Summary:

- Amazon.com’s brush with the FTC is to be taken seriously.

- However, the market may have already overreacted here, coupled with recent market weaknesses.

- I present 9 reasons why I am adding to my position here.

FinkAvenue

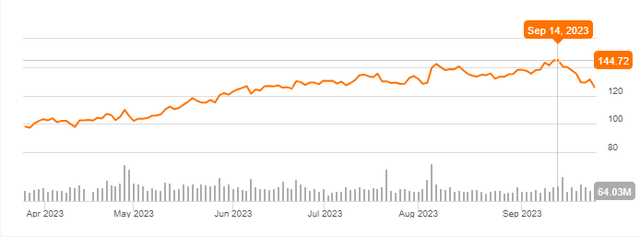

Amazon.com, Inc. (NASDAQ:AMZN) stock has faced a rather quick reversal in its fortunes. A little less than two weeks ago, the stock reached its 52-week high of $145.86 and has sharply reversed since then, first due to the general market weakness and next, the Federal Trade Commission’s [FTC] antitrust case. As a result, the stock is down almost 15% in no time.

Let’s get the obvious out of the way. An antitrust case by the FTC is to be taken seriously. And in this case, specifically, the allegations are strongly worded. For example, the one below caught my attention as it alleges that Amazon.com has not only been doing the alleged illegal practices for long but also that each tactic reinforces itself in a cycle, which I interpret as a hit on the Amazon ecosystem.

“Through its years-long course of illegal conduct, Amazon has deeply entrenched its monopolies & further widened the gulf between Amazon and everyone else. Each tactic amplifies the force of the rest, in a self-reinforcing cycle of dominance and harm.“

However, could the market have overreacted to the FTC news? Especially when you consider the fact that the general market has been weak in the last couple of weeks and had only one positive day in the last 6 trading days. I believe so, and I am presenting 9 reasons in this article to back this. Let us get into the details.

- FTC’s History: Once again, the FTC exists for a reason. The strong shouldn’t get stronger at the expense of the weak and the market needs to be fair to everyone. Fair point and point taken. However, there is a reason that mega-cap companies got to be mega-cap companies, breaching many times what was once an unimaginable barrier with $1 trillion market caps. Are we to believe that they (the big companies) never knew the threat of FTC if they ever got so big? Besides the panic, what’s the biggest deterrent here? What is the FTC’s history against big companies? What is the largest ever fine that FTC has ever levied? The burden of proof lies here with the FTC, and it is especially harder to prove liability to the extent that may actually hurt these big companies. I remember the case against YouTube (GOOG) (GOOGL) alleging that the company collected kids’ personal information (a far more serious charge in my mind than unfair business practices). It ended with Google paying a miniscule $170 million in fine. While $170 million is huge by any other stretch of imagination, it is a tiny drop (0.017%) for a $1 trillion company.

- Getting Even Bigger: While the FTC and many others are arguing that Amazon is already too big for anyone’s benefit (bar Amazon), this article lists 12 additional and very plausible industries that Amazon could disrupt. These industries range from healthcare where Amazon is already establishing itself to luxury goods. If you think about it, Amazon already has the most important ingredient to succeed in almost any business it undertakes: the distribution system. Irrespective of how the FTC case ends, this underlying business strength is not going away from Amazon and its investors, even if it results in a breakup of the company into different entities.

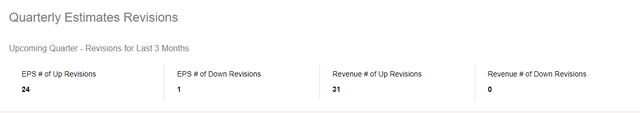

- Strong Projected Earnings Momentum: Shifting gears a little, Amazon is expected to report its quarterly earnings in the last week of October and the stock has momentum in its favor based on analyst estimates. 24/25 EPS revisions and 31/31 revenue revisions have been to the upside. More specifically, FY 2023 Q3’s EPS estimate has gone up from 45 cents at the beginning of the year to 58 cents now. Even as the FTC cloud hangs over the stock, the cloud that will likely matter more in a few weeks is the one that Amazon will report on and is covered below.

