Summary:

- Although Amazon.com, Inc. stock slowly approaches a more reasonable valuation, I cannot help but continue to be bearish on the e-commerce giant.

- In this article, I discuss 3 key arguments why Amazon might still trade lower.

- The reasons are: 1) lack of profitability; 2) slowing growth; and 3) macroeconomic concerns.

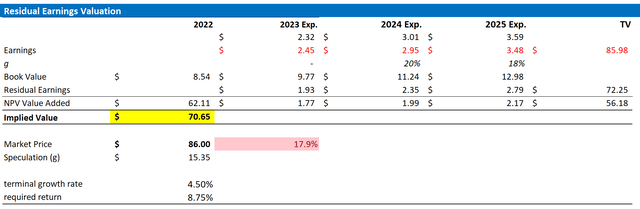

- Personally, I estimate that Amazon stock should be priced at approximately $70.65 and reiterate a “Sell” rating.

Daria Nipot

Thesis

I have voiced a negative opinion on Amazon.com, Inc. (NASDAQ:AMZN) multiple times, see here, here, and here. And although AMZN stock is slowly approaching my latest target price of $84.70/ share, I cannot help myself but to continue being bearish. In this article, I discuss 3 key arguments why Amazon might trade lower still and might even reach a target price of $70.65/ share. The reasons are: 1) lack of profitability; 2) slowing growth; and 3) macroeconomic concerns.

For reference, for the trailing twelve months AMZN stock is down approximately 47% YTD, versus a loss of only 17% for the S&P 500 (SP500).

1. Lack Of Adequate Profitability

While Amazon.com, Inc. shares continue to drop, Amazon management is stepping up promises with regards to improving profitability through cost discipline. Notably, already in late 2022 Amazon has announced layoffs of approximately 10,000 employees. In a latest statement from CEO Andy Jassy, this number has now grown to 18,000. In addition to layoffs, Amazon has also been looking for other cost saving opportunities. In that context, the company’s capital expenditure on e-commerce infrastructure is expected to be approximately $10 billion lower in 2022 than it was in 2021 — according to management estimates.

But I would like to point out that these efforts, although appreciated from an investor’s point of view, are not sufficient to change the profitability narrative. Investors should consider that for the trailing twelve months (Q3 2022 reference), Amazon has only generated operating income equal to $12.97 billion. As compared to the same metric one year earlier, Amazons profitability declined by an astonishing 54% in 2022. And if adjusted for currency exposure, the drop in operating profitability would be even more significant: a contraction of 57%.

For reference, if we assume an average annual salary of $90,000 per Amazon employee (those laid off), then we can estimate Amazon’s operating cost saving to be somewhere around $1.62 billion. This hardly changes the needle: according to my calculations, Amazon’s EV/EBIT multiple would fall from about x80 to x72, which is still way too expensive to warrant an investment.

2. Slowing Growth

The concerns surrounding Amazon’s lack of profitability are compounded by sharply decelerating growth. Notably, Amazon’s year-over-year revenue growth has now fallen below the sector median. And Amazon’s reference sector is not technology–with high-growth verticals such as cybersecurity and data analytics–but consumer discretionary.

Amazon’s slowing growth makes it harder for the company to expand profitability, as additional scale advantages are unlikely to materialize. And perhaps even more important, Amazon’s slowing growth pressures investor sentiment and changes the market narrative from “let’s value Amazon like a growth company” to “let’s see if the company can actually make a profit.”

To be fair, AWS is likely to continue to be a growth driver. Personally, I remain bullish on the outlook for cloud computing, data storage, and other services such as analytics and machine learning initiatives. However, investors should consider that the expansion of the cloud industry is a long-term narrative. And this narrative might come under pressure in the next few quarters, as recession concerns are likely to lead many AWS customers to tighten their software and technology budgets. It is worth noting that AWS already failed to meet analyst expectations in Q3 2022. A similar disappointment was delivered from AWS’ largest competitor, Microsoft Corporation (MSFT), who disclosed that growth for Azure has slowed by 5 percentage points as compared to the same period in 2021.

