Summary:

- Altria Group stock downtrend bias has played out as expected, with a failed reversal at the $42 level before the recent plunge following BAT’s writedown fears.

- The market remains uncertain about MO’s medium- and long-term recovery, given its US market concentration and high exposure to smokeable products.

- However, buying sentiments at the $40 level remains robust, helping to underpin MO’s recent consolidation. In other words, the worst could be over.

- I explain why I’m ready to turn bullish at the current levels, as MO likely reached peak pessimism, providing the setup for a 2024 recovery.

iantfoto

My caution on Altria Group (MO) has played out according to my expectations since my previous update in October. I urged investors to avoid trying to catch MO’s falling knife, as it remains mired in a downtrend bias. However, I also underscored that MO could enter a “near-term consolidation, which I would typically associate with more bullish undertones, given the re-test.”

MO then staged a momentary reversal toward the $42 level before it failed again as sellers intensified their selling. Recall that was precisely what I anticipated, as I highlighted previously:

However, I urge dip-buyers to avoid trying to catch the falling knife, as the trend bias has moved in favor of sellers. I expect astute bears looking at a potentially failed reversal toward the $42 level to reload their sell orders, rejecting dip-buyers further. It could then open up a steep drop toward MO’s October 2020 lows ($35 level), completing a three-year round trip. – JR Research October 2023 Altria Group article

There were two parts to my thesis. First, we need to see a rejection at the $42 level, which played out brilliantly. That selloff was significant, as it occurred while the broad market rebounded with a vengeance, but MO buyers fled (more on that later). However, dip-buyers didn’t allow another decisive breakdown of the $39 level (MO’s October 2023 low), suggesting the worst could be over.

Why? How could the worst in MO be over when it significantly underperformed the S&P 500 (SPX) (SPY) since my previous caution? Given the turn of events in the broad market that lifted the S&P 500 close to its 2022 all-time highs, the underperformance in MO was stunning. However, it’s also important to consider that the most attractive risk/reward presents itself when the market is most pessimistic. It occurred in late 2022 when the S&P 500 stunned most Wall Street strategists who got their market prognostications for 2023 well off the mark. Economists were flabbergasted as their hard landing outlook didn’t pan out, leaving them flummoxed as we headed into 2024.

Observant MO investors could point out that the recent de-rating in British American Tobacco or BAT (BTI) stock took out the bullish optimism in MO, contributing to the plunge. Investors should recall that BAT decided to write down its assets, leading to a significant “non-cash impairment charge on its balance sheet for 2023, amounting to about GBP25B.” As a result, that led to a broad selloff in tobacco stocks, including MO. Investors must reflect execution risks on Altria Group, given its US market concentration and relatively high smokeable products contribution to its overall net revenue excluding excise taxes (about 87% of Q3 revenue).

That observation is justified, as MO suffered a steep selloff in early December, declining to the $40 level. However, the worst could be over as long as MO holds its $39 critical support level without a decisive failure. Here’s why.

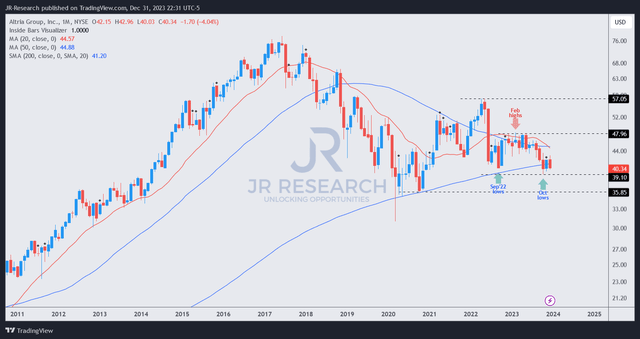

MO price chart (monthly) (TradingView)

It should be clear why MO’s September 2022 low was significant. As seen above, the initial October 2023 plunge took out those lows and formed a reversal in November 2023. In other words, dip-buyers have attempted to help MO bottom out at the $40 level and not allow another selloff toward the $35 zone, as I previously posited.

However, investors must remain wary of MO’s $42 resistance zone until it can be decisively breached. Despite that, I view the recent consolidation over the past three months as validating the firmness of MO’s buying sentiments at the $40 level. In other words, I don’t expect my previous $35 breakdown to be the base case moving ahead, assessing that its long-term low likely occurred in October 2023.

I believe these dip buyers were likely attracted by the MO’s forward dividend yield, which is almost 10% at the current levels. With the Fed expected to execute three rate cuts in 2024, income investors are expected to return to MO’s more appealing yields. With a robust “B-” dividend safety grade assigned by Seeking Alpha Quant, I don’t anticipate imminent risks on a rate cut that could send recent buyers sprawling for cover.

Furthermore, MO’s highly attractive “A” valuation grade should help undergird MO’s recent consolidation above the $40 zone, helping to bolster a possible re-rating in 2024.

As a result, I assessed that the entry level for MO investors to add more shares is appealing at the current levels, supported by constructive price action. With that in mind, I’m ready to upgrade my thesis.

Rating: Upgraded to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!