Summary:

- The current macro environment looks promising for Amazon as inflation continues to decline in addition to commodity pricing.

- Amazon has a margin problem as they are operating at a 2.58% operating income margin, and their profits have come from AWS in recent quarters.

- Amazon could shock the street over the next several quarters, and the forward P/E could fall into the 20-30 range if management can get operational expenses under control.

4kodiak/iStock Unreleased via Getty Images

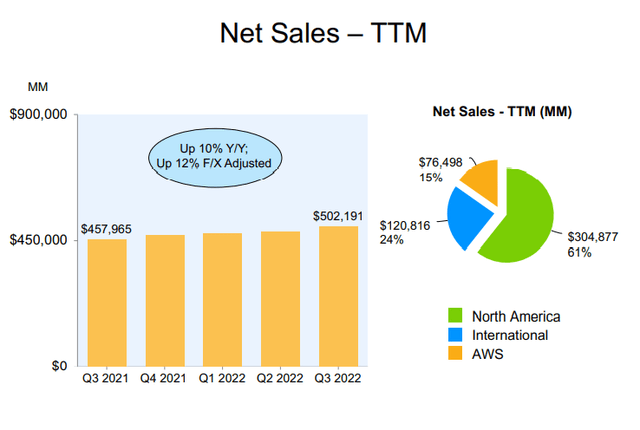

Amazon (NASDAQ:AMZN) confirmed its plans to lay off over 18,000 employees compared to the previous projection of around 10,000 jobs. AMZN is one of the largest employers in the U.S as they have over 1.6 million employees and spent over $136 billion in the trailing twelve months (TTM) on selling general and admin expenses. I am not a fan of layoffs because it drastically impacts families, but from a business aspect, AMZN may have overhired, and its declining EPS, FCF, and tight margins need to be addressed for the stock to recover. Today AMZN has a market cap of $868.57 billion, generates $502.19 billion in revenue, and its total operating income is $12.97 billion, while Walmart (WMT) has a market cap of $387.69 billion, generates $600.11 billion in revenue and $24.05 billion of operating income. It will be hard for AMZN’s stock to rebound without improvements to its margins. I believe that AMZN has the ability to shock the street as the combination of an easing macro and a decreasing payroll could lead to several earnings beats and create some excitement in the stock again.

Amazon has a margin and profitability problem that needs to be addressed.

Some investors may look at AMZN and assume that now is the time to buy due to AMZN’s market cap falling roughly 50% over the previous year. Just because a stock has retraced by a large percentage doesn’t mean that it’s an opportunity to allocate capital toward it. Back in May of 2022, I changed my investment thesis from very bullish to neutral on AMZN (can be read here) due to the cash from operations the business generates declining and my concerns around AMZN’s lack of profitability outside of Amazon Web Services (AWS). I recently became very bullish again due to inflation continuing to decline and commodity prices receding closer to normalized levels. I believe for AMZN’s stock to rebound, their EPS and FCF needs to do a 180. AMZN is no longer a young company, and the fact that WMT can run a profitable business, yet AMZN can’t with respect to its operations outside of AWS, is concerning.

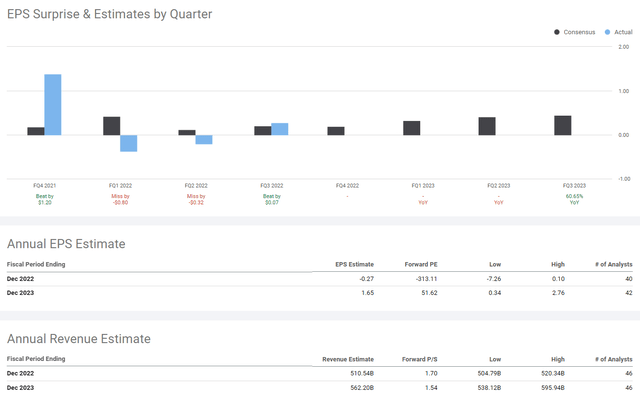

The company and the company’s stock price are two separate things, yet sometimes investors have a hard time separating the two. There is no question that AMZN has built one of America’s most influential businesses as it changed the retail experience while AWS is the largest cloud infrastructure platform. From a stock aspect, it’s hard to make the numbers work around AMZN’s multiple when they have generated negative EPS in Q1 and Q2 of 2022, and the EPS estimate for 2023 is $1.65 per share, placing it at a forward P/E of 51.62. AMZN can’t hide behind future growth as its entrenched itself as the dominant force in e-commerce and cloud services, generating over $500 billion in revenue.

