Summary:

- Amazon stock had a banner 2023, but it is still well off its all-time highs.

- However, the company is stronger than ever.

- Here are three compelling reasons for optimism in 2024.

Nora Carol Photography/Moment via Getty Images

2024 is off to the races, with the S&P 500 (SPY) making a new all-time high. After a brief dip to open the year, the index has gained ~ 1.5% year to date (YTD). Amazon (NASDAQ:AMZN) stock followed a similar pattern and has gained a little over 2%. The company will report Q4 and full-year earnings on February 1st after the market closes. You’ll be able to listen to the conference call here.

Here are some things to watch this year.

Will AWS growth accelerate?

Here are three reasons for optimism.

Artificial intelligence (AI) could be a massive growth driver for Amazon Web Services (AWS), and I’ll cover it below. Still, there is another reason I am optimistic that growth will accelerate in 2024: New budgets.

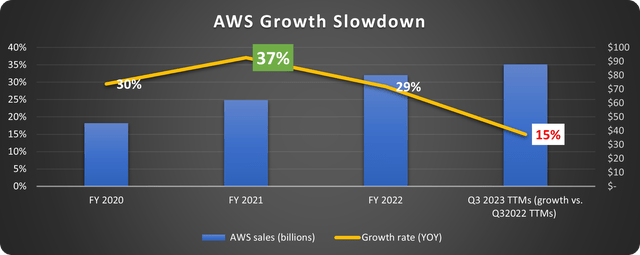

Many (probably a vast majority) of us expected a recession in 2023 that never materialized. This includes businesses that use cloud data. Much of AWS’s revenue functions like a utility – users pay for the data they use. It’s a terrific secular model since data use is almost guaranteed to increase exponentially over time. But it hurt in 2023, as depicted below.

Data source: Amazon. Chart by the author.

Companies across industries cut data-usage budgets last year. This is what happens when an economic slowdown happens or when it is widely forecast.

The second thing that happened is that many companies still operating on-premise paused moving to the cloud in 2023. Companies aren’t going to plan costly switches in advance of a recession. You may think, “Okay, but many are predicting a recession this year, too.” While that’s true, I don’t believe companies will hunker down two years in a row on a “maybe.”

Lastly, the massive data needs of generative AI could have a galvanizing effect. This third piece is also budget-related. We will see businesses investing in and experimenting with new technologies for years.

Much of the consternation over Amazon’s performance was the significant slowdown in the growth of AWS. The stock could take off if AWS sales accelerate. Q1 2024 results will be a great indicator.

Can advertising sustain the momentum?

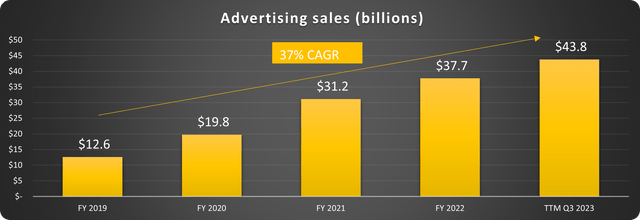

Digital advertising was a revelation last year. The overall ad market was flat, but Amazon’s pay-per-click, product placement, and other ads grew more than 20% YOY each quarter, including a 2023 high of 25% in Q3. Holiday advertising in Q4 could take this even higher.

This segment went from an afterthought to a powerhouse by nearly quadrupling sales in four years, as depicted below.

Data source: Amazon. Chart by author.

There are several reasons for this success. First, advertising is in a transition period. There are so many platforms now with streaming television, video, and social media platforms. Programmatic is taking hold, and advertisers are thinking beyond television.

Amazon is an attractive place to move those budgets because these ads reach consumers actively looking to purchase certain products. The company is also using AI to enhance performance for advertisers. Here is an example:

In advertising, we just launched a generative AI image generation tool, where all brands need to do is upload a product photo and description to quickly create unique lifestyle images that will help customers discover products they love. – CEO Andy Jassy on Q3 2023 earnings call.

This type of value-adding initiative will keep Amazon’s ad business growing faster than the industry as a whole.

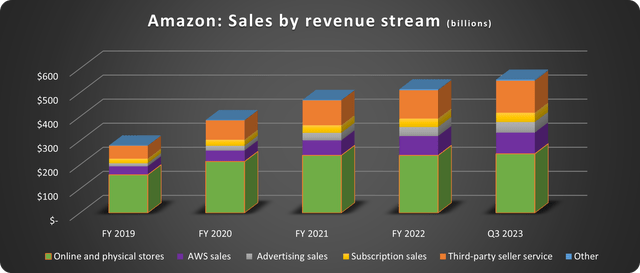

The advancement of this segment creates another solid service revenue stream, further diversifying into segments with high-margin potential, as shown below.

