Summary:

- Altria Group announced a 4% increase in its quarterly dividend, maintaining a high dividend yield of 7.8%.

- MO shares have outperformed the market, with a 20% return in the past five months, driven by its resilience to economic downturns.

- The company’s solid operational performance, low valuation, and high dividend yield make it an attractive investment option for income-oriented investors.

FotografiaBasica

Article Thesis

Altria Group, Inc. (NYSE:MO) has been a strong performer in recent months, driven by an undemanding valuation and a declining rates environment that made it more attractive for income investors. On Thursday, the company announced another dividend increase, keeping the dividend growth story intact.

Past Coverage

In the past, I have written about Altria Group here on Seeking Alpha. My most recent article is from March 2024, or around five months ago. In that article, I argued that Altria was a strong investment due to a low valuation and a high dividend yield (around 9% at the time) while also covering the monetization of Altria’s stake in brewer Anheuser-Busch InBev (BUD). Since then, shares have delivered returns of more than 20%, which easily beat the broad market’s 7% return over the same time frame. In today’s article, I will focus on Altria Group’s recent earnings results, the just-announced dividend, and what the current valuation tells us about an investment in Altria’s shares.

What Happened?

On Thursday, Altria Group announced an increase in its quarterly dividend. From the previous level of $0.98 per share per quarter, the dividend has been lifted to $1.02 per share per quarter, which pencils out to an increase of a little more than 4%. The new annual payout is now $4.08, which, considering a share price of $52, pencils out to a forward dividend yield of 7.8%.

Altria: Strong Outperformance

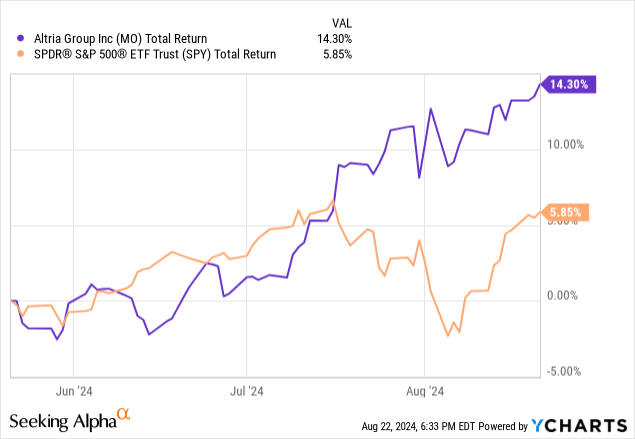

Shares reacted positively to this announcement, with Altria trading up slightly on Thursday, despite the broad market being down considerably for the day. This continued a recent trend of strong share price gains for Altria, as we can see in the following chart:

Over the last three months, Altria gained close to 15%, while the broad market is up around 6% over the same time frame. Most of that outperformance started in mid-July, as we can see above.

That is when investors started to worry about the strength of the US economy and a potential recession, which may explain why Altria started to outperform strongly — after all, the tobacco business is very resilient versus macro shocks including recessions.

There are studies that show that rising unemployment and economic weakness can result in more cigarettes being smoked, e.g. this study or this study. Many other industries face considerable headwinds when unemployment rises and consumers and businesses spend less, such as the automobile industry or the travel and hospitality industry. But with the tobacco industry being pretty safe from macroeconomic headwinds, Altria is a recession-safe pick. It thus makes sense that its shares started to outperform when recession worries increased a couple of weeks ago.

Altria’s resilience versus recessions has also been proven in the past, including during the pandemic. In lockdown-impacted fiscal 2020, Altria Group saw its revenues climb by around 4% compared to the previous year’s period, which was a strong result. The excellent resilience versus recessions and other macro shocks also helps explain why Altria was able to raise its dividend for decades, a trend that remains intact thanks to the just-announced dividend increase for 2024.

Altria: Solid Operational Performance

While the tobacco industry is resilient, it is not a high-growth industry. The smoking rate in many industrial countries, including the US, is declining. That is offset by rising prices per package in most quarters, although there are quarters with small revenue declines from time to time. During the most recent quarter, Altria Group experienced such a revenue decline, as sales were down 3% compared to the previous year’s period.