WMT doesn’t have an AWS division that acts as a crutch during inflationary periods, yet their operating at a better margin and delivering larger amounts of operating income during the TTM. The reason I am comparing WMT to AMZN isn’t just because they are competitors but the sheer volume of revenue and expenses. WMT’s total operating expenses over the TTM were $576.06 billion, exceeding AMZN’s total revenue across all business lines. While these companies have different expenses, WMT was able to generate an additional 85.44% of operating income and create a larger operating margin. WMT spends an additional $86.84 billion in total operating expenses (17.75%) than AMZN and generates an additional 19% ($97.92 billion) of total revenue. WMT’s margins are also in the low single digits, but they have found a way to generate almost double the amount of operating income without benefiting from a high-margin cloud business. This is important because it indicates that there is a road for AMZN to become more profitable and improve its margins and overall profitability.

|

Operating Income Over The TTM in Millions |

|||

|

AMZN |

WMT |

% Difference |

|

|

Total Revenue |

$502,191.00 |

$600,112.00 |

19% |

|

Cost of revenue |

$286,026.00 |

$453,820.00 |

59% |

|

Selling general and admin |

$136,564.00 |

$122,238.00 |

-10% |

|

R&D |

$66,102.00 |

$0.00 |

|

|

Other operating Expenses |

$528.00 |

$0.00 |

|

|

Operating Income |

$12,971.00 |

$24,054.00 |

85.44% |

|

Operating Margin |

2.58% |

4.01% |

|

Why I am bullish on Amazon going forward

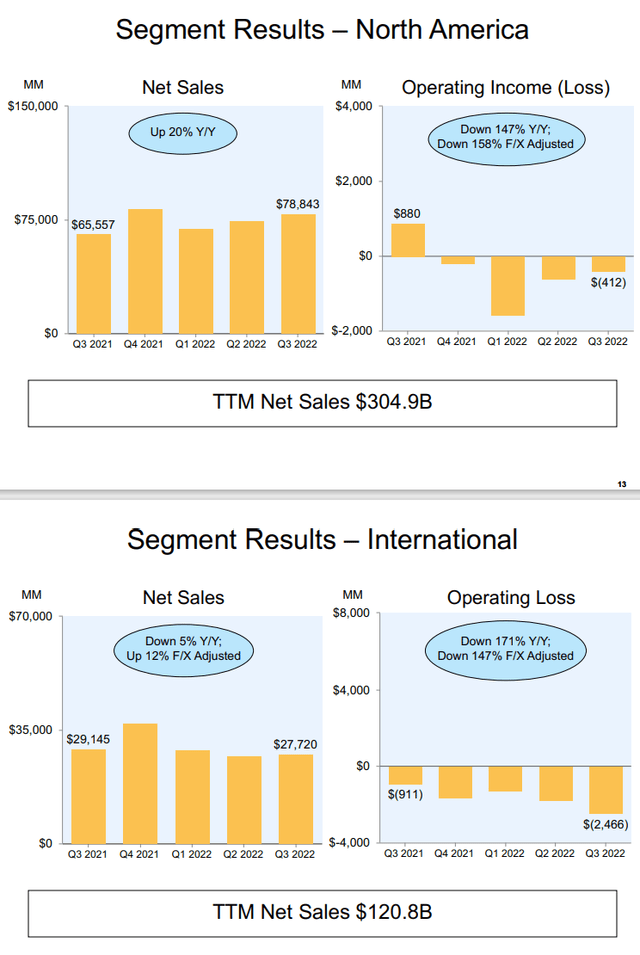

AMZN breaks up its business segments as North America, International, and AWS. Over the previous four quarters, the North America segment has generated operating losses rather than income each quarter. The International segment has strung together five consecutive quarters of operating losses. AWS has accounted for 100% of AMZN’s operating profits in the TTM. This has been concerning because AMZN wasn’t able to generate a single dollar of operating income over the past twelve months from $425.7 billion of revenue produced from North America and the International business segments.

