Summary:

- Amazon shares were down nearly 50% in 2022, despite the fact that revenues kept growing rapidly.

- We rank 100 top growth stocks, as compared to Amazon, now that the pandemic bubble is just starting to burst.

- We conclude with our strong opinion about investing in Amazon and growth stocks in general.

Blue Harbinger Research, Big Dividends PLUS Daria Nipot

2022 was an ugly year for growth stocks. And it’s going to get worse for many of them (as the pandemic bubble continues to burst). In this report, we rank 100 top growth stocks based on the financial metrics we consider most important in the current market environment (i.e. how they function with higher interest rates). We have a special focus on Amazon (NASDAQ:AMZN), comparing it to peers on these same financial metrics, but also diving into its specific business fundamentals, including competitive advantages (not just scale and Amazon Web Services, but also subscriptions like Prime and its burgeoning advertising business), risks and valuation. We conclude with our strong opinion on Amazon and investing in select growth stocks in the current market environment.

100 Growth Stocks, Ranked

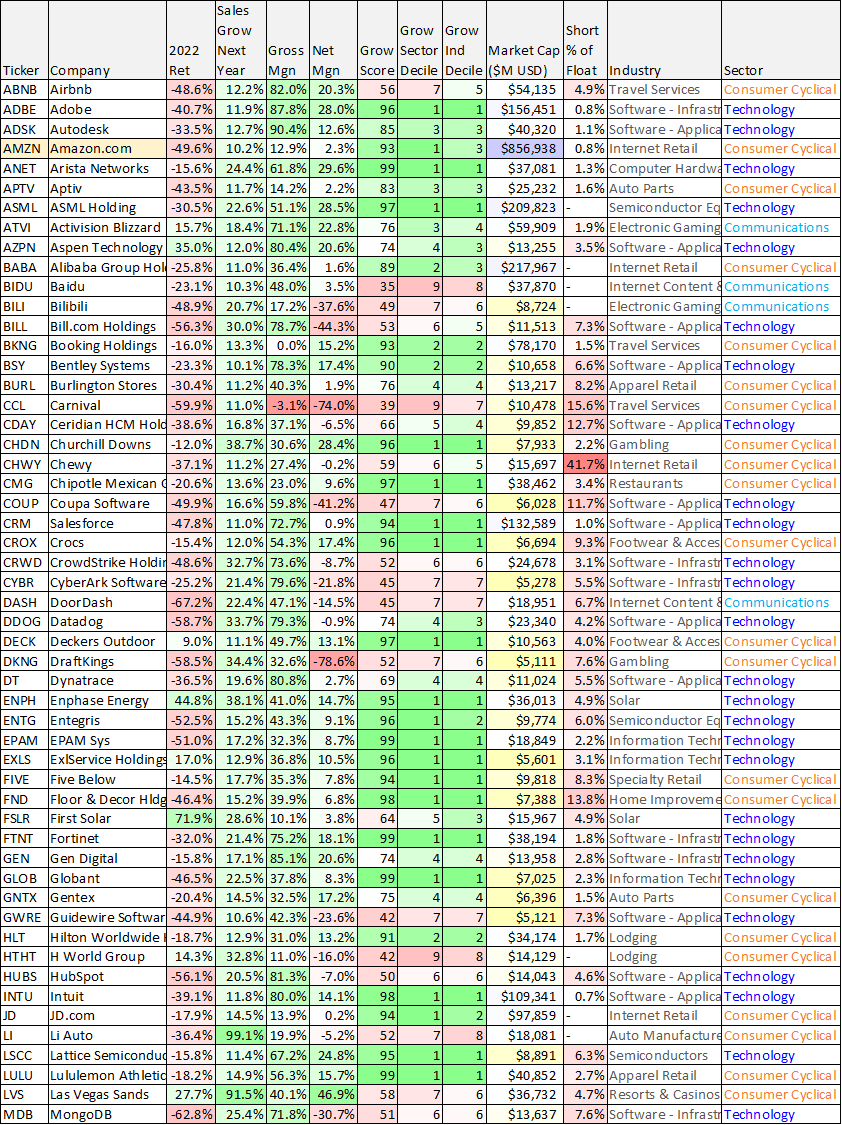

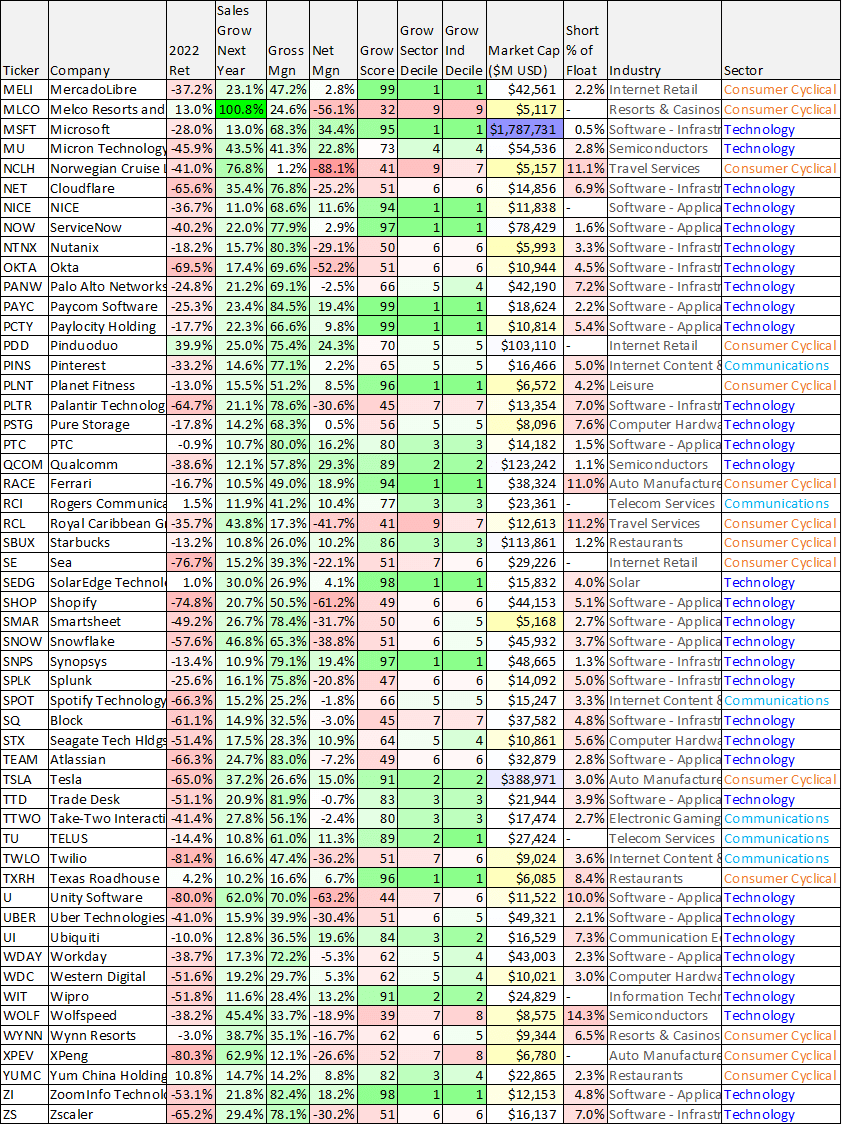

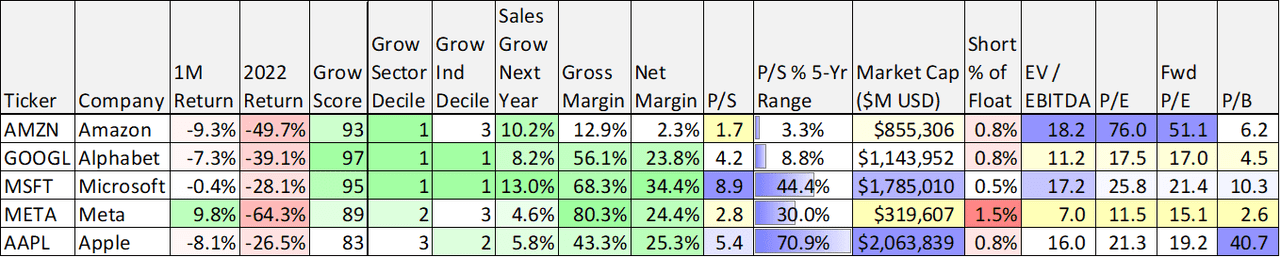

Before getting into the details on Amazon, here is our high-level ranking of 100 top growth stocks (see below). To be included in this table, we required at least a 10% expected growth rate for next year (many of them are much higher) and a market cap of at least $5 billion. We also limited the table to the three worst-performing market sectors of 2022: Technology, Communications and Consumer Discretionary.

