Summary:

- MO has been handsomely rewarded for the US FDA marketing approval of NJOY’s menthol-flavored e-cigarette products, with the acquisition highly accretive to its existing tobacco portfolio.

- The management has submitted NJOY ACE 2.0 device with access restriction technology, along with the resubmissions for blueberry and watermelon pod products that work exclusively with the 2.0 device.

- This is on top of the robust QoQ/ YoY growth in MO’s oral tobacco pouches sale, on!, with H2’24 likely to bring forth similarly great numbers, attributed to Zyn’s shortage.

- These developments have triggered the raised FY2024 adj EPS midpoint guidance, leading to the stock’s upgraded P/E valuations.

- We shall further discuss why MO continues to offer a compelling investment thesis for investors seeking capital appreciation and dividend incomes.

Gorlov

We previously covered Altria (NYSE:NYSE:MO) in May 2024, discussing its mixed performance in the Smokeable/ Smoke-free segments and recommending readers to remain patient given its nascent transition to smoke-free approaches.

With NJOY already reporting growing retail share and H2’24 likely to bring forth improved numbers as guided by the management, we had reiterated our Buy rating attributed to its still rich dividend investment thesis and robust support levels of between $40s and $44s – with it offering investors with an improved margin of safety.

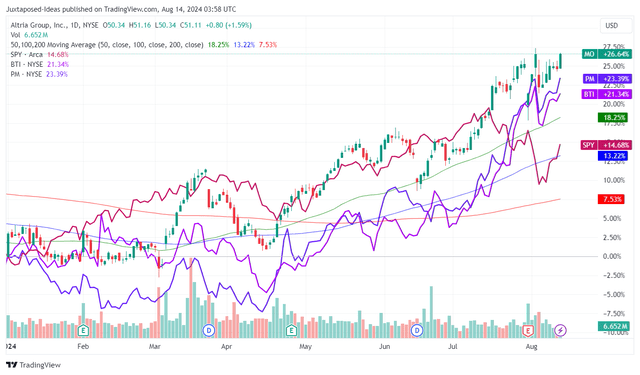

Since then, MO has rallied by +15.4%, well outperforming the wider market at +4.7%, thanks to the unexpected US FDA marketing approval for NJOY’s four menthol-flavored e-cigarette products in June 2024.

The growing popularity of Phillip Morris’ (PM) Zyn has also spilled over to MO’s on!, with the latter reporting double digit volume growths on a QoQ/ YoY basis – triggering the robust top line expansion for the oral tobacco product segment.

We shall further discuss why we continue to rate MO as a Buy.

MO’s Investment Thesis Is Even More Compelling Here, Thanks To The US FDA Marketing Approval & Growing NJOY Share

MO YTD Stock Price

Trading View

MO has had a good YTD performance indeed, significantly aided by the reversing market sentiments from high growth stocks as observed in the SPY’s decline by mid July 2024.

The long-awaited US FDA approval for NJOY’s four menthol-flavored e-cigarette products, including:

- NJOY Ace Pod Menthol 2.4%,

- NJOY Ace Pod Menthol 5%,

- NJOY Daily Menthol 4.5%, and

- NJOY Daily Extra Menthol 6%,

cannot be ignored as well, with it reversing the US government’s proposed menthol ban regulation announced in April 2021.

At the same time, readers must note that MO received the very first approval for flavored e-cigarette product, compared to the painful rejection received by British American Tobacco p.l.c. (BTI) in October 2023, for the latter’s Vuse menthol and fruit-flavored e-cigarette products.

While it is impossible to understand the real reasons for MO’s marketing approval, perhaps it may be attributed to NJOY’s relatively small retail share in the US multi-outlet and convenience channel at 5.5% by FQ2’24 (+1.2 points QoQ/ +2.5 from March 2023 levels).

This is compared to Vuse at 51.2% (-1.1 points YoY), with the platform only receiving the US FDA marketing approval for conventional Vuse Alto tobacco-flavored pods, implying the potentially reduced risks related to NJOY’s e-cigarette platform.

Whatever the reason may be, it is apparent that MO investors and the market are encouraged by these recent developments, as the stock finally climbs out the sideways trading since June 2022.

This is significantly aided by the growing NJOY market share as discussed above, along with robust increase in consumable shipment volume by +14.7% QoQ and device volume by +80% QoQ in FQ2’24.

The US FDA approval has also prompted the MO management to submit NJOY ACE 2.0 device with access restriction technology, along with the resubmissions for blueberry and watermelon pod products that work exclusively with the 2.0 device.

