Summary:

- Amazon is set to report earnings for the third quarter on Thursday and may beat moderate EPS expectations.

- The strength of the U.S. economy (payroll and wage growth) could drive EPS out-performance for Amazon’s e-Commerce business in Q3’23.

- A rebound in IT spending and a re-acceleration of Amazon Web Services’ top line could lead to sequential operating income margin improvements.

- Amazon is expected to generate 32% annual EPS growth over the next five years.

- Shares have an attractive risk profile heading into Q3’23 earnings.

Daria Nipot

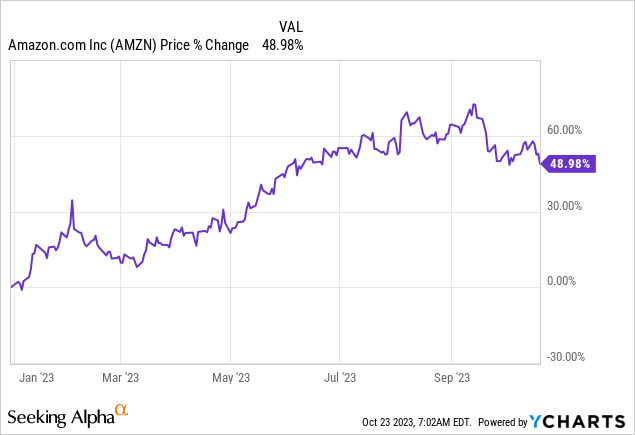

Amazon (NASDAQ:AMZN) is set to report earnings for the third-quarter on October 26, 2023 and the current consolidation ahead of earnings actually let me to initiate a speculative buy position. Amazon, I believe, could be set for a strong earnings release due to relatively moderate EPS expectations, operating income momentum in the e-Commerce business (in North America) supported by favorable macro trends (payroll strength, inflation decline and wage growth) and there is potential for a re-acceleration of top line growth in the Amazon Web Services business. IT spending is projected to make a strong comeback in FY 2023 and FY 2024 and Amazon would likely be a major beneficiary. Ahead of the Q3’23 earnings report, I see a favorable risk profile!

Previous rating

I rated Amazon a hold after the company submitted a better than expected earnings card for Q2’23. Amazon at the time delivered solid earnings growth and also initiated a decent outlook for its third-quarter. While the valuation appeared unattractive to me at the time, in part due to decelerating growth in Amazon Web Services, I believe strong macro trends in the third-quarter skew the odds in favor of Amazon crushing earnings estimates on Thursday.

1. Moderate EPS expectations ahead of Q3’23

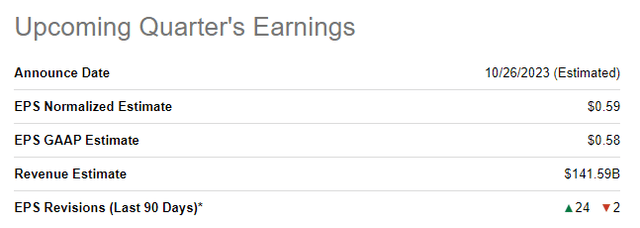

Earnings expectations for Amazon’s third-quarter have improved in the last ninety days, but overall appear to still be moderate. The consensus is that Amazon will report adjusted earnings of $0.59 per-share on $141.59B in revenues. Amazon earned $0.65 per-share in the previous quarter and the company has guided for up to 13% top line growth and, crucially, a more than doubling of its operating income compared to the year-earlier period: Amazon sees $5.5-8.5B in operating income in Q3’23 while it earned just about $2.5B in last year’s third-quarter. Importantly, the outlook, which is strong in itself, may underestimate Amazon’s earnings potential in Q3’23 due to robust and favorable macro trends in the third-quarter.

Source: Seeking Alpha

2. Strength in the U.S. economy, wage growth, receding inflation (Y/Y)

My educated guess is that operating income expansion in North America could potentially drive EPS out-performance for Amazon in the third-quarter. The U.S. economy stayed in excellent shape during the third-quarter and although inflation has seen a bit of momentum again lately, the situation for Amazon in the e-Commerce industry is a lot better than it was a year ago when inflation of 8-9% caused a cutback in spending as well as decelerating top line growth.

