Summary:

- Altria is transitioning its focus from smoking to smokeless nicotine products as smoking declines but nicotine addiction remains high.

- The company’s financial performance has remained strong, with increasing margins and growth in adjusted OCI.

- Altria is committed to providing strong shareholder returns through increased cash returns, steady share repurchases, and a high dividend yield.

Mario Tama

Altria Group, Inc. (NYSE:MO) has seen its share price continue to stagnate with an almost double-digit dividend yield. The company has either not been in the news at all or in the news for all the wrong reasons, such as an ill-timed, incredibly expensive investment into Juul. Despite that, the company stays true to its roots as a “sin” stock focused on driving substantial long-term shareholder returns.

Altria Smoker Transition

The company is working to a transition in smoking, as nicotine addiction remains high, but smoking declines.

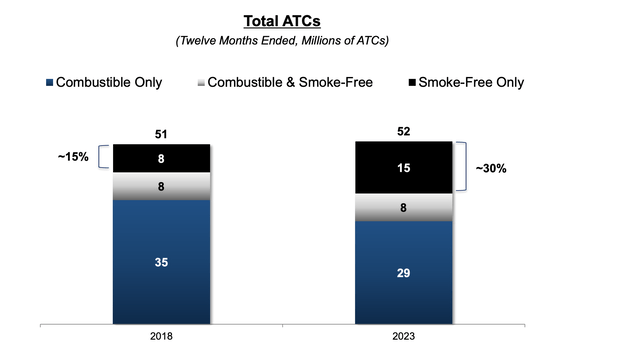

The above shows volumes for tobacco. Volumes for adult tobacco consumers have increased over the past 5 years, with smoke-free only doubling, while combustible volumes decline significantly. The addictive nature of narcotics means that the company has been able to see its business remain roughly constant.

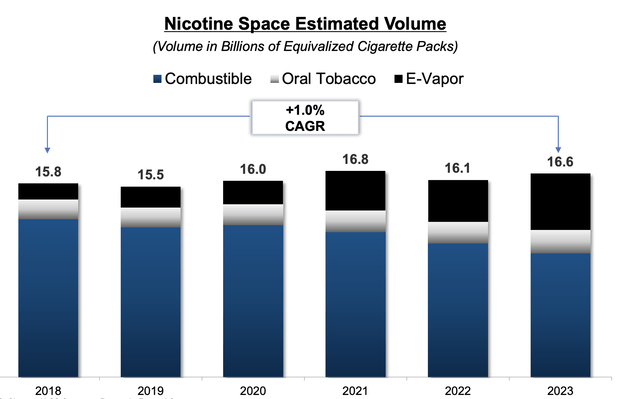

The above shows the billions in equivalent cigarette packs and their growth as a result of the rapid growth of E-Vapor. That market has actually grown at 1% annualized over the past 5-years. Another advantage of E-Vapor is margins can actually be higher as consumption tailors nicotine directly. That combined with lower health risks is a win-win combination for the company.

Transitioning smokers along with lower health risks mean a company that’s likely to see profits for longer. We also want to highlight something else here. Ozempic has taken the world by storm, and companies around the world are already noting a change in how consumers shop. Smoking status is heavily tied to the prevalence of obesity.

That means as customers get healthier and lifespans expand from obesity, non-smoking users using tobacco could stay alive and consume nicotine (and Altria products) for much longer.

Altria Legitimacy

More so, the company is continuing to receive strong legitimacy from governments due to its commitment to working with regulators.

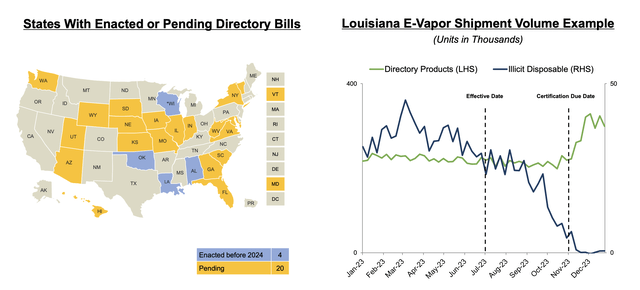

Numerous bills are occurring across the U.S. to remove dangerous e-vapor products and many of them push volumes to the company’s regulated products. There is evidence of this in Louisiana, which enabled a strong double-digit increase in the company’s volumes after seeing illicit disposable product volumes collapse.

This is the same thing as the cigarette master settlement agreement, which protected the market share of some of the largest companies in the industry. That enabled them to make strong profits for a long time. That legitimacy will help Altria in E-Vapor for the long run as well.