Assuming another US FDA approval, we may see the tobacco company succeed in further growing NJOY’s market share as the US Justice Department and FDA tackles the sale/ distribution of illicit e-cigarettes, which often comes in fruity flavors.

At the same time, MO has benefitted from Zyn’s ongoing shortage, with FQ2’24 bringing forth 41.2M of on! cans sold (+7.9M QoQ/ +11.2M YoY) as Zyn’s sales growth slows to 149.9M cans (+4.2M QoQ/ +50.4M YoY) on a QoQ basis.

While PM has guided ongoing expansion efforts of its existing Zyn manufacturing facilities to around 900M cans in annualized capacity by 2025, it is apparent that its near-term prospects remain mixed, based on the 2024 sales projection of 570M cans.

As a result of the imbalanced demand and supply dynamics, we may see MO continue to benefit from the ongoing Zyn shortages while expanding its existing consumer base, with H2’24 likely to bring forth robust on! sales growth on a sequential/ YoY basis.

These developments have also triggered the management’s raised FY2024 adj EPS guidance to $5.11 at the midpoint (+3.2% YoY), compared to the original midpoint guidance of $5.075 offered in the FQ4’23 earnings call (+2.5% YoY).

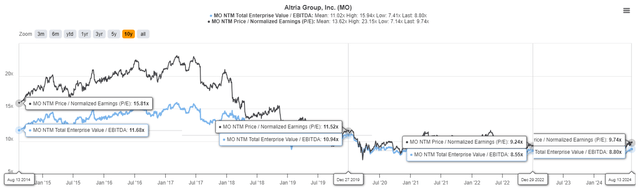

MO Valuations

Tikr Terminal

Perhaps this is the reason why the market has moderately upgraded MO’s FWD EV/ EBITDA valuations to 8.80x and FWD P/E valuations to 9.74x, compared to its 1Y mean of 7.96x/ 8.52x while nearing its 2019 averages of 10.77x/ 11.44x, respectively.

The upgrades are not overly aggressive as well, since MO is still expected to generate an adj EPS growth at a CAGR of +3.9% through FY2026, compared to PM at FWD P/E valuations of 18.17x with adj EPS growth of +8.9% and BTI at 7.60x/ +2.4%, respectively, implying that the former is still attractively valued at current levels.

MO’s investment thesis is significantly aided by the lower net debts of $21.68B (-6.5% YoY/ -13% from FY2019 levels) and the moderating net-debt-to-EBITDA ratio of 1.92x, compared to 1.93x in FQ1’24, 2.01x in FQ2’23, and 2.35x in FY2019.

Therefore, while NJOY remains unprofitable with the All Other segment recording immense cash burn on an adj operating income basis, we believe that these remain teething pains and are likely to improve once NJOY hits operating scale and eventually breaks even.

This is especially since the Smokeable and Oral Tobacco segments remain profitable enough to well balance the ongoing transition pains.

So, Is MO Stock A Buy, Sell, or Hold?

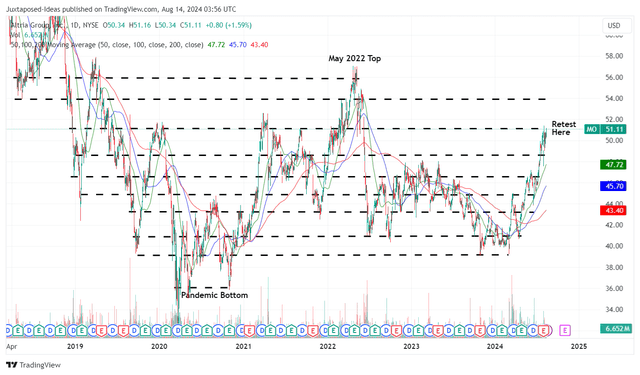

MO 6Y Stock Price

Trading View

For now, MO has recorded an impressive +28.6% rally from the March 2024 bottom, while running away from its 50/ 100/ 200 day moving averages.

As with all dividend stocks, the capital appreciation has naturally moderated the tobacco stock’s forward dividend yields to 7.79%, compared to its 4Y average of 8.04%.

Even so, we believe that MO’s dividend investment thesis remains rich when compared to its peers, including PM at 4.48% and BTI at 8.26%.

This is especially since the market is already pricing in a 50 basis point rate cut in the Fed’s upcoming FOMC meeting in September 2024, as the US Treasury Yields also decline to a range of 3.68% and 5.18%.

This is on top of the potential +23.8% capital appreciation from the market’s ongoing upgrade on its FWD P/E valuations nearer to its historical means of 11.44x, with it implying a bull-case long-term price target of $63.30.

As a result of the attractive risk/ reward ratio at current levels, we are maintaining our Buy rating for the MO stock here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.