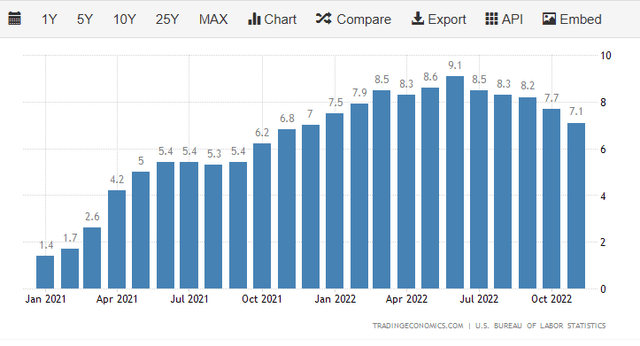

AMZN’s operating losses started occurring in the North American segment in Q4 of 2021, as inflation averaged 6.67% throughout the quarter. Since then, inflation has remained at a larger quarterly average, peaking in Q2 at 8.67%. While inflation is a backward-looking indicator, inflation looks to have topped out in June at 9.1% and is falling faster than it rose. Over the previous five months, inflation has declined by 2% from 9.1% to 7.1%, while it increased by 1.6% in the five months leading into the June peak.

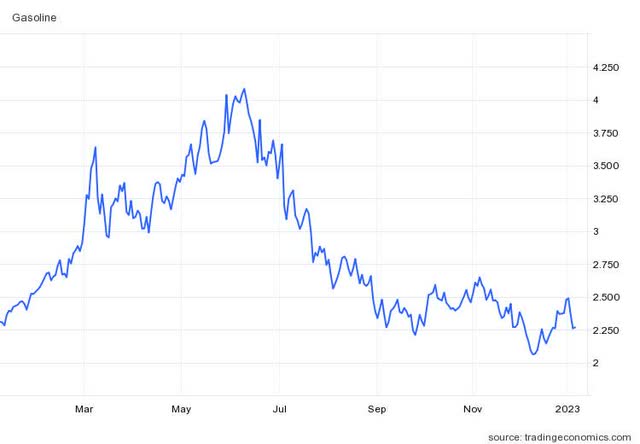

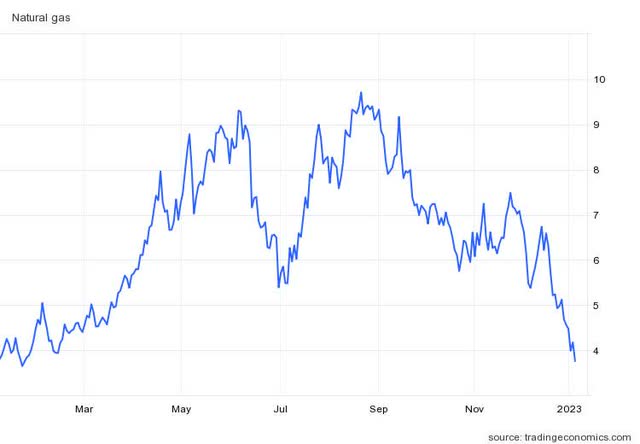

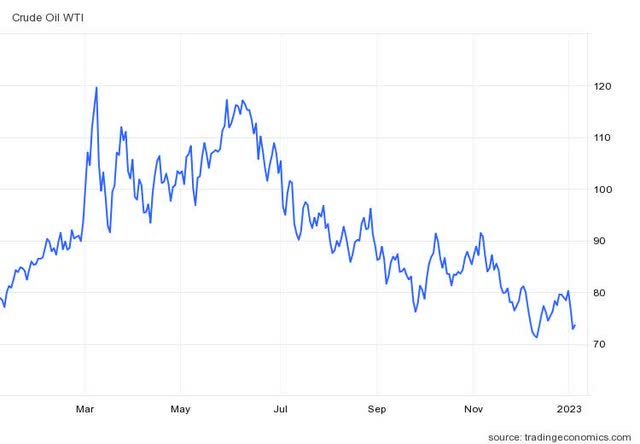

Since inflation peaked in June, commodity prices that impact AMZN have declined significantly. On 6/6/22, gasoline reached $4.08 per gallon and declined from 44.36% to $2.27. Natural gas has declined -59.78% since 6/6/22, falling from $9.30 to $3.74. Crude has declined -37.16% since 6/8/22, falling from $117.15 to $73.62. As commodity prices and inflation roll over, I am expecting AMZN’s price of goods and total operating expenses to decline. I think we’re starting to see the early ramifications of commodity prices and inflation decline in the cost of goods, as AMZN’s cost of revenue actually declined QoQ by $75 million while their revenue increased by $4.79 billion.