One big theme behind this table is that profitable businesses (those with positive net income margins) have performed a lot better than those that are not profitable (as you can see in the table below). This has a lot to do with rapidly increased interest rates (higher rates means funding growth is more expensive, future earnings are discounted more, and economic growth is slower; not to mention issuing new shares is less attractive for businesses now that share prices are down significantly). The table is sorted alphabetically by ticker.

data as of 31-Dec-2022 (Stock Rover) data as of 31-Dec-2022 (Stock Rover)

(ASML) (BABA) (CRM) (DDOG) (EPAM) (SNOW) (SHOP) (SE) (NET) (TTD) (PAYC) (PLTR) (SQ) (SPLK) (NOW) (CRWD) (ENPH) (FTNT) (MELI) (COUP)

For reference, the growth score in the table looks at the 5 year history, as well as forward estimates, for EBITDA, Sales, and EPS growth. The best companies score a 100 and the worst score a 0. We also included sector and industry growth deciles (1 is best, 10 is worst) to help make the scores more comparable. You likely recognize at least a few of your favorite growth stocks on the list.

You may have also noticed that Amazon, one of the most popular and widely recognized business names in the world, was down ~50% in 2022, but ranks well in the table.

Amazon

Amazon Business Overview:

If you don’t know, Amazon divides its business into three segments (North America, International and Amazon Web Services), but that is a bit of a disservice to analysts considering essentially 100% of the profit is generated by AWS. North America and International are basically the geographical breakdown of retail sales, which generate essentially zero profit on a segment basis, but have very profitable and growing sub-areas in those segments (mainly subscriptions like Prime and the burgeoning advertising business) that will likely be growth and profit drivers in the future. Most of Amazon’s revenues come from North America (~60%) and International (~27%), but virtually all profit (100%) currently comes from its third segment, AWS.

Competitive Advantages:

Amazon has huge competitive advantages over its peers stemming from massive economies of scale (which enable it to deliver low cost services) and network effects, as described below.

(for example, Amazon gathers all types of information about users that will help its advertising efforts).

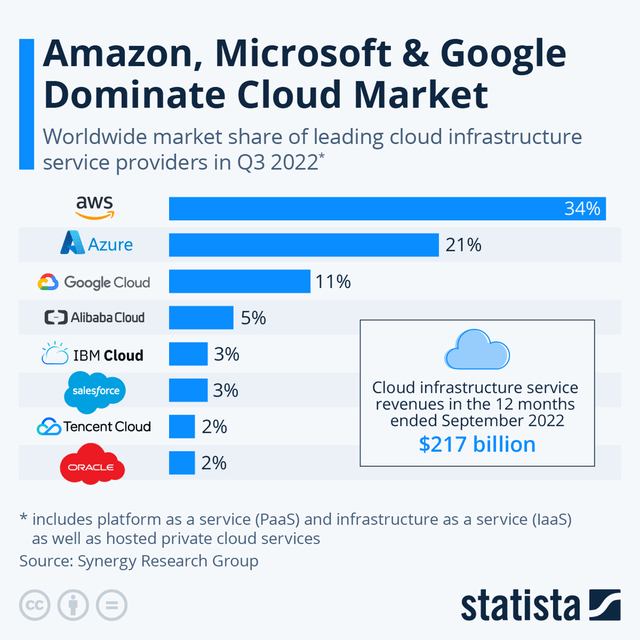

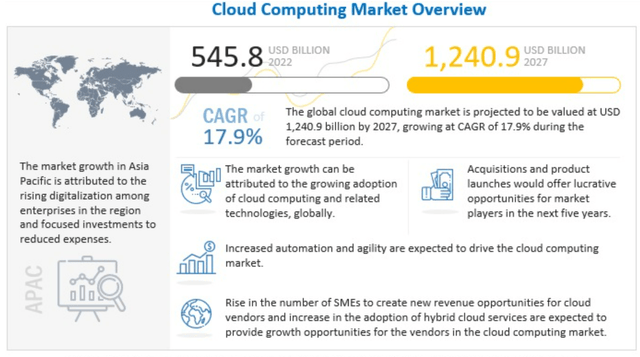

Amazon Web Services (“AWS”): For starters, AWS is the leading cloud services provider (ahead of Microsoft Azure (MSFT) and Google Cloud (GOOGL)), and this segment has massive long-term growth potential stemming from the ongoing digital transformation and migration to the cloud (an enormous long-term secular trend that has slowed in recent months, but is still only just beginning in terms of long-term opportunity).

For some perspective, the cloud opportunity is expected to grow dramatically over the next five years (and significantly more in the years after that) as shown in this next graphic.

Advertising: And while AWS is the only profitable of the three main segments, advertising is a smaller, but-high-margin business that already has some scale plus significant more room to keep growing. Amazon advertising is special because it naturally has tons of eyeballs (i.e. people using Amazon’s platform already) and it has access to vast proprietary data (including real time data). It is these network effect benefits (existing eyeballs, unique proprietary data, and scale), combined with significant room for continued growth, that make Advertising an important future growth diver for Amazon.

