Summary:

- Altria stock is undervalued based on my dividend discount model valuation.

- Despite the firm’s declining sales in recent years, this trend can stabilize as the tobacco market grows and especially as smoke-free products become a bigger piece of the revenue pie.

- Buybacks can continue to improve per-share revenue and other per-share metrics, which tell a different story than non-per-share metrics.

krblokhin

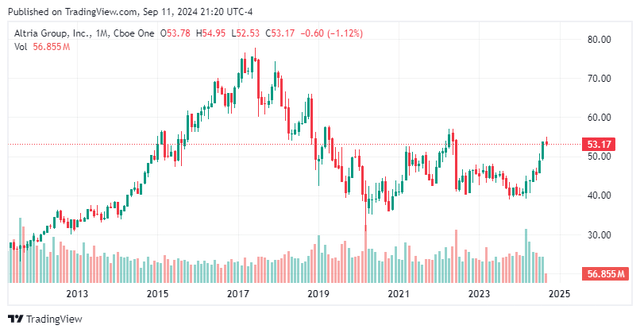

Altria (NYSE:MO), the 2nd-largest tobacco company by market cap, has performed relatively well since my latest Buy rating on the stock in May 2023. After reviewing the stock’s valuation again today, I realized that it’s still undervalued and has plenty of upside potential ahead.

Additionally, the US tobacco market is actually expected to grow (albeit very slowly) in the coming years, so that can help Altria maintain relatively stable revenue figures in the longer term, even though it has seen sales declines recently. The growing smoke-free products market can also support the company. Nonetheless, even if the slight revenue declines continue, per-share revenue and other per-share metrics can show more resiliency due to Altria’s share repurchases, so I don’t see a big problem here.

Therefore, I rate the stock as a Buy for the longer term. However, I recognize that due to MO’s recent rally — it saw a 35% increase in share price from March’s low to now — it may be wise to wait for a dip before taking a full-sized position.

The US Tobacco Market Is Still Expected To Grow. Smokeless Products Are Growing, Too

Altria mainly operates in the US. According to Statista, the US tobacco products market is worth $107.5 billion. It’s expected to grow at a CAGR of 0.84% from 2024 to 2029, and that includes growth in the cigarette market. That’s because although the volume of smokeable tobacco sales is expected to decline, the price per unit is expected to rise, offsetting the declines.

This, along with the expected growth in the smokeless cigarettes and nicotine pouches markets, can help support the firm’s future revenues. For reference, the global smokeless cigarettes market is expected to grow at a CAGR of 14.6% from 2023 to 2033 to a total value of over $126 billion by the end of the forecast period (I couldn’t find an estimate for the US market, but I assume it’s still growing there as well).

In the smokeless cigarettes market, Altria owns NJOY, an e-vapor product that has been seeing momentum lately. In Q2, NJOY consumables saw a 14.7% sequential increase in shipment volumes to 12.5 million units. Notably, NJOY device shipments grew 80% sequentially to 1.8 million units, and NJOY’s retail share in the US multi-outlet and convenience channel grew from 4.2% in Q1 to 5.5% in Q2.

Meanwhile, the global nicotine pouches market was valued at $3.0114 billion in 2023 and is expected to grow by 34% per year from 2024 to 2030. If my math is correct, that would bring the 2030 total value to $17.43 billion. I used the global market for this segment because Altria is already in the early stages of selling its on! PLUS nicotine pouches internationally in Sweden and the UK.

Is Altria’s Declining Revenue A Problem?

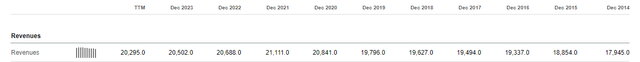

Although there’s the argument above that the tobacco market is growing and is expected to continue growing, we also need to look at Altria individually. Here’s the thing: its revenue has been declining in recent years, going from a high of $21.1 billion in 2021 to $20.3 billion for the trailing 12 months. Plus, in Q2 2024, its net revenues fell by 4.6% year-over-year, and revenues net of excise taxes fell 3% year-over-year. However, the revenue decline is not a major concern for me right now because it could stabilize or at least be offset on a per-share basis by buybacks. More on that later.

Altria’s Historical Revenues (Seeking Alpha)

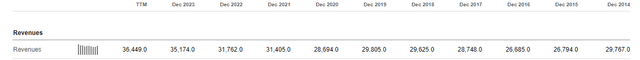

Still, Altria’s revenue growth has been underperforming that of its biggest peer, so it’s worth noting. In fact, when you look at Philip Morris (PM), the largest tobacco company by market cap, you’ll see a very different revenue trend, as revenues grew from $31.41 billion in 2021 to $36.45 billion in the trailing 12 months.

Philip Morris’s Historical Revenue (Seeking Alpha)

Keep in mind that Philip Morris saw a boost in 2023 from its Swedish Match acquisition in late 2022. Nevertheless, Philip Morris is now showing solid continued growth, partially due to the acquisition (with more growth expected in the future), while Altria’s revenues are going nowhere.