AMZN EPS Revision (Seekingalpha.com)

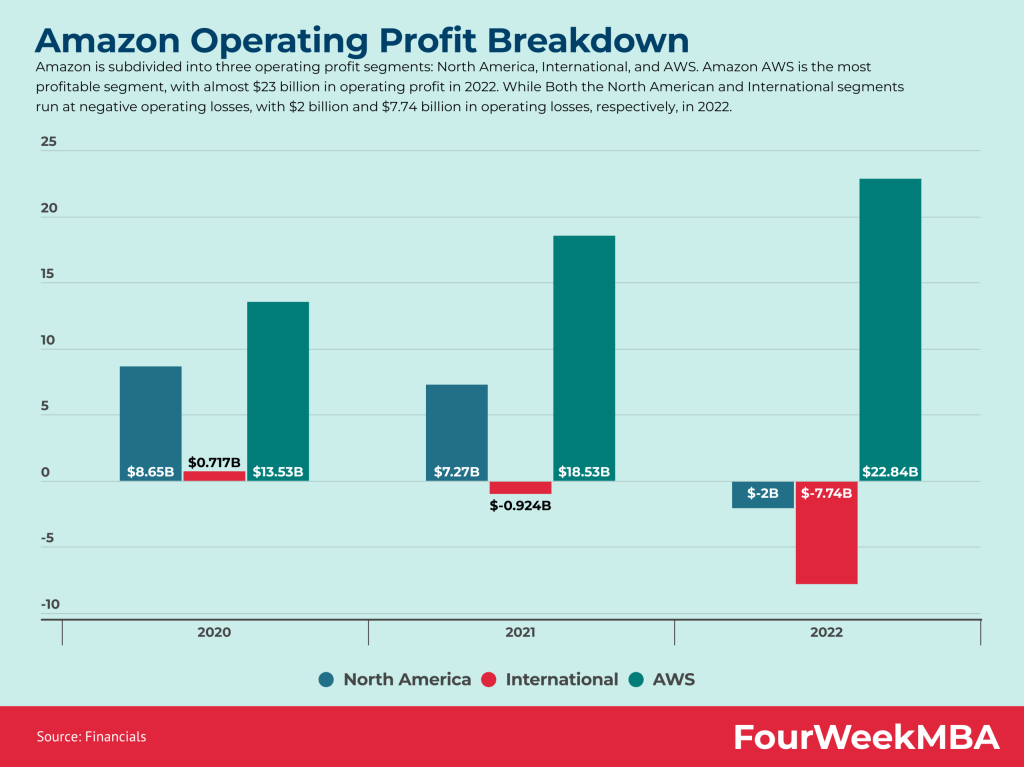

- Could the FTC Accelerate An AWS Spin-Off: I’ve written in a few of my articles that Amazon Web Services [AWS] being spun-off remains an enticing possibility for me to stay invested in the present-day Amazon.com, Inc. Recent history has made it clear that AWS contributes way more than its fair share to Amazon’s overall profit margin. Even though the FTC says this antitrust is not about how “big” Amazon is but its “exclusionary conduct”, their eyes are on Amazon entirely. The whole point of building an ecosystem is for you to leverage your own platforms. Imagine Apple, Inc. (AAPL) getting sued because iTunes works more seamlessly with an iPhone than with a Motorola Razr.

AWS Profit vs. Rest (fourweekmba.com)

- Stock Valuation: Amazon’s stock has always been a forward-looking story. When retail was making money, the company was (unknown to the outside world) pumping the profits into AWS. While AWS is still killing it, the company nurtured its advertising segment. Where I am going with this is, I am very comfortable looking at forward estimates for a company like Amazon that has a rich history of nurturing tomorrow’s revenue with today’s profits. At $126, Amazon’s stock is trading at a forward multiple of 40 based on 2024’s average EPS forecast. When you factor in the expected earnings growth rate of 80%/year (helped by the deceleration in 2022) over the next 5 years, the stock has a price-earnings/growth [PEG] of 0.50 that would make Peter Lynch proud.