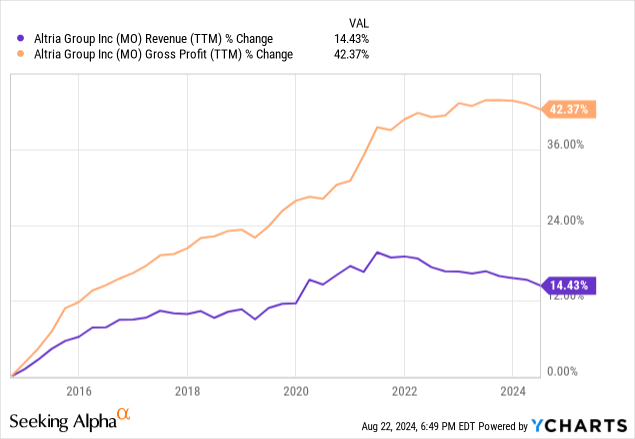

The good news is that higher prices per package generally allow for margin expansion, which is why Altria’s earnings growth has outperformed its revenue growth in the past, as we can see in the following chart:

The trend is even more pronounced when we look at net earnings or EBITDA, although one-time items such as the write-down of Altria’s stake in JUUL can distort these numbers from time to time.

During the most recent quarter, earnings per share were flat while revenues were down — not a great result, but not too bad, either. After all, Altria is not priced for massive growth, and according to management, growth will pick up during the second half of the year.

The company is guiding for earnings per share of $5.07 to $5.15, which would make for an earnings per share increase of around 3% to 4% compared to the previous fiscal year. A low to mid-single digits earnings per share growth rate is not exciting when a company trades at a high valuation and offers a low dividend yield, but for a company like Altria with its strong dividend yield of close to 8% and an undemanding valuation, this kind of growth is very solid, I believe.

Growth will be weighted towards the second half of the current year, i.e. the current quarter and Q4, according to management. The ongoing roll-out of NJOY likely plays a role in that, as Altria’s menthol e-vapor is seeing compelling growth that should continue going forward. Shipment volumes for NJOY devices was up 80% sequentially during the second quarter, and market share was up nicely as well, growing from 4.2% in Q1 to 5.5% in Q2. If that growth continues for a while, NJOY should contribute more and more to Altria’s top line and could eventually become a major source of profits that could compliment, and eventually, substitute the contribution from the traditional smokeable products franchise that remains the main cash cow for now.

Altria received marketing approvals from the FDA for some of its NJOY products in June; thus, growth could be even higher in the current quarter and Q4, as Altria might push for even higher market share gains in the near term.

Shareholder Yield And Valuation

For many investors that own shares of Altria Group, the dividend is one of the key arguments. But dividends are not the only way for Altria to return cash to its owners, as the tobacco company also returns cash via share repurchases. Share repurchases are neither automatically good nor automatically bad — it depends on whether management is able to acquire shares below value or whether they overpay. In Altria’s case, the stock’s valuation is rather low — shares trade for 10x forward net profits right now.

Buying back shares that trade with an earnings yield of 10% is a relatively good deal, I believe, but Altria luckily was able to buy back shares at even better prices during the first half of the current year. Altria has bought back 54 million shares under an accelerated share repurchase program during the first quarter, paying, on average, $44.50 per share. That’s more than 10% lower than the current share price; thus those buybacks look pretty good from today’s perspective. Management seemingly was able to identify a good time to buy back shares on the cheap and to pump up the buyback pace at the time via the accelerated share buyback program.

Altria also bought back shares under its regular buyback program and plans to spend another $990 million, or close to $1 billion, on buybacks during the second half of 2024. Using current share prices, that’s another 1.1% of Altria’s shares.

As noted above, Altria trades for 10x this year’s expected net earnings right now, which is an undemanding valuation (although MO was even cheaper at times over the last year). The valuation also isn’t high when we look at Altria’s enterprise value to EBITDA ratio, which can be a useful metric as it accounts for debt and cash on the balance sheet. The EV to EBITDA ratio stands at 9 right now, which is, again, an undemanding valuation.

If interest rates decline considerably over the next couple of quarters, this could make income stocks more attractive, as income-oriented investors will possibly shift funds from fixed-income investments such as bonds to income stocks. Altria with its high dividend yield is among the companies that could benefit from that, which is why I believe that there is further upside potential for MO’s share price. Further gains aren’t guaranteed, of course, but when we consider that Altria has traded at almost $80 per share a couple of years ago despite its dividend being lower back then, it would not be surprising to see Altria experience some further gains over the coming quarters if interest rates do indeed decline from here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!