Altria Financial Performance

The company’s financial performance has remained strong.

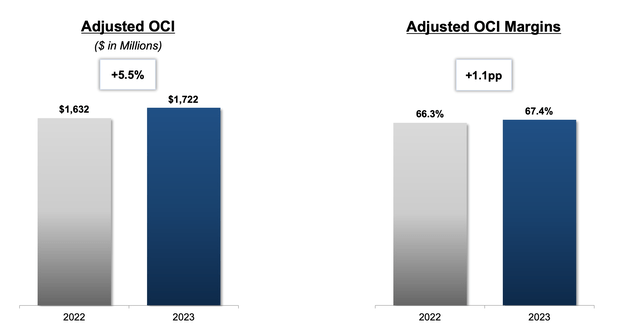

The company’s OCI for oral tobacco products increased 5.5% YoY. More importantly, margins increased by 1.1% YoY. The incredibly strong margins in this business highlight the benefits of switching to oral tobacco for the company, with margins approaching 70% and continuing to increase YoY. We expect that growth to continue.

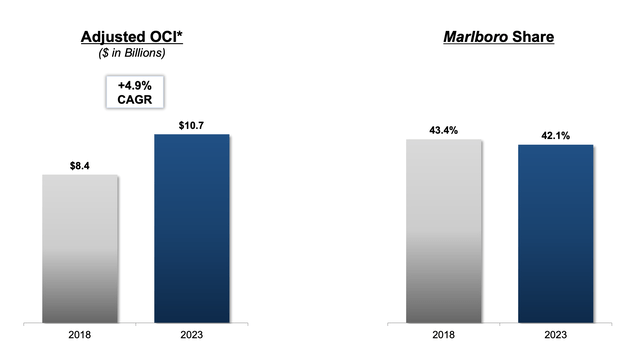

The company’s much larger smokeable segment increased 4.9% YoY in adjusted OCI with total growth >20% over the last 5 years. The company has seen the share of Marlboro decline, but that’s in an incredibly tough environment. The fact that the company can continue to grow OCI in such a tough market highlights its strength.

More importantly, the company is at a low valuation, so its ability to grow in a tough market is exciting to see.

Altria Shareholder Returns

Putting all this together, the company remains committed to strong shareholder returns.

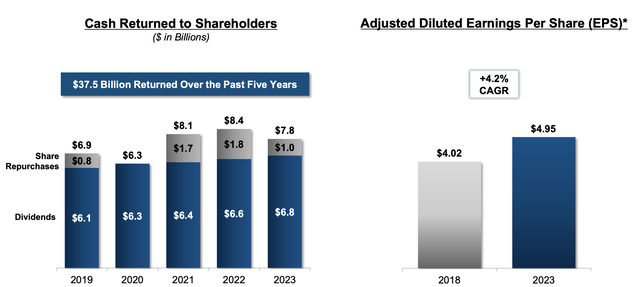

The company has worked to increase the cash returned to shareholders, as diluted earnings per share have increased by 4.2% annualized over the last 5-years. The company managed to return almost $8 billion to shareholders in 2023, primarily through a dividend that’s now approaching 10%. At the same time, it’s steadily repurchased shares.

The company has a high single-digit P/E and its strong earnings mean we expect double-digit total shareholder returns to continue. The decline in the company’s outstanding shares by 15% over the past decade shows the strength of repurchases and their leveraged effect. We remain concerned about the company’s $26 billion in long-term debt.

In a high interest environment, we’d like to see it pay it off as it’s due. However, the company also has a more than $10 billion stake in Anheuser-Busch that will help it out, while providing cash flow.

Thesis Risk

The largest risk to our thesis is regulation. While regulation is benefiting the company right now, there’s many who argue that nicotine is a net negative on society and should slowly be phased out. Some countries have begun to do that with slowly increasing the minimum age such that some people will never be able to smoke.

Still we expect that the shift to smokeless nicotine and its lower harm, combined with Altria’s dominant position will mean incredibly strong returns for years to come.

Conclusion

Altria is changing right under the noses of numerous investors who view it as a sin-stock that’s on its way out. The company is taking advantage of the rapid growth in oral tobacco, with its incredibly high margins, and lower health risks. In fact, over the past 5 years, nicotine consumed by the U.S. population has remained constant as smokeable products have declined.

The company is focused on substantial continued shareholder returns. A dividend of almost 10%, combined with repurchases, income from Anheuser-Busch, and a manageable dividend mean growing shareholder returns. We expect the company to provide reliable double-digit returns making it a valuable long-term investment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.