- The Contrarian In Me: This is a personal reason as I tend to go against the crowd, especially when backed by a solid company like in this case. I called the bottom in Meta Platforms, Inc. (META) when the company swallowed its pride and announced layoffs. I called Amazon’s RSU restrictions a welcome move and one that indicated the company was going to reign in on expenses, which is exactly what followed. In short, when the going gets tough, the tough gets going and backing a cornered tiger is not as hard as backing a cornered goat. A lot of commenters on this Seeking Alpha news item are taking Amazon for a goat that is just going to succumb here.

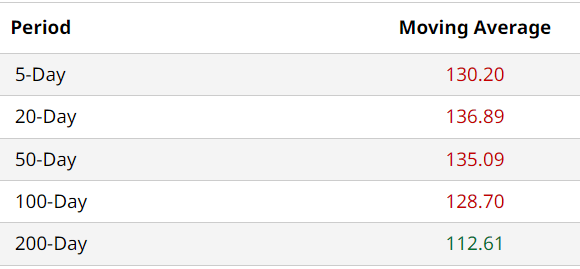

- Technical Reason #1: Amazon’s stock has now worryingly broken below the 100-Day moving average but the 200-Day moving average is not far off, at about 11% down from the current market price. Buying at the current price comes in with the reasonable protection offered by the 200-Day moving average being fairly close.

AMZN Moving Avgs (Barchart.com)

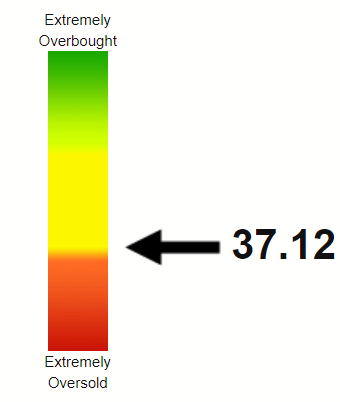

- Technical Reason #2: It is not often that the words “Amazon” and “Oversold” are used together. If anything, this stock has been accused of being among the most over-valued names in the last decade and a half. However, as the stock’s Relative Strength Index [RSI] of 37 indicates, the stock is very close to the oversold level and a couple of more weak days may send the RSI below 30.

AMZN RSI (stockrsi.com)

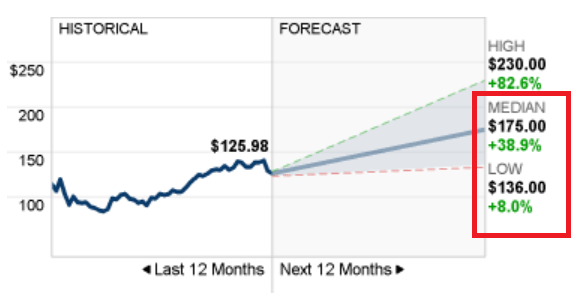

- Price Target: Lastly, I fully expect the Amazon.com “fanboy” analysts to show up any time now and defend the stock. This may not move the needle immediately given the overall market conditions, but the fact remains that Amazon’s stock is a market darling. And you don’t often see market darlings trailing their median price targets by 40%. Even the lowest price target of $136 in a poll of 45 analysts is 8% above the current price.

AMZN Price Target (money.cnn.com)

Risks and Conclusion

My bullish tone throughout the article does not mean the company has no risks. There are quite a few, including the elephant in the room, FTC. The FTC ride will be bumpy, there will be “experts” voicing their opinions on how this may permanently damage Amazon and plenty of lengthy, legal back and forth between FTC and Amazon. Other risks include AWS’ slowdown and the overall economy looking shaky, which impacts Amazon’s growing advertising stream. However, the land of opportunities did not get its name and fame by stifling growth, as threatening as that growth may seem to other players and even the Government. At worst, I expect fines/settlements that may not even pinch Amazon in the grand scheme of things and a break-up of the company, which may not be a bad thing in the long run.

I retain my “Buy” rating on the stock given my belief in the company’s strong ecosystem. Yes, the same ecosystem that is serving as the base for the FTC’s case.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, AMZN, GOOG, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.