AMZN’s Q4 of 2021 saw record revenue with $137.41 billion, and its selling, general, and admin expenses came in at $30.94 billion. In Q3 of 2022, AMZN generated $127.10 billion of revenue, and their selling, general, and admin expenses increased by 26.56% or $7.8 billion. The expense line item of selling, general, and admin expenses shouldn’t be increasing while revenue is declining, and this could be due to overhiring, inflation, and elevated commodity pricing, which all play a role in AMZN’s operating costs.

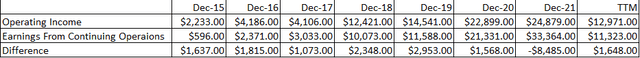

Trading Economics Trading Economics Trading Economics

The macro is easing, and AMZN should be a benefactor in Q4 on an expense level, and the positive impacts should carry over into 2023 as falling commodity prices and inflation haven’t had a chance to fully work their way through the system. If AMZN can keep its R&D expenses at its current level of $16.79 billion from Q3 and reduce its quarterly selling, general, and admin expenses to its Q4 2022 level, they would reduce its operating expenses by 7.84 billion quarterly, or $31.36 billion annualized. This doesn’t take into account top-line growth. AMZN hasn’t been a traditional stock that trades on fundamentals and has traditionally had a high P/E ratio. Today the P/E based on the TTM is 77.13, and the analysts are expecting AMZN to produce $1.65 of earnings in 2023 for a forward P/E of 51.62. Due to what AMZN claims on their EBT Incl Unusual Items, and other accounting factors such as income tax expense, currency exchange, and net interest expenses, excluding 2021, there has been a tight spread between a $1 – $3 billion differential from their annual operating income to earnings from continuing operations.

Based on the 10.218 billion weighted shares outstanding, AMZN’s current EPS is $1.11 ($11,323 / 10,218.3). If AMZN was able to reduce its total operating expenses by $5 billion quarterly, its operating income could be $32.97 billion in 2023, and if the same spread between operating income and earnings from continuing operations occurs, there is a possibility that AMZN would generate $29-$30 billion in earnings continuing operations. Based on the current shares, $29 billion in earnings would increase their EPS to $2.84, which would be a forward P/E of 29.28. Suppose AMZN could reduce its expenses due to an easing macro and continue its top-line growth. In that case, there is also a possibility that they could replicate 2021’s earnings from operations of $33.36 billion in 2023, which would place their EPS at $3.27 and create a forward P/E of 25.46.

Steven Fiorillo, Seeking Alpha

Conclusion

AMZN has the potential to exceed analyst expectations in the 1st half of 2023 through a series of beat and raise quarters which could lead to price target increases. AMZN is going to be a low-margin business, but it needs all of its sectors to be profitable for the stock to rebound. I am bullish on AMZN because the market is discounting how impactful the easing macro will be on overall operating expenses over the next six months. Suppose inflation continues to decline and commodity prices stay around these levels or also decline. In that case, AMZN could see a dramatic increase in their earnings from operations, which would lead to a more attractive forward P/E. AMZN is also tightening its belt in payroll, which will positively impact its margins. AMZN has the revenue and forward top-line growth momentum. Now it’s a margin game, and I feel AMZN will surprise everyone going forward.

Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

I will be launching a subscription service called Barbell Capital on the Seeking Alpha Marketplace. Barbell Capital will provide exclusive research, model portfolios, investment tools, Q&A sessions, watchlists, and additional features for its members. I will also have a live portfolio dedicated to generating capital from trading, selling puts and selling covered calls. The profits will be allocated to future capital appreciating investments and investing in dividend investments to generate income while we sleep.

https://seekingalpha.com/checkout?service_id=mp_1315