Amazon Prime: Prime memberships are also special for Amazon because they help attract sticky customers and they generate high-margin recurring revenue. Amazon Prime is basically a subscription service ($139 per year) that includes fast shipping, exclusive sales, free movie streaming and free access to Amazon’s 100 million song music catalog, to name just a few. What’s more, Prime helps bring users into the ecosystem, and once they’re in they use Amazon more than they would have and they’re less likely to leave (i.e. improved customer retention).

Amazon Retail: Amazon’s website and retail business is the first thing that comes to mind for many people. What’s important to note about this business is that it has massive revenues but very narrow profit margins. However, it’s a critical piece of the ecosystem because it brings people to Prime, it creates the platform for advertising and it led to the creation of AWS (Amazon had a huge head start versus other cloud providers because it had already built out great cloud expertise in improving its own website).

Overall, Amazon’s impressive ecosystem and scale has created tremendous competitive advantages (as well as powerful cash flows for innovation though research and development), and will help the company continue to succeed in the years ahead.

Amazon Risks:

Market Cycle: Amazon faces risks. For starters, the market was disappointed by Amazon’s most recent quarterly earnings announcement (whereby the shares sold off sharply) stemming from slower growth than expected in AWS as the aftereffects of pandemic-driven social distancing (and work from home) continue to wear off). What’s more, this negative trend could continue as overall economic growth has slowed and the potential for an ugly recession continues to loom. Furthermore, there are reports that Amazon is set to lay off up to 20,000 employees (a recent trend among large technology-driven companies) in the coming months; this is encouraging from a proactive cost-control standpoint, but concerning, and indicative of potentially rough roads ahead.

Foreign Currency: Another risk is foreign currency effects whereby earnings have recently been impacted negatively by negative translation effects. The varying degree and pace of post-pandemic monetary policy shifts and lockdown policies have contributed to a dynamic foreign currency risk environment.

Regulation: Regulatory pressures are another risk for Amazon. In particular, “big tech” companies (including Amazon) face growing pressures over anti-competitive practices as well as data privacy issues. For example, in 2021 Amazon received a record $888 million EU fine over data violations. Regulatory pressures are a constant risk for Amazon.

Cloud Competition from Microsoft (which is gaining ground on AWS) and Google are also a risk. However, given the scale of the massive cloud secular trend-there is room for multiple big players to succeed, and cloud will likely be a leading profit-driver for the next decade at least.

Valuation:

Don’t be fooled by Amazon’s low net profit margins (see table below). It is largely a high-sales low-net-margin retail business. And this massive revenue retail business creates massive economic moats and network effects that strengthen its other profitable high-growth operations (AWS, subscriptions, and advertising).

Currently trading at under 2 times sales (the lower end of its historical range), and with revenue expected to grow (and keep growing) at roughly double digits (based on massive long-term secular trends), Amazon is extremely attractive-despite the fact that it’s growing at a slightly slower pace than most analysts had previously expected (as they over-extrapolated the short-term “pandemic bump”). Also important to note, Amazon spends heavily on research and development, a cost that can be reduced anytime to increase profit, but remains important for future growth.

Stock Rover, data as of 30-Dec-22

Furthermore, the Fed’s aggressive interest rate hikes this year have had a particularly negative impact of high-growth stocks (see performance in the tables above). We believe these factors help explain the share price declines, and also contribute to the attractiveness of the investment opportunity as inflation will eventually slow, the Fed’s aggressively hawkish policies will moderate (hopefully sooner than later), and Amazon will keep growing rapidly for many years.

Conclusion

Growth stocks, including Amazon (down ~50% in 2022) have been hit particularly hard by rapidly rising interest rates. And as we wrote in our new 2023 Outlook: 10 Stocks Worth Considering:

We could be in the very early innings of a new long-term market paradigm whereby near-zero interest rates are gone for decades and so too may be the incredible leadership and performance of growth stocks.

That said, many of the high-growth pandemic darlings that have already fallen so hard, may still have further to fall as higher interest rates have pushed profitability further into the future (and maybe never).

Amazon, however, is one of the select growth stock leaders that is already profitable and has the financial wherewithal to sidestep the significant capital market challenges that many (unprofitable) growth stocks will likely succumb to in the years ahead. We don’t know where the market will be next week, next month or at the end of 2023, but over the long-term Amazon (and select financially-strong growth-stock leaders) will likely be trading dramatically higher.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

If you are interested in more investment ideas, consider a subscription to Big Dividends PLUS, where you’ll get access to the holdings in our 30-stock portfolio, plus a lot more. We’re currently offering 45% Off all new annual subscriptions.

Learn More – Get Instant Access. *Offer expires Tues, Jan 3rd.