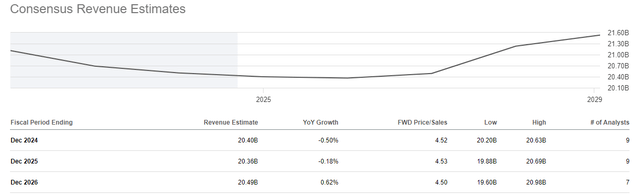

Perhaps smokeless products can help Altria stabilize this downtrend over time as they become a larger portion of the revenue mix (the firm’s Oral Tobacco Products division saw 5.5% growth in Q2, net of excise taxes), but that remains to be seen. The good thing is that Altria’s revenues are expected to be stable over the next few years, according to analysts, which is an improvement compared to the Q2 results.

Revenue Estimates For Altria (Seeking Alpha)

Free Cash Flow and Buybacks To Save The Day

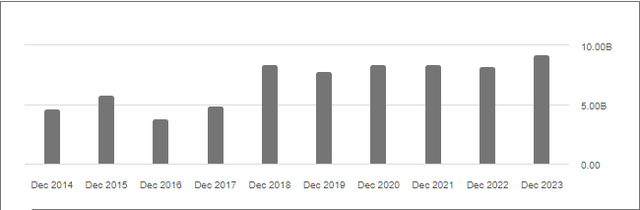

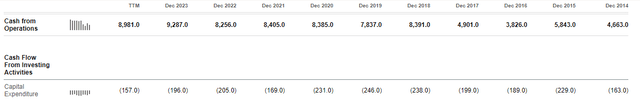

Declining revenues would be an issue if the declines were large and if cash flow was declining as well, but that’s not the case. As you can see in the screenshot below, Altria’s cash from operations has been increasing over the years.

Altria’s Cash From Operations (Seeking Alpha)

Meanwhile, its capital expenditures have remained steady over the years. Therefore, free cash flow sits near record levels ($8.82 billion for the trailing 12 months).

Altria’s Free Cash Flow (Seeking Alpha)

This allows Altria to pay dividends to shareholders and use the remaining funds to pay off debt or buy back shares. In the first half of this year, Altria bought back $2.4 billion worth of shares and is expecting to repurchase another $1 billion worth of shares by the end of the year. This would give shareholders a buyback yield of about 3.75% based on a market cap of $90.7 billion.

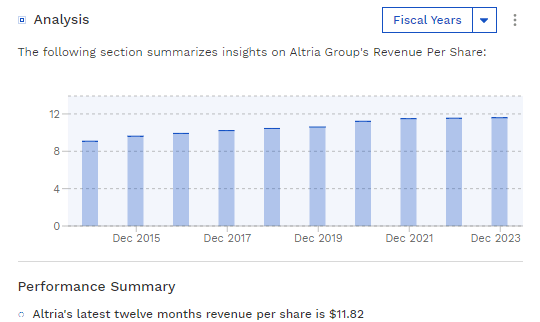

Due to its falling share count over the years, the company’s per-share revenue trend doesn’t look as bad. Funnily enough, revenue per share has been increasing every year, including the last 12 months. I don’t know about you, but if I’m buying shares of companies, then I’ll more heavily base my analysis on per-share figures.

Altria’s Revenue Per Share (Finbox)

Altria Stock Remains Undervalued

To value Altria stock, I’ll use a single-stage dividend discount model, since the firm has steady and predictable dividend payments. By the way, its forward dividend yield comes in at a healthy 7.7%.

I’ll be using a 7.12% discount rate for the valuation based on the cost of equity I calculated with the CAPM Model.

To help me calculate the cost of equity, I used the following inputs:

- 5% equity risk premium (taken from Kroll)

- 3.67% risk-free rate (I used the 10-year US Treasury yield)

- Five-year monthly beta of 0.69

Now, onto the valuation. The company’s forward dividend per share is $4.08, and I set the terminal growth rate to 2% to be conservative, as its five-year dividend growth rate is actually above 4%. Additionally, 2% is roughly in line with the annual growth of the economy over the long term.

Using the inputs above, I got the following calculation:

- Fair Value = (Dividends) / (Discount Rate – Terminal Growth)

- ~$79.69 = $4.08 / (0.0712 – 0.02)

As a result, Altria is worth approximately $79.69 per share under current market conditions. If you think that’s too aggressive, you can use its re-levered beta of 0.882, per simplywall.st, which would give you a discount rate of 8.08% and a fair value of about $67.11. To get a fair value near its current price of $53.17, you’d have to up the discount rate to about 9.67%.

The Bottom Line On MO Stock

Altria stock is operating in a low-growth industry, and its revenues have been declining in recent years. Nonetheless, its free cash flow continues to be strong, revenues are expected to stabilize, and smoke-free products can help the firm stay relevant in the long term.

In addition, its share buybacks have helped per-share metrics remain strong, with per-share revenue at an all-time high, for example. And to me, per-share metrics matter more, so the declining sales are not much of an issue.

Lastly, based on my DDM valuation, Altria’s fair value is $79.69 per share or $67.11 if you use a higher discount rate, giving investors upside potential. But I wouldn’t buy too much right away, as the stock may need a short-term breather from its rally.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.