Data source: Amazon. Chart by author.

The difference between 2019 and now is astronomical and a testament to terrific management.

Will free cash flow stay strong?

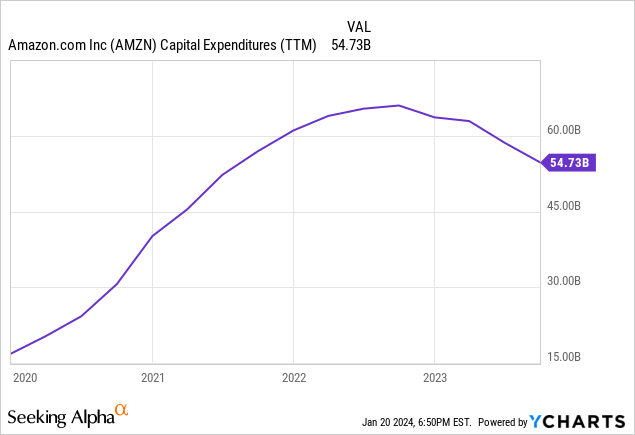

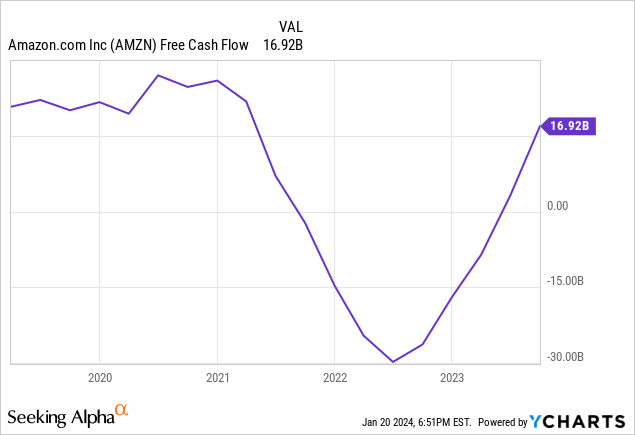

Cash is back! After bottoming in 2022 due to a plethora of COVID boomerang effects and significant capital investment (CapEx). Now, CapEx has stabilized, as depicted below.

Other issues like labor and logistics were also ironed out last year, and free cash flow came back in a big way:

The tailwinds in Amazon’s service revenues could push this higher in 2024.

Is Amazon stock a buy?

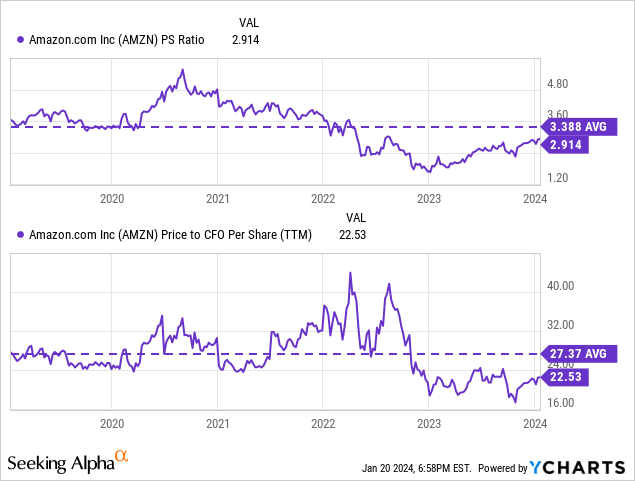

Despite the tremendous performance and kudos given to the Magnificent 7, Amazon is undervalued historically, 17% below its all-time high, and the price doesn’t reflect the company’s potential. There are numerous ways to value Amazon stock; I prefer looking at it in terms of sales and operating cash flow.

These metrics put the stock 16% to 21% below 5-year averages. Amazon is a terrific long-term investment and will have an excellent 2024 if AWS, advertising, and cash flow thrive.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors' goals, financial situations, timelines, and risk tolerances vary widely. The stocks mentioned may not be suitable for all. As such, the article is not meant to suggest action on the reader's part. Each investor should consider their unique situation and perform their own due diligence. The author's positions included options that he may exit or enter at any time.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.