after mutual accusations of patent infringement last year. The patent war might last for ages and turn out to be costly for Altria, even in case the litigation is won by the company. Worst case scenario means losing the litigation and this will lead to massive adverse consequences for the company’s prospects in the vapes industry, which I am betting on. If Altria loses this case, the company will not only likely record substantial fines and penalties, but will highly likely lose its competitive edge in a promising industry.

It is highly likely that e-cigarettes/vapes and nicotine pouches are much healthier than smoke products like traditional cigarettes or cigars. However, these products are still do not benefit to people’s health and are not completely harmless, in my opinion. According to McKinsey, the U.S. wellness market is booming. Such a trend indicates that Americans are likely becoming more health conscious, which might pose a significant long-term challenge if the critical mass of health conscious people prevails.

Conclusion

Altria’s stellar dividend yield and substantial upside potential makes the stock a “Strong Buy”. The management’s execution in the evolving environment where number of cigarette smokers is declining rapidly, is exceptional. Altria has strong position in two rapidly growing industries and its distribution network from its legacy business is a strong synergetic asset for new products. The valuation is very attractive and the forward dividend yield is nothing but a gift, in my opinion.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.