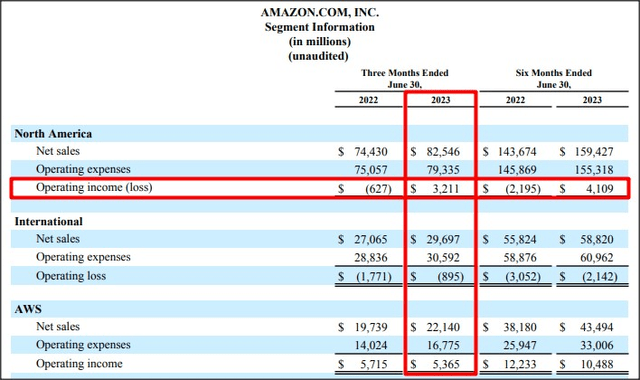

Importantly, Amazon has seen some real momentum in the second-quarter in the North American e-Commerce business… which posted a 3.6X factor increase in operating income relative to the first-quarter of FY 2023, indicating supportive macro tailwinds.

The reason why I am especially optimistic about Amazon beating estimates for its third-quarter relates to labor market strength in the U.S. The precondition for strong consumer (and business) spending is that payrolls are growing and workers have confidence in the safety of their jobs. The U.S. economy created 336,000 jobs in September, almost double the estimate of 170,000 jobs. This likely implies that American consumers continued to spend a lot of money on e-Commerce platforms like Amazon. Average hourly earnings also increased: they were up 4.2% year over year. Inflation grew in September, by 3.7%, but flat-lined compared to August.

In other words, consumer spending tailwinds driven by payroll gains, wage growth and low-to-moderate inflation in the third-quarter were extremely favorable for Amazon. My expectation is for Amazon to see operating income in its core North American business of $4.5-5.0B with total operating income likely coming in at the top of guidance.

Source: Amazon

3. IT spending rebound and AWS top line re-acceleration

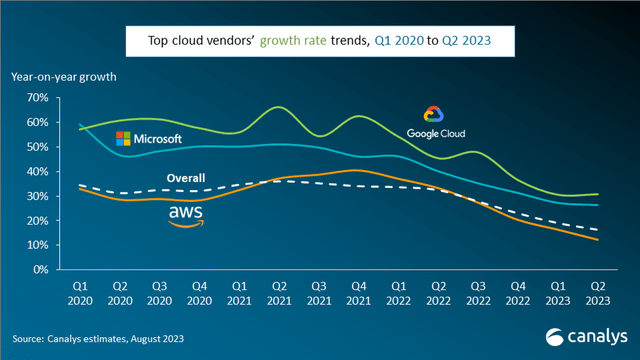

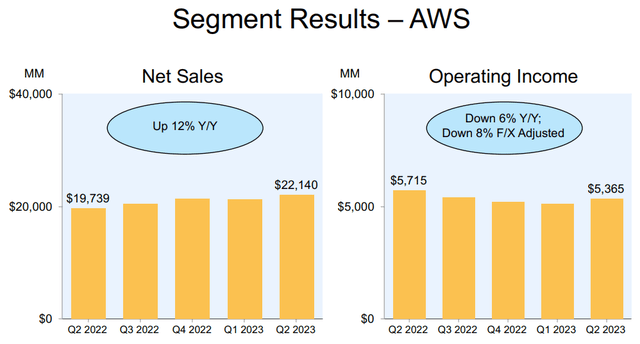

The third reason why I am bullish on Amazon ahead of the third-quarter earnings release is that the company could report a re-acceleration of its Cloud top line growth and see a sequential improvement in its operating income margin in the Amazon Web Services business… which is the still the largest public cloud service provider with a market share of more than 30%.

In last year’s high-inflation world, corporations cut back on and optimized their IT spending which resulted in a top line deceleration for Amazon Web Services. Companies like Alphabet (GOOG), however, were equally affected and the sector broadly suffered a loss of growth momentum.

Source: Canalys

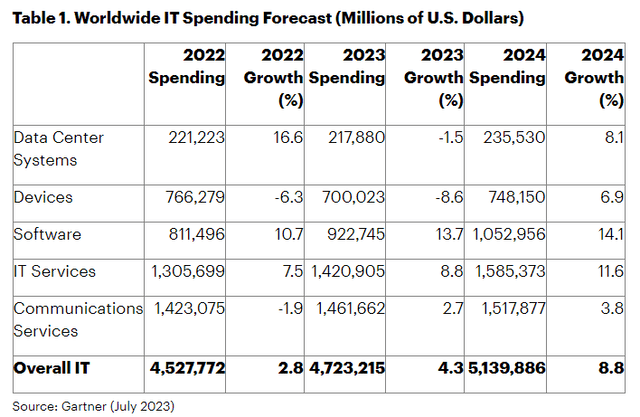

But with inflation now being less of a headwind and labor market strength resulting in significant job gains (and employment security), the fear over a recession is receding broadly. Payrolls gains also signify growing confidence on the part of businesses in the current growth path of the economy. This could have opened up the wallets not just of consumers, but also of corporations that invest more dollars into their IT infrastructure and their Cloud capabilities when confidence in the future is growing. According to Gartner, IT spending is set for a solid rebound in FY 2023 (4.3% Y/Y growth) and the growth rate is expected to accelerate to 8.8% in FY 2024.

