Summary:

- Altria Group’s stock has outperformed the S&P 500 in Q1 2024, up nearly 9% compared to the market’s 7% gain.

- Despite underperformance in recent years, Altria’s loyal investors are attracted to its reliable and growing dividends.

- Altria’s recent stock turnaround can be attributed to the favorable macro environment and the company’s strategic moves, including a new buyback program and reducing stakes in other companies.

- The stock has plenty of room to go up before entering my trim zone.

Mario Tama

My most recent coverage of my favorite stock, Altria Group, Inc. (NYSE:MO) was more than three months ago in December 2023. I had rated the stock a “Buy”, urging investors to buy on the weakness triggered by a move by peer British American Tobacco p.l.c. (BTI). Since then, the stock has returned about 9% compared to the market’s 12% return. Despite my liking for the stock, had someone told me at the time of my previous article that Altria’s stock would outperform the S&P 500 in the first quarter of 2024, I’d have likely laughed at them. Yet, that is exactly what Altria’s stock has done as the first calendar quarter of 2024 almost draws to a close. Altria stock is up nearly 9% (excluding dividend) compared to the market’s 7% gain YTD.

It is no secret that MO stock has significantly underperformed the market over the last year to even 10 years. However, the stock still has its loyal followers and investors (myself included) as you can witness in the comments stream on almost any news item or article about Altria Group on Seeking Alpha. The reason is fairly simple: reliable and growing dividends. Hence, despite disappointing price action, many investors (again, including myself) have stuck with the stock and will likely remain so, as long as the company continues paying its generous and ever-increasing dividends.

The company can blame the macro environment as well as itself for the stock’s underperformance over the last few years. First, the “risk-on, free money” macro environment favored riskier assets over reliable but slow growing stocks like Altria. Second, the company did itself no favors with repeated “di-worsification” efforts with the likes of Juul and Cronos.

So, what sparked the stock’s recent turnaround? Well, the same two factors mentioned above: macro environment and the company’s moves.

After a record-breaking 2023, the market has continued 2024 in the same vein, making new highs every week, if not daily. However, there are enough reasons to be concerned about the stock market from a macro perspective with recession concerns raising and inflation data still coming in hotter than expected at times. One could easily make a case for value and dividend stocks over risk-on names in such a set up and it comes as no wonder in hindsight that Altria stock went up for seven straight sessions.

For its part, Altria has also made some right moves recently. The company posted in-line Q4 results while announcing a new $1 billion buyback program. Shortly after this, at an investor conference, Altria reaffirmed its 2024 guidance. However, the most positive news in my opinion came out a few days ago when the company announced reducing its stakes in Anheuser-Busch InBev (BUD) and using the proceeds to enhance its buyback program.

I tend to view share repurchases with a skeptical eye, especially from technology companies that merely use buybacks to offset dilution. In addition, I am skeptical of buyback programs that don’t have a definite end date. Altria, however, generally has an end date associated with each of its buyback programs and is not known for diluting away. Let’s evaluate the financial impact of the recently announced $2.4 billion repurchase program that is expected to be carried out by December 31st, 2024.

- To be extremely conservative, let’s say Altria repurchases these shares at the current 52 week high price of $48. That would mean the company can comfortably retire 50 million shares using the $2.4 billion.

- Altria currently pays out $3.92 per share in annual dividend, which means the company (and shareholders) stands to save at least $200 million annually through this repurchase program alone. To reiterate, Altria just pulled a master stroke (albeit a bit late arguably) where it forwent BUD’s 1.35% yield to save itself from paying nearly 9% yield on its own stock.

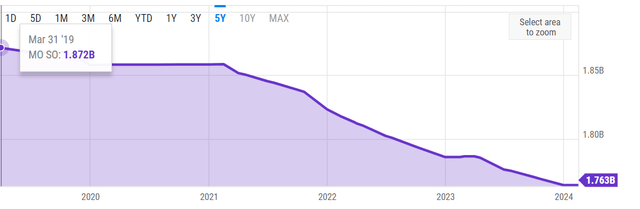

- Another way to understand the size of this new buyback program is by looking at the chart below. Over the last 5 years, Altria has retired just about 6% of its shares outstanding. This buyback (in about 3 quarters) alone will retire nearly 3% of the shares outstanding.

- Finally, with a 3% reduction in shares outstanding, Altria’s EPS is likely to go up. By how much? Let’s find out with some reasonable assumptions. I acknowledge there are various factors that will be at play including but not limited to potential dilution, pro-forma earnings, and the timing of the buyback.

- Using the 1.763 billion shares outstanding at the end of the most recent quarter and the mid-point of forward guidance (covered below), Altria is expected to have net income of $9 billion in FY 2024. If 200 million shares are retired as calculated above, Altria’s EPS could jump to as high as $5.76. This is calculated by dividing the $9 billion in net income by the 1.563 billion shares expected to be outstanding at the end of the new $2.4 billion buyback program.