3. Macroeconomic Concerns

Amazon is clearly vulnerable to macroeconomic challenges. In a previous article, I have already pointed out the negative implications of Amazon’s additional Prime Day, which I considered a “desperate move to meet market revenue expectations” and to hide stealthily declining retail sales.

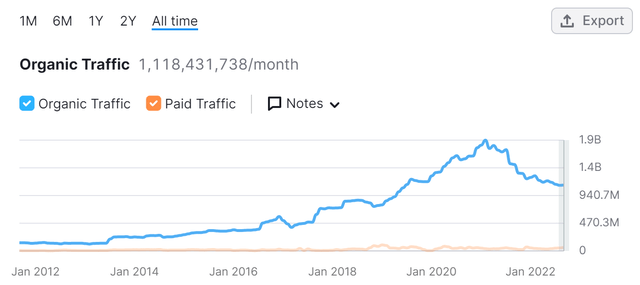

But Amazon’s slowing demand might be even more severe than what I have previously estimated. In that context, I would like to point out data provided by Semrush, which monitors estimated global web traffic to “Amazon.com” and reports rapidly falling visitor interest.

Reflecting on macro challenges, I now believe that Amazon will struggle to deliver on even disappointing Q4 guidance: with revenues estimated between $140 billion and $148 billion and operating expected to be around $4 billion. If Amazon would indeed fail to meet these expectations, then the stock would likely respond with a steep drop.

Risks

As a counter-thesis against my bearish arguments, I would like to highlight what I have written before:

There are two risks to point out. First, betting against Amazon is hardly ever a smart move – or at least it has not been in the past. Despite the shot-term headwinds Amazon remains one of the best managed companies in the world, and the long-term outlook for the e-commerce giant remains bright. Second, investors should consider that Amazon frequently misses earnings estimates (less so revenues) and the market does not very much care. Arguably, Amazon has taught its investors to look past short-term accounting and profitability targets. And accordingly, the (expected) earnings miss may fail to materialize a stock sell-off.

Hard To Justify The Valuation

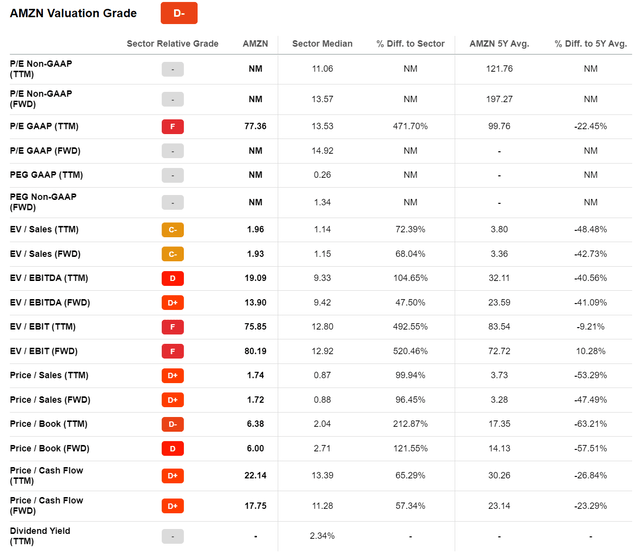

I have already touched on Amazon’s x80 EV/EBIT multiple, which I think makes little sense in light of slowing growth and macro-economic challenges. But to get a more “complete” picture regarding Amazon’s rich valuation, please take reference from the table below. Notably, no matter where and how you look at Amazon’s multiples, the stock looks very pricey as compared to the respective industry median – trading at a premium of at least 47.5%.

Personally, I estimate that Amazon stock should be priced at approximately $70.65. I base my argument on a residual earnings model anchored on updated EPS estimates, an 8.75% cost of equity and a 4.5% terminal growth rate. Notably, as compared to my prior valuation, I have raised my cost of equity estimate by 50 basis points. In my opinion, this increase reasonably reflects the higher risk premia that investors require for stock investments.

I reiterate a “Sell” rating on Amazon.com, Inc.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: not financial advise