Source: Gartner

Strong payroll trends, moderating inflation and a recovery in IT spending could be a potent force that results in a re-acceleration of Amazon Web Services’ top line growth om Q3’23. Amazon Web Services’ growth, due to enterprise customers cutting back on IT spending, slumped to 12% in Q2’23, down from 33% in the year-earlier period.

Since Amazon has invested a lot of time and money into scaling AWS globally, a re-acceleration of growth in Q3’23 could lead to an operating income margin improvement as well. Amazon Web Services generated an operating income margin of 24% in Q2’23 and I believe it is possible for Amazon Web Services to grow its margin on the back of new customer acquisitions, stronger pricing as well as a recovery in IT spending. In the longer term, I believe an operating income margin around ~30% is fully realistic.

Source: Amazon

Amazon is expected to generate 32% annual EPS growth in the next five years

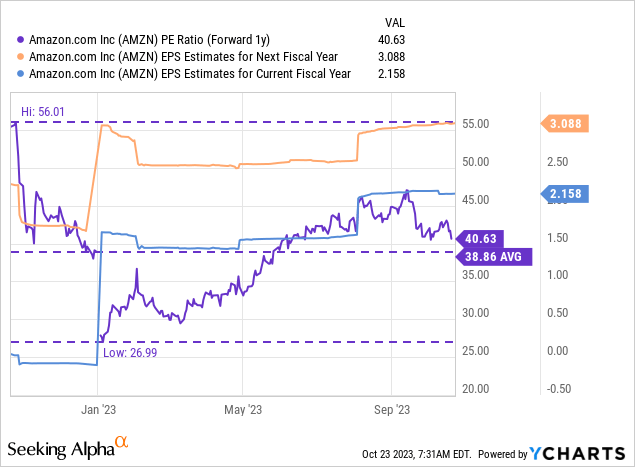

I have been on the fence with regards to Amazon’s valuation which I consider not to be especially cheap. Shares of Amazon are valued at 2.0X FY 2024 revenue (which is a high valuation multiplier) and the firm is expected to grow its top line at an average annual rate of 12% in the next five years.

Its EPS, however, is projected to grow 32% during between FY 2023 and FY 2028 and given both favorable macro trends in Q3’23 as well as a high expected earnings growth rate, I actually believe that Amazon’s P/E ratio of 39X is not entirely unreasonable… especially if the company were to see margin growth as well as a re-acceleration of its top line growth in Amazon Web Services.

Risks with Amazon

One specific risk that I see with Amazon is the recent USD strength which could negatively affect Amazon’s earnings picture and which could be a headwind to EPS and top line growth in Q3’23, but also beyond. Amazon is doing business in many different countries and a strong USD makes profits generated and parked in non-USD currencies less valuable for U.S. companies. Another risk I see could be a potential top line deceleration in the Cloud business if macro and sector (IT recovery) trends aren’t as profound as expected. A deceleration of AWS segment revenue growth, and potentially a decline in operating income margins, would be concerning and likely translate into valuation headwind for Amazon this week.

Final thoughts

Amazon might be best seen as a macro bet that benefits from strong underlying consumer spending trends, driven by payroll gains and a recovery in corporate IT spending. Both trends provide tailwinds to Amazon’s two core businesses: e-Commerce and Cloud services for the enterprise market.

I believe Amazon has a very reasonable chance of crushing moderate EPS estimates on October 26, 2023. Strength in payrolls/wage growth strongly suggests that Amazon’s North American e-Commerce segment has earnings outperformance potential while a recovery in IT spending could boost Amazon Web Services’ top line and operating income prospects.

While shares of Amazon are not especially cheap (based off of P/S), I believe the macro setup has become much more favorable in the third-quarter. The P/E valuation is supported by Amazon’s strong prospects for EPS growth in the next five years. If Amazon beats earnings expectations by a good margin and submits a strong outlook for Q4’23 this week (which I consider to be likely given the inclusion of the holiday period), I believe Amazon’s shares could rally!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.