MO Shares Outstanding (YCharts.com)

| Current Shares Outstanding | 1,763,000,000.00 |

| Forward EPS | $5.11 |

| Total Profit | $9,008,930,000.00 |

| New shares | 1,563,000,000.00 |

| EPS | $5.76 |

| EPS Difference | $0.65 |

| EPS Growth | 12.80% |

Still Cheap, Lucrative, And Getting Stronger

The yield, at almost 9%, is still higher than the stock’s forward multiple and still handily beats the already-high five-year average yield of 7.75%. Speaking of forward multiple, while announcing the BUD news, Altria also increased its FY 2024’s guidance to be between $5.05 and $5.17 per share. If we use the middle point of that guidance range, $5.11, Altria’s stock is trading at a forward multiple of 8.58 while the S&P 500 is trading at a multiple of nearly 28 as of this writing.

It is reasonable to worry if Altria stock is being considered a junk yield by the market if the yield is still this high. Fair enough. You may recall that Altria recently shifted its dividend increase target from being 80% of its earnings to mid-single digit dividend growth. Does that put the payout ratio in dangerous zone? Not quite, as based on the current dividend of $3.92/share and the mid-range of EPS at $5.11, Altria’s payout ratio is about 76%, well below the stated 80% payout goal of the past that the company promised and delivered for decades.

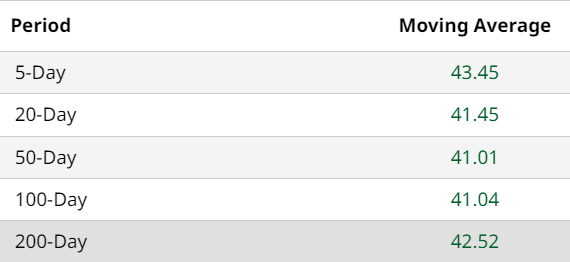

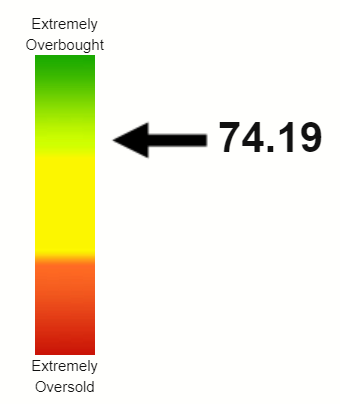

Finally, given the stock’s recent strength, it should come as no surprise that Altria’s technical indicators, for once, appear great. The stock is well above all the commonly used moving averages, with the 200-day moving average being just 3% lower than the current market price. This means the stock has strong technical support around the corner should things turn south from here. However, with a relative strength index [RSI] of 74, I’d expect Altria’s stock to remain strong in the short to medium term with ex-dividend date approaching (March 22nd) and the market showing weakness with a two-week losing streak.

MO Moving Avgs (Barchart.com) Altria RSI (Stockrsi.com)

Risks And Conclusion

Although I firmly believe Altria stock is likely to be strong in the short to medium term given the still-undervalued thesis explained above, there are viable risks to be aware of. The Federal Reserve may shock us all and offer more (and larger) interest cuts than expected in 2024, which would spur the risk-on names and hamper names like Altria. Although Altria has the pricing power to offset at least some of the inflation impact and sells a sticky product, a weak consumer outlook is hardly a good thing for any consumer staple company.

What’s a fair value for Altria stock? And do I have an exit strategy? As long as the dividend keeps coming in (and is increasing at the promised rate each year), I will almost always have an exposure to this stock. But, that does not mean I never plan to trim. The only time I sold Altria stock in bunch was around 2016/2017 when extremely low interest rates sent stocks like Altria and Realty Income Corporation (O) through the roof. I recall both names were yielding below 4% when I sold them to lock in many years of dividends in capital gains (some tax-sheltered). Even if Altria stock goes back to those dizzying heights now, around $75, the stock would still yield well above 5%, thanks to the dividend going up from 61 cents/quarter to 98 cents/quarter now. In other words, Altria has plenty of room to go before getting anywhere close to my trim region and I will be glad to hold the stock at least into the $60 region before considering trimming. At $60, the stock would still yield 6.50% and will be trading at a forward multiple of 11.74 based on FY 2024’s mid-point guidance of $5.11/share.

To conclude, I always recommend buying stocks of good companies on weakness. For a change, Altria’s stock is appearing strong fundamentally and technically, warranting a “Strong Buy” upgrade. I believe the macro environment, the stock’s undervaluation, and the company’s reenergized focus on enhancing shareholders value make the Altria stock a strong